The global financial landscape is experiencing a significant shift as of February 5, 2026. For market participants who have observed the bullish momentum of the past year, the sudden price correction in the cryptocurrency sector today serves as a reminder of the inherent volatility and risk associated with digital assets.

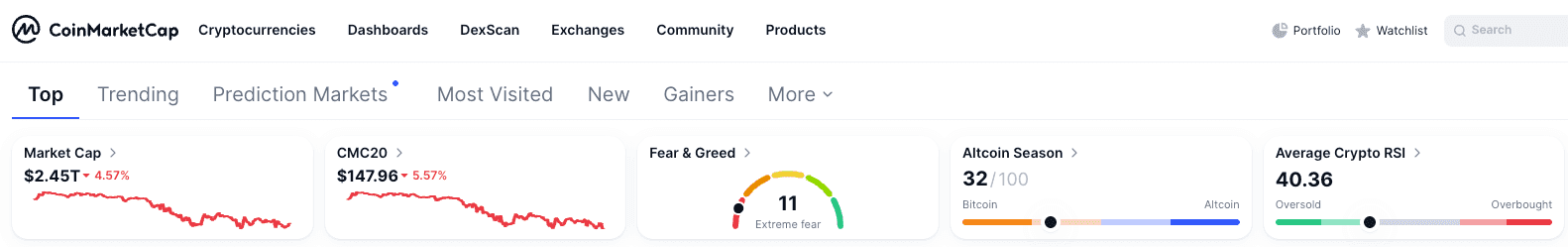

As of this morning, the total cryptocurrency market capitalization has decreased by 4.57%, moving to approximately $2.45 trillion. This movement is more pronounced in the CMC20 Index—which tracks the top 20 digital assets by market cap—showing a 5.57% daily decline. Furthermore, the Fear & Greed Index has reached a level of 11, categorized as "Extreme Fear," reflecting a significant shift in prevailing retail sentiment.

The primary inquiry among market participants remains: "Will crypto recover?" Today’s market activity appears to be the result of a complex interplay between regulatory discussions in Washington D.C., a rotation into traditional "safe-haven" assets, and an evolving institutional adoption perspective on risk-reward ratios for 2026.

1. What is Happening with Crypto Today? Primary Catalysts

The recent downward pressure in the crypto market stems from a combination of "sell the news" dynamics and emerging details regarding U.S. legislative discussions on market structure.

Legislative Discussions and Uncertainty

According to industry reports, including those from Eleanor Terrett, Senate Democrats recently convened to discuss market structure following discussions at the White House concerning Treasury yields and digital asset integration.

While long-term legislative clarity is often viewed as a prerequisite for broader institutional participation, the immediate market reaction reflects uncertainty regarding specific "asks" within the proposed framework. Reports indicate that Senate Majority Leader Chuck Schumer has emphasized the need for momentum on this legislation.

From a compliance and market perspective, regulation remains a double-edged sword. While "Market Structure" legislation may provide the legal framework needed for institutional growth, it also introduces potential short-term concerns regarding stricter KYC (Know Your Customer) requirements for DeFi protocols or adjustments to capital gains tax structures. Consequently, some participants appear to be de-risking their portfolios to mitigate potential legislative uncertainty.

