XinFin is a permissioned blockchain platform aiming to facilitate international trade finance and inter-organizational payment operations. XinFin inherits much of its functionality from two prominent platforms – the public Ethereum (ETH) blockchain and the private Quorum blockchain.

XinFin’s native cryptocurrency, XDC, currently trades at $0.095 USD with a circulating supply of 12.3 billion tokens for a market cap of around $1.1 billion USD.

What Is XinFin (XDC)?

XinFin was created as a fork of the Quorum blockchain, which, in turn, is a fork of Ethereum. The platform combines Ethereum’s decentralized open-access functionality with Quorum’s support for creating private-access networks.

The platform uses its own variation of the Delegated Proof of Stake (PoS) block verification method that allows it to achieve fast transaction speeds and low costs. XinFin positions this verification model and its speed and cost efficiencies as core value propositions.

XinFin mainly targets financial institutions, governments, insurance providers, and, in general, all business entities that may have an interest in efficient trade finance, settlement, and inter-organizational payment operations.

One of XinFin’s most useful features for financial institutions is its ability to integrate data from internal legacy systems, such as ERP systems or SWIFT payments databases, into the blockchain using the ISO20022 electronic data interchange standard. ISO20022 is extensively used by financial institutions for inter-organizational data exchange.

So far, XinFin has made some modest yet somewhat limited progress in targeting governments and financial organizations. It has cooperated with the government of Maharashtra, one of the largest Indian states, to present a proof-of-concept for the land registry records on blockchain.

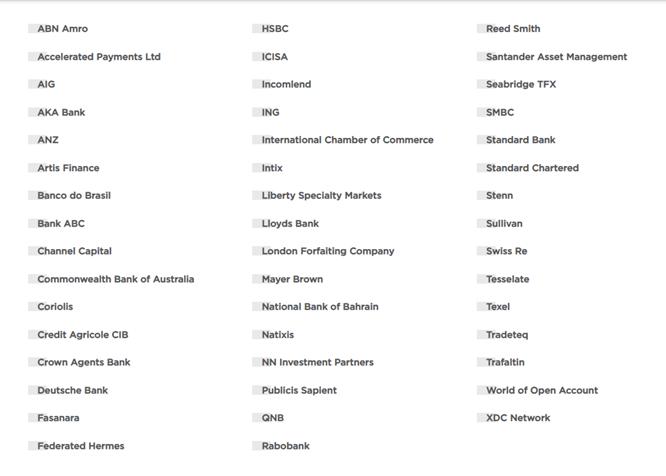

XinFin has also recently become a partner of the Trade Finance Distribution (TFD) Initiative, a consortium of financial institutions cooperating on improving transparency and efficiency of inter-organizational payments. The TFD Initiative includes some prominent finance industry names, such as ABN AMRO, ING, Deutsche Bank, Standard Chartered, ANZ Bank, and the Commonwealth Bank of Australia.

It is expected that the members of the Initiative will be making use of XinFin for some of their operations or projects. So far, there has been an announcement by the Initiative to use XinFin for “SME-oriented supply chain finance”.

How Does XinFin Work?

At the heart of XinFin’s value proposition is its Delegated PoS (DPoS) block verification model. XinFin credits this model for the low transaction costs and fast performance it boasts. XinFin’s average transaction confirmation time is only around two seconds, while transaction fees are about 1/100th of the typical fees on Ethereum.

XinFin Master Nodes

XinFin’s DPoS uses the concept of master nodes, powerful server-like computers with a capacity to quickly process a large number of transactions, to achieve its technical efficiencies.

Any user can join XinFin and propose their candidate as a master node. In that respect, XinFin is an open-access decentralized network. In order to qualify as an active master node, you will need to commit at least 10,000,000 XDC ($950,000 USD), have the requisite hardware and software, and attain enough votes from other network nodes to place you in the top 50 master nodes during each epoch.

XinFin Epoch

Each epoch on XinFin lasts about 30 minutes and involves 900 transaction blocks. Given the rather hefty requirement of nearly a million USD to become an active master node, XinFin currently has only 108 master nodes.

XinFin Rewards

The master nodes earn rewards in XDC for block verification. XinFin uses a double-verification step to enhance the security of the block verification process. When a master node verifies a block, a second master node is chosen randomly to confirm the block. Only after this confirmation, the block is added to the ledger.

Network users that are not master nodes can earn rewards by staking their XDC on the qualified master nodes. Every time the master node they voted for with their XDC earns a block reward, the network users get rewards, albeit in much lower amounts, as well.

