Introduction to DeAgentAI Crypto

Introduction to DeAgentAI Crypto

Integrating artificial intelligence with blockchain infrastructure presents several structural challenges. AI systems are inherently probabilistic, while blockchains require deterministic execution. In addition, most AI agents lack persistent identity and memory across chains, limiting their usefulness in decentralized environments.

DeAgentAI aims to address these challenges by providing a modular, decentralized framework for AI agents that can execute tasks, interact with smart contracts, and maintain persistent state across blockchain ecosystems. The project positions itself as infrastructure for Web3 use cases such as decentralized finance (DeFi), on-chain analytics, gaming, and automated workflows. DeAgentAI remains an early-stage project, with live products and additional tools under active development.

Quick Facts About AIA Price and Supply

-

Token: AIA

-

Total / Max Supply: 1,000,000,000 AIA

-

Circulating Supply: 146.8 million AIA

-

Market Capitalization: $14.5 million

-

Fully Diluted Valuation: $99 million

-

24h Trading Volume: $2.9 million

Note: Historical price data for newly listed tokens can vary significantly across data aggregators due to limited trading history and liquidity. Cryptocurrency prices are highly volatile.

What Is DeAgentAI?

DeAgentAI is a multi-chain infrastructure project designed to support decentralized AI agents capable of autonomous and verifiable execution. The platform is intended to allow developers to deploy agents for tasks such as market analysis, strategy automation, and data processing, while maintaining transparency and on-chain accountability.

Rather than focusing on model training alone, DeAgentAI emphasizes agent coordination, execution logic, and persistence within blockchain environments.

Key Features of DeAgentAI

Modular Agent Framework

Agents are designed around modular components, including:

-

Identity: Persistent on-chain representation

-

Memory: State continuity across interactions

-

Lifecycle Management: Creation, execution, and termination

-

Verification: Mechanisms for validating agent outputs

Multi-Chain Deployment

DeAgentAI supports deployment across chains such as Sui, BSC, and Bitlayer, aiming to balance performance and transaction costs.

Verifiable Execution

The project emphasizes verifiable execution through on-chain logic and consensus mechanisms, intended to reduce reliance on off-chain trust.

Open Ecosystem Approach

Parts of the framework are expected to be progressively open-sourced, with community participation encouraged through incentives and governance.

How Does AIA Work?

The AIA token functions as the core utility asset within the DeAgentAI ecosystem:

-

Agent Services: Used for agent creation, execution, and access to premium tools

-

Staking: Participants may stake AIA to support network operations and incentives

-

Governance: Token holders can participate in protocol-level decision-making

-

Ecosystem Incentives: The project has stated that protocol revenue may be used for ecosystem incentives, potentially including token buybacks, subject to governance decisions

Use cases highlighted by the team include AI-assisted crypto analytics (AlphaX), no-code DeFi automation (CorrAI), incentivized market insights (Truesights), and custom automation workflows.

