Introduction

The Cup and Handle pattern is a well-known bullish continuation formation that traders look for on price charts. It resembles a teacup, featuring a rounded “U”-shaped bottom (the cup) followed by a smaller consolidation on the right (the handle) before prices break out upward. In both cryptocurrencies and stocks, spotting a Cup and Handle can signal a potential sustained uptrend, making it popular among breakout traders.

Originally described by technical analyst William J. O’Neil in the 1980s, this pattern is often used to identify buying opportunities during an uptrend. For example, Bitcoin and other cryptocurrencies have formed Cup and Handle structures during bullish markets, leading to sharp rallies upon completion of the pattern. In this guide, we’ll explain how to recognize, confirm, and trade the Cup and Handle pattern in crypto, as well as discuss its risks and origins.

What Is the Cup and Handle Pattern?

The Cup and Handle is a price chart pattern that appears as a cup with a handle attached on the right side. The cup features a rounded bottom, ideally taking the shape of a smooth “U” rather than a sharp “V.” After the cup forms and the price climbs back to near the previous high, a handle is created through a smaller pullback or sideways movement. Typically, the handle slopes slightly downward or remains flat, resembling a small flag or consolidation on the right edge of the cup.

This formation usually signals a bullish continuation. Essentially, the asset experiences an uptrend leading into the cup, pauses to digest its gains, and the handle serves as the final consolidation. When the price breaks above the handle’s resistance line, the pattern is considered complete, often resulting in a further upward move. Due to its bullish nature, traders interpret the Cup and Handle as a cue to enter long positions following the breakout.

There is also an inverse version (an upside-down Cup and Handle), which is bearish; however, we will focus on the standard (bullish) pattern here. The key characteristics to identify this pattern include a relatively rounded bottom (the cup), a handle that forms at about the same level as the cup’s starting point, and a final breakout above the handle’s peak.

Psychology Behind It

The Cup and Handle pattern reflects the underlying trader psychology during an uptrend. It typically forms after an extended rally. Here’s the psychology behind it: the asset rises to a high, attracting buying interest and some profit-taking. As selling pressure subsides, buyers gradually step in, creating a rounded bottom—this is the formation of the cup. The deep part of the cup represents a period of consolidation or slight correction, where bearish sentiment is gradually absorbed by bullish sentiment.

After reaching the bottom, the price climbs back near the previous high. The handle then forms as some traders take profits again, creating a smaller pullback. The down or sideways drift of the handle indicates caution—traders are testing the breakout level without much selling pressure. Importantly, volume often decreases during the formation of the handle, indicating that selling is limited.

Once most sellers are out of the way, bullish traders gain confidence. The prevailing sentiment becomes: “We have absorbed all that selling, and the price is poised to rise.” When the price breaks out above the handle with increased volume, it often triggers a rush of buying—a classic continuation pattern. Essentially, the Cup and Handle indicates that bulls have staged a controlled consolidation and are ready to continue the uptrend. It represents accumulation and renewed buying: the market has tested support twice (at the bottom of the cup and the bottom of the handle) and has held each time, suggesting strength for the next upward move.

How to Identify Cup and Handle

To identify a Cup and Handle on a crypto chart, look for these key signals:

-

Cup Shape: The price should create a rounded "U" shaped bottom. Avoid sharp "V" shapes, as a true cup has a gradual curvature. The longer and smoother the cup, the stronger the pattern.

-

Handle Formation: After the cup, there should be a smaller pullback on the right side. The handle often slopes down or moves sideways. Crucially, the handle should be relatively shallow – generally no more than one-third the depth of the cup. A deep handle can invalidate the pattern.

-

Volume Pattern: Volume typically decreases as the cup forms (less enthusiasm on the way down) and drops further during the handle. A good confirmation is a volume spike when price breaks above the handle’s resistance.

-

Timeframe: Cups usually take longer to form (weeks to months), while handles are shorter (days to weeks). If the cup is extremely long or extremely deep, be cautious – it might be a different formation. Moderate-sized cups with clear U-shapes are idea.

