On a day that will either be remembered as a moment of renaissance or a profound ideological schism, the Bitcoin network passed block height 912,690. For the vast majority of its users, miners, and node operators, it was an unremarkable event—another immutable block appended to the world’s most secure ledger. Yet, within the layered complexities of Bitcoin’s burgeoning meta-protocols, a seismic shift occurred. The BRC-20 token standard, a controversial yet wildly popular experiment, completed its “BRC 2.0” upgrade. With this upgrade, orchestrated by the Ordinals infrastructure firm Best in Slot with the blessing of BRC-20 creator Domo, the intellectual heart of its greatest rival, the Ethereum Virtual Machine (EVM), began to beat within the data payloads of Bitcoin transactions.

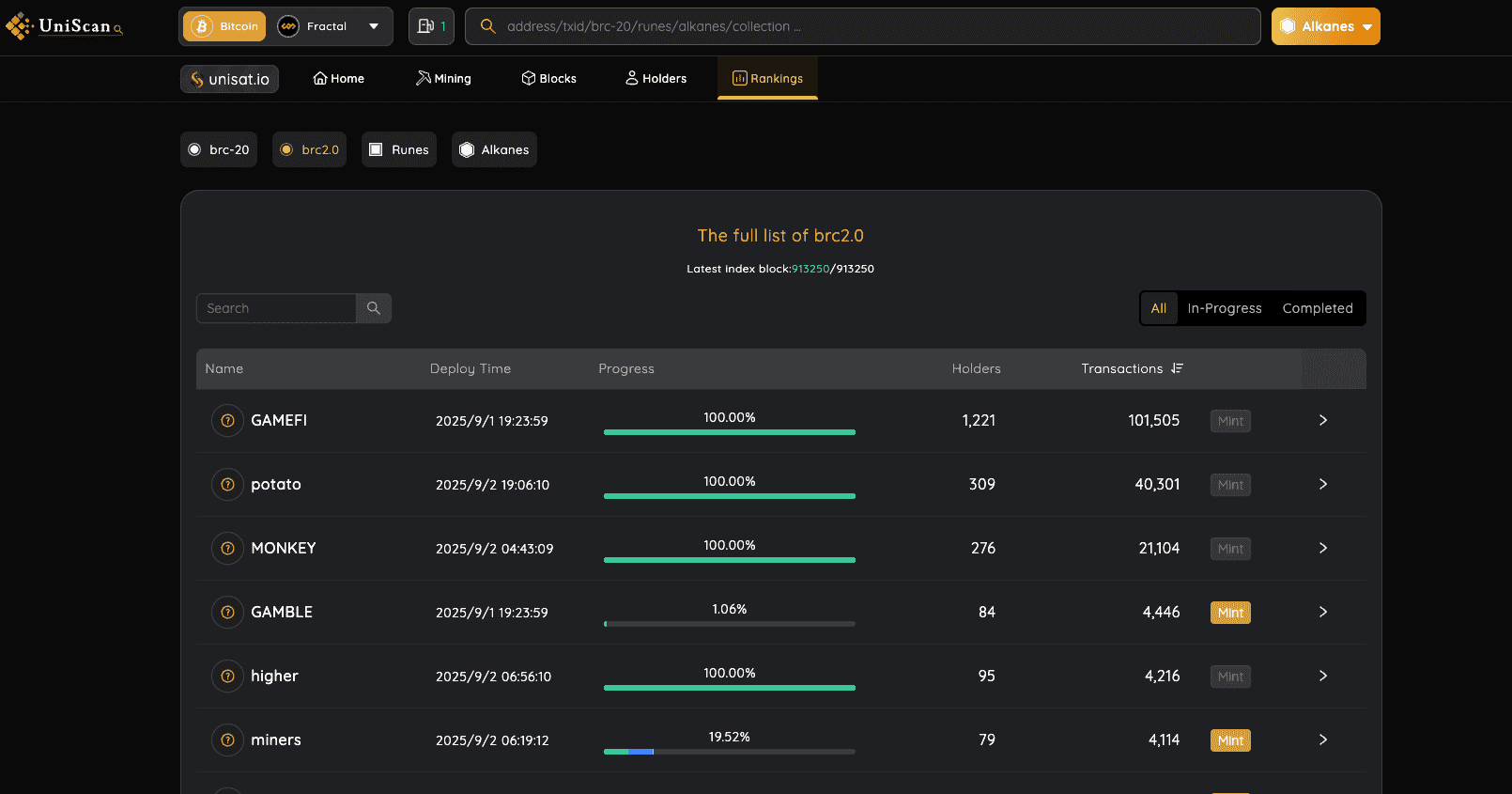

The announcement was both technically dense and philosophically explosive. BRC-20, a protocol that didn’t even exist two years ago, now boasts Turing-completeness, enabling Ethereum-style smart contracts on a network whose creator famously and deliberately restricted such capabilities. According to UniScan data, within hours of the upgrade, 42 new 6-character BRC-20 tokens had been deployed, a trivial fact that belies a monumental question: What does it mean for Bitcoin, the stoic, unyielding originator, to adopt the complex, dynamic, and often chaotic features of its successors?

