Summary: NFT Market Rebound Signals Risk-On Sentiment

The non-fungible token (NFT) market has staged a remarkable comeback, with its total market capitalization soaring past $6.3 billion, nearly doubling from $3.2 billion a month ago. Leading collections like CryptoPunks (+14% in 24 hours), Moonbirds (+31.1%), and Azuki (+9.2%) are driving the rally, defying a broader crypto market pullback. Meanwhile, Bitcoin’s dominance has dropped to approximately 61%, suggesting traders are shifting capital into higher-risk assets like NFTs and altcoins. Yuga Labs co-founder Garga.eth’s recent hint at “NFT treasury companies” has sparked speculation about institutional adoption, potentially fueling further growth. This article explores the NFT market surge, top-performing collections, and how traders can capitalize on this trend using platforms like Phemex.

Key Metrics (as of July 23, 2025):

-

NFT Market Cap: $6.31 billion (+17.2% in 24 hours)

-

Bitcoin Dominance: ~61% (-6.6% from recent peak)

-

Top Performers: CryptoPunks (48 ETH floor), Moonbirds (1.68 ETH floor)

-

Trading Opportunity: NFT-related tokens (APE, BLUR, PENGU, MEME) on Phemex

As the crypto market braces for a potential altcoin season, NFTs are emerging as a key indicator of risk appetite. Whether you’re a seasoned trader or a curious investor, understanding this rally could unlock significant opportunities.

NFTs Break Out Amid Crypto Market Consolidation

After a robust second quarter in 2025, major cryptocurrencies like Bitcoin and Ethereum have entered a consolidation phase, with prices stabilizing after weeks of gains. Bitcoin, for instance, has hovered around $60,000, while Ethereum trades near $3,350, down slightly by 2.06% in the last 24 hours (as of July 23, 2025). Most altcoins have followed suit, pausing their upward momentum. However, the NFT market has bucked this trend, surging 9.44% in a single day and pushing its total market cap above $6.3 billion, according to data aggregated from platforms like CoinGecko and OpenSea.

This rapid growth marks a near-doubling from the $3.2 billion market cap recorded just a month ago, signaling a shift in investor sentiment. Unlike past NFT bull runs, which were often fueled by retail hype or viral meme-driven projects, this rally appears more calculated. Traders are interpreting the NFT surge as a sign of growing risk appetite, akin to how investors shift from safe-haven assets like bonds to equities during bullish market phases. With Bitcoin’s dominance declining and altcoins showing stability, NFTs may be a leading indicator of the next speculative wave in the crypto market.

For example, consider Sarah, a 28-year-old crypto trader from San Francisco. After months of focusing on Bitcoin, she noticed the NFT market’s breakout and shifted 20% of her portfolio into NFT-related tokens like APE and BLUR. Within a week, her portfolio gained 15%, highlighting how early movers can capitalize on these trends. Stories like Sarah’s are becoming more common as traders recognize NFTs as a high-reward opportunity.

