Bitcoin is often called the king of crypto – and for good reason. It was the first ever cryptocurrency, introduced in 2009, and it remains the largest by market capitalization and global recognition. However, since Bitcoin’s creation, the crypto universe has expanded dramatically. There are now thousands of other cryptocurrencies (often called “altcoins”), each with its own features and purposes. This raises a common question, especially for newcomers: What is the difference between Bitcoin and other cryptocurrencies?

To put it simply, Bitcoin is a cryptocurrency, but it holds a unique status within the broader cryptocurrency market. It’s similar to how gold relates to other metals: gold is a metal, yet it’s considered special among commodities. Likewise, Bitcoin is a cryptocurrency, yet it’s often discussed separately from the rest of the crypto pack because of its history, market role, and characteristics. In this article, we’ll break down the key differences between Bitcoin and other cryptocurrencies. Whether you’re a beginner hearing names like Ethereum, Solana, or Dogecoin for the first time, or an intermediate crypto enthusiast looking to understand Bitcoin’s role vs. other projects, this guide will clarify the distinctions.

Bitcoin: The First and Most Important Cryptocurrency

Bitcoin was introduced by the pseudonymous Satoshi Nakamoto in a 2008 whitepaper and launched in January 2009. It was a revolutionary concept – a decentralized digital currency that operates on a peer-to-peer network secured by cryptography and consensus (proof-of-work mining). Bitcoin solved the “double-spend” problem without needing a central authority, using a public ledger called the blockchain. In simpler terms, Bitcoin allowed people to transfer value over the internet without banks or payment processors, relying instead on a network of nodes and miners to validate transactions and secure the system.

Key attributes that make Bitcoin stand out:

-

Decentralization: No single entity controls Bitcoin. Its network is globally distributed. This makes it censorship-resistant and robust. Thousands of nodes run the Bitcoin software worldwide, and a diverse set of miners contribute hash power. There’s no Bitcoin company or CEO; changes to the network rules require broad consensus.

-

Digital Gold Narrative: Over time, Bitcoin has increasingly been seen as “digital gold.” It’s used as a store of value by many investors, thanks to its provable scarcity and longevity. Only 21 million bitcoins will ever exist. This hard cap (embedded in code) makes Bitcoin naturally deflationary over the long term – a stark contrast to government currencies that can be printed in unlimited quantities. As of 2025, around 19.5 million BTC have been mined, leaving only ~1.5 million to be mined over the next century. This scarcity is a major part of Bitcoin’s value proposition.

-

Simplicity and Security Focus: Bitcoin’s blockchain is intentionally kept limited in scope. Its scripting language for transactions is not Turing-complete (meaning it’s not designed to run complex programs or smart contracts easily). While this means Bitcoin’s functionality is mainly focused on basic transactions (send/receive) and some multi-signature or timelock logic, it also reduces attack surfaces. Bitcoin’s priority is being ultra-secure and reliable as a base layer for value transfer. Upgrades to Bitcoin are slow and conservative, emphasizing security and decentralization above all.

-

First-Mover Advantage: Being the first cryptocurrency, Bitcoin has the strongest brand recognition. It’s the coin people hear about on mainstream news, and it’s often the entry point for new investors. It also achieved the widest adoption: by 2025, Bitcoin is held by tens of millions of people globally, has been adopted as legal tender in countries like El Salvador, and is considered a hedge by some institutional investors. This prominence creates a self-reinforcing cycle — since everyone knows Bitcoin, it’s the default “blue chip” crypto asset.

In summary, Bitcoin’s identity is tied to being a peer-to-peer digital cash and a store of value. It has a singular purpose and a robust, time-tested network. But Bitcoin is not the end of the story because it inspired a whole industry of other cryptocurrencies that aim to do things differently or serve other use cases.