This is not merely a technical upgrade; it is a referendum on the very soul of Bitcoin. Is this the dawn of a new era, a Cambrian explosion of innovation that will finally unlock the trillions of dollars of "lazy capital" on the Bitcoin network? Or is it an identity crisis, a heretical act that risks diluting Bitcoin’s core value proposition as the world’s most reliable, simple, and secure digital money, turning its pristine ledger into a host for the very complexity it was designed to transcend? To understand the gravity of this moment, we must journey back to the beginning, through the history of Bitcoin's technical evolution and the ideological battles that have defined it.

The Genesis - From Digital Cash to Inscribed Data

Satoshi Nakamoto’s 2008 whitepaper, "Bitcoin: A Peer-to-Peer Electronic Cash System," is a masterclass in elegant, focused design. Its purpose was singular: to create a censorship-resistant, trustless system for transferring value. The tool for this was a limited, non-Turing-complete scripting language known simply as Bitcoin Script. This limitation was a feature, not a bug. By preventing complex loops and unbounded computations, Satoshi drastically reduced the network's attack surface, ensuring its predictability and robustness. Bitcoin was built to be a fortress, not a playground. Its code was law, and the law was simple.

For years, this philosophy reigned supreme. Bitcoin was digital gold, a store of value. Ethereum, launched in 2015, was the playground—a "world computer" where the EVM enabled developers to build decentralized applications (dApps), from DeFi lending protocols to DAOs. The two ecosystems had a clear division of labor: Bitcoin was the secure foundation, the ultimate settlement layer; Ethereum was the expressive application layer.

However, the desire for more functionality on Bitcoin never truly died. Early experiments like Colored Coins (2012) attempted to "color" specific bitcoins to represent other assets, but they were clunky and struggled to gain traction. The ecosystem seemed destined to remain a bastion of monetary purity, with more complex functionalities relegated to sidechains or separate "Layer 2" networks.

This paradigm was shattered in late 2022 by Casey Rodarmor's Ordinals Theory. Rodarmor proposed a novel idea: what if each individual satoshi (the smallest unit of a bitcoin) could be uniquely identified and tracked? This numbering scheme, or "Ordinals," allowed for data—images, text, audio—to be "inscribed" directly onto these satoshis. Crucially, this required no change to the Bitcoin base protocol. It was a meta-protocol, a new way of interpreting existing blockchain data that was entirely backward-compatible. If you didn't run an Ordinals-aware client, you wouldn't even know it was there.

The "NFTs on Bitcoin" narrative exploded in popularity, driving up transaction fees and igniting fierce debate. But the true Pandora's Box was opened in March 2023 by an anonymous developer named Domo. He used the Ordinals text-inscription feature to create BRC-20, a simple, experimental standard for creating fungible tokens on Bitcoin. By inscribing JSON text data for deploy, mint, and transfer functions, a social consensus could be formed around the balances of these new tokens. It was crude, inefficient, and relied entirely on off-chain indexers to track the state of the system. Yet, it worked. The market embraced it with a speculative fervor, creating billions of dollars in value out of thin air and proving an undeniable demand for native asset issuance on Bitcoin.

The Upgrade - Injecting the EVM into Bitcoin's Bloodstream

BRC-20, in its initial form, was a pale imitation of Ethereum's ERC-20. It lacked any form of on-chain logic. You couldn't build a decentralized exchange, a lending protocol, or a stablecoin with it. Its state was not enforced by Bitcoin miners but calculated and agreed upon by external indexers like UniSat and Best in Slot's UniScan. This centralization of state interpretation was its greatest weakness.

The BRC 2.0 upgrade is a direct and audacious attempt to solve this problem. It does so by embedding the logic of the Ethereum Virtual Machine directly into the BRC-20 meta-protocol.