-

Handle Position: The handle should generally form around the upper half of the cup. If the handle dips below the midpoint of the cup’s height, the pattern is weaker.

In practice, scan your charts after a bullish rally. If you see a rounded bottom and it retraces slightly with low volume, zoom in to confirm the handle characteristics. Patterns that closely match these criteria are classic Cup and Handle setups.

How to Trade Cup and Handle

Trading a Cup and Handle involves these steps:

-

Confirm the Pattern: Ensure the cup and handle meet the criteria above. It’s wise to wait until the handle is nearly complete before acting.

-

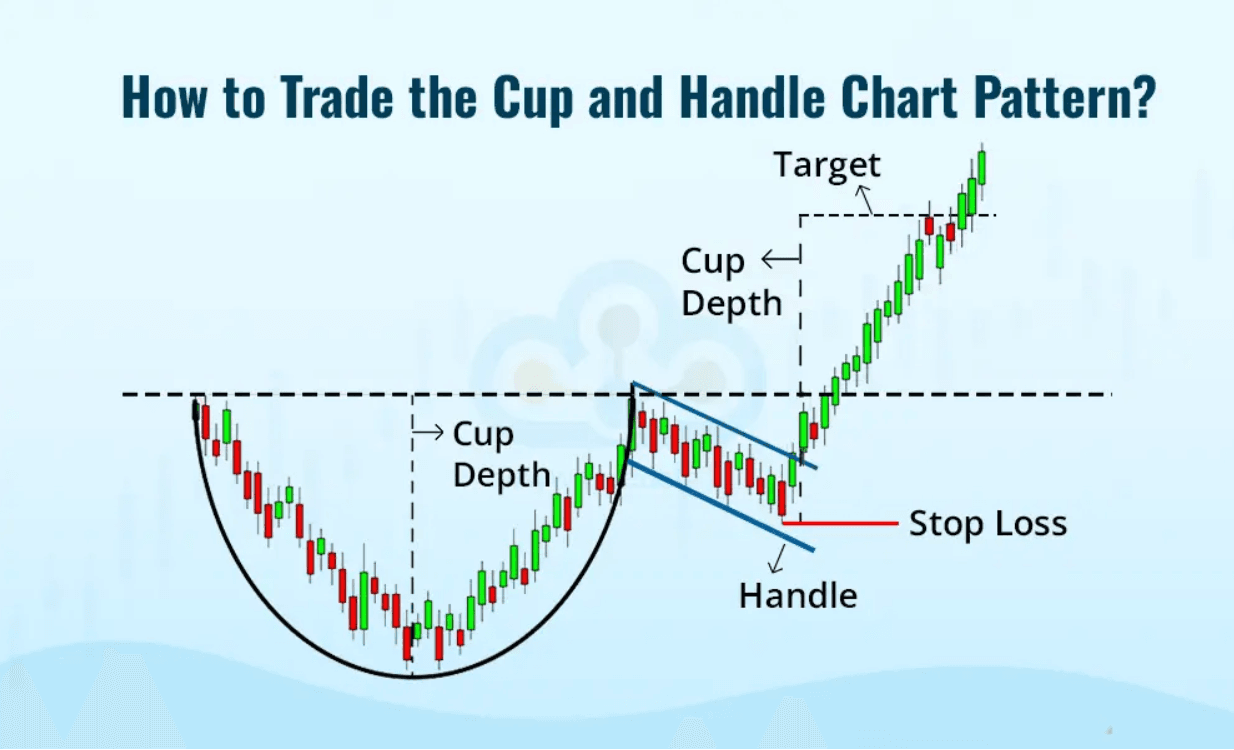

Entry Point: The typical entry is a buy-stop order placed slightly above the high of the handle (the breakout level). This way you only enter if price actually breaks above the handle peak. Some traders wait for the daily candle to close above the handle for confirmation.

