Unlike conventional investment assets that have a track record and fixed investment duration (like 10-year bonds), there really is no definitive time period for what constitutes “long-term” and “short-term” investing in crypto.

After all, the oldest cryptocurrency, Bitcoin (BTC), only has a 13-year history.

Short-term investing can mean anything from a month to a year for some, while for others it can be just weeks. At the same time, long-term can refer to a period of 3 to 5 years for some, and for others, 6 to 8 years.

Time horizon aside, there are other factors that determine one’s crypto investing style:

- Risk tolerance: How much risk are you willing to take on? Are you comfortable with volatility or do you prefer a more stable investment? Your risk tolerance will also help guide your investment strategy.

- Investment goals: What are you hoping to achieve with your investment? Are you looking to grow your wealth, preserve your capital, or generate income? Your investment goals will help shape your overall strategy.

- Investment experience: Do you have experience investing in cryptocurrencies? Are you new to the space? Your investment experience will also play a role in shaping your strategy.

These are just a few of the key factors that will determine your crypto investing strategy. There is no one-size-fits-all approach, so it’s important to tailor your strategy to your own individual circumstances.

How to invest in crypto long term?

When it comes to long-term investing in crypto, the main idea is “buy and hold” or HODL. This basically means buying and storing a crypto, without looking for the next immediate opportunity to sell the moment prices go up.

The strategy that many investors choose to do this is to dollar-cost average (DCA). This can look like setting aside $10 or $100 every week or month to buy a crypto like BTC or ETH.

Dollar cost averaging is an investing strategy whereby an investor breaks up their total investment into smaller, periodic investments, rather than investing all at once. By buying crypto-assets over time, the buyer reduces their exposure to market volatility and price swings. Dollar cost averaging can also be a good strategy for investors who are new to the market or uncomfortable with large fluctuations in prices.

More savvy investors who are skilled in timing the market will try to buy a lump amount when the market has reached the bottom. However, it is extremely hard to do this perfectly and even very experienced investors may try to use a combination of DCA and market timing–they might start off DCA-ing but once prices have fallen to levels much lower than initially predicted, they might increase their allocation.

Long-term crypto investors will also keep a lookout for factors such as planned network upgrades, partnerships, roadmaps, and other important project milestones in order to ascertain growth outlook.

In addition, they will keep an eye out for metrics like liquidity, market cap, trading volume and adoption rate.

Which crypto to buy today for long-term?

Just as their counterparts, blue chip stocks, are the preferred stocks of long-term value investors, large-cap cryptos (those that rank in the top 20 by market cap) are generally the preferred category for investors looking for long-term stable plays in the volatile world of crypto.

The most famous of these, obviously, are Bitcoin and Ethereum.

Bitcoin: Digital Gold

Bitcoin is undoubtedly the most exciting technology the world has witnessed since the Internet’s emergence in the 1990s. Widely seen as “digital gold” for its digital scarcity, Bitcoin is expected to give gold a run for its money especially among investors who want some exposure to crypto in their portfolio.

The largest crypto by market cap ($370 billion at time of writing) is seeing steady institutional adoption.

The latest: Bank of New York Mellon, the world’s largest custodian bank, recently launched its crypto custodian services, enabling specific clients to hold and transfer bitcoin and ether through BNY Mellon.

“…we continue to see significant demand from institutional investors and are excited about future opportunities from blockchain and tokenization technology for assets and cash,”

said Caroline Butler, chief executive of custody services at BNY Mellon, told MarketWatch.

And this is why even though Bitcoin has lost about 70% of its value year-to-date, it is still quite possibly the safest pick of all crypto assets for long-term investing.

Bitcoin’s 10-year CAGR, at 196.7%, “is unmatched in financial history,” outperforming all other assets, says Casebitcoin.com, an informational resource on all things Bitcoin