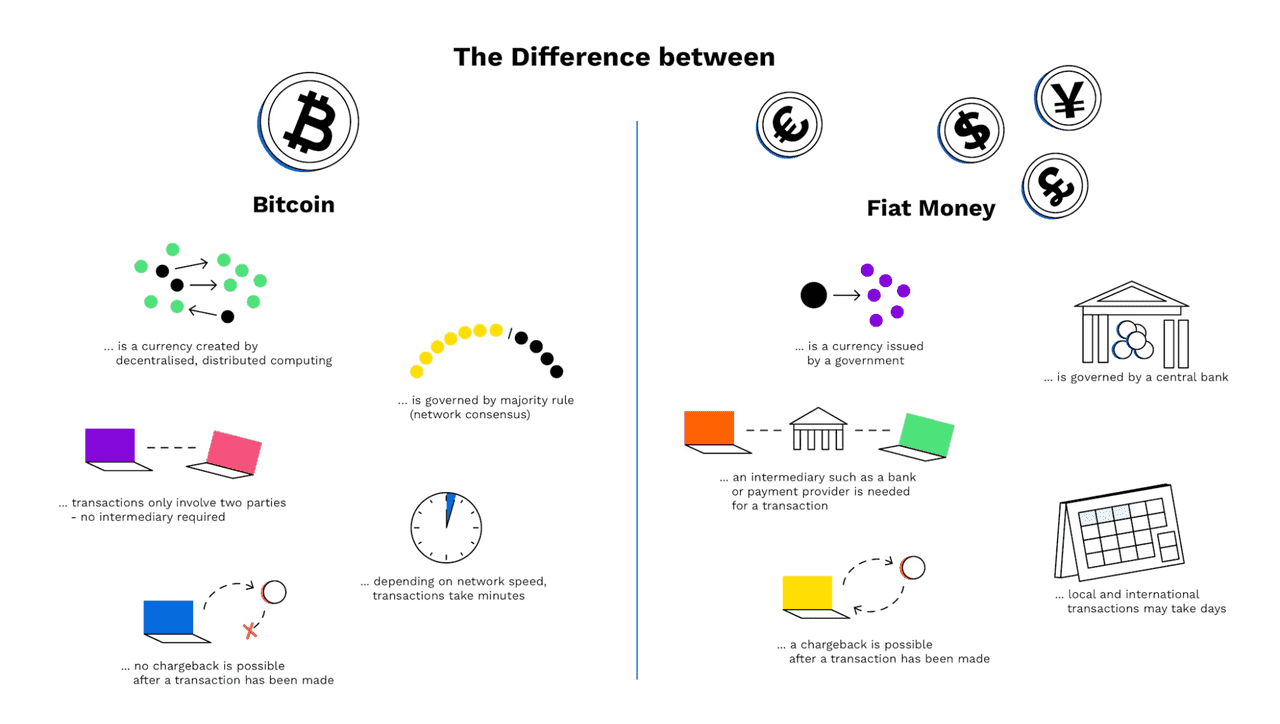

Bitcoin vs. Fiat

What Are Cryptocurrencies (Beyond Bitcoin)?

Cryptocurrency is a broad term for digital assets that use cryptography and blockchain technology to function as a medium of exchange, store of value, or to power specific platforms and applications. After Bitcoin’s invention, developers realized they could create new networks and tokens for a variety of purposes. Broadly speaking, any decentralized digital coin or token that isn’t controlled by a bank or central authority qualifies as a cryptocurrency.

Here are some general points about cryptocurrencies as a whole:

-

They typically rely on blockchain technology, which is a distributed ledger enforced by a network of computers (nodes). This ensures transparency and tamper-resistance.

-

Cryptocurrencies can have different consensus mechanisms. Bitcoin uses Proof-of-Work (miners solving puzzles), but many newer cryptos use Proof-of-Stake (validators staking coins) or other methods like delegated proof-of-stake, proof-of-history, etc. Different consensus algorithms have trade-offs in terms of security, decentralization, and energy usage.

-

Many cryptocurrencies are open-source projects with communities of developers, rather than companies. However, some have more centralized teams or foundations behind them.

-

Use cases vary widely: some cryptos aim to be money like Bitcoin, others fuel smart contract platforms, some are tied to real-world assets (like stablecoins), and some started as jokes (meme coins) or experiments.

Importantly, there are thousands of cryptocurrencies in existence. As of early 2025, over 10,000 different cryptocurrencies are actively traded or used (with many more having existed and died off). The vast majority of these have small market caps and are relatively unknown. Only a small subset of cryptocurrencies have achieved significant adoption or technological innovation. Let’s talk about the major types of cryptocurrencies you should know about.

