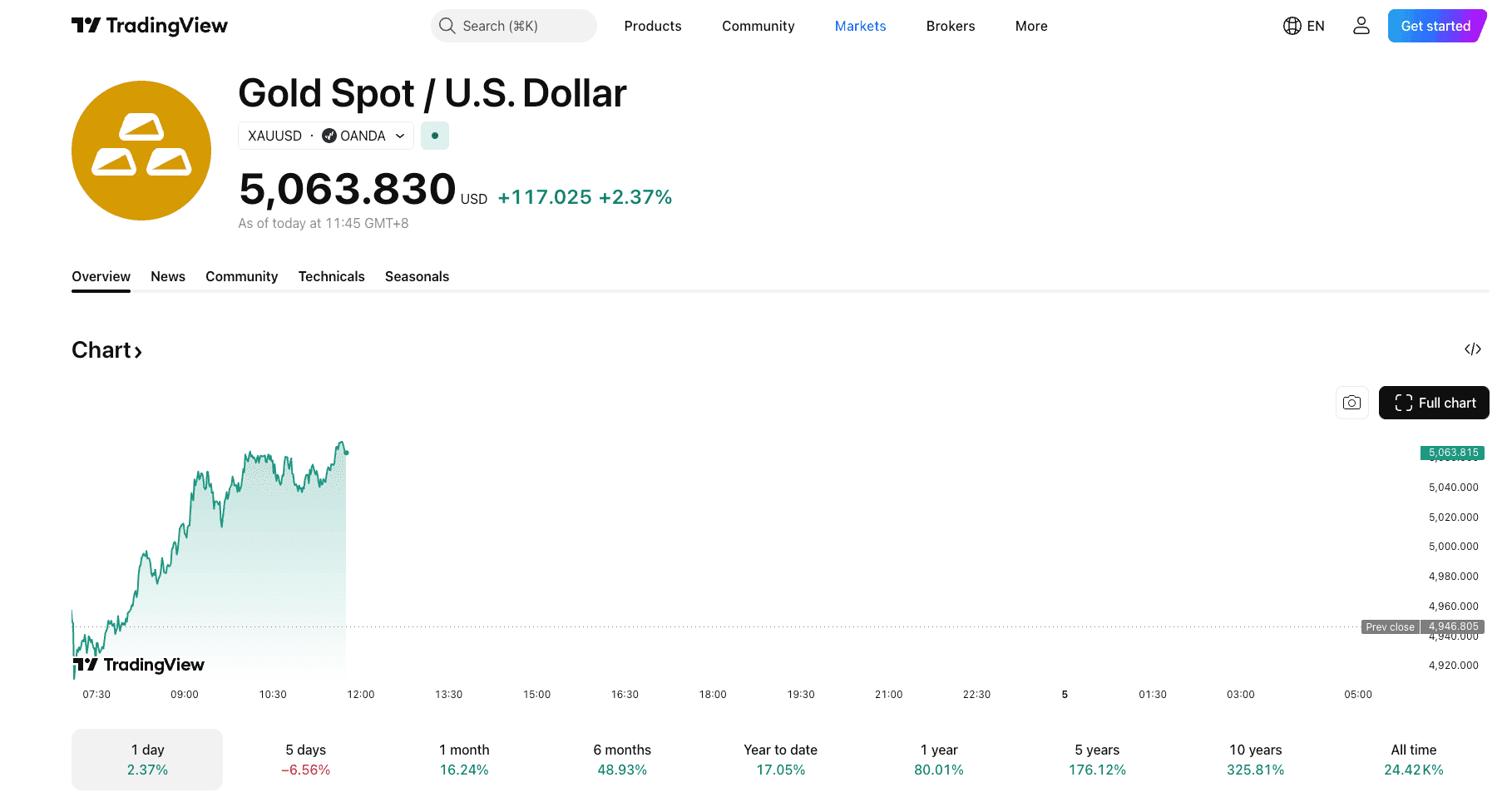

The financial landscape of 2026 has been defined by a fundamental shift in the global monetary regime. On February 4, 2026, the gold market reached a historic inflection point, decisively breaching the $5,000 psychological resistance level. Currently trading at $5,063.83, the precious metal has transitioned from a traditional defensive hedge to a primary, high-liquidity reserve asset in a multi-polar economy. This report examines the structural catalysts behind this "melt-up" phase, the evolution of Tokenized Real-World Assets (RWA), and the tactical outlook for the remainder of the 2026 fiscal year.