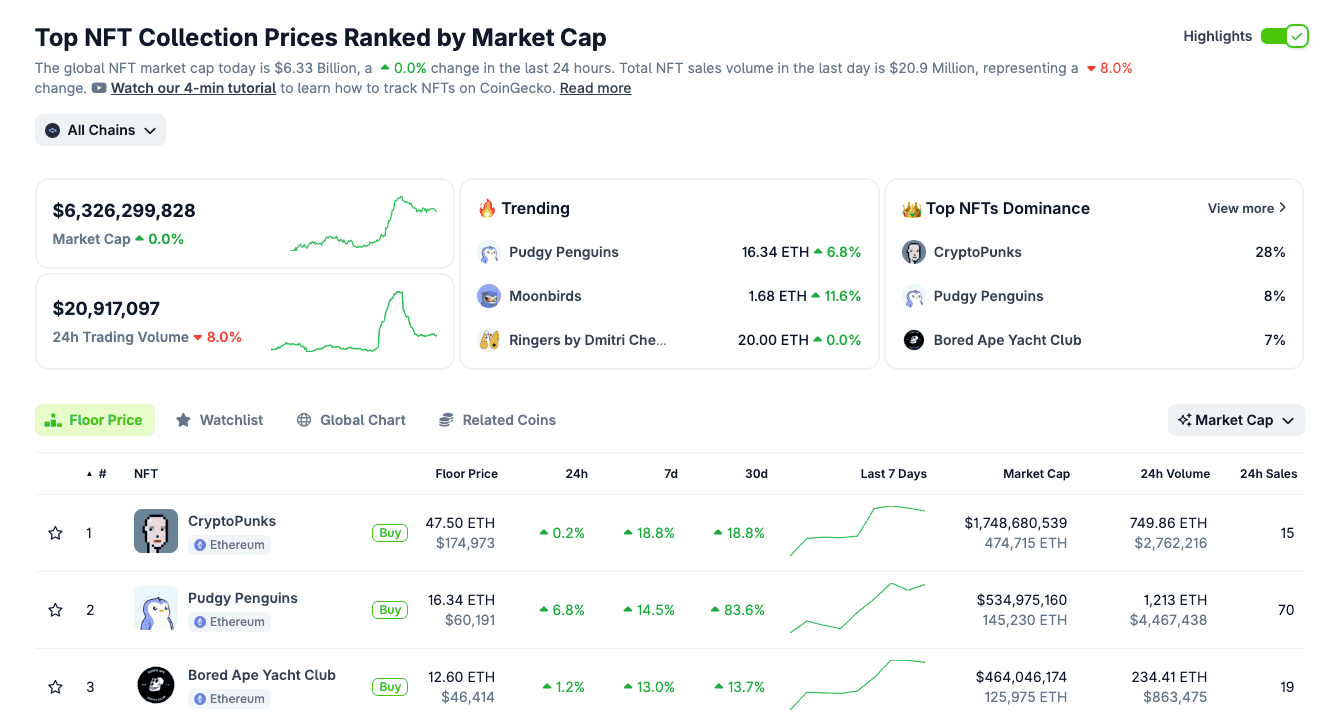

NFT Market Cap Hits $6.3 Billion: A Closer Look

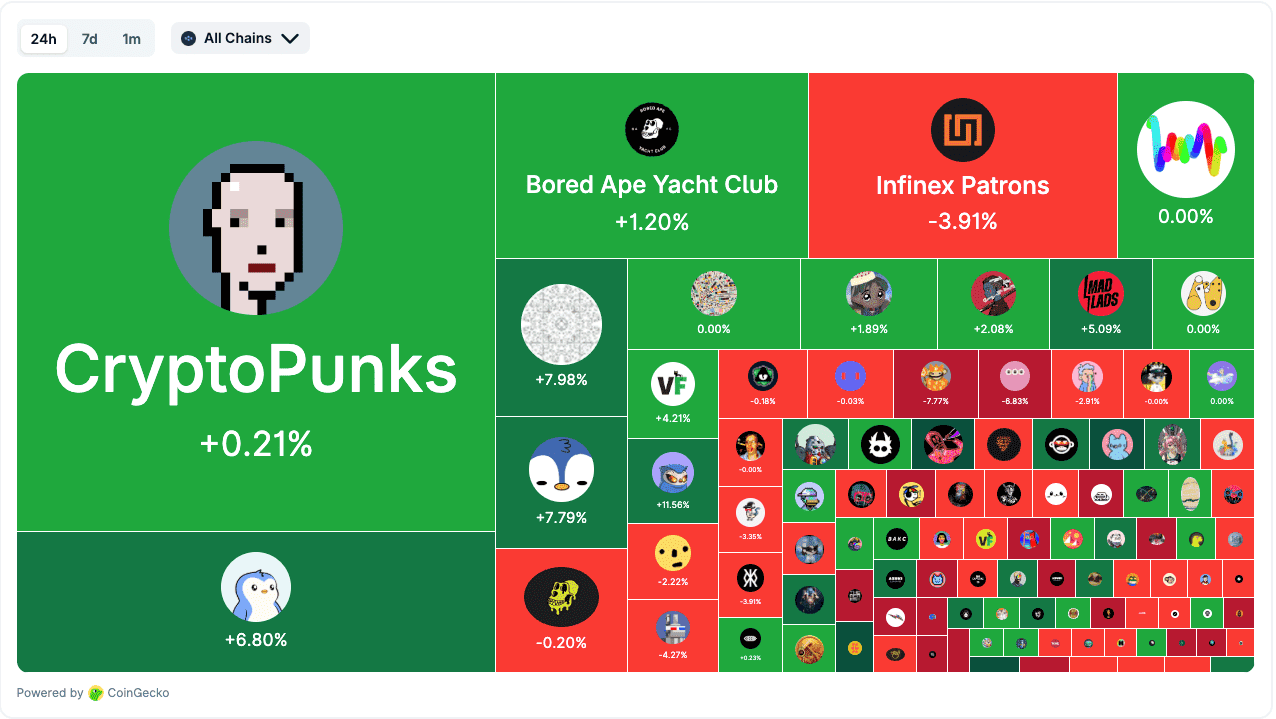

The NFT market’s explosive growth is backed by compelling data. As of July 23, 2025, the total market capitalization approached $6.3 billion, reflecting a significant increase in investor appetite, according to aggregated data from analytics platforms. This surge is visibly led by blue-chip collections, with the top 10 projects alone accounting for over $3.5 billion in total market value. This momentum has built steadily over the past month, outpacing other crypto sectors.

Here’s a snapshot of the key market metrics driving this trend:

-

Aggregate NFT Market Cap: ~$6.3 Billion

-

Bitcoin Dominance: ~61% (-6.6% from its recent peak)

-

Ethereum Price: ~$3,350

-

Top Performing Collections: CryptoPunks, Pudgy Penguins, Bored Ape Yacht Club (floor prices rising)

This surge comes as other crypto sectors are cooling off, suggesting capital is rotating into NFTs. The decline in Bitcoin dominance further supports this narrative, signaling that traders are moving into higher-risk assets. NFTs, with their potential for outsized returns, appear to be acting as a frontier for this capital shift.

Blue-Chip Collections Are Driving the Rally

The market's rebound is not uniform; it is being decisively led by a handful of established collections, which have historically signaled the start of speculative cycles.