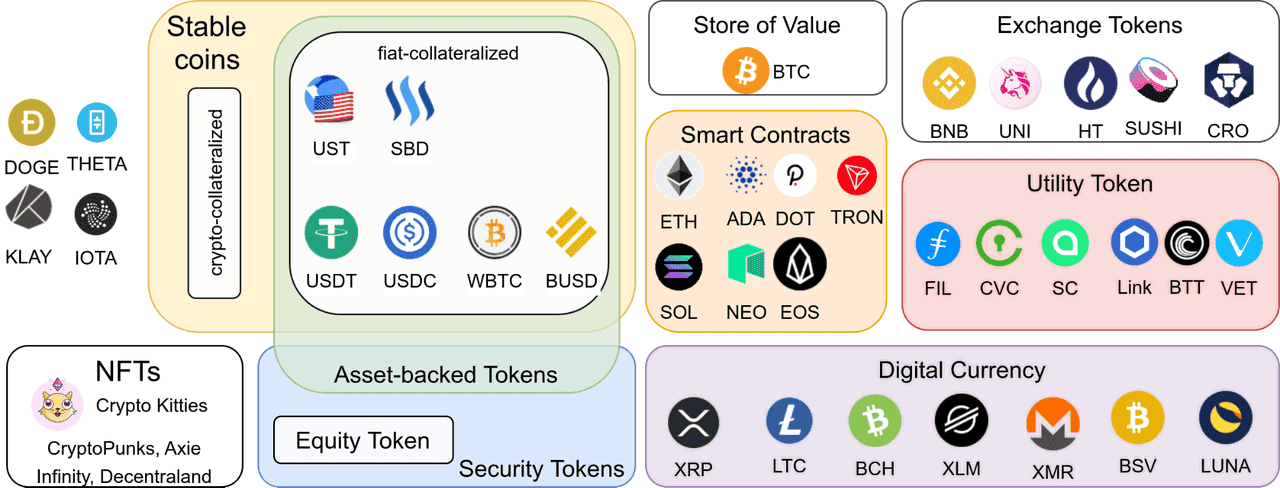

Categories of Cryptocurrencies (Altcoins Explained)

“Altcoin” is an umbrella term for any cryptocurrency that isn’t Bitcoin. Altcoins can be grouped into a few categories based on their purpose and characteristics:

-

Payment Coins: Designed primarily for transactions, examples include Litecoin (LTC) and XRP, with Bitcoin Cash (BCH) also focusing on transaction efficiency.

-

Smart Contract Platforms: These are essential for running decentralized applications (dApps). Ethereum (ETH) leads this space, with competitors like Binance Smart Chain (BNB) and Solana (SOL). Their value is linked to the adoption of their networks.

-

Stablecoins: Cryptocurrencies like Tether (USDT) and USD Coin (USDC) are pegged to fiat currencies to maintain stable values. They serve as a reliable medium of exchange within the crypto ecosystem.

-

Exchange and Utility Tokens: Tokens such as Binance Coin (BNB) and UNI offer benefits within their respective platforms, often granting governance rights and fee discounts.

-

DeFi Tokens: These are linked to decentralized finance platforms, such as Aave (AAVE) and Maker (MKR), providing governance rights and potential revenue shares.

-

NFT and Metaverse Tokens: Tokens like MANA and SAND are used in virtual worlds. NFT projects also sometimes have released their own tokens such as PENGU and APE, with success tied to platform popularity.

-

Meme Coins: Often created as jokes, coins like Dogecoin (DOGE) can gain significant speculative value, driven by community sentiment, despite lacking serious utility.

-

Privacy Coins: A notable category aiming at enhanced privacy for transactions. Monero (XMR) and Zcash (ZEC) are examples. These coins use advanced cryptography to obscure sender, receiver, and/or transaction amounts, offering more anonymity than Bitcoin.

There are other niche categories as well (like utility tokens for specific services, fan tokens, governance tokens for DAOs, etc.), but the above are the main groupings. Now, importantly: Bitcoin does not fit neatly into many of those categories. It’s not a platform for smart contracts (though some limited functionality and second-layer solutions exist, like the Lightning Network for faster payments, or projects to bring tokens to Bitcoin like Ordinals). It’s not a stablecoin (its price fluctuates freely). It’s not controlled by an exchange or specific application. It’s certainly not a meme coin. And it doesn’t prioritize fancy features or high throughput. Bitcoin’s niche is somewhat singular: sound money and a secure settlement network. It focuses on doing a few things well rather than being everything to everyone.

