Summary

-

Ticker: ENSO

-

Blockchain Network: Ethereum (ERC‑20) – also available on BNB Chain (BEP‑20)

-

Circulating Supply: ~20.59 million ENSO (≈16% of max supply, as of Oct 2025)

-

Max Supply: 127,339,703 ENSO (capped after ~10 years of limited inflation)

-

Primary Use Case: Utility token for Enso’s cross-chain network – used in governance, to stake/secure the network, and to pay fees for Enso’s on-chain actions.

-

Phemex Availability: Yes. ENSO will be available to buy and trade on Phemex following its token launch in October 2025.

What Is Enso?

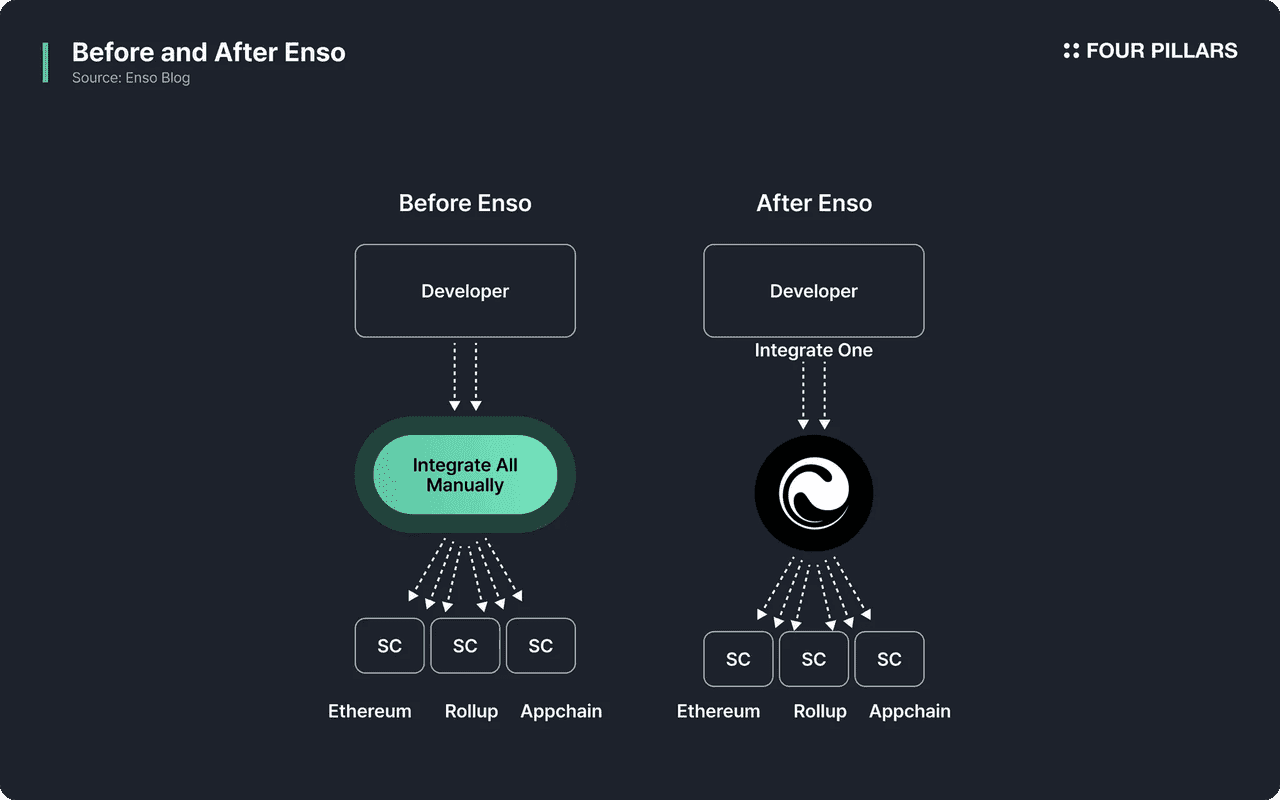

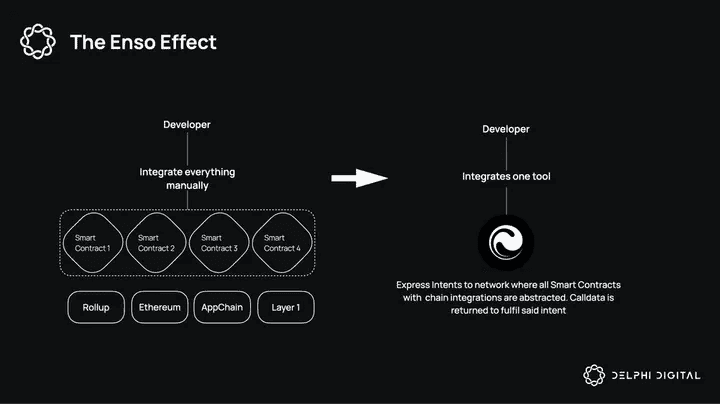

Enso is a cryptocurrency platform designed to connect all blockchains, simplifying cross-chain app development for developers. It acts like a universal translator, allowing users to read and write data across various blockchains from a single interface, much like how GitHub or Unreal Engine functions in Web2. By offering reusable building blocks called “Shortcuts,” Enso reduces the complexity of multi-chain integration, enabling developers to focus on creation rather than integration challenges. This could greatly increase the number of decentralized apps, which currently number only around 4,700 compared to millions in traditional tech.

Enso's unified Layer‑0 network has reportedly cut development time from six months to under a week. It's already powering over 100 projects and has facilitated more than $17 billion in on-chain transactions, supporting major platforms like Uniswap and LayerZero. For beginners, Enso is like middleware for blockchains, providing necessary infrastructure for a connected crypto ecosystem. With the launch of the ENSO token, everyday users and investors can now engage with this innovative platform, not just developers.

Enso Application (source)

How Many ENSO Tokens Are There?