Market Data Analysis

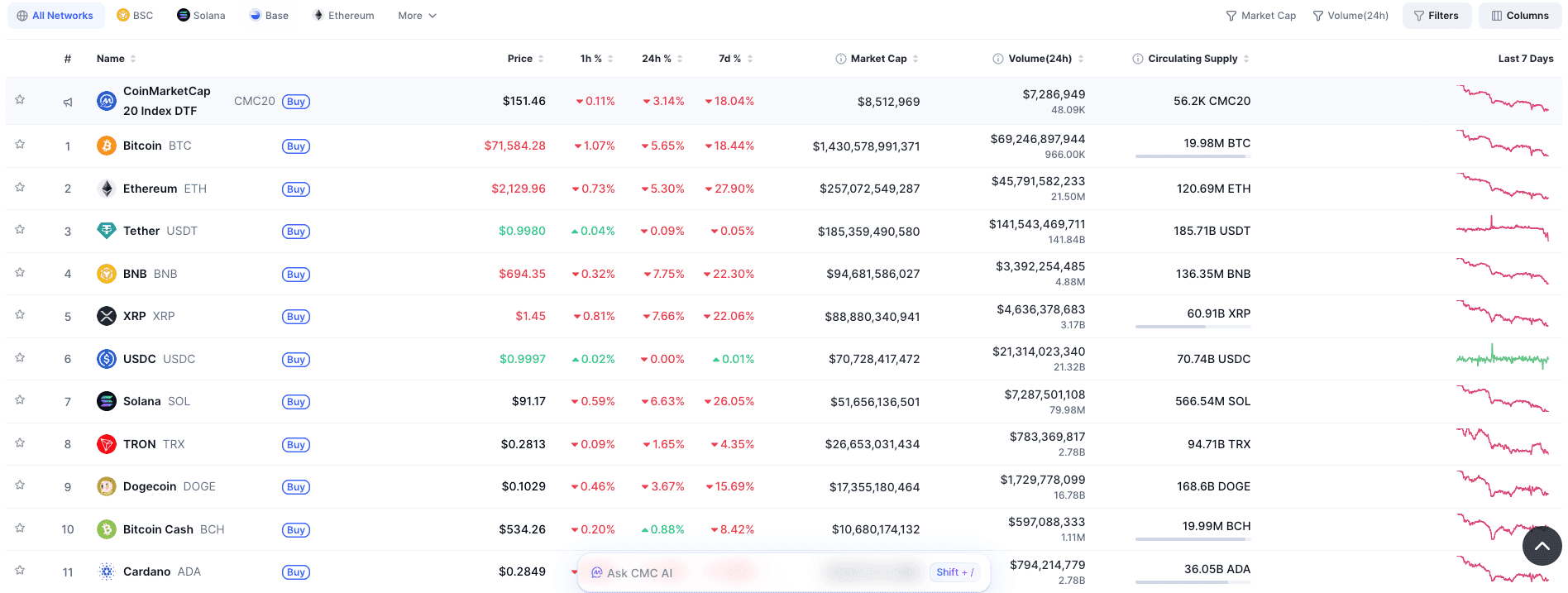

As of today's market update, several major assets have seen significant price adjustments:

-

Bitcoin (BTC): Trading at $71,584.28, representing a 5.65% 24-hour decline and an 18.44% decrease over the past 7 days.

-

Ethereum (ETH): Currently valued at $2,129.96, reflecting a 27.90% decline over the last week.

-

Solana (SOL): Trading at $91.17, down 26.05% over a 7-day period.

The average Crypto RSI (Relative Strength Index) is currently at 40.36. In technical analysis, while this suggests the market is approaching "oversold" territory, it remains above the sub-30 levels that some analysts associate with a definitive market bottom. This indicates that volatility may persist in the near term.

2. Market Outlook for 2026: Long-Term vs. Short-Term Perspectives

During periods of price correction, search interest for "Will crypto recover" typically increases. Answering this requires a distinction between short-term volatility and the fundamental developments scheduled for 2026.

The Resilience of Market Structure and Institutional Integration

A critical takeaway from recent Senate activity is that the effort to regulate digital assets is undergoing significant development. Legislation that moves past initial committee stages often returns with broader bipartisan considerations, reflecting a maturing political understanding of the sector. Current industry consensus indicates that the movement to integrate traditional finance (Wall Street) with on-chain technology continues to progress at a foundational level, irrespective of short-term price volatility.

This transition involves a structural shift from purely speculative digital assets toward a more robust tokenized financial infrastructure. In this context, the underlying tokenization technology is increasingly being recognized as the essential plumbing for the next generation of global finance. This trend, often categorized under the tokenization of Real World Assets (RWA), suggests that the long-term value proposition of the sector is becoming inextricably tied to its utility and efficiency within the broader global economic system. As the framework for these digital representations of value becomes clearer, the focus shifts from price action to the fundamental integration of decentralized ledgers into the sovereign financial stack.

The Zcash (ZEC) Observation

Notably, while major "blue-chip" assets are experiencing declines, there has been a recorded increase in interest for privacy-preserving technologies. Google Trends indicates a surge in queries for Zcash (ZEC).

Historically, such trends often coincide with periods of increased regulatory scrutiny. As discussions regarding "Market Structure" and "Industry Engagement" intensify, some participants may look toward privacy coins as a potential hedge against increased on-chain surveillance. However, it is important to note that privacy coins face their own set of unique regulatory challenges and liquidity risks.

The 2026 Sentiment

The Altcoin Season Index currently stands at 32, suggesting that Bitcoin continues to outperform a majority of altcoins. In a potential recovery scenario in 2026, the market may see a bifurcation where established assets with clear utility or regulatory status recover more effectively than speculative assets with lower liquidity. Today’s movements can be interpreted as a significant correction within a broader market cycle.