Let's be crystal clear on the technical implementation: the EVM is not running on the Bitcoin base layer. Bitcoin miners are not executing Solidity code. Instead, the Bitcoin blockchain is being used as a perfectly ordered, immutable, and hyper-secure data layer. Developers can now inscribe EVM bytecode—the compiled language of smart contracts—into satoshis.

The magic happens at the indexer level. The BRC 2.0-compliant indexers, which are essential for the protocol to function, now run an EVM environment. They read the inscribed bytecode from the Bitcoin blockchain, execute it within their local EVM, and update the state of the BRC-20 ecosystem accordingly. In essence, the Bitcoin network plays the role of a decentralized data sequencer, providing the raw, ordered input, while the indexers act as the distributed computation layer.

As Best in Slot CEO Eril Binari Ezerel stated, this grants BRC-20 Turing-completeness. The simple mint and transfer functions are now supplemented by the ability to execute any arbitrary logic. This opens the door to the entire suite of DeFi applications that have defined Ethereum: AMMs, lending pools, liquid staking derivatives, DAOs, and more.

Domo's stated goal is to "combine Bitcoin's decentralization and security with the EVM's composability and programmability." This is the grand vision. The pitch is simple: build your dApps using the familiar tools of the EVM (Solidity, Foundry, Hardhat), but anchor their final state to the most secure and decentralized ledger in human history. The secondary feature of the upgrade, enabling 6-character tickers, is a practical but minor addition, expanding the namespace for a new wave of token deployments.

The Philosophical War - Pragmatic Evolution vs. Principled Purity

This upgrade has cleaved the Bitcoin community into two broad, and often hostile, camps. The debate is not merely technical; it is a battle for the soul of Bitcoin itself.

Camp 1: The Pragmatic Evolutionists

This camp views the BRC 2.0 upgrade as a necessary and brilliant step forward. Their arguments are rooted in pragmatism and economic incentives.

First, the long-term security budget of Bitcoin. The Bitcoin network is secured by miners who are rewarded with a block subsidy and transaction fees. Every four years, the subsidy halves. The final bitcoin will be mined around the year 2140. For the network to remain secure in perpetuity, transaction fees must eventually rise to a level sufficient to incentivize miners. The simple, low-fee transactions of a peer-to-peer cash system, they argue, may not be enough. Protocols like Ordinals and BRC-20 create a vibrant fee market, making blockspace highly valuable and ensuring the network's security for centuries to come. This upgrade supercharges that fee market.

Second, the problem of "lazy capital." There is over a trillion dollars of value stored in Bitcoin. Most of it sits idle in wallets. The evolutionists see this as a colossal waste of capital efficiency. By building a native DeFi ecosystem on Bitcoin, this capital can be "unlocked." BTC can be used as collateral to borrow stablecoins, supplied to lending pools to earn yield, or paired in liquidity pools, all without leaving the native chain. This would create a powerful, self-reinforcing economic flywheel, capturing value that currently flows to wrapped versions of BTC on other chains (like WBTC on Ethereum).

Third, the principle of voluntary association. They stress that BRC 2.0, like Ordinals before it, is a meta-protocol. It doesn't change a single rule of the Bitcoin consensus. Those who see Bitcoin only as digital gold can continue to use it as such. Their transactions are unaffected. This is a voluntary, opt-in layer of innovation that coexists peacefully on the base chain. To oppose it, they argue, is to oppose permissionless innovation, one of Bitcoin's core tenets.

Camp 2: The Principled Purists

This camp, often associated with Bitcoin Maximalism, views the upgrade with horror. They see it as a dangerous deviation from Bitcoin's core mission, a betrayal of Satoshi's vision.

Their primary argument is one of purpose and simplicity. Bitcoin's singular focus on being the world's best money is its greatest strength. By cluttering the blockchain with what they deride as "contract spam" and "decentralized casinos," the network loses its focus. This introduces unnecessary complexity and "tech debt," bloating the blockchain and making it more expensive for ordinary users to run full nodes, which could lead to centralization over time. Bitcoin, for them, is a finished masterpiece of monetary technology, not a canvas for endless experimentation.

Their second, more technical critique, is the centralization of indexers. The state of BRC 2.0 is not validated by the 100,000+ Bitcoin nodes worldwide. It is validated by a handful of centralized indexer operators. The "truth" of whether your BRC-20 DeFi transaction succeeded is determined by companies like Best in Slot, not by the decentralized consensus of Bitcoin miners. This introduces a new, trusted third party—the very thing Bitcoin was designed to eliminate. What happens if indexers disagree? What happens if they are pressured by governments or suffer a catastrophic bug?