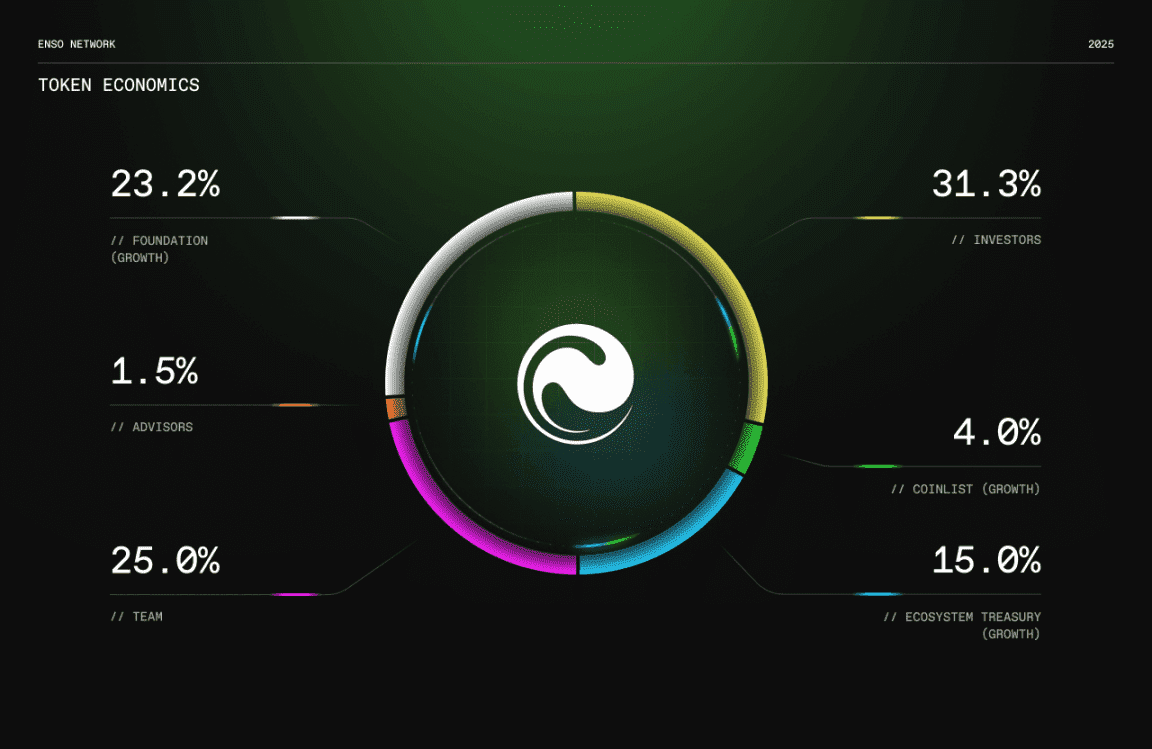

Enso (ENSO) operates on a fixed supply model that began with a genesis supply of 100 million tokens, which will gradually increase to a maximum of approximately 127.34 million over the next 10 years. The inflation starts at an annual rate of around 8%, decreasing to nearly zero (~0.35% annual) by the tenth year, after which no new tokens will be minted.

At launch in mid-October 2025, approximately 20.6 million ENSO tokens (about 16% of the max supply) are in circulation. The low initial supply is due to most tokens being allocated for long-term purposes, including:

-

21.59% for an Ecosystem Fund to support development and community initiatives.

-

16.605% for the Enso Foundation's operational costs and development.

-

4% from a community sale on CoinList, which had immediate token unlock.

-

31.305% for investors, locked for a year and then vesting over two years.

-

25% for the team, also subject to a 1-year lockup and 2-year vesting.

-

1.5% for advisors with similar vesting conditions.

The initial circulating supply mainly comprises the CoinList sale and airdrop tokens, while most of the tokens remain locked, creating a relatively low free float. After the 10-year period, no new ENSO will be created, ensuring a capped supply. Enso does not employ a token burning mechanism; instead, it carefully controls issuance.

ENSO Tokenomics (source)

What Does ENSO Do? (Enso Use Case)

ENSO is a utility token integral to the Enso network's functionality. Here are its main use cases:

-

Paying Network Fees: Users pay small fees in ENSO tokens for executing intents on the Enso network, similar to Ethereum gas fees. These fees reward contributors like validators who ensure requests are handled correctly. Increased network usage leads to greater demand for ENSO tokens.

-

