Summary Box (Quick Facts)

-

Ticker Symbol: YB

-

Chain: Ethereum

-

Contract Address: 0x01791f726b4103694969820be083196cc7c045ff

-

Circulating Supply: Approximately 88 million.

-

Total Supply: 1 billion.

-

Primary Use Case: A DeFi protocol designed to eliminate impermanent loss for liquidity providers.

-

Current Market Cap: Approximately $62 million.

What Is Yield Basis (YB)?

Yield Basis (YB) is a sophisticated decentralized finance (DeFi) protocol built on the Ethereum blockchain, designed to solve one of the oldest and most significant problems for liquidity providers: impermanent loss (IL). In simple terms, Yield Basis allows users to deposit Bitcoin and earn trading fees without the risk of their position underperforming a simple "buy and hold" strategy, a common issue in traditional automated market maker (AMMs).

The project was created by Michael Egorov, the renowned founder of Curve Finance, and its architecture leans heavily on the battle-tested infrastructure of the Curve ecosystem. The core innovation is a mechanism that allows a liquidity position's value to track the price of Bitcoin on a 1-to-1 basis, effectively neutralizing the "divergence loss" that plagues other platforms.

Yield Basis explained, is a tool for earning a sustainable and more predictable yield on Bitcoin holdings within DeFi. By removing the complex risk of impermanent loss, the protocol aims to establish itself as a foundational liquidity layer for on-chain Bitcoin, making DeFi yield farming more accessible and secure. For those looking to deepen their understanding of core crypto concepts, the Phemex Academy offers a wealth of resources to get started.

How Many YB Are There?

The tokenomics of Yield Basis are meticulously structured to promote long-term stability and align the interests of its diverse stakeholders, including users, the development team, and investors. The maximum supply of YB tokens is permanently capped at 1 billion, ensuring there will never be more tokens created.

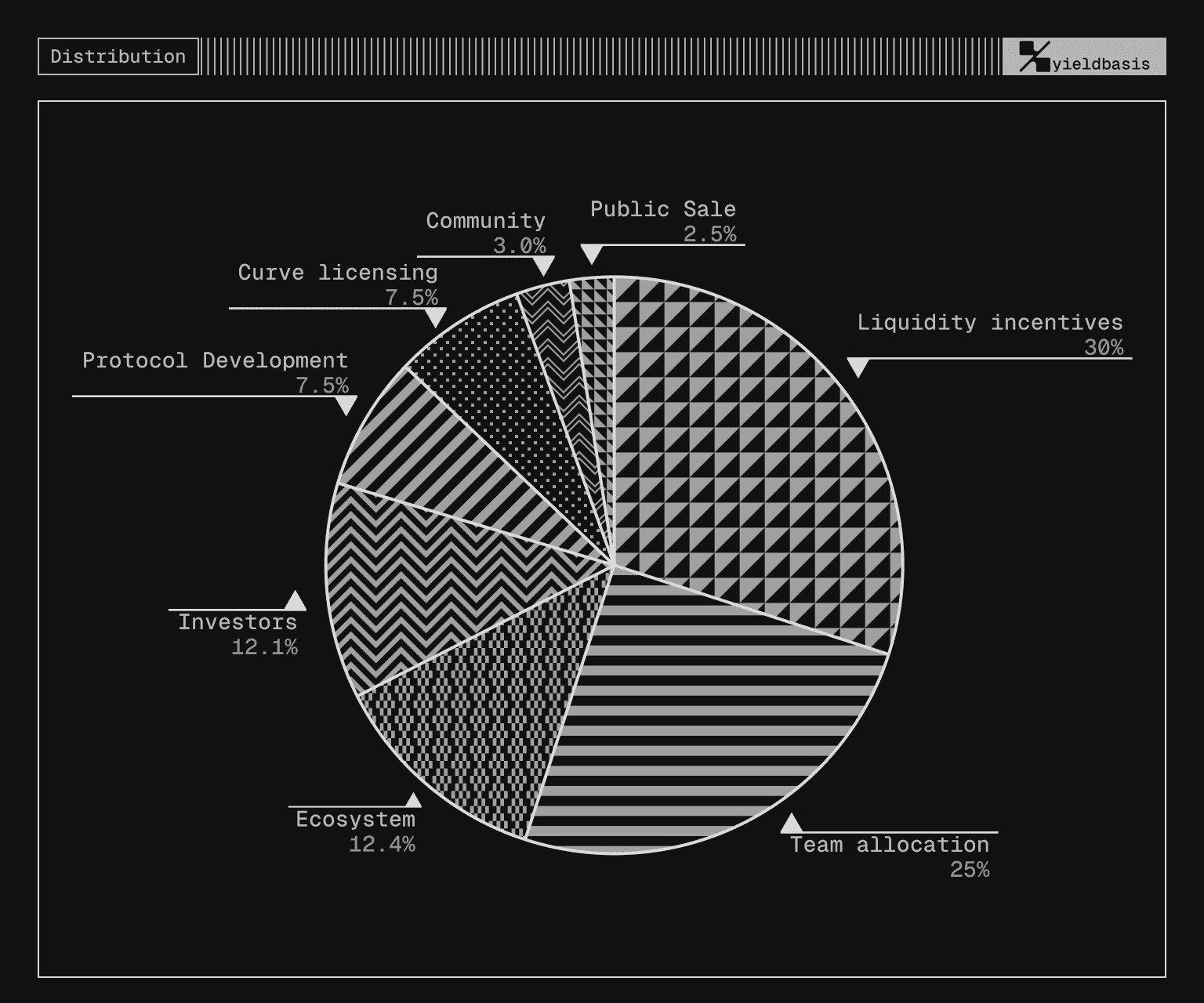

Token Distribution

The allocation of the 1 billion YB tokens is as follows:

-

Liquidity Incentives (30%): The largest portion is reserved for rewarding users who provide liquidity to the protocol, driving adoption and ensuring the system remains robust.

