Imagine using your favorite Ethereum dApps—like Uniswap for swaps or Aave for lending—directly inside your Telegram app. No clunky cross-chain bridges, no need to manage extra wallets, and no dealing with confusing wrapped assets. It sounds like a distant dream, but this is the exact future that TAC Protocol (TAC), a groundbreaking Layer-1 blockchain, is building. It aims to be the super-highway connecting Ethereum’s mature DeFi ecosystem with Telegram’s colossal billion-user base.

But before you dive in, a critical warning: a simple Google search for "TAC Coin" can lead you down a rabbit hole of confusion. The crypto space is currently buzzing with at least two major, and entirely different, projects using the TAC ticker. Investing in the wrong one could be a costly mistake.

This is your definitive guide. We will not only dissect the real, high-potential TAC Protocol set to revolutionize the TON ecosystem but also clarify the widespread confusion. We'll explore its groundbreaking technology, its powerful token use cases, and answer the ultimate question: is this the next big investment opportunity on your radar?

Summary Box: Key Facts on the TON-linked TAC

-

Ticker Symbol: TAC

-

Core Narrative: The EVM for Telegram. A Layer-1 blockchain connecting Ethereum dApps to TON users.

-

Ecosystem: TON (The Open Network) & Cosmos

-

Key Technology: CosmosSDK, Ethermint, TON Adapter, Hybrid dApps

-

Primary Use Case: Enabling seamless, native use of Ethereum DeFi within the Telegram environment.

-

Key Selling Point: Aims to unlock Ethereum's deep liquidity and dApp ecosystem for Telegram's ~1 billion users.

-

Availability on Phemex: Coming Soon! Get Ready!

The Multi-Billion-Dollar Problem TAC Solves

The crypto world currently has two separate, titanic ecosystems. On one side, you have Ethereum, the undisputed king of DeFi. It boasts the largest and most professional developer community, the deepest liquidity pools, and a battle-hardened ecosystem of blue-chip applications.

On the other side, you have Telegram, a communications giant with nearly a billion active users, now deeply integrated with The Open Network (TON) blockchain. This represents a gargantuan, largely untapped market for decentralized applications.

The problem? A massive gulf separates them.

-

The Developer's Pain: An Ethereum developer with a successful dApp cannot simply bring it to Telegram's users. They face a daunting choice: either rewrite their entire codebase in FunC (TON's native language), a costly and time-consuming process, or give up on this massive user base.

-

The User's Pain: A TON user who wants to access superior yields or token variety on Ethereum DeFi must navigate a treacherous path. This involves using risky and often unreliable cross-chain bridges, managing multiple wallets and seed phrases, and dealing with "wrapped" assets that add layers of complexity and security risk. The user experience is broken.

TAC Protocol's mission is to bulldoze this wall. It acts as a universal translation layer and a high-speed transportation network, creating a seamless bridge where value and data can flow freely between these two worlds.

The Technology Behind TAC: How Hybrid dApps Work

TAC's ambitious goal is achieved through a sophisticated and elegant architecture. It's not just another bridge; it's a foundational solution. Think of it as a three-layered cake designed for a perfect user experience.

1. The Execution Layer: TAC EVM Chain

At its core, TAC is a sovereign, high-performance blockchain built using the Cosmos SDK and Ethermint.

-

Cosmos SDK: This is a popular framework for building custom blockchains. It provides TAC with modularity, sovereignty, and a clear path to interoperability with the wider Cosmos ecosystem.

-

Ethermint: This is the magic ingredient that makes TAC fully compatible with the Ethereum Virtual Machine (EVM). This means any smart contract written in Solidity (Ethereum’s programming language) can be deployed on TAC without a single change to the code.

-

Delegated Proof-of-Stake (dPoS): Instead of Bitcoin's energy-intensive Proof-of-Work, TAC uses dPoS. This allows for a fast finality of around 2 seconds, ensuring transactions are quick and cheap, which is essential for a good user experience in DeFi.

2. The Translation Layer: The TON Adapter

This is TAC's secret weapon and its most significant innovation. The TON Adapter is a bidirectional, asynchronous messaging layer that functions like a hyper-secure universal translator.

-

When a user on Telegram initiates a transaction (e.g., "swap 10 TON for some ETH-based token"), they do it from their native TON wallet (like Tonkeeper).

-

The TON Adapter securely picks up this request, validates it, and "translates" it into a format the TAC EVM chain can understand.