-

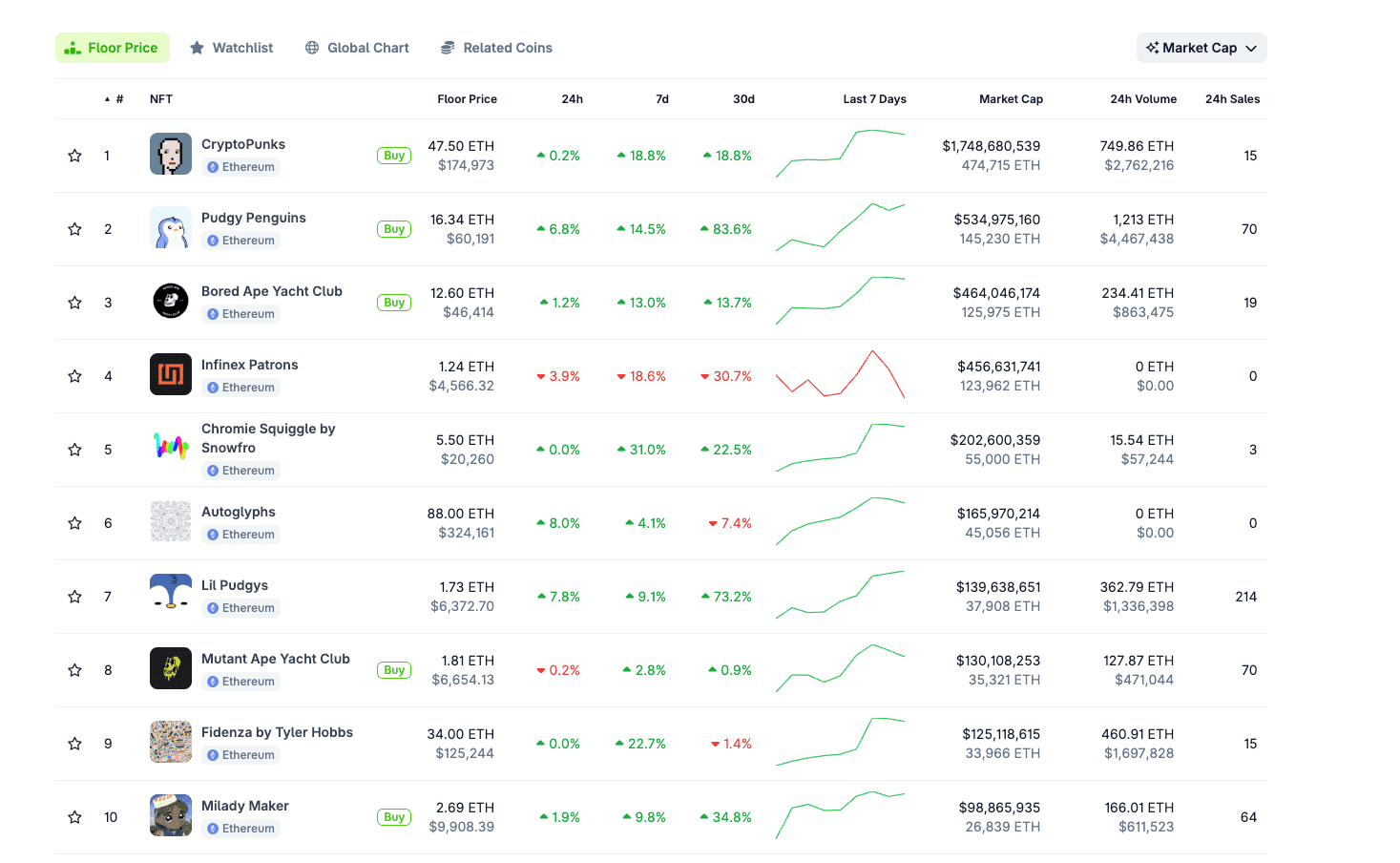

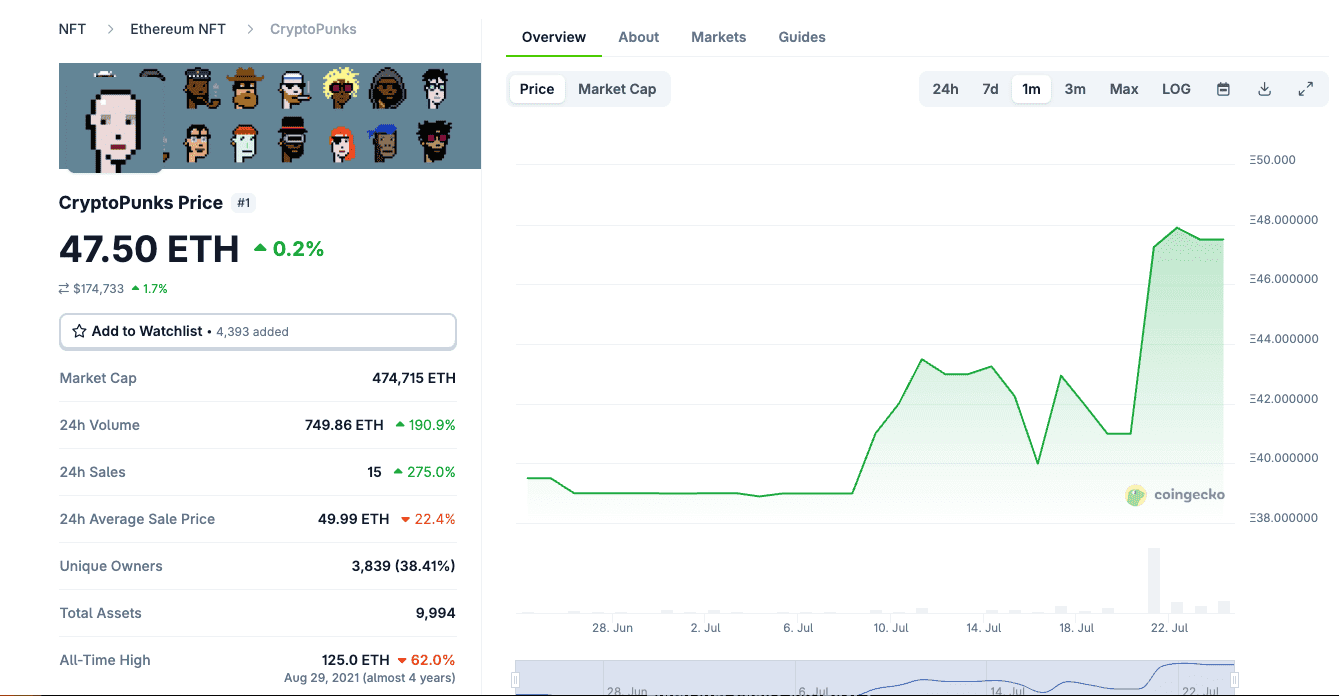

Floor Price: 47.50 ETH

-

30-Day Gain: +18.8%

Often dubbed the “Bitcoin of NFTs,” CryptoPunks anchors the market with a staggering $1.75 billion market cap. While its 24-hour gain is modest, its powerful 18.8% rise over the last month confirms that large investors (“whales”) are securing positions for the long term.