Types of crypto tokens (source)

Bitcoin vs Other Cryptos: Key Differences

Let’s highlight a few fundamental ways Bitcoin differs from most other cryptocurrencies:

-

Origin and Development: Bitcoin was created by Satoshi, who disappeared after its launch, resulting in a decentralized structure without a formal organization. In contrast, many altcoins have identifiable founders or supporting organizations, like Ethereum with its foundation and Cardano with IOHK.

-

Supply and Monetary Policy: Bitcoin has a fixed supply cap of 21 million and a predictable issuance schedule, making it appealing for those concerned about inflation. Many altcoins lack a hard supply cap, and some, like Ether, have a dynamic monetary policy due to their transition to Proof-of-Stake.

-

Consensus Mechanism: Bitcoin uses Proof-of-Work mining, which is energy-intensive and ties the network to real-world energy costs. Many altcoins utilize Proof-of-Stake, which may be less secure and can lead to wealth concentration among holders.

-

Ecosystem and Use Cases: Bitcoin primarily serves as a store of value and a transfer method, while many altcoins target specific functionalities, such as decentralized applications or file storage. Bitcoin operates mostly standalone, lacking direct integration into DeFi or NFTs.

-

Market Behavior: Bitcoin leads the market with the largest cap and often influences price movements of other cryptocurrencies. Altcoins tend to be more volatile, experiencing rapid gains and losses compared to Bitcoin.

-

Perception and Regulation: Bitcoin is increasingly recognized as a digital commodity and is treated differently by regulators. In the U.S., it is not classified as a security, while many altcoins face scrutiny. Institutions are starting to accept Bitcoin more readily than other cryptocurrencies.