-

Stop-Loss: Place a stop-loss order to manage risk. A common method is below the bottom of the handle or below the midpoint of the cup. For example, you can place it around the halfway point of the cup to allow some volatility. You could also place it just below the lowest point of the handle for a tighter stop.

-

Profit Target: Estimate your price target by adding the cup’s depth to the breakout point. For instance, if the cup’s bottom to its rim is $100, and the breakout happens at $200, a target might be around $300. Alternatively, use a fixed risk:reward or trail your stop as price moves favorably.

-

Position Sizing: Because patterns can fail, many traders risk only 1-2% of their capital on a single trade. Ensure your stop distance is factored into your sizing.

-

Monitor Volume: Ideally, a strong breakout comes with high volume. If price breaks out on low volume, be cautious or consider waiting for a retest of the breakout level. A second breakout attempt with confirmation can be another entry chance.

A concise trading checklist:

-

Entry: Place a buy-stop just above the handle’s high.

-

Confirmation: Look for a strong breakout candle (preferably with rising volume).

-

Stop-Loss: Set below the handle or mid-cup.

-

Target: Aim for roughly the cup’s height above the breakout point.

-

Alternate Entry: Aggressive traders might enter as the handle is forming if early bullish signals appear, but this carries higher risk.

When Not to Use It / Limitations

Despite its usefulness, the Cup and Handle can fail.

