Summary:

-

Ticker Symbol: AURORA

-

Blockchain Network (Chain): Aurora EVM (built on NEAR Protocol)

-

Contract Address: 0xaaaaaa20d9e0e2461697782ef11675f668207961 (Ethereum ERC-20)

-

Circulating Supply: ~641.6 million AURORA (about 64% of max supply)

-

Max Supply: 1,000,000,000 AURORA (fixed at genesis)

-

Primary Use Case: Governance and staking token for the Aurora network (an EVM scaling solution on NEAR)

-

Current Market Cap: ~$47–48 million USD (as of Sep 29, 2025)

-

Available on Phemex: Not yet listed on Phemex’s spot market

What Is Aurora (AURORA)?

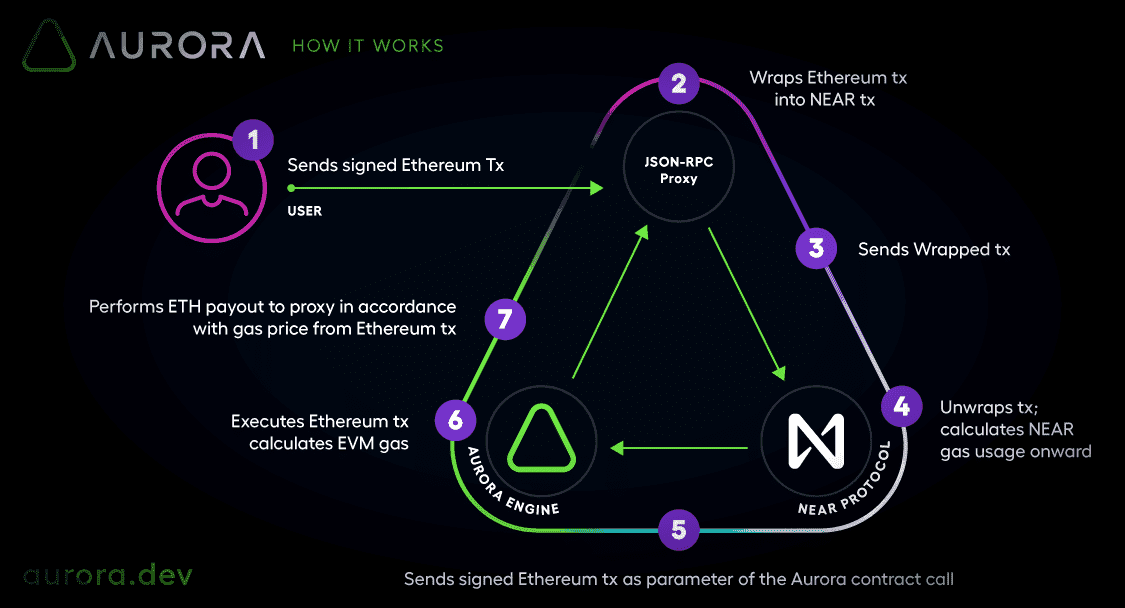

Aurora is an Ethereum-compatible layer-2 solution on the NEAR Protocol designed to help users and decentralized apps (dApps) migrate from Ethereum to a faster, lower-cost environment. In essence, Aurora lets developers run Solidity smart contracts on NEAR’s blockchain while leveraging NEAR’s scalability. It accomplishes this via the Aurora Engine – an Ethereum Virtual Machine (EVM) implemented as a smart contract on NEAR – and the Rainbow Bridge, which enables trustless transfer of assets (like ERC-20 tokens) between Ethereum, NEAR, and Aurora. This means users can easily bridge their tokens and contracts from Ethereum to Aurora and enjoy far lower fees and faster speeds, all while maintaining compatibility with Ethereum’s tools and wallets.

Notably, Aurora uses ETH as the base token for transaction fees on the network to provide a familiar experience. This allows Ethereum users to interact with Aurora dApps without learning a new gas currency – they simply pay gas in ETH on Aurora. Meanwhile, the AURORA token itself is not used for gas; instead, AURORA serves primarily as a governance and ecosystem token. Holders of AURORA can participate in the AuroraDAO (the project’s decentralized governance body) to vote on protocol upgrades and other decisions. In summary, Aurora aims to combine the best of Ethereum’s smart-contract capabilities with NEAR’s high throughput and low latency, providing a developer-friendly platform for DeFi, NFTs, and Web3 apps that need better performance without sacrificing Ethereum compatibility.

Aurora Statistics (source)

Aurora Tokenomics

Supply: Aurora has a capped total supply of 1 billion AURORA tokens, all minted at launch on October 7, 2021. As of September 2025, approximately 641.6 million AURORA (about 64% of the total) are in circulation, with the remainder held in treasuries or vesting.