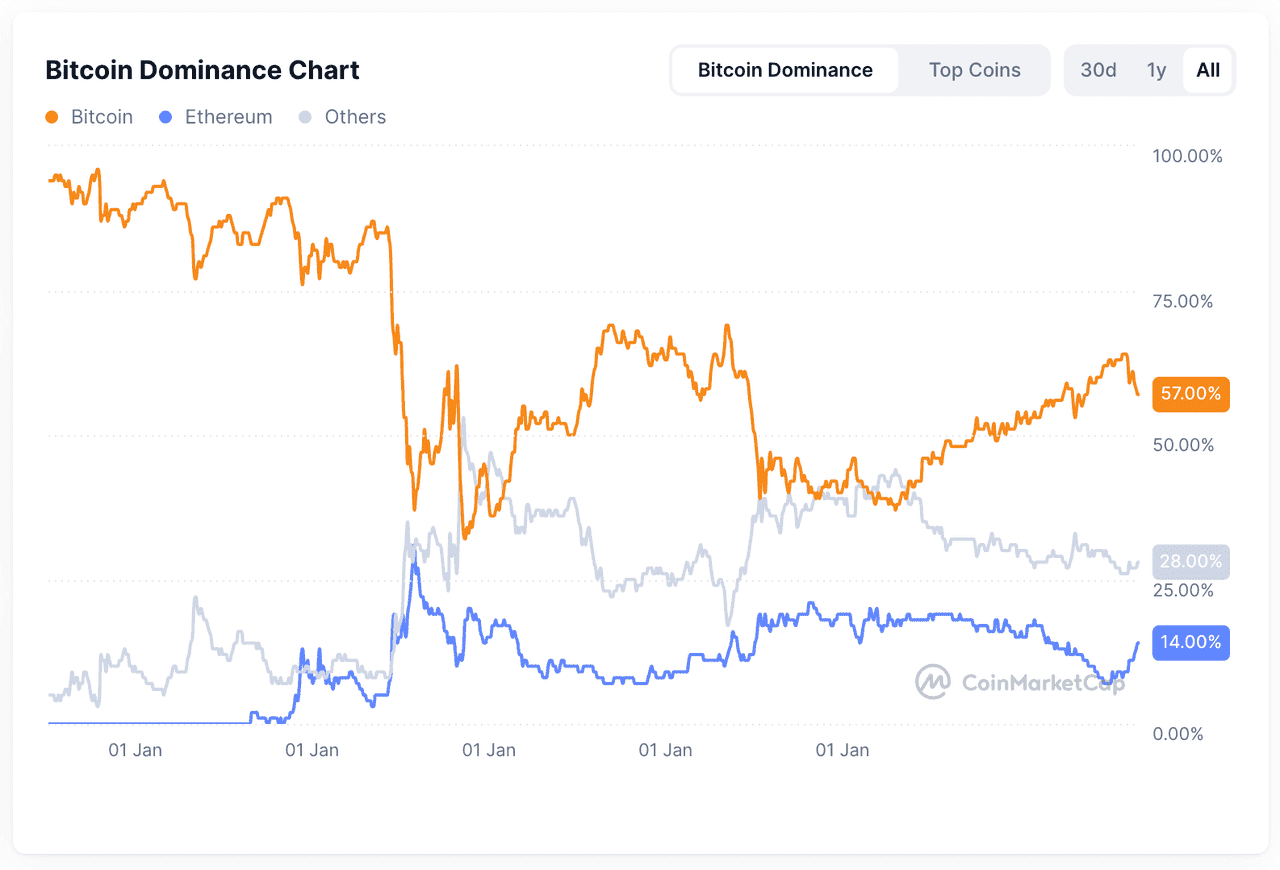

Bitcoin Dominance and Market Trends (2023–2025)

Bitcoin dominance refers to the share of Bitcoin’s market capitalization relative to the total crypto market capitalization. It’s a metric that shows how much of the crypto market’s value is in Bitcoin versus all other coins. Over the years, this dominance has fluctuated significantly.

According to a Binance research report, Bitcoin’s dominance rose from roughly 40% to 65.1% in early 2025, fueled by things like ETF demand and big money flows into BTC. This was a significant surge, meaning nearly two-thirds of all crypto value was in Bitcoin at one point. However, as the year went on, some capital rotated into altcoins, and by mid 2025 Bitcoin dominance eased to about 57%. In late August 2025, it was noted to be just below 60%. This suggests that while Bitcoin is still the single largest asset by far, there has been an altcoin rally in the summer of 2025 that gave life to other projects (often, when Bitcoin stabilizes after a big move, traders seek higher returns in altcoins, causing an “alt season”).

Generally when BTC dominance is rising, it means Bitcoin is outperforming the rest of the market. Often this happens in early bull phases where investors trust Bitcoin first, or during bear markets when many altcoins lose value faster (people consider Bitcoin the safer crypto asset, akin to a reserve). A rising dominance can also reflect skepticism about unproven projects – money flows back to the “tried and true” Bitcoin.

When BTC dominance is falling, it indicates altcoins collectively are outperforming Bitcoin. This can be due to hype cycles for specific sectors (like DeFi, NFTs, or a new blockchain trend), or overall exuberance where investors are willing to take on more risk for higher reward. A sharp drop in dominance often corresponds to an altcoin season, where numerous alts see rapid price increases. However, very low dominance can be hard to sustain if those altcoin gains aren’t backed by lasting value – often the pendulum swings back.

It’s also worth noting Ethereum’s role. Ethereum is the second-largest cryptocurrency and often when discussing “Bitcoin vs crypto” one implicitly means “vs Ethereum and others.” Ethereum has a huge ecosystem and its price movements sometimes diverge from Bitcoin’s based on network-specific factors (like major upgrades or DeFi activity). In 2025, Ethereum has transitioned to 2.0 (Proof-of-Stake, sharding on the horizon, etc.) and continues to be the backbone of DeFi and NFTs. Some people compare Bitcoin and Ethereum to gold and oil: Bitcoin being a store of value (gold), Ethereum being a productive asset powering an economy (oil). Ethereum’s dominance (its share of total market cap) sits around 18-20% in 2025, which is significant but still far from Bitcoin’s share.

Bitcoin Dominance Chart (source)

Does Bitcoin Do What Other Cryptocurrencies Can’t (and Vice Versa)?

Bitcoin’s strengths are security, simplicity, and being a trust-minimized neutral currency. It doesn’t try to do everything. Many altcoins emerged specifically to do things Bitcoin couldn’t or wouldn’t.