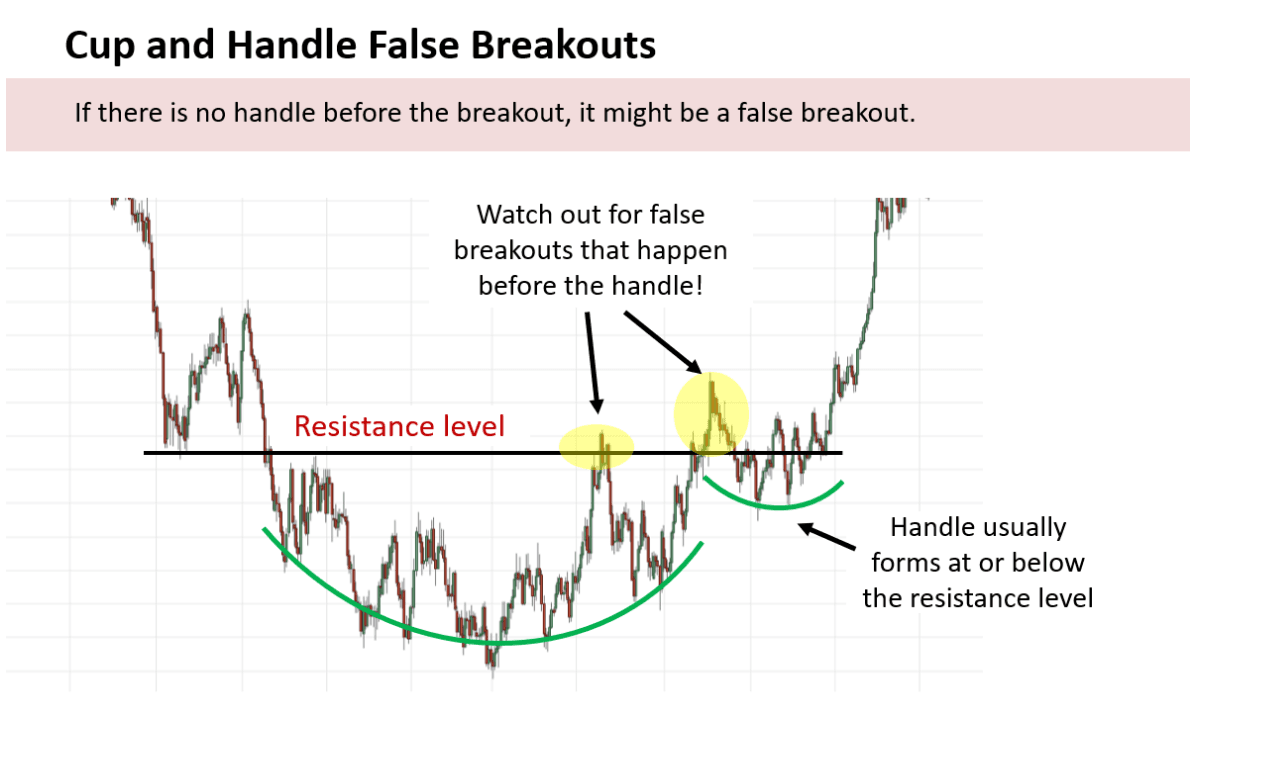

False Breakouts: Price can break above the handle and then quickly reverse. This often traps traders. Always wait for a clear breakout and consider a retest.

Pattern Clarity: Sometimes what looks like a cup may actually be a rounding bottom without a true handle, or just random consolidation. Ensure the trend is bullish on higher timeframes. If the daily chart is in a downtrend, a seemingly valid short-term cup and handle might not work. Small-frame cup-and-handles that contradict the daily trend should be approached with caution.

Duration: If a cup forms over an excessively long time, market conditions might change by the handle’s appearance. Crypto moves fast; a pattern that took a year might be less reliable than one over a few weeks.

Deep Vs. Shallow: A very deep cup with a shallow handle might still be valid (often called a “cup and saucer”), but very deep handles (drop below the cup’s midpoint) can invalidate the setup.

Volume Isn’t Perfect: Ideally volume falls during the cup and handle and spikes on breakout, but in reality it can mislead. A breakout on low volume might still succeed, or a high-volume break could fail. Don’t rely solely on volume – use it as one confirmation.

In summary, utilize the Cup and Handle pattern within the outlined guidelines for better success in trading.

Bonus Tips or Historical Notes

William O’Neil’s Legacy: William J. O’Neil first popularized the Cup and Handle pattern in his 1988 classic, “How to Make Money in Stocks.” He emphasized that cups should be rounded and handles should be shallow. Following his guidelines, often referred to as the CANSLIM principles, can enhance your chances of success.

Inverse Pattern: Be aware of the inverse Cup and Handle, which signals a bearish continuation. This pattern is simply the upside-down version of the traditional Cup and Handle and can be used to time short entries or hedges. Recognizing both variations is valuable for comprehensive market analysis.