This leads to their third point: the illusion of borrowed security. Proponents claim BRC 2.0 leverages Bitcoin's security. Purists argue this is a dangerous half-truth. The data (the inscribed bytecode) is indeed secured by Bitcoin's Proof-of-Work. However, the execution and state interpretation are not. A bug in the indexers' EVM implementation could lead to tokens being double-spent or contracts being wrongly executed, and Bitcoin's base layer would be completely unaware and unable to prevent it. It's like storing a flawed legal contract in the world's most secure vault; the vault protects the paper, but it doesn't fix the faulty logic written on it.

The Competitive Landscape - A New Contender or a Redundant Follower?

With the EVM now active, the inevitable question arises: Is BRC-20 on Bitcoin aiming to become the "next Ethereum"? And in a world with a mature Ethereum, high-performance chains like Solana, and a vast ecosystem of L2s, is there even a need for it?

The Bull Case for a Bitcoin-Anchored EVM:

The argument for its success rests on three pillars. First and foremost is Bitcoin's unparalleled security and brand. No other blockchain comes close to Bitcoin's hash rate, decentralization, or Lindy effect (the idea that the longer something survives, the longer its future life expectancy). For high-value DeFi applications where security is paramount, the appeal of anchoring to Bitcoin is immense.

Second is capital gravity. The largest, most pristine collateral asset in the entire crypto ecosystem is BTC. A native DeFi ecosystem eliminates the custodial and bridge risks associated with wrapping BTC for use on other chains. The capital is already there; BRC 2.0 simply provides the tools to use it.

Third is the "fair launch" culture. The BRC-20 standard, born from a simple experiment, has fostered an ethos of community-driven, no-VC, no-pre-mine token launches. This grassroots appeal resonates strongly with a segment of the crypto community weary of venture-capital-dominated projects and could be a powerful driver of adoption.

The Bear Case Against It:

However, the challenges are monumental. The primary obstacle is technical clumsiness and inefficiency. Building a smart contract layer on top of a blockchain not designed for it is inherently suboptimal. Transactions will be slower, more expensive, and less gas-efficient than on native smart contract platforms. The reliance on centralized indexers remains a significant technical and philosophical bottleneck that sophisticated DeFi users may be unwilling to accept.

Next is Ethereum's colossal head start. Ethereum's ecosystem is a decade in the making. It has a vast network of developers, battle-tested infrastructure, deeply liquid markets, and a rich library of audited, composable smart contracts. Replicating this network effect is a Herculean task. Developers and users are creatures of habit, and the existing tools and liquidity on Ethereum present a powerful gravitational pull.

Finally, there is internal competition. Bitcoin itself is not a monolithic entity. There are other, arguably more elegant, solutions for bringing smart contracts to Bitcoin. Layer 2 networks like Stacks (which has its own smart contract language, Clarity) and the Lightning Network (for payments) are specifically designed to scale Bitcoin's functionality without bloating the base layer. BRC 2.0 is not just competing with Ethereum; it is competing with other visions for Bitcoin's own future.

Conclusion: The Experiment Begins

The activation of EVM capabilities on BRC-20 at block 912,690 is not an ending, but the explosive start of a new, uncertain chapter for Bitcoin. It represents the triumph of a permissionless ethos, where any idea, no matter how controversial, can be built and tested in the free market of the meta-protocol layer.

The base layer of Bitcoin remains unchanged, a testament to its incredible resilience. It continues its singular mission of processing peer-to-peer electronic cash transactions with unparalleled security. But floating above it, a vibrant, chaotic, and now profoundly more capable application layer has come to life.

Will this be the Cambrian explosion that finally awakens the sleeping giant of Bitcoin's locked capital, creating a DeFi ecosystem that rivals and perhaps even surpasses Ethereum's? Or will it prove to be an identity crisis, a clumsy and inefficient detour that introduces centralized failure points and detracts from Bitcoin's true purpose?

The code has been inscribed. The experiment is live. The purists and the pragmatists will continue their debate, but the final verdict will not be written in philosophical treatises or angry tweets. It will be written in the immutable blocks that follow 912,690, forged by the developers who choose to build, the users who choose to transact, and the market that will ultimately decide whether this audacious fusion of Bitcoin's security and Ethereum's logic is a stroke of genius or a beautiful, tragic heresy.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. The views expressed are solely those of the author(s) and do not necessarily reflect the official policy or position of Phemex. Cryptocurrency trading involves substantial risk and is not suitable for all investors. Investors should consider their financial situation and consult with a financial advisor before making any investment decisions. Phemex is not responsible for any direct or indirect losses arising from the use of this information.