Staking & Network Security (Validation): Validators secure the network by staking ENSO tokens as collateral to verify transactions. If they act maliciously or make errors, their staked tokens can be penalized. Thus, ENSO tokens are crucial for network security, and validators earn rewards from query fees.

-

Delegation (Staking for Yield): Token holders can delegate their ENSO to validators, boosting their security and sharing in the rewards. This encourages long-term holding as it offers a passive income stream for ENSO holders.

-

Governance: ENSO serves as the governance token for the Enso protocol, allowing holders to vote on proposals for upgrades and initiatives. Voting may require staking, and governance focuses on technical decisions rather than profit distribution.

-

Integration & Access: Developers may need to hold ENSO for premium services, fostering a stake in the network. Being an ENSO holder also connects you to the community, which may provide airdrops and early access to initiatives.

In summary, ENSO supports network fees, ensures security through staking, and provides governance participation. Its utility is directly tied to the Enso platform's success; as adoption grows, so may the demand for ENSO.

The Technology Behind ENSO

Enso’s tech is where things get really intriguing – it’s not a standard blockchain project copying an existing formula, but rather a novel Layer-0 approach with several moving parts. Let’s unpack the key technological elements behind ENSO:

-

Unified Network & Shared State: Enso creates a “shared network state” across multiple blockchains (like Ethereum and Solana) by mapping their disparate states into a single graph. For instances of protocols like Aave existing on different chains, Enso represents them as one entity and catalogs their functions, data, and capabilities. This robust directory currently integrates over 250 protocols.