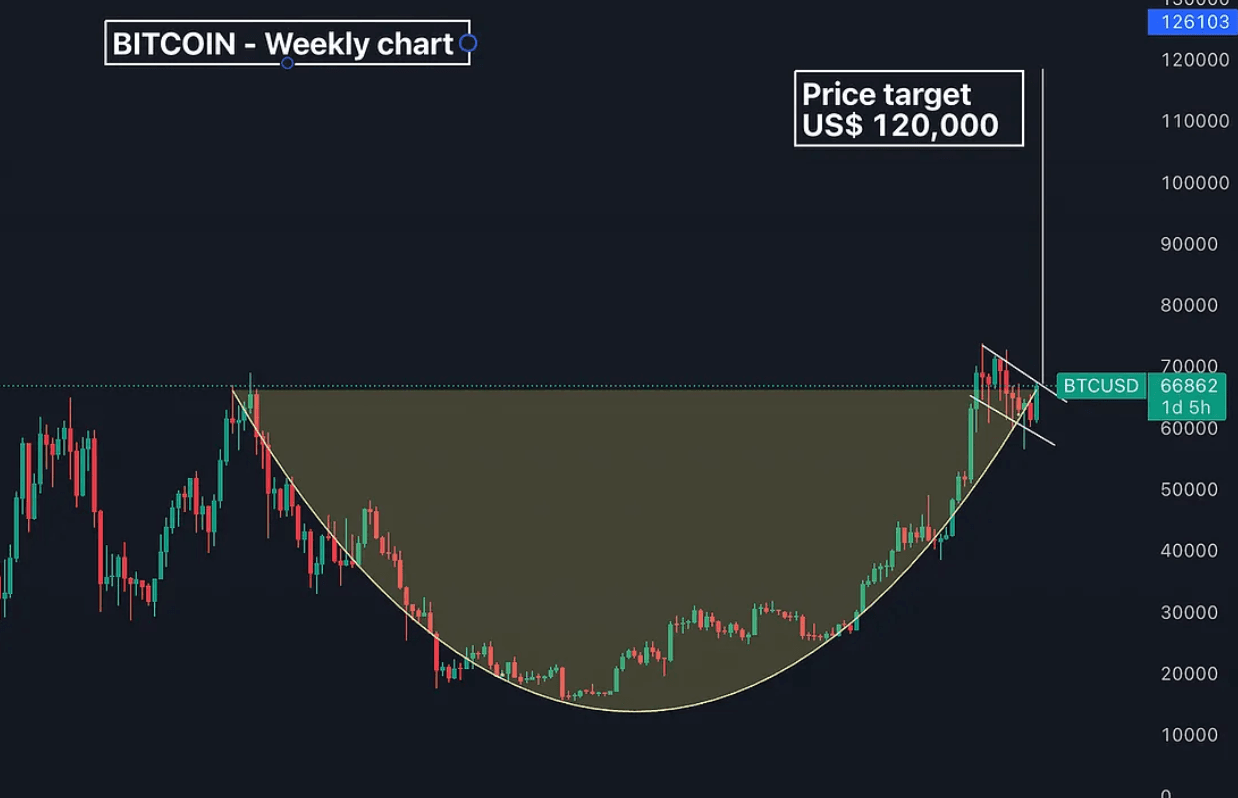

Crypto Context: In the cryptocurrency market, cup and handles often form on weekly charts. For instance, analysts have identified a Bitcoin weekly cup-and-handle pattern targeting very high levels. Remember to check the pattern across multiple exchanges to avoid data inconsistencies and take into account the additional volatility in crypto markets compared to stocks.

Success Rate: In hindsight, clearly defined cup-and-handle patterns frequently precede significant price movements. One report estimates an approximate 80% success rate for properly formed cups, but keep in mind that this is contingent on strict criteria and market conditions. The takeaway is that when patterns are textbook-perfect, the success rate can be high, but it is essential to remember that it is never guaranteed.

Pattern Variations: Cup and handles come in various sizes and shapes. Variants include scalloping cups, double-bottom handles, and wedge handles. The core concept remains the same: a rounded base followed by a brief consolidation and then a breakout. Training your eye on real charts, such as those of Bitcoin or major altcoins, will help you identify these subtle differences.

Combination Patterns: Sometimes, the handle may resemble a small flag or even a mini head-and-shoulders pattern. It is beneficial to learn about multiple patterns. If a cup-and-handle formation fails, observe what else the price action might be indicating…perhaps a double bottom is forming.

Conclusion

The Cup and Handle is a well-established bullish pattern that assists traders in planning breakouts with defined entries, stop-loss levels, and targets. It provides a clear entry point (the breakout above the handle), a stop-loss (below the handle or cup), and a target (the height of the cup). However, success relies on discipline: trade only when the pattern is valid, confirm breakouts, and always manage your risk.

Phemex’s trading tools can support this strategy. Utilize our platform to draw the cup’s rim and handle levels, set breakout alerts, and calculate your risk/reward ratio. Phemex Academy emphasizes responsible trading - remember to manage your risk. As Phemex advises, even strong patterns should be coupled with confirmations and stop-loss orders.

Whether you’re trading Bitcoin or altcoins, the Cup and Handle can be a “pro-level” strategy when recognized correctly. Combine it with Phemex’s charts and indicators, and trade with discipline: wait for confirmed breakouts, respect your stop-losses, and let trading volume validate the move. By doing so, you can turn this classic pattern into a practical approach for your crypto trades. Good luck, and trade wisely!