The 2026 Breakout: A Data-Driven Analysis of the $5,000 Floor

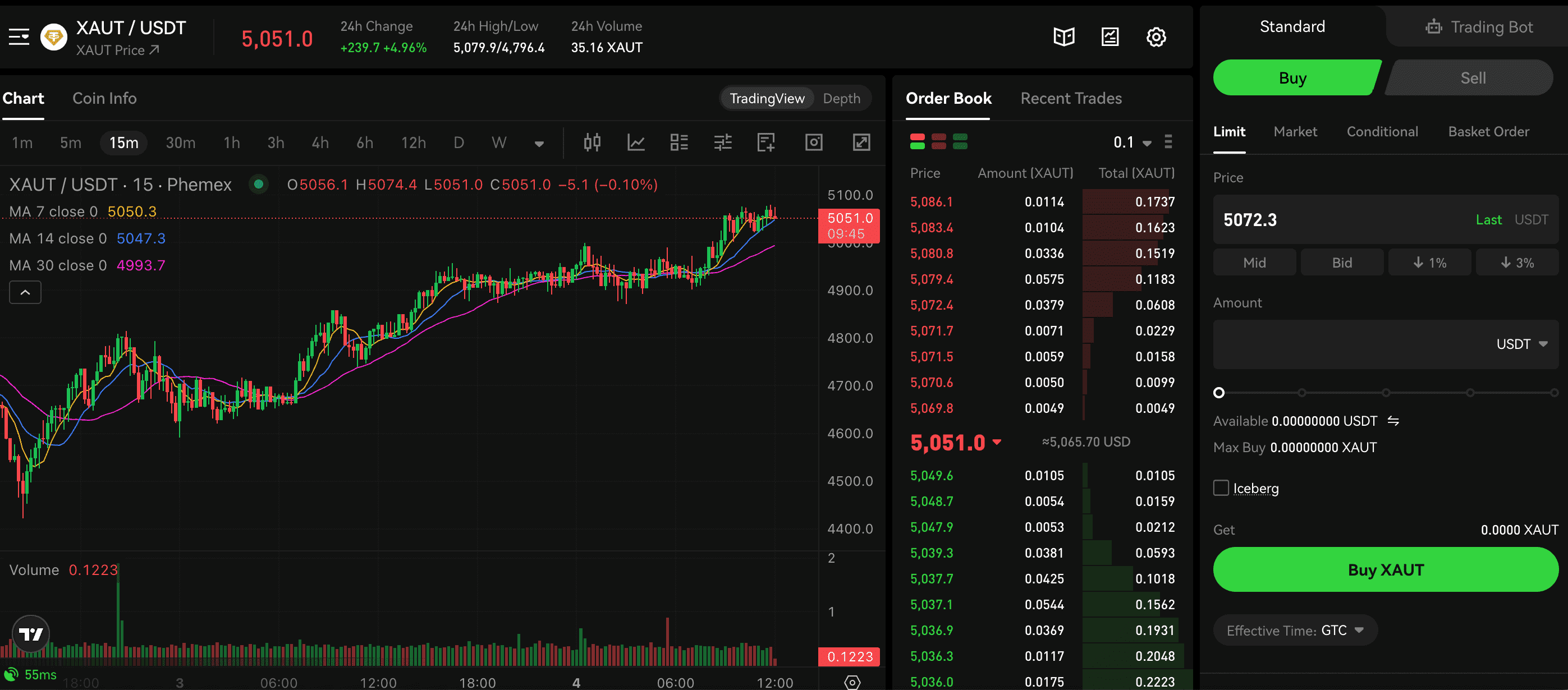

As observed on the midday TradingView charts for February 4, 2026, gold’s intraday surge of $117.02 (+2.37%) is not an isolated speculative event. Rather, it represents the culmination of a three-year re-rating cycle.

1. Technical Indicators and Market Velocity

The current price of $5,063.83 follows a period of aggressive price discovery. With a 1-year return of 80.01%, gold has outperformed nearly every major equity index in the G7. The velocity of this move is underpinned by a transition from "Fear-Based Hedging" to "Structural Allocation." Technical support has now migrated from the $2,500 levels seen in 2025 to a firm baseline above $4,900.