-

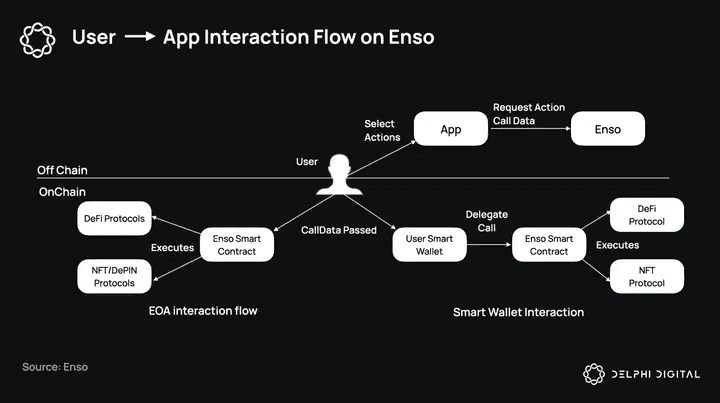

Actions and Shortcuts: Enso modularizes on-chain operations into Actions, which are abstractions of smart contract calls (e.g., “Swap,” “Lend,” “Transfer”). Developers can combine these Actions into Shortcuts, reusable mini-programs that streamline workflows. This significantly accelerates development, as developers only need to express high-level intents like “invest my ETH in the best yield,” while Enso manages the underlying integrations.

-

Intent-Based Engine: Using an "Intent" model, developers express desired outcomes rather than specific steps. Enso’s engine figures out the optimal path to achieve these intents across chains. For example, if a user wants to swap USDC for ETH and stake it, Enso determines the best route based on available protocols and executes the necessary transactions.

-

Validator Network & Consensus: Enso's validators ensure the safety of cross-chain transactions by simulating transactions off-chain and validating proposed Actions and Shortcuts. They use a Proof-of-Stake consensus model, incentivizing validators to maintain accuracy. Once they reach consensus on an execution plan, they securely trigger the transactions across target chains.

-

Innovations & Integrations: Enso integrates with advanced technologies like LayerZero and Stargate for cross-chain communication and liquidity, enhancing its functionality without reinventing existing solutions.

In summary, Enso’s technology is aspirational in scope – it aims to unify an increasingly fragmented blockchain world – but it’s built in a very grounded, practical way. Instead of requiring every blockchain to change or adopting some unrealistic universal protocol, Enso works with existing chains (via integrations) and adds a layer of smart coordination on top.

The Enso Effect (source)

Team & Origins

Enso, founded in 2021 by Connor Howe and his team, emerged from a bold "vampire attack" strategy in DeFi, aiming to lure users from established platforms with better incentives. Connor, with extensive experience in blockchain since 2016, previously helped build a legal digital asset bank in Switzerland. Joining him in founding Enso are Milos Costantini and Peter Phillips, who navigated various pivots and learned valuable lessons.

By 2023–2024, Enso re-emerged with a working product and top-tier backers, including Polychain Capital, Naval Ravikant, and numerous angel investors from major crypto projects. Their strong engineering team has been rapidly shipping features, and they prioritize community engagement, launching their token via CoinList and airdrops.

Overall, Enso combines seasoned crypto expertise with the lessons learned from their early challenges. With solid backing and an expanding community, they've transitioned into a prominent player in the space. If Enso were a band, Connor would be the frontman with underground cred, now in the spotlight with a talented crew.

Key News & Events

Since its inception, Enso has hit several noteworthy milestones and events. Here’s a rundown of key news and events in Enso’s history:

-

June 2025 – Community Token Sale: Enso's community token sale on CoinList raised $5 million, selling 4% of the total supply with no vesting, creating a broad base of holders.

-

June 2025 – Cross-Chain DeFi Deposits Launch: Launched simultaneously with the token sale, this feature allows users to deposit across different blockchains seamlessly, showcasing Enso's composability.

-

September 2025 – “Checkout” Bridging CeFi and DeFi: Introduced in September 2025, this payment layer connects centralized finance to DeFi, allowing users to use funds from centralized exchanges for on-chain transactions.

-

October 2025 – Airdrop and Token Launch (TGE): Taking place in mid-October 2025, with airdrop pre-registrations for early adopters and distribution of ENSO tokens to CoinList participants.

-

October 2025 – Exchange Listings: With the token live, ENSO began trading on various platforms. CoinList opened trading for ENSO on Oct 14, 2025, directly distributing tokens to sale participants’ accounts and enabling a secondary market. Around the same time, Phemex listed ENSO on its spot market, making it accessible to a global user base.