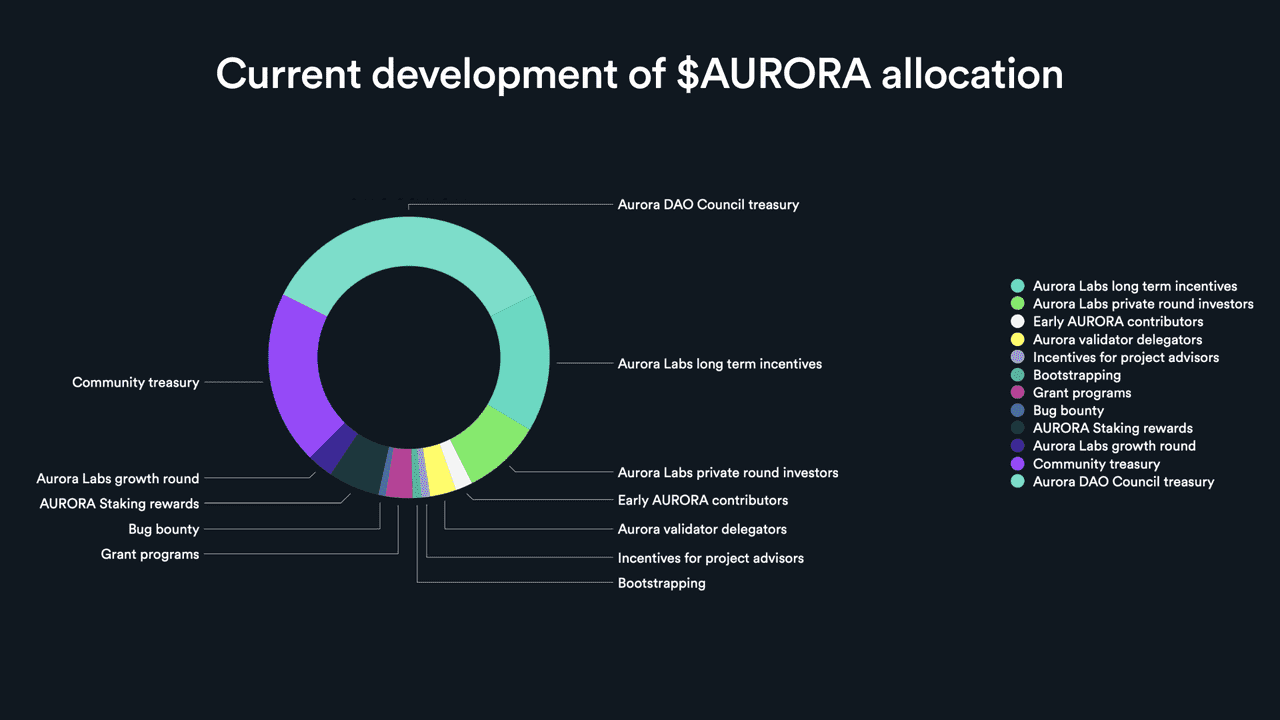

Token Distribution & Vesting: The initial distribution aimed to foster ecosystem growth and decentralization, allocating 20% to a Community Treasury, 35% to Aurora DAO reserves, 16% to team incentives, and smaller portions to investors and rewards. Tokens for private investors and early contributors follow a vesting schedule with a 6-month cliff and gradual unlocking over 24 months, concluding in November 2023. Over 99% of the total supply is projected to be unlocked by 2032.

Burning Mechanism: A buyback-and-burn mechanism introduces deflationary pressure. Users pay transaction fees in ETH (on Aurora) and NEAR (on NEAR), with the collected NEAR used by the Aurora DAO to buy AURORA tokens and burn them. This links platform activity to token value, with some burned amounts recorded (e.g., 10,482 AURORA in late 2023). Overall, AURORA's tokenomics feature a fixed supply and a focus on ecosystem participation.

Aurora Use Case

The AURORA token’s use cases center on governing and growing the Aurora ecosystem, as well as rewarding participants:

-

Governance: AURORA is primarily a governance token, giving holders voting rights in the AuroraDAO. This allows the community to influence protocol upgrades, treasury spending, and strategic decisions, ensuring that changes align with user interests.

-

Staking & Rewards:Token holders can stake AURORA on the Aurora+ platform to earn rewards and passive income, including additional AURORA and tokens from partner projects. Staking is user-friendly, with no gas fees required, and offers benefits like free transactions on Aurora’s network.