2. The 24/7 Liquidity Phenomenon

A critical observation in today’s session is that the 2.37% gain occurred primarily during the overlap of Asian and European trading hours. In the 2026 market, the concept of "market opens" is becoming obsolete. The rise of liquidity through tokenized gold assets (RWAs) allows for continuous price discovery, preventing the "gapping" traditionally seen at the London or New York opens.

Start Trading TradFi on Phemex

The Macro Catalyst: The $350 Trillion Debt Wall

The primary driver of the 2026 gold rally is the "Sovereign Debt Maturity Apex." Analysts have long warned of a collision between record debt levels and sustained high interest rates; 2026 is the year that collision became a reality.

1. The Refinancing Trap

A significant volume of sovereign debt issued during the low-interest-rate environment of 2020–2021 reached maturity in early 2026. Governments have been forced to refinance this debt at what the market terms "Crisis Rates." This has led to a "Fiscal Dominance" regime, where central banks are increasingly perceived as being forced to prioritize government solvency over inflation targets.

2. Negative Real Yields in All G7 Currencies

Despite nominal rates remaining elevated, the "opportunity cost" of holding gold has turned negative in real terms. In 2026, inflation has proven "sticky" due to supply-chain restructuring and energy transition costs. Consequently, gold at $5,000 is being priced as a mathematical hedge against the inevitable devaluation of fiat currency required to service global debt.

The Central Bank Revolution: De-dollarization and Gold-for-Trade

Central bank behavior in 2026 has moved beyond simple reserve diversification. We are witnessing the implementation of a new "Neutral Reserve Paradigm."

1. The BRICS+ Roadmap

By Q1 2026, the BRICS+ expansion has successfully launched its technical framework for a gold-backed settlement unit. This does not aim to replace the Dollar in all transactions but serves as a "Hard Collateral" layer for intra-bloc trade. This creates a permanent, non-price-sensitive demand floor for gold, as nations settle balances in physical or tokenized bullion rather than fiat-denominated debt.

2. Regional Case Study: The "Goldpreis Prognose 2026"

In Europe, particularly Germany, the "Goldpreis Prognose 2026" (Gold Price Forecast 2026) has become a primary driver of retail and institutional asset allocation. As the Euro struggles with structural divergence between member states, German investors have led the pivot back to "Sachwerte" (real assets), viewing gold as the only credible neutral asset within the Eurozone framework.

The Institutional Pivot: From Legacy ETFs to Tokenized Gold (XAUT)

A major shift in 2026 is how market participants gain exposure to gold. The era of the T+2 settlement cycle and bank-custodied ETFs is being challenged by the efficiency of tokenized real-world assets (RWAs).

1. Why XAUT is Dominating 2026 Trading

Institutional allocators, including sovereign wealth funds and high-frequency trading (HFT) firms, now prioritize 24/7 liquidity and instant settlement. XAUT has emerged as the preferred vehicle for this transition.

-

Instant Portability: Unlike physical bullion, XAUT can be moved across borders and exchanges instantly to satisfy margin requirements or hedge against sudden geopolitical events.

-

Zero Storage Drag: The traditional costs of vaulting and insurance are mitigated through the tokenization model, providing a more efficient "Baseload Collateral."

2. The Phemex Advantage

On platforms like Phemex, the integration of Tether Gold into the broader digital asset ecosystem allows traders to use gold as collateral for more complex strategies. The 2.37% move seen today was largely facilitated by traders moving out of stablecoins.

Gold vs. Bitcoin in 2026: The "Dual Safe-Haven" Consensus

The 2026 market has finally moved past the "Gold vs. Bitcoin" rivalry. They are now viewed as the two pillars of an "Anti-Fragile" portfolio.

1. The Correlation Shift

As of February 2026, the correlation between Gold and Bitcoin stands at +0.82. Both assets are responding to the same underlying stimulus: the erosion of confidence in centralized fiscal management.

-

Bitcoin as "High-Beta Digital Gold": Bitcoin provides the growth engine and technological utility for the 2026 digital economy.

-

Gold as "Baseload Collateral": Gold at $5,000+ provides the stability and historical precedence required by institutional risk committees.

2. The "Exit from the System" Narrative

Market sentiment suggests that both assets are part of a broader "Exit Strategy" from the traditional banking system. In an era of potential "Digital Dollar" (CBDC) implementation, the demand for assets that exist outside the immediate control of central judicial overreach has reached an all-time high.

The Commodity Super-Cycle: Silver and Copper

While gold captures the headlines, the 2026 commodities super-cycle is also being driven by industrial necessity.