-

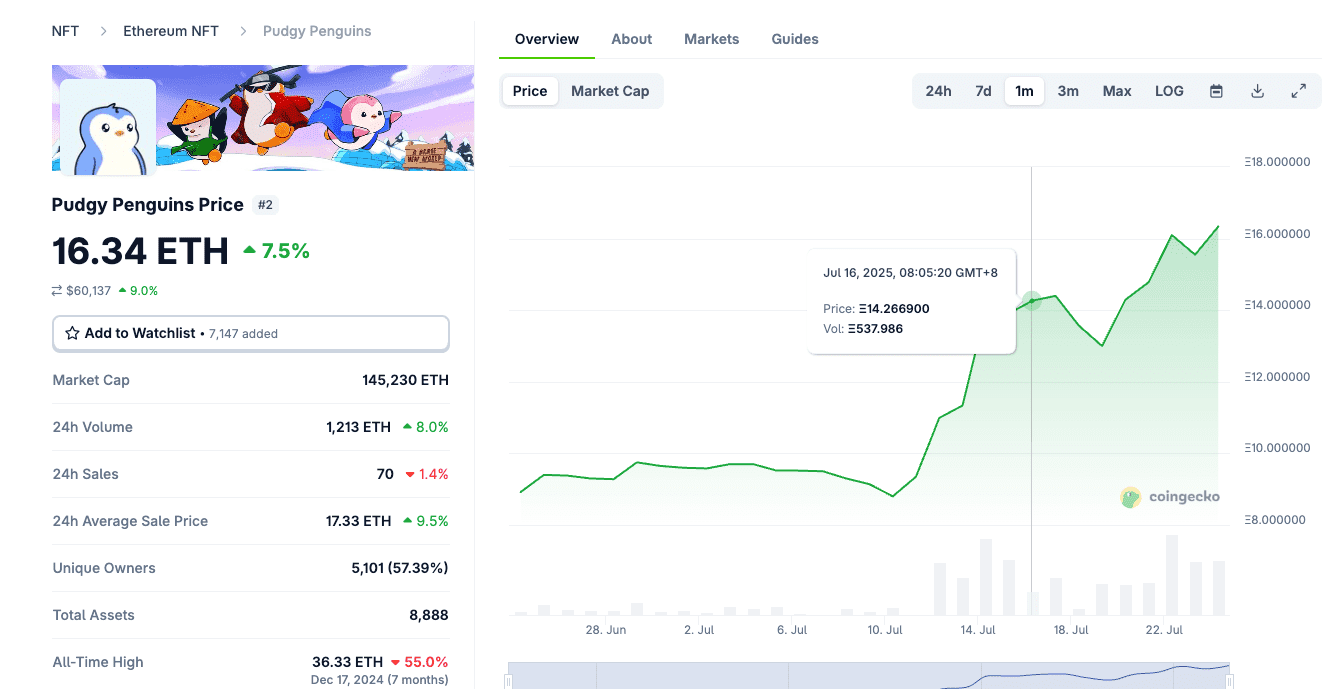

Floor Price: 16.34 ETH

-

30-Day Gain: +83.6%

Pudgy Penguins has emerged as the standout performer. Its floor price has seen an explosive 83.6% surge over the past 30 days, driven by immense trading activity. With over 1,213 ETH in 24-hour volume, its momentum is backed by strong commercial licensing deals and a rapidly growing community.