-

It then sends this instruction to the EVM chain for execution. Once the swap is complete, the Adapter translates the result back and delivers the new tokens directly to the user's TON wallet.

-

This entire process is secured by a network of collateral-backed sequencers, ensuring that the messages cannot be tampered with.

3. The Presentation Layer: The TAC SDK & Hybrid dApps

This is what the end-user sees and interacts with. The TAC SDK (Software Development Kit) is a toolkit for developers to easily build frontends for their applications as Telegram MiniApps (TMAs).

The result is a Hybrid dApp. The frontend (the buttons you press) lives natively inside Telegram, while the backend logic (the smart contract execution) runs on the powerful and secure TAC EVM chain.

For the user, the entire experience is seamless. It feels exactly like using a native TON application, but under the hood, they are tapping into the full power of Ethereum's multi-billion dollar DeFi ecosystem. This is the ultimate goal: TON's native experience combined with EVM's infinite possibilities.

The TAC Showdown: Don't Invest in the Wrong Coin

This is the most crucial part of this article. Before you consider investing, you MUST understand the difference between the projects using the "TAC" name. It could save you from a significant financial mistake.

| Feature | TAC Protocol (on TON) | TAC Protocol (Data Protocol) | TaiChi (TAC) |

| Core Narrative | The EVM for Telegram | Trustless Data Aggregation | Decentralized Reserve Currency |

| Associated Hype | TON, Telegram, DeFi, EVM | AI, DeSci, Oracles, Web3 | DeFi 2.0, Olympus (OHM) Fork |

| Technology Base | Cosmos SDK, Ethermint | Substrate, Polkadot Ecosystem | BNB Chain |

| Founding Story | Tech-driven team focused on bridging ecosystems. | Founded by renowned artists/theorists Holly Herndon & Mat Dryhurst. | Community/anonymous-driven project. |

| Investment Thesis | A direct bet on the explosive growth of the TON/Telegram ecosystem. | A long-term bet on the future of verifiable data and AI. | A speculative play on DeFi 2.0 tokenomics. |

The Bottom Line: The project generating immense hype, raising significant funds, and poised for a listing on Phemex is the first one: TAC Protocol, the EVM for Telegram. While the other projects have their own merits, they are entirely different investments.

What Drives the TAC Token's Value? (Tokenomics)

The TAC token is the lifeblood of this entire ecosystem. Its value is not based on pure speculation but is intrinsically linked to the network's adoption and utility. The primary value accrual mechanisms are standard for a powerful Layer-1 protocol:

-

Gas Fees: Every single transaction on the TAC EVM chain—a swap, a lend, a mint—requires a fee to be paid in TAC tokens. As more dApps deploy on TAC and more users from Telegram interact with them, the demand for TAC to pay for these transactions will grow organically.

-

Network Security (Staking): TAC's dPoS consensus mechanism requires a set of validators to process transactions and secure the network. To become a validator, an entity must stake (lock up) a significant amount of TAC tokens as collateral. Token holders can also delegate their TAC to these validators to earn a share of the staking rewards. This staking mechanism creates a constant demand for TAC and removes a large portion of the supply from the open market, supporting its price.

-

Service Fees: The TON Adapter is a highly specialized service. It is likely that dApps or users leveraging this core piece of infrastructure will need to pay service fees in TAC, creating another direct demand driver tied to cross-chain activity.