1. Silver (SLVON): The Catch-Up Play

Historically, silver outperforms gold in the later stages of a bull market. With gold at $5,000, the Gold-to-Silver ratio is significantly stretched.

-

Solar & 6G Catalyst: In 2026, the mass deployment of Perovskite solar cells and the global rollout of 6G telecommunications infrastructure have created a supply deficit in silver that is now being reflected in the price.

-

Target: Analysts are monitoring a "catch-up" rally for silver to test $150/oz by year-end.

2. Copper (TCU29): The Infrastructure Alpha

If gold is the thermometer for monetary distress, copper is the barometer for technological advancement.

-

AI Data Centers: The 2026 generation of AI Data Centers requires a 400% increase in copper density for power distribution compared to 2023 levels.

-

The Space Economy: Satellite constellations and orbital logistics modules have introduced a new, price-inelastic source of demand for high-purity copper alloys.

Strategic Scenarios: 2026 Price Targets

Following today's breach of $5,063.83, Phemex Market Intelligence has updated its scenario-based projections for the remainder of 2026.

| Scenario | 2026 Year-End Target | Macro Trigger |

| Optimistic (Bull) | $8,500 | A systemic failure of a major G7 currency or a significant escalation in geopolitical "Dark Zones." |

| Baseline (Standard) | $6,500 - $7,200 | Sustained 4% inflation, continued 24/7 central bank accumulation, and ongoing sovereign debt refinancing stress. |

| Conservative (Bear) | $4,200 | A "forced liquidation" event where institutions sell gold to cover margin calls in collapsing equity markets, or an unexpectedly successful CBDC launch. |

Risk Management in the $5,000 Era

With gold entering a vertical "melt-up" phase, risk management is paramount. The volatility seen in today’s session (+2.37% in hours) suggests that 20th-century investment strategies—such as quarterly rebalancing—may be insufficient.

1. Real-Time Hedging

Traders are increasingly using the 24/7 liquidity of Phemex to hedge physical holdings with XAUT or futures contracts. This allows for immediate response to geopolitical news that often breaks outside of traditional banking hours.

2. Avoiding "Hype" Traps

While the $5,000 milestone is significant, professional market participants should avoid the "FOMO" (Fear Of Missing Out) typical of retail bubbles. The 2026 rally is fundamentally supported by debt math, but "Liquidity Vacuums" can still cause sharp, short-term corrections.

Conclusion: The Era of the $5,000 Floor

The February 4, 2026, print of $5,063.83 is a historical marker. It signals the end of the "Post-War Fiat Exuberance" and the beginning of a "Hard Collateral Reset."

Gold is no longer just a commodity; it is the benchmark against which all other assets—and currencies—are being measured. Whether through the lens of the "Goldpreis Prognose" in Europe or the "De-dollarization Roadmap" in the East, the consensus is clear: the $2,000 gold floor of the early 2020s is a relic of the past. The $5,000 floor is the new reality.

For the modern investor, success in 2026 requires a sophisticated approach that combines the timeless security of gold with the technological advantages of the digital asset economy.

FAQ: Navigating the 2026 Gold Market

Q: Why did gold break $5,000 today?

A: A combination of a record $350 trillion global debt wall, a surge in central bank "Gold-for-Trade" settlements, and a technical breakout above the long-term resistance channel.

Q: Can I trade gold 24/7 on Phemex?

A: Yes. Phemex provides access to XAUT (Tether Gold), which tracks the price of physical gold and can be traded 24/7, allowing you to react to price moves like today's +2.37% surge in real-time.

Q: Is silver a better investment than gold in late 2026?

A: Silver offers higher convexity (potential for higher percentage gains) but carries significantly higher volatility. Many 2026 portfolios use a 3:1 ratio of Gold to Silver to balance stability with growth.

Q: What is the biggest risk to the gold rally?

A: A systemic "liquidity crunch" where all assets are sold simultaneously to cover margin calls is the primary risk. However, in 2026, central banks have historically intervened to provide liquidity, which often further fuels the gold rally.

Start Trading TradFi on Phemex

Disclaimer:

This report is provided for institutional research and informational purposes only. It does not constitute financial, investment, or legal advice. Trading in commodities, digital assets, and tokenized real-world assets (RWAs) involves a high degree of risk and may not be suitable for all investors. Past performance, including the 80.01% YoY return cited, is not an indicator of future results. Phemex is a trading platform; we do not provide personal financial consulting.