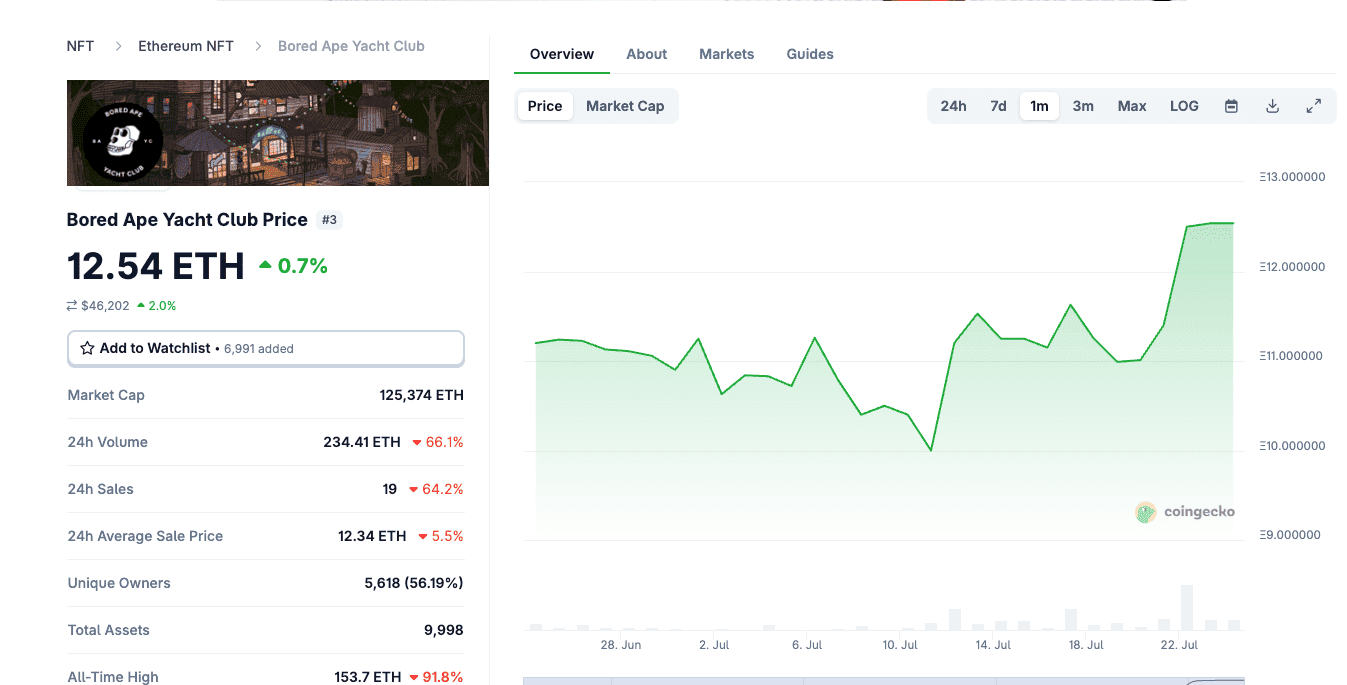

Bored Ape Yacht Club (BAYC)

-

Floor Price: 12.54 ETH

-

30-Day Gain: +13.7%

Trading with a robust $464 million market cap, BAYC shows steady and reliable growth. Its consistent appreciation reinforces the enduring appeal of blue-chip NFTs, proving their resilience even amidst uncertain macroeconomic signals.