-

Integrations and Partnerships: Throughout 2024–2025, Enso quietly racked up partnerships. Enso co-developed a Uniswap position migrator tool (with Uniswap’s team, plus LayerZero and Stargate) that allowed liquidity providers to seamlessly move positions across chains. Enso played a key role in the high-profile testnet launch of Berachain (a new Layer-1), facilitating over $3.1 billion in executed transactions during the event. Projects like Plume, zkSync, and Sonic used Enso for their incentivized launch campaigns, highlighting trust in Enso’s tech for critical launches.

This timeline of events paints a picture of a project that has been executing rapidly – delivering technology (cross-chain deposits, Checkout), engaging the community (airdrop, CoinList sale), and collaborating with industry players (Uniswap, LayerZero, etc.). For a beginner or investor, these milestones show that Enso has been actively used and tested in real scenarios even before the token launch.

Enso Interaction Flow (source)

Is ENSO a Good Investment?

Before we dive in: Not financial advice! Crypto investments carry risk – always do your own research and consider your financial situation before investing.

Bullish Factors (Why ENSO might be promising):

-

Innovative Solution to a Real Problem: Enso addresses the complexities of Web3 development, which could drive blockchain adoption. Its unique infrastructure positioning (like Chainlink for oracles) might lead to significant value if successful.

-

Strong Early Traction & Partnerships: With over $17B settled on-chain and integrations with major players like Uniswap and LayerZero, Enso shows promise and mitigates risk compared to unproven projects.

-

Top-Tier Team and Backers: The team’s background and support from notable VCs (Polychain, Multicoin) suggest credibility. Their backing brings not only funds but also valuable connections.

-

Tokenomics Align with Growth: A public sale and airdrops created a community-friendly distribution, with team tokens locked, reducing immediate sell pressure. Low initial circulating supply could lead to quick price appreciation if demand rises, along with sustainable utility in fees and staking.

-

Market Opportunity (TAM): Enso aims at the vast market of blockchain development, positioning itself as essential infrastructure for a multi-chain future. If Web3 expands, so could its user base, potentially leading to long-term value growth for ENSO tokens.

Bearish Factors (Risks & Challenges):

-

Execution & Adoption Risk: Enso has a grand vision, but onboarding enough developers and projects is crucial. Slow adoption or competition catching up could hinder its utility and perceived value.

-

Competition: The interoperability space is becoming crowded with projects like Polkadot and Chainlink's CCIP. Enso's unique developer shortcuts overlap with some offerings from others, making it essential to stay ahead technologically. If a major competitor were to adopt similar features, it could pose a significant challenge.

-

New Token Volatility: As a new token, ENSO may experience significant price volatility. Initial spikes may be followed by sharp declines as traders seek quick profits. Investors should be prepared for potential short-term fluctuations.

-

Regulatory/Legal Unknowns: Despite no current SEC issues, the regulatory landscape for tokens is uncertain. While Enso’s cautious approach mitigates some risks, scrutiny could increase as the project gains value and U.S. involvement grows.

-

Technology and Security Risks: Enso's complex system involves smart contracts and off-chain infrastructure, which can lead to bugs or exploits. A major technical incident could damage confidence in the project and negatively impact the token price.

Investment Outlook: Enso exhibits traits of a high-upside, high-risk crypto investment. Targeting a significant need, it's backed by knowledgeable players, which lends credibility and strong expertise. If Enso becomes the go-to platform for cross-chain development, the value of ENSO tokens could rise due to demand and limited supply.

However, as with any early-stage crypto, success isn't guaranteed; it's similar to investing in a tech startup poised for growth. Interested investors should monitor growth metrics like the number of developers, integrated protocols, and transaction volume. Community sentiment is also vital—engaging with Enso’s Discord or social media can provide insights on grassroots support.

In conclusion, Enso offers a compelling investment narrative based on real technology. If you choose to invest, consider starting small and only investing what you can afford to lose. Regardless, it’s a project worth watching as it could influence the multi-chain future.