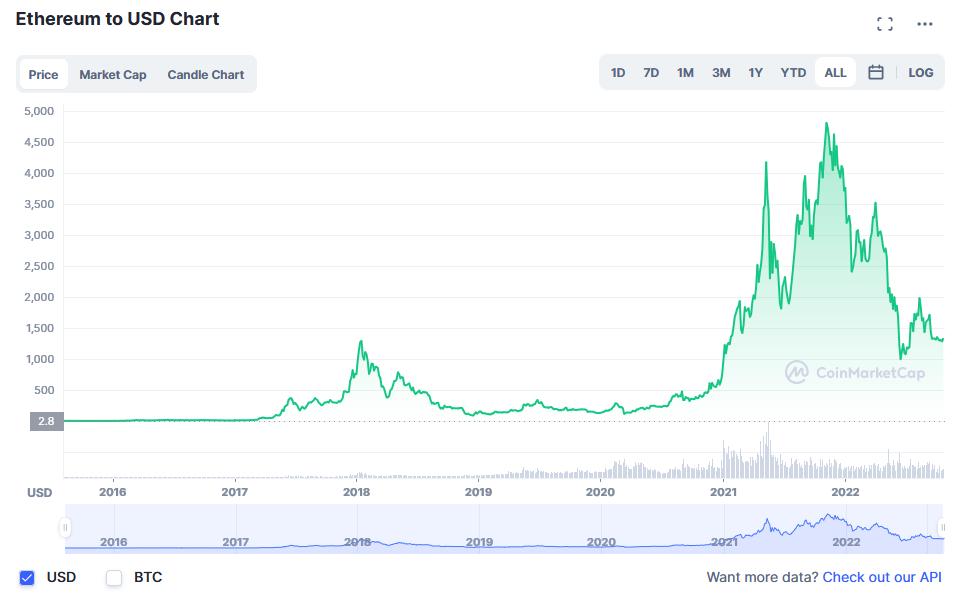

Ethereum: Smart Contract Platform Leader

Ethereum, as the leading smart contract platform, has driven the 2020 decentralized finance (DeFi) boom and 2021 non-fungible token (NFT) explosion. Bank of America, in its first Cryptocurrency & Digital Assets paper in 2021, stated, “Digital assets are not about payments per se. They’re about a new computing paradigm–a programmable computer that is accessible everywhere and to anyone and owned by millions of people globally.”

“If Bitcoin’s demand is driven by users’ desire to hold Bitcoin, a large portion of Ether’s demand is driven by users who want to spend it on transactions. Given these dynamics, if Bitcoin can be viewed as digital gold for holding, Ether can be viewed as digital oil for burning,”

said Morgan Stanley in its Global Investment Committee Report (Feb 2022). Ethereum’s market cap at time of writing: $164 billion.

Short term crypto trading

As opposed to long-term investors who hold out for super-sized returns over a longer period of time, short term crypto trading refers to regular buying and selling of coins to earn smaller, but more regular gains.

Some short-term crypto trading strategies in crypto may include the following:

- Day trading: This involves buying and selling assets within the same day, in an attempt to profit from small price movements. These profits can add up to a larger amount by the end of the day.

- Swing trading: This entails holding an asset for a period of time, typically a few days to a few weeks, in order to take advantage of larger price swings.

- Scalping: This is a strategy whereby traders attempt to profit from small, frequent price movements, typically holding an asset for only a few minutes or hours. Scalpers have to be experts in micro-market movements in order to identify the ideal entry or exit opportunities.

- Arbitrage: Arbitrageurs leverage price discrepancies between identical crypto assets on different exchanges or different trading pairs in the same market to generate profits. The essence is taking advantage of market inefficiencies.

Day trading and scalping can be especially high-risk strategies, and may not be suitable for all investors.

If you are holding a crypto asset for the short term, it is important to carefully monitor the market and watch for signs of a potential reversal. By selling at the first signs of trouble, you can help to limit your losses and maximise your chances for success.

For short-term traders, a good grasp of chart / candlestick patterns will be of greater importance than for long-term traders. They also need to have a solid understanding of technical indicators such as Moving Averages, Relative Strength Index (RSI), Stochastic Oscillator, and Average Directional Movement.

Which crypto to buy today for short-term?

Investors who prefer to engage in short-term crypto trading generally go for cryptos that have more volatility i.e. small-cap coins, because short-term gains are made on the price movements. But even among small-cap coins, one should do proper due diligence to avoid rug pulls or obvious losers.

Some key attributes to look out for:

- A strong team: One of the most important things to look for in a small-cap crypto is a strong leadership team. The team should have a proven track record in the industry and should be composed of experienced individuals.

- A solid “why”: The project should have a well-defined roadmap and should be focused on solving valid problems. The project should also have a working product or prototype.

- A strong community: A strong community is essential for any crypto project. The community should be active and supportive, and there should be a clear demand for the project’s token (note: this does not refer to influencers paid to “shill” a coin.)

Some investors who have a higher risk appetite will choose to invest a small sum (e.g. $1,000) in small-cap coins that have a lot of room for explosive growth.

Their modus operandi–buy penny cryptocurrencies when they are still under the market radar, and immediately sell when they skyrocket to 500% / 1,000% / 10,000% gains. Again, the rule to remember here is “high risk, high returns.”

For some specific recommendations: check out Newest Cryptocurrencies To Buy In 2022 – Phemex Blog

Conclusion

When making a decision on whether to embark on a long-term or short-term crypto investing/trading strategy, it is important to consider your goals, risk tolerance, and investment horizon.

While the crypto market experienced encouraging developments in 2021, such as Bitcoin being made the legal tender in El Salvador and increasing market participation from institutional investors and firms, it will likely remain highly volatile in 2022 as regulators play catch-up with this rapidly growing asset.

Nevertheless, with realistic expectations and a well-thought out investing plan, the risks and volatility can be properly mitigated.

Read More

- Crypto Trading vs. Investing: Key Differences Explained

- How To Trade Crypto: The Ultimate Investing Guide

- Buy Low, Sell High Crypto: 4 Things To Do (3 To Avoid)

- How To Do Crypto Research: The Best Ways to Get Started

- Day Trading Crypto for Beginners: Get started with Day Trading

- What is Position Trading: The “HODL” Alternative for Bitcoin Trading

- What is Cryptocurrency & How It Differs From Digital Cash

- How to Short Bitcoin (BTC)? Steps, Benefits & Risks Explained