3. Asset Rotation: Bitcoin vs. Gold 2026

When the "Crypto Market Today" experiences high volatility and sentiment reaches "Extreme Fear," capital often rotates into different asset classes. This has renewed the discussion regarding Bitcoin vs. Gold in 2026.

Rotation into Traditional Safe Havens

While Bitcoin is frequently categorized as "Digital Gold," recent data confirms it retains a high correlation with "risk-on" assets, such as high-growth technology stocks. When legislative uncertainty increases, Bitcoin prices often react with higher sensitivity.

Conversely, physical gold continues to be utilized by many as a traditional "Safe Haven." Current market data suggests a distinct rotation; as BTC prices fell below the $72,000 support level, some capital flows moved toward the precious metals market. This reflects a strategy where investors prioritize wealth preservation through established commodities during periods of legislative or macroeconomic uncertainty.

Portfolio Rebalancing

In volatile markets, institutional participants often engage in portfolio rebalancing rather than exiting the market entirely. This involve moving a percentage of digital asset holdings into gold or other low-volatility assets to weather potential "legislative storms." This multi-asset approach seeks to capture the growth potential of digital assets while providing a buffer against downside risk.

As market participants rebalance, the consensus on stability is evolving. While Bitcoin offers growth potential, some traders are revisiting the stability of precious metals. For a detailed analysis, see our Gold Price Prediction 2026 to understand the factors driving gold's current valuation.

4. The Tokenization of Wall Street: A Long-term View

Despite the "Market Panic" observed in short-term price action, structural developments remain a primary focal point for the remainder of 2026. Current industry insights into the initiative of "bringing Wall Street on-chain" highlight a fundamental shift in the methodology of global asset management and capital settlement.

A growing cohort of institutional-grade financial entities and technology providers are actively developing frameworks to tokenize traditional instruments, ranging from government-backed bonds and money market funds to complex private equity structures. This systemic evolution suggests that the digital asset ecosystem is maturing into a primary, transparent, and programmable ledger for a vast array of global asset classes. This movement, often categorized as the expansion of Real-World Assets (RWA), represents the formal convergence of legacy financial systems with modern distributed ledger technology, providing a degree of utility that extends beyond speculative trading.

The fact that high-level legislative discussions are occurring within the U.S. Senate regarding this transition may suggest that the current price correction is a reaction to the complex process of establishing formal regulation rather than an absence of underlying value. The active engagement of senior legislative leadership indicates that digital assets have reached a level of systemic importance, necessitating a formalized growth framework. This ongoing regulatory integration is increasingly viewed by analysts as the "infrastructure phase" of the 2026 market, where the focus shifts from retail volatility to the institutionalization of the entire financial stack.

Key Data Takeaways:

-

Short-term: Technical indicators suggest an oversold market (RSI 40) accompanied by low sentiment (Fear Index 11).

-

Long-term: Infrastructure for institutional adoption is currently under legislative review.

5. Utilizing Risk Management Tools on Phemex

Whether analyzing a potential market bounce or a continued rotation into gold, utilizing a platform with robust risk management tools is essential during periods of high volatility. The current "Crypto Market Today" presents various scenarios for disciplined participants.

Risk Management Features on Phemex:

-

Hedging Positions: Phemex provides Inverse perpetual contracts, allowing users to hedge their spot holdings against downward price movements.

-

Asset Diversification: Beyond Bitcoin and Ethereum, Phemex offers access to a wide range of altcoins and privacy-focused assets, allowing for diversified market exposure.

-

Infrastructure Stability: During periods of high market volume and liquidations, Phemex’s trading engine is designed to maintain high uptime and order execution speeds.

-

Monitoring Divergence: Participants can monitor the divergence between different asset classes, utilizing Phemex’s liquidity to adjust their strategies as market conditions evolve.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Digital assets are subject to high market risk and extreme volatility. Past performance is not indicative of future results. Always conduct your own thorough research and consult with a professional financial advisor before making any trading decisions.

Conclusion

Is crypto dropping today? The data confirms a significant correction. However, this is often a characteristic of mature financial markets reacting to regulatory and macroeconomic shifts.

The combination of uncertainty regarding Senate deliberations and a rotation into traditional assets like gold has created a period of heightened volatility. With the Fear & Greed Index at 11, the market is experiencing a phase of significant psychological pressure. For the disciplined participant, this is a time for objective analysis of Bitcoin vs. Gold 2026 dynamics and a review of long-term sector fundamentals.

The consensus from recent legislative activity suggests that the digital asset sector is transitioning into a more regulated, institutional phase. As the Senate moves toward a framework for 2026, the current volatility may be seen as a component of the market's maturation process.