-

Network Utility & Ecosystem Integration: AURORA functions as a governance and reward asset within various dApps. It can be used in DeFi protocols for collateral and rewards and is easily transferable via the Rainbow Bridge. New users can also buy AURORA with credit cards through integrated fiat on-ramps.

-

Custom Chains and Discounts: AURORA may also play a role in the economics of community-created blockchains through Aurora Cloud. While it isn’t used for gas fees, holding AURORA may offer benefits like free transactions via the Aurora Pass.

In summary, the AURORA token matters for governance, staking rewards, and aligning incentives in the Aurora ecosystem. It does not replace ETH as the fee token on the network; instead, its value comes from the growth of the Aurora network itself – as more projects and users utilize Aurora for DeFi, NFTs, gaming, etc., the theory is that governance influence and staking yields (and the buyback burns) make AURORA a proxy for the platform’s success.

Aurora vs Bitcoin

Aurora and Bitcoin represent two distinct aspects of the cryptocurrency landscape: Bitcoin serves as the original blockchain focusing on secure value storage and transfer, while Aurora is a modern smart contract platform supported by NEAR Protocol.

-

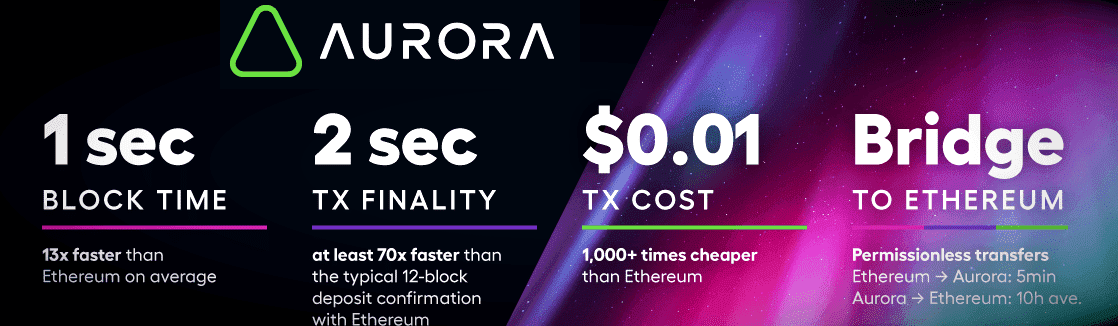

Consensus and Speed: Bitcoin uses a Proof-of-Work (PoW) mechanism that results in a transaction confirmation time of around 10–60 minutes. In contrast, Aurora operates on NEAR’s Proof-of-Stake (PoS) with sharding, achieving block production in approximately 0.6 seconds and transaction finality in about 1.2 seconds, making it ideal for decentralized applications.

-

Transaction Fees: Bitcoin transaction fees can range from a few to several tens of dollars during congestion, with a limit of about 7 transactions per second. Aurora benefits from NEAR’s efficiency, where typical transaction costs are only around $0.01–$0.02, with many users enjoying 50 free transactions monthly.

-

Use Cases: Bitcoin primarily functions as digital gold, lacking native support for complex smart contracts. Conversely, Aurora is designed for decentralized applications, enabling DeFi protocols, NFT marketplaces, and Web3 apps, making it suitable for a wide range of uses.

-

Decentralization and Security: Bitcoin is lauded for its decentralization, supported by a vast network of nodes and miners. Aurora, while having around 100 validators, strikes a balance between decentralization and performance through NEAR’s design. Both networks emphasize strong security measures, though Bitcoin's simpler architecture may reduce its attack surface compared to Aurora's complex smart contracts.

-

Environmental Impact: Bitcoin's PoW mining is often criticized for energy consumption, although much of it uses renewable energy. In contrast, NEAR's PoS is more energy-efficient and carbon-neutral, representing a more sustainable approach.

Overall, Bitcoin excels in secure value retention, while Aurora enables a dynamic ecosystem of blockchain-based services.

Aurora Workflow (source)

Technology Behind Aurora

Aurora’s technology stack is what enables its high performance and Ethereum compatibility. It’s best understood as a combination of NEAR’s advanced blockchain architecture with an Ethereum Virtual Machine layer and a suite of supporting infrastructure.

-

NEAR Protocol Core: Aurora is built on the NEAR Protocol, a layer-1 blockchain known for its Nightshade sharding and Doomslug consensus. This design allows NEAR to scale efficiently, achieving thousands of transactions per second with fast finality. By operating on NEAR, Aurora benefits from its security and scalability without needing separate consensus nodes.