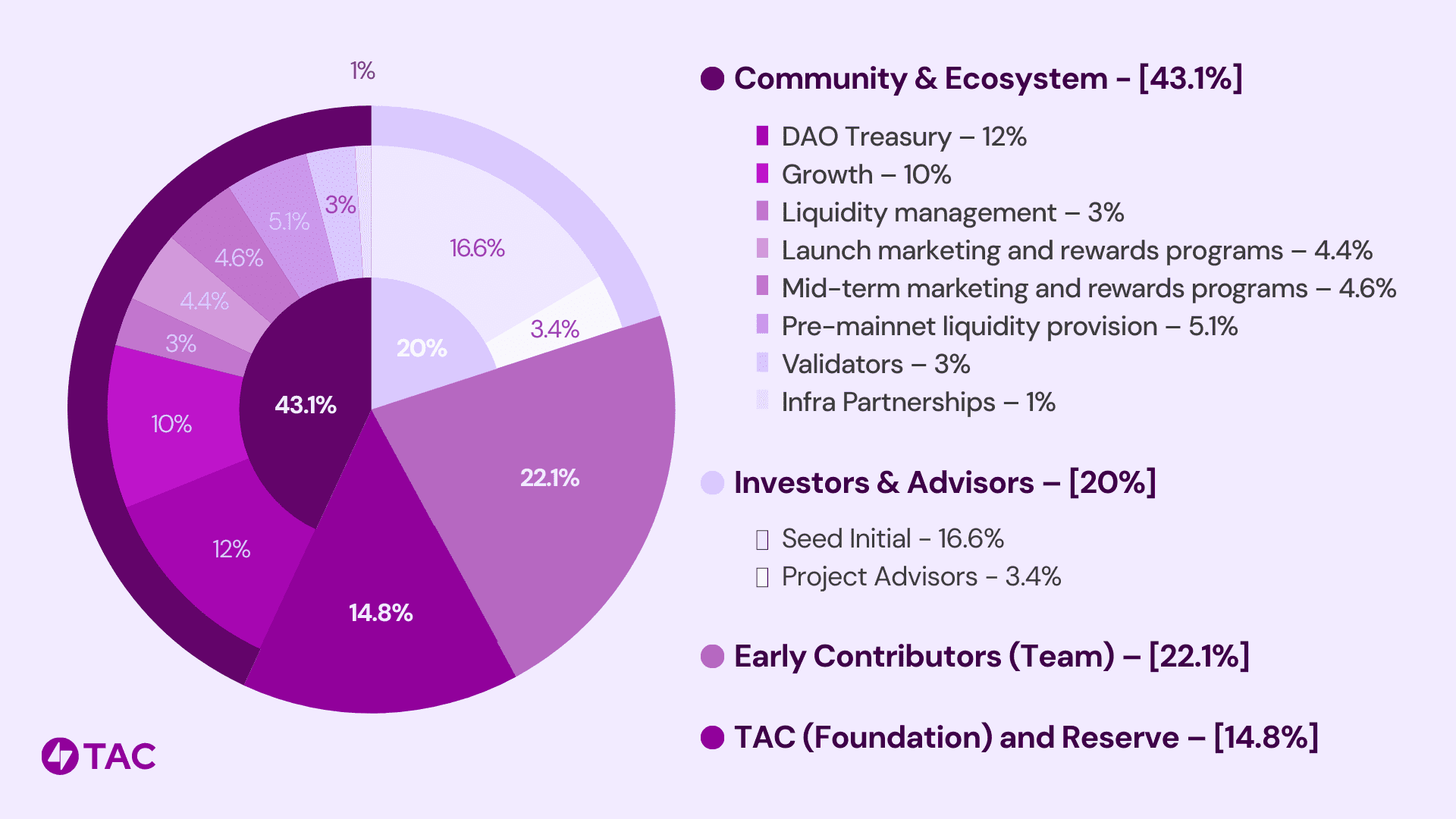

A Quick Look at TAC's Tokenomics & Supply

TAC's tokenomics are strategically designed to foster long-term growth while rewarding the community. The total supply is 10 billion TAC tokens, with a thoughtful distribution plan to prevent early sell-offs and align all stakeholders with the project's success.

Key Token Allocation Points:

-

Community First (43.1%): The largest portion is dedicated to the community and ecosystem. This includes funds for a community-run DAO Treasury, growth programs to incentivize dApp usage, initial liquidity, airdrops, and validator rewards.

-

Long-Term Alignment (42.1%): Allocations for the team (22.1%) and early investors/advisors (20%) are subject to long lock-up periods, typically a 12-month cliff followed by 2-3 years of linear vesting. This ensures that early backers and builders are committed to the project's sustainable development.

-

Foundation & Reserve (14.8%): A reserve is set aside for the project's operational longevity, including future development, partnerships, and attracting new talent.

Initial Circulation and Inflation:

At the Token Generation Event (TGE), approximately 18% of the total supply will be in circulation, primarily from community rewards and liquidity provisions. The remaining 82% is locked and will be released gradually over several years.

TAC employs a clever inflation model to secure the network without devaluing the token. While the maximum annual inflation is capped at 5%, the effective inflation (the rate at which the circulating supply increases) is projected to be only around 2.1%. This is achieved by a unique mechanism where a large portion of staking rewards earned by locked insider tokens are burned. This allows the network to offer an attractive staking APY of around 8-10% to public stakers, providing strong incentives for network security while maintaining long-term token scarcity.

Investment Analysis: The Next Ecosystem Gem or a High-Risk Bet?

Disclaimer: This section is for informational purposes only and is not financial advice. All cryptocurrency investments carry significant risk. Always do your own research (DYOR).