Smart contracts and programmability: Bitcoin doesn’t natively support complex smart contracts (though there are layer-2 solutions and sidechains exploring it). Ethereum and others fill that gap, enabling applications like decentralized exchanges, lending protocols, games, etc. If you want to borrow stablecoins against collateral, or trade an NFT, you’re likely using an Ethereum-based platform or another smart contract chain, not Bitcoin. Bitcoin’s design prioritizes reliability over flexibility.

High throughput or fast finality: Bitcoin’s base layer handles about 5-7 transactions per second and has ~10 minute block times. This is too slow for, say, daily retail purchases on a global scale or high-frequency trading. Other chains sacrifice some decentralization or use different mechanisms to achieve thousands of TPS and faster confirmation (Solana boasts high throughput, as do newer chains like Aptos or Avalanche subnets, etc.). However, Bitcoin can scale via Layer 2 solutions like the Lightning Network, which allows instant, high-volume micropayments by opening payment channels. By 2025, Lightning has grown and is used for things like El Salvador’s Bitcoin payment system and various tipping apps. Still, for most users interacting with blockchain apps, altcoins will be the go-to since those apps largely don’t exist on Bitcoin.

Privacy features: As mentioned, coins like Monero offer privacy far beyond Bitcoin’s pseudonymity. Some Bitcoin enthusiasts use mixing services or privacy techniques, but Bitcoin’s base layer isn’t private. Altcoins can cater to users who need private transactions.

Governance and upgrades: Bitcoin’s development process is slow and consensus for changes is conservative. This is a feature for stability – Bitcoin doesn’t change much, and when it does (like the SegWit upgrade in 2017 or Taproot in 2021), it’s through painstaking community agreement. Other projects move faster, experimenting with new features (like Ethereum’s rapid evolution or Cardano’s research-driven upgrades). Altcoins often act as innovation sandboxes – if something succeeds, it might inform future Bitcoin improvements or at least coexist as separate options. But this means altcoin networks can sometimes have unforeseen issues due to cutting-edge changes, whereas Bitcoin is battle-tested.

BTC vs Crypto: Which Should You Choose?

For someone new to the space, it’s not necessarily an either/or between Bitcoin and the rest – it depends on your goals:

-

If you believe in the long-term value of a decentralized, scarce store of value that could act as a global reserve asset or inflation hedge, Bitcoin is the primary choice. It has the longest track record and is often seen as lower risk (relatively speaking) within crypto. It’s the asset institutions are most likely to hold and nations might consider in the future.

-

If you are excited about specific technologies or use-cases – say smart contracts, decentralized applications, or specific sectors like decentralized finance or gaming – then exploring altcoins (such as Ethereum or others relevant to that sector) makes sense. Owning Ether might appeal to you if you want to use DeFi or believe ETH will gain value from powering the next internet of value.

-

Some people align philosophically: “Bitcoin maximalists” argue that Bitcoin is the only cryptocurrency that truly matters, viewing many altcoins as unnecessary or even scams. On the other hand, others see a multi-coin future where different platforms serve different purposes (just as we have different internet companies or different commodities).

From an investment perspective, historically Bitcoin has been more stable in downturns, while altcoins can offer higher upside in euphoric times but can also go to zero if the project fails. It’s analogous to blue-chip stock vs. tech startup stock. Bitcoin is the blue-chip of crypto.

Conclusion

In summary, Bitcoin vs. other cryptocurrencies is about understanding roles: Bitcoin is the original cryptocurrency, primarily serving as a decentralized store of value and digital cash, while “cryptocurrency” as a broader term encompasses a wide array of projects with diverse goals. Bitcoin is to crypto what the sun is to the solar system – everything else in crypto in some way defines itself in relation to Bitcoin’s existence.

For a beginner, a good approach is often to start with Bitcoin to grasp the core idea of blockchain-based money, then branch out to explore major altcoins like Ethereum to see what else blockchain technology can do (smart contracts, etc.). Always do thorough research, though - beyond the top few, many altcoins have high risk and some may not survive long-term. Bitcoin, with its large network and Lindy effect (the longer something survives, the more likely it continues), is likely to be around for the foreseeable future.