-

Aurora Engine (EVM Compatibility): The Aurora Engine is an Ethereum Virtual Machine that runs on NEAR, ensuring full EVM compatibility. Developers can use familiar tools like Solidity, Truffle, and MetaMask, making it easy to deploy Ethereum apps on NEAR. Aurora uses ETH for gas fees, allowing users to interact without acquiring NEAR tokens, while automatically converting ETH to NEAR for transaction fees behind the scenes.

-

Rainbow Bridge (Interoperability): The Rainbow Bridge connects Ethereum, NEAR, and Aurora, allowing users to transfer assets between these networks securely. This trustless bridge enables seamless asset flow, enhancing interoperability and supporting various Ethereum assets within Aurora's ecosystem. Aurora’s commitment to security is highlighted by its ability to resist attacks and its significant bug bounty efforts.

-

Aurora Cloud and Virtual Chains: Aurora Cloud allows projects to create customizable EVM-compatible blockchains on NEAR known as Virtual Chains. These chains operate independently while leveraging Aurora’s infrastructure, as demonstrated by the collaboration with Turbo to launch TurboChain for the TURBO token. CEO Alex Shevchenko aims to create 1,000 interconnected chains by 2025, offering custom features and tokens while maintaining NEAR's security.

-

Infrastructure and Partnerships: Aurora’s ecosystem has thrived by integrating a comprehensive infrastructure early on. Partnerships with The Graph, Covalent, Pyth Network, and Gnosis Safe enhance its functionality. Major DeFi protocols like Curve Finance provide liquidity, while Aurora's own Block Explorer and integration with the 1inch DEX aggregator facilitate transaction tracking and token swaps. Backed by Pantera Capital and Electric Capital, Aurora Labs boasts a team of experts, including CEO Dr. Alex Shevchenko. Their technical prowess has led to rapid innovation, including advanced bridging and the launch of Virtual Chains.

-

Unique Features: Two more technical features deserve mention:

-

Developer Gas Fee Remuneration: As a contract on NEAR, Aurora receives 30% of gas fees, funding its DAO and allowing greater sustainability as its usage grows.

-

Ethereum Tooling Compatibility: Aurora supports nearly all Ethereum tools, enabling easy integration for developers using MetaMask, Solidity, and existing Ethereum bytecode. This significantly lowers entry barriers, allowing Ethereum dApps to run faster and cheaper on Aurora.

-

Overall, Aurora’s technology merges Ethereum’s versatility with NEAR’s performance, supporting scalable solutions for developers and fostering a multi-chain universe. Users benefit from a seamless experience powered by robust infrastructure without needing to consider the underlying complexities.

Team & Origins

Aurora began as part of NEAR Protocol’s initiative to enhance Ethereum compatibility, officially launching in mid-2021 under Aurora Labs, led by CEO Dr. Alex Shevchenko, a prominent advocate for Ethereum scalability. The team includes skilled professionals like CTO Arto Bendiken and Head of Security Frank Braun, establishing credibility from the start.

In October 2021, Aurora raised $12 million in its first funding round, led by Pantera Capital and Electric Capital, with many strategic partners involved. This approach helped integrate top-tier DeFi infrastructure from the outset. The Aurora Token Generation Event (TGE) occurred on November 18, 2021, during a bullish altcoin market.

Aurora is considered a “Linked Project” to NEAR, operating semi-autonomously while benefiting from NEAR Foundation support, including early contributions facilitated by NEAR. As Aurora progresses, it has started to chart its own path with innovations like Aurora Cloud.

The decentralized governance structure, AuroraDAO, holds a reserve of AURORA tokens and includes representatives from diverse blockchain sectors. It makes decisions regarding token allocations and technical upgrades, aiming for a community-driven network while Aurora Labs continues its development.

Aurora Tokenomics (source)

Key News & Events

Staying updated with AURORA is crucial due to its rapid developments. Here’s a condensed timeline of key milestones:

-

October 2021 – Funding Round: Aurora raised $12 million in its first private funding round, led by Pantera Capital and Electric Capital, with backing from over 100 investors.

-

November 2021 – Mainnet & Token Launch: The mainnet on NEAR launched on Nov 18, 2021, alongside the AURORA Token Generation Event (TGE), with 1% of the token supply distributed through an Initial DEX Offering.

-

Q1 2022 – $800M DeFi Incentive (NEAR): NEAR Protocol introduced an $800 million DeFi incentive fund, granting Aurora a $90M Ecosystem Fund for financing DeFi apps, significantly boosting Aurora’s TVL.

-

Q3 2022 – Ecosystem Growth: Aurora’s DeFi ecosystem expanded with numerous dApps, including Aurigami and Bastion. By late 2022, TVL peaked in the hundreds of millions, alongside NFT marketplace activity.