Although XinFin has the public access mode, organizations can create their own gated-access networks on it and benefit from the platform’s cost and speed efficiencies. Being a fork of Quorum, XinFin offers great functionality for configuring restricted-access networks.

Who Is Behind XinFin?

XinFin was founded in 2017 by technology entrepreneurs Atul Khekade and Ritesh Kakkad. The company is registered in Singapore. The project’s mainnet was launched in June 2019.

Both co-founders are active in the project. Khekade is heading XinFin’s Technology & Ecosystem Development function, while Kakkad is involved in a more generalized role as the project’s strategist. Kakkad is also an early investor in XinFin.

The project is also supported by five business advisors. Among them are the CEO of Bitcoin.com Roger Ver and the COO of Bitcoin.com Mate Tokay.

There is no credible information on any external funding secured by XinFin so far.

XDC Coin Price History

From its launch in 2017 to early 2021, XDC traded at small fractions of one US cent, staying below $0.01 until mid-February 2021.

It then started rapidly appreciating, riding the wave of the overall market bubble, and reached $0.13 by mid-April 2021. As the cryptocurrency market crashed, XDC dropped to about $0.05 by mid-June.

The market’s recovery helped XDC quickly climb back to above $0.10 levels, and by late August, the coin reached its all-time peak of $0.18. It could not sustain these levels for too long, and by now, it has halved in value from that peak. As of the time of writing, XDC trades at slightly under $0.10.

Though twice lower than its historical peak value by now, XDC has appreciated by 1,000% from the beginning of the year. Compared to the overall crypto market appreciation of 267% over the same period, XDC has performed comparatively well this year.

What Is the Future for XinFin?

The overall outlook for the XinFin project looks cautiously optimistic. Although the platform has not yet finalized deals with many institutional clients, recent developments instill confidence in the platform’s business viability.

The partnership agreement with the TFD Initiative should serve as a major springboard for XinFin into the world of big finance. TFD boasts a large number of finance and banking giants among its members. If even a small fraction of these companies start using XinFin extensively, the platform will receive a much-needed boost from the corporate “social proof”.

In March 2021, XinFin also signed an agreement with R3, the owner of the Corda blockchain. As per the agreement, XDC became a recommended platform-wide settlement coin for the Corda blockchain.

Given that Corda is the undisputed leader of enterprise blockchain solutions for the finance industry, this agreement is another positive development for XinFin. While Corda’s clients can create their own tokens and coins on the platform, XDC solves the problem of the absence of a platform-wide coin that would support operations between all the private networks hosted on Corda.

The market’s optimism towards XinFin is evident from its strong appreciation in value from the start of the year (1,000% vs the overall market average of 267%).

The key issue that may hinder XinFin’s pace is the relative lack of network decentralization. The platform relies on just 108 nodes to verify blocks. Although additional verification techniques, such as the double-verification step and continual voting process for each epoch are employed, the total number of the verifier nodes is comparatively low.

This might serve as a trust issue for potential clients, particularly with XinFin trying to attract the interest of big entities such as governments and financial institutions.

Conclusion

XinFin is a blockchain that offers organizations an efficient platform to conduct finance operations. The platform primarily tries to cater to the needs of financial institutions and governments.

Though run as a public decentralized platform at its core, XinFin offers organizations the ability to create their own permissioned or private networks on the platform.

Although XinFin had seen little business success before 2021, this year proved a real breakthrough for the project. Since the start of the year, XinFin has signed important partnership agreements with organizations such as R3 and TFD Initiative.

These agreements are expected to boost future opportunities for the blockchain. The year 2022 is likely to bring the first substantial benefits of these partnerships.

The issue that might hinder XinFin’s adoption or expansion in the enterprise world is the platform’s relatively low level of decentralization. XinFin’s reliance on just 108 verifier nodes may seem to be not sufficiently decentralized by some in the industry. The key question is whether XinFin’s technical advantages, such as low costs and fast transaction speeds, will outweigh its lower decentralization in the eyes of potential clients.

Read More

- https://phemex.com/academy/defi

- Blockchain in Trade Finance: Opportunities, Uses, and Obstacles

- ISO 20022 for Crypto: Are Cryptos ISO-Compliant and Can Be Used by Banks?

- What Are Decentralized Applications (dapps)?

- Analysis- Unlocking synergy: Can TradFi converge with DeFi?

- Blockchain Analytics: 11 Free Crypto Research Tools You Need

- What Is DeFi: How To Be Your Own Bank With $100

- What is Cryptocurrency & How It Differs From Digital Cash