AIA Tokenomics

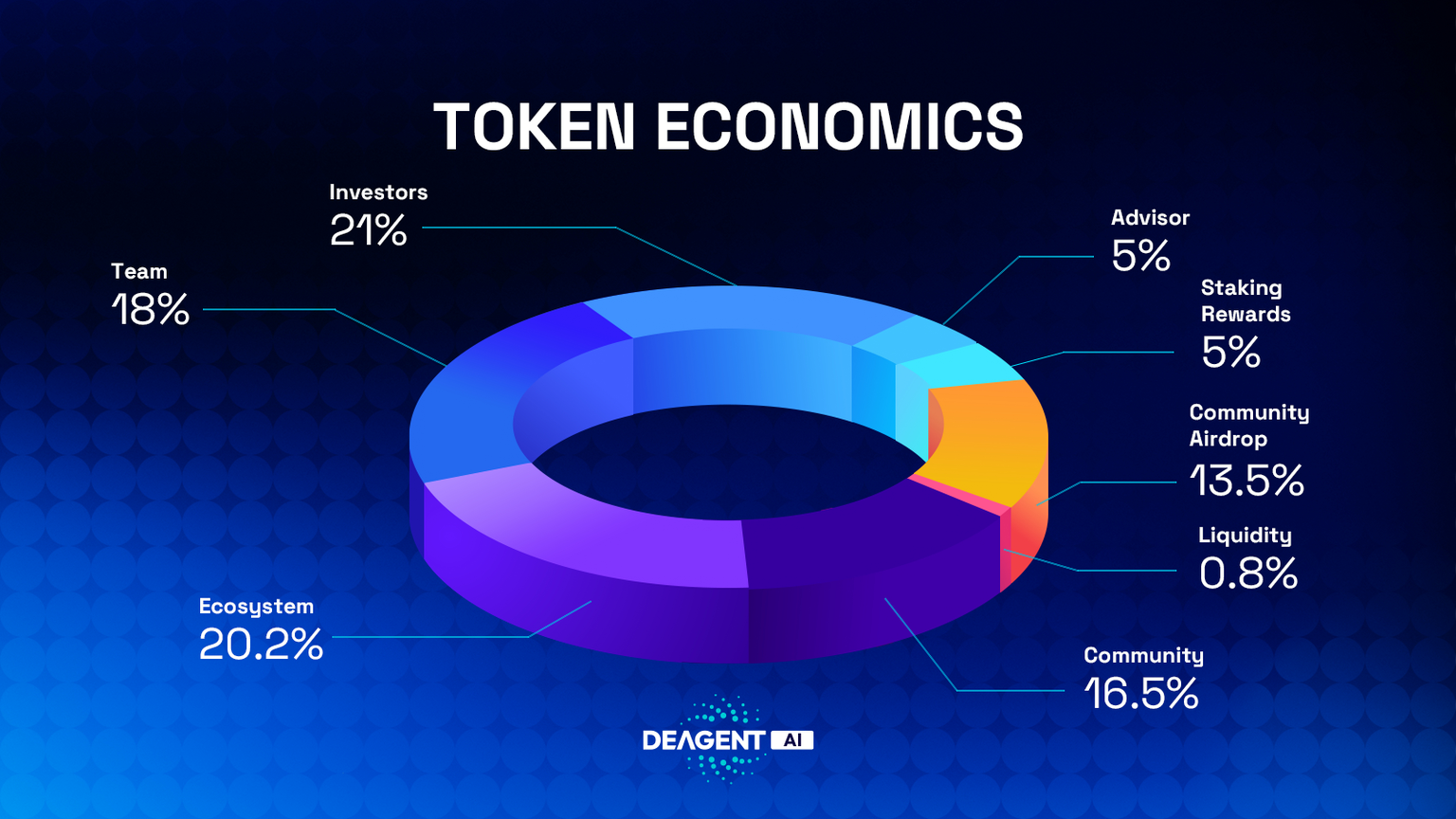

AIA has a fixed maximum supply of 1,000,000,000 tokens. According to project disclosures, only a small portion of the total supply was unlocked at token generation, with the remainder subject to long-term vesting schedules.

Token Allocation Overview

| Category | Percentage | Amount (AIA) | Notes |

|---|---|---|---|

| Investors | 21.0% | 210,000,000 | Subject to vesting schedules |

| Ecosystem | 20.2% | 202,000,000 | Partnerships and incentives |

| Team | 18.0% | 180,000,000 | Long-term vesting |

| Community | 16.5% | 165,000,000 | Growth and development |

| Community Airdrop | 13.5% | 135,000,000 | Phased distribution |

| Staking Rewards | 5.0% | 50,000,000 | Network incentives |

| Advisors | 5.0% | 50,000,000 | Vesting applies |

| Liquidity | 0.8% | 8,000,000 | Initial liquidity |

| Total | 100% | 1,000,000,000 |

Vesting schedules are designed to release tokens gradually over multiple years, beginning after applicable cliff periods.

DeAgentAI vs. Similar AI Crypto Projects

| Feature | DeAgentAI (AIA) | Fetch.ai (FET / ASI) | Bittensor (TAO) |

|---|---|---|---|

| Primary Focus | On-chain AI agents & execution | Agent marketplace | Decentralized ML training |

| Core Differentiation | Agent identity & verification | Agent economy | Incentivized intelligence |

| Deployment | Multi-chain | Multi-chain | Specialized subnetworks |

DeAgentAI emphasizes practical agent execution and coordination, rather than purely model training or marketplaces.

Team and Project Background

DeAgentAI was initiated in 2022 by a distributed team with experience in AI, blockchain engineering, and quantitative research. The project is incorporated in the Cayman Islands, a common jurisdiction for Web3 protocols.

The team has stated that it has raised venture funding from Web3-focused investors, though exact funding amounts and investor participation have not been fully disclosed through major third-party publications.

Roadmap and Recent Developments (Up to December 2025)

-

2022: Project initiation

-

2024–2025: Development of AlphaX and core infrastructure

-

2025: Token launch and exchange listings

-

Late 2025: Phased rollout of CorrAI and Truesights targeted, subject to development timelines

Factors That May Influence AIA’s Future Performance

Potential Tailwinds

-

Growing interest in decentralized AI and autonomous agents

-

Expansion of AI-assisted tools within Web3

-

Increased utility if ecosystem products gain traction

Risks and Challenges

-

High volatility typical of early-stage crypto assets

-

Competitive AI-token landscape

-

Future token unlocks increasing circulating supply

-

Execution risk for roadmap products

How to Buy AIA on Phemex

For those interested in How to buy AIA, the token is available for purchase on Phemex. You can acquire AIA by navigating to the spot market after signing up and funding your account. Phemex offers a dedicated page with a step-by-step guide for a seamless purchasing experience, allowing you to Trade AIA in minutes.

Summary: Why DeAgentAI Matters

DeAgentAI represents an attempt to bring autonomous, verifiable AI agents into blockchain environments through a modular, multi-chain infrastructure. While still early in development, the project highlights growing interest in decentralized AI beyond model training alone. AIA offers exposure to this narrative but comes with significant volatility and execution risk, making careful research essential.

Frequently Asked Questions (FAQ)

What is DeAgentAI (AIA)?

A decentralized infrastructure project focused on AI agents with persistent identity, memory, and on-chain execution.

What is AIA used for?

Network fees, staking, governance participation, and ecosystem incentives.

What products are part of the DeAgentAI ecosystem?

AlphaX (live), with CorrAI and Truesights announced on the roadmap.

Where can I trade AIA?

On Phemex via spot trading page AIA/USDT.

What are the risks of AIA?

High volatility, early-stage development risk, competition, and future token unlocks.