-

March 2023 – Aurora Cloud Launch: On March 2, 2023, Aurora launched Aurora Cloud, introducing features for Web2 and Web3 businesses, allowing one-click EVM blockchain launches.

-

Q2 2023 – Aurora+ Enhancements: Mid-2023 saw improvements like built-in token swaps and the Aurora Pass mobile wallet, aiming to simplify user onboarding.

-

December 2024 – TurboChain & TurboSwap: On Dec 17, 2024, Aurora Labs launched TurboChain, the first customization chain for the TURBO memecoin ecosystem, alongside TurboSwap DEX, enhancing cross-chain liquidity.

-

April 2025 – Partnership with Open Format: Aurora partnered with Open Format to improve community engagement through AI-powered tools, highlighted at Token2049.

-

Mid/Late 2025 – Continued Development: Aurora’s team focused on onboarding more Virtual Chain clients, expanding its ecosystem further.

This timeline illustrates Aurora’s journey from a new entrant in 2021 to a multi-faceted crypto ecosystem by 2025. The project’s ability to hit technical milestones (like the bridge, Aurora Cloud) and recover from challenges (security attacks, bear market price drawdowns) speaks to its resilience.

AURORA Investment Potential

When evaluating Aurora (AURORA) from an investment perspective, it's essential to consider its market positioning, growth potential, recent performance, and risks. AURORA has experienced significant volatility, with a steep rise followed by a sharp decline, highlighting the need for cautious evaluation.

Market Position & Value Proposition: Aurora serves as a scaling solution for Ethereum while also extending NEAR Protocol, positioning itself uniquely within the competitive landscape of Layer-1 and Layer-2 chains. It competes not only with Ethereum's Layer-2 solutions but also with other EVM-compatible chains like Polygon and Avalanche. Its key differentiators include ultra-fast finality and sharded throughput. If Aurora effectively attracts projects to its Aurora Cloud (Virtual Chains), it could establish itself as a central hub in a multi-chain future, driving demand for AURORA tokens.

Community and Ecosystem Growth: Aurora is building a community of users, developers, and token holders, although it's smaller than Ethereum's. Despite moderate growth metrics, the introduction of Virtual Chains could stimulate ecosystem expansion. Aurora's social media updates on new partnerships and project launches indicate a diverse ecosystem, with over 100 projects spanning DeFi, NFTs, and more. While early investors faced price declines, community sentiment appears cautiously optimistic, with recent comments suggesting a potential turnaround.

Recent Price Performance: AURORA’s price history has been tumultuous, plummeting from ~$35 in early 2022 to an all-time low of around $0.0475 by October 2023. Although it has recently stabilized at about $0.07–$0.08, this still represents a 99.8% drop from its peak. With a market cap of around $47 million, Aurora's low valuation can be seen as a potential opportunity for investors believing in its long-term prospects. However, challenges remain, including reduced user activity and strong competition from established solutions.

Development & Adoption Indicators: Aurora shows strong development activity, as indicated by frequent code commits and updates. The number of developers building on Aurora and its DeFi total value locked (TVL), currently low, are important metrics to watch. Successful dApps could significantly attract liquidity and users. Aurora's focus on niche markets like memecoins and community tools may offer growth opportunities outside the crowded L1 space.

Risks: Investing in AURORA comes with notable risks, including intense competition with platforms like Arbitrum and Polygon. If Aurora fails to differentiate itself or leverage network effects, it may remain a smaller player. There are concerns regarding the token’s utility since it isn't essential for gas and governance is still developing, which may limit demand. Regulatory uncertainty could also affect AURORA, as tightened regulations could impact exchange listings and trading. Lastly, with a market cap under $50M, AURORA experiences low liquidity and high volatility.

Outlook and Potential Catalysts: Positive catalysts for AURORA include increased adoption through "killer apps" or partnerships and technical breakthroughs such as improved bridging features. Additionally, a market recovery following the next Bitcoin halving in 2024/2025 could enhance interest in AURORA, making it appealing for investors.

In conclusion, Aurora is an ambitious project blending two blockchain worlds, and its token’s fortunes will rise or fall with the network’s real-world adoption. The investment potential of AURORA hinges on whether Aurora can carve out a sustainable ecosystem niche. As with any cryptocurrency investment, proceed with caution, keep a long-term perspective on the technology, and remember that this is not financial advice – one should consult multiple sources and, if possible, seek professional guidance when making investment decisions in the crypto space. Phemex provides the tools to access AURORA, but it’s up to each individual to assess if AURORA aligns with their risk tolerance and portfolio strategy.