Evaluating TAC requires a clear-eyed look at its monumental potential and its inherent risks.

The Bull Case for TAC (Why It Could Succeed)

-

Mega-Narrative Alignment: TAC is perfectly positioned at the intersection of two of the hottest narratives in crypto today: the rise of the TON Ecosystem and the integration of DeFi into consumer super-apps like Telegram.

-

Access to a Colossal Market: No other project has a clearer path to onboarding hundreds of millions of users. By making DeFi accessible to Telegram's user base, TAC's total addressable market (TAM) is astronomical.

-

Solves a Real, Painful Problem: TAC isn't a solution looking for a problem. It directly addresses the very real pain points of both developers and users, making it a utility-driven project.

-

Superior User Experience (UX): The "Hybrid dApp" model is a potential game-changer. In crypto, the project with the best UX often wins. By eliminating the need for bridges and extra wallets, TAC is building a massive competitive moat.

Risks and Considerations

-

Execution Risk: The team's vision is ambitious. Their success hinges entirely on their ability to deliver a secure, reliable, and performant platform that flawlessly executes on its whitepaper promises.

-

Competition: While TAC has a unique approach, it's not the only project trying to bridge ecosystems. It will face competition from other Layer-2s, interoperability protocols, and potentially even native solutions developed by TON itself in the future.

-

Security is Paramount: As a bridge for potentially billions of dollars in value, TAC will be a prime target for hackers. A single security breach could be catastrophic for its reputation and value. The "collateral-backed" security model must be flawless.

-

Market Volatility: As with any altcoin, TAC's price will be subject to the wild swings of the broader cryptocurrency market. A bear market could significantly impact its growth trajectory regardless of its technological progress.

Frequently Asked Questions (FAQ) about TAC Protocol

1. What is TAC Protocol in simple terms?

TAC Protocol is a Layer-1 blockchain that acts as a bridge, allowing Ethereum-based applications (dApps) to run seamlessly for users on Telegram. It enables Telegram users to interact with DeFi using their native TON wallets, without complex bridging procedures.

2. Which blockchain is TAC Protocol built on?

TAC is a sovereign blockchain built using the Cosmos SDK and Ethermint, which makes it fully EVM-compatible. It connects deeply with The Open Network (TON) via its specialized TON Adapter technology.

3. What is the primary use case for the TAC token?

The TAC token is the native utility token of the protocol. Its primary uses are:

-

Paying for transaction (gas) fees on the network.

-

Staking to secure the network and earn rewards.

-

Potentially paying for specialized services like the TON Adapter.

4. Is TAC Protocol related to the Substrate-based project founded by Holly Herndon?

No. This is a common point of confusion. The TAC Protocol discussed here is the EVM for Telegram, built on Cosmos. The other project is a separate, Substrate-based protocol focused on trustless data aggregation. They share the same ticker but are completely different projects.

5. Is TAC a good investment?

TAC represents a high-potential investment due to its strong connection to the TON and Telegram ecosystems, a massive user base, and a solution to a real market problem. However, as a new project, it also carries significant risks related to execution, competition, and overall market volatility. It is crucial to do your own research before investing.

6. How can I buy TAC?

TAC will be listed on major cryptocurrency exchanges. Phemex will be listing TAC soon. To be prepared, you can register an account on Phemex, complete verification, and fund your account with USDT.

How to Prepare for the TAC Listing on Phemex

With TAC coming soon to Phemex, now is the perfect time to get ready. By preparing in advance, you can ensure a smooth trading experience and be among the first to participate in what could be one of the most exciting listings of the year.

-

Create and Secure Your Phemex Account: If you don't already have one, the first step is to register for a Phemex account. The process is fast and secure. Be sure to complete the identity verification (KYC) process to unlock all trading features and enhance your account security.

-

Fund Your Account: To buy TAC as soon as it's listed, you'll need funds ready in your Phemex wallet. The most common trading pair for new listings is with USDT, so consider buying or depositing USDT into your account ahead of time. This will allow you to execute trades instantly without waiting for deposits to clear on launch day.

-

Stay Informed and Get Ready for Launch Events: Phemex often celebrates new token listings with special promotional events, such as trading competitions or airdrops. To be the first to know the exact listing date and participate in these events, make sure to follow the official Phemex announcements.

By taking these simple steps, you'll be fully prepared to engage with TAC as soon as it launches on Phemex, armed with the knowledge to make informed decisions.