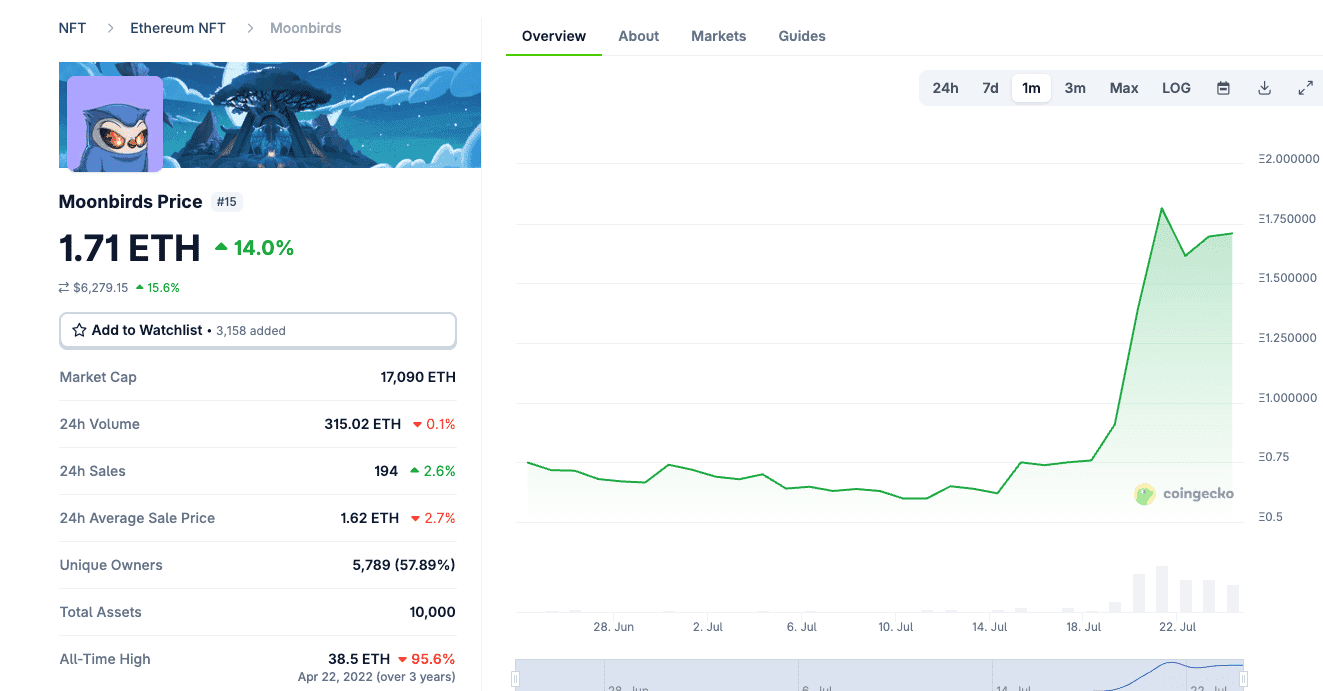

Moonbirds

-

Floor Price: 1.71 ETH

-

30-Day Gain: +152.4%

Moonbirds has emerged as the top performer, shrugging off past controversies around its leadership and roadmap. The sharp rise in its floor price indicates renewed confidence in the project, possibly driven by community developments or strategic buying.

This clear leadership from established collections, rather than pure retail speculation, suggests seasoned capital is re-entering the market. Historically, strong performance in blue-chip NFTs precedes broader interest in mid- and low-tier projects, setting the stage for a potential market-wide boom.

Garga.eth’s Vision: The Rise of NFT Treasury Companies

Adding to the bullish sentiment, Garga.eth, co-founder of Yuga Labs, posted a thought-provoking message on X: “The world isn’t ready for NFT treasury companies. But they’re on their way.” This ignited widespread discussion, with many interpreting it as a signal of institutional-grade adoption for NFTs.

The concept of “NFT treasury companies” suggests that Web3 projects or DAOs may begin holding NFTs as strategic assets, similar to how corporations hold Bitcoin. This could lead to:

-

Institutional Validation: NFTs transitioning from simple collectibles to long-term strategic assets for protocols and brands.

-

Liquidity Support: Projects actively holding their own NFTs to stabilize floor prices and enhance market confidence.

-

Value Accrual: DAOs using NFT treasuries to signal brand strength, akin to corporate stock buybacks.

While speculative, this vision aligns perfectly with the growing maturity of the NFT market. The very rally we are witnessing, led by high-value assets like CryptoPunks and BAYC, could be the precursor to this new phase of institutional adoption, transforming NFTs into a more stable and integrated asset class.

Bitcoin Dominance Decline Signals Altcoin Season

Bitcoin’s dominance, which measures its market cap relative to the total crypto market, has fallen from 67.6% to approximately 61% in less than a month, according to TradingView data. This decline is a critical signal for traders, as it often indicates a shift from safe-haven assets like Bitcoin to riskier plays like altcoins and NFTs.

In traditional markets, a similar dynamic occurs when investors move from bonds to equities during periods of optimism. In crypto, falling Bitcoin dominance typically marks the start of an “altcoin season,” where smaller cryptocurrencies outperform. NFTs, with their high volatility and speculative appeal, often lead this charge, acting as a high-beta sector that amplifies market trends.

For example, in early 2021, a similar drop in Bitcoin dominance preceded a surge in NFT projects like CryptoPunks and Axie Infinity, followed by gains in altcoins like Solana and Avalanche. If this pattern repeats, traders could see opportunities in:

-

Layer 1 Altcoins: Solana (SOL), Avalanche (AVAX), and others with strong ecosystems.

-

NFT-Related Tokens: APE (ApeCoin), BLUR, and MEME, which are tied to NFT marketplaces or communities.

-

Emerging Projects: Mid- and low-tier NFTs that often follow blue-chip gains.

How to Trade the NFT Surge on Phemex

As the NFT market heats up, traders are seeking exposure not just through direct NFT purchases but also via liquid assets like Ethereum and NFT-related tokens. Phemex, a leading crypto exchange, offers a range of tools to capitalize on this trend, including spot and futures trading with deep liquidity.

Trading Strategies for the NFT Boom:

-

Buy Ethereum: As the backbone of most NFT transactions, Ethereum often rises during NFT bull runs. Available on Phemex (spot and futures).

-

Long NFT Tokens: Tokens like APE, BLUR, and MEME offer high volatility and liquidity, ideal for short-term trades. Available on Phemex.

-

Scalping Volatility: Pairs like ETH/USDT or APE/USDT allow traders to profit from short-term price swings.

-

Leveraged Trading: Phemex’s futures markets enable traders to amplify exposure to Ethereum or NFT tokens, though leverage carries higher risk.

Why Trade Tokens Instead of NFTs?

-

Liquidity: Tokens are easier to buy and sell than individual NFTs.

-

Accessibility: Phemex’s user-friendly interface simplifies entering and exiting positions.

-

Volatility: NFT tokens often experience sharper price movements than NFTs themselves.

-

Capital Efficiency: Futures trading allows traders to maximize returns with smaller capital outlays.

To get started, visit Phemex’s platform to explore trading pairs and strategies tailored to the NFT market. For beginners, Phemex offers educational resources to navigate crypto trading effectively.

NFTs as a Risk Barometer for Crypto Markets

The NFT market’s resurgence is more than a fleeting trend—it’s a potential signal of broader crypto market expansion. As Bitcoin’s dominance wanes and NFT floor prices climb, speculative capital is flowing back into the ecosystem. This dynamic positions NFTs as a “risk barometer,” indicating when traders are ready to move beyond safe assets like Bitcoin and explore high-reward opportunities.

For traders, this opens several avenues:

-

NFT Token Plays: Tokens like APE and BLUR often surge alongside NFT collections, offering liquid exposure.

-

Ethereum Longs: NFT minting cycles typically drive Ethereum demand, making it a core holding.

-

Altcoin Speculation: Mid-cap altcoins with NFT ties, such as those linked to metaverse or gaming projects, could see gains if the rally spreads.

Phemex provides the tools to act on these opportunities, with competitive fees, robust security, and a seamless trading experience. Whether you’re chasing short-term volatility or building a long-term portfolio, staying ahead of the NFT trend could yield significant rewards.

Conclusion: Positioning for the NFT and Altcoin Boom

The NFT market’s 9% surge in a single day, coupled with a near-doubling of its market cap in a month, signals a shift in crypto market dynamics. Led by blue-chip collections like CryptoPunks and Moonbirds, this rally reflects growing investor confidence and risk appetite. Garga.eth’s hint at NFT treasury companies adds a layer of intrigue, suggesting that NFTs may soon play a larger role in institutional portfolios.

For traders, the implications are clear:

-

Monitor Bitcoin dominance for signs of a broader altcoin season.

-

Explore NFT-related tokens like APE and BLUR for high-volatility plays.

-

Use platforms like Phemex to trade Ethereum and NFT tokens with efficiency and leverage.

The NFT rally may be the first spark of a larger market expansion. By positioning early, traders can ride the wave of speculative capital flowing into NFTs and altcoins. Visit Phemex today to start building your strategy and stay ahead of the curve.