-

Team (25%): This allocation is for the core contributors responsible for building and maintaining the protocol.

-

Ecosystem Reserve (12.4%): These funds are earmarked for grants, partnerships, and other initiatives that help grow the broader Yield Basis ecosystem.

-

Investors (12.1%): Reserved for early backers who provided the initial capital for the project's development.

-

Protocol Development Reserve (7.5%): A dedicated fund to ensure continuous improvement, security audits, and future feature development.

-

Curve Licensing (7.5%): An allocation acknowledging the foundational role of Curve Finance's technology in the protocol.

-

Public Sale & Initial Liquidity (5.5%): A smaller portion was allocated for the public launch and to bootstrap liquidity on decentralized exchanges.

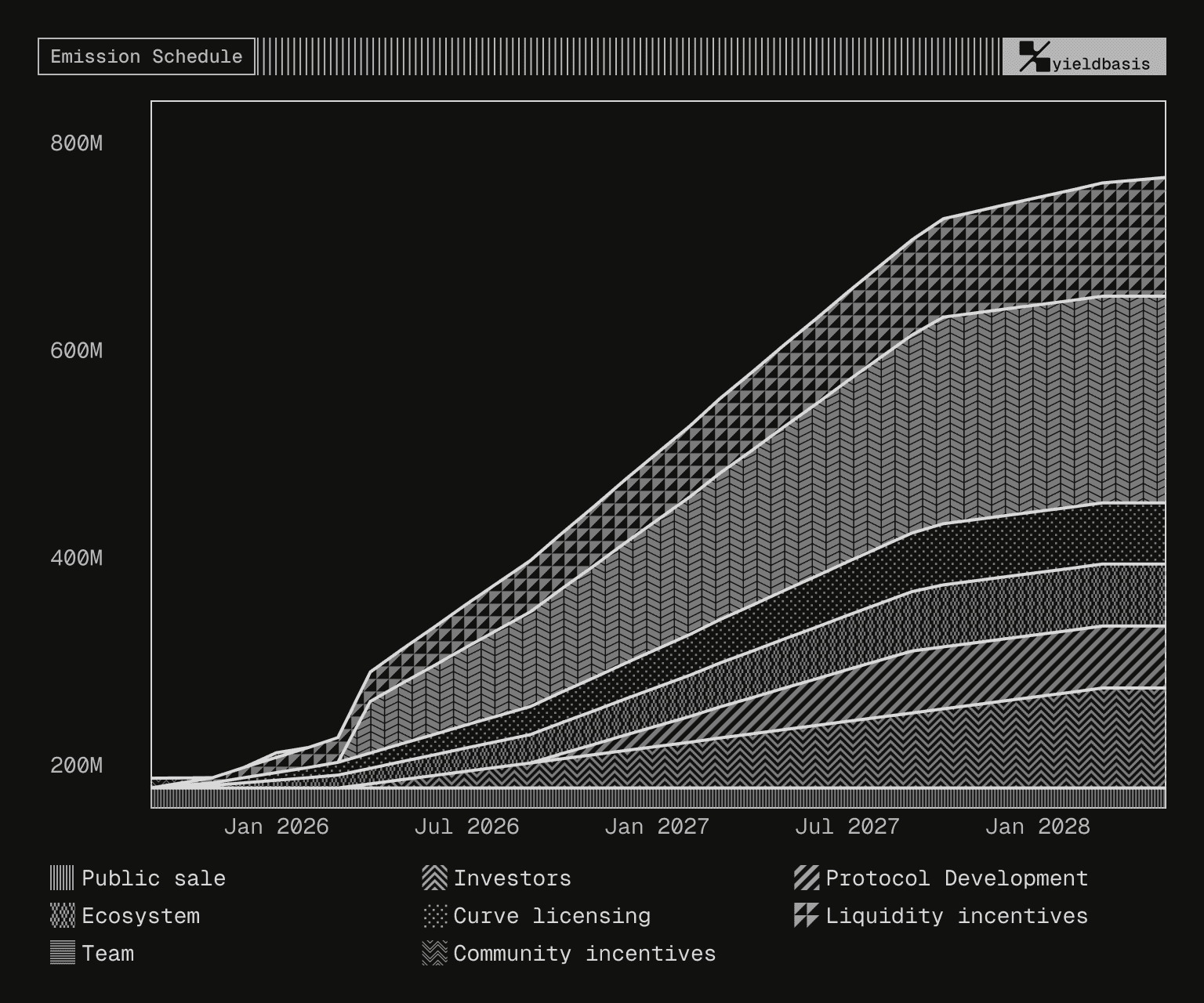

Vesting Schedules and Emission

To foster long-term commitment and prevent market volatility from early sell-offs, Yield Basis implemented a strategic vesting schedule for key stakeholders.

-

Team and Investor Tokens: Both are subject to a 2-year vesting period with a 6-month cliff. This means no tokens are released for the first six months, after which they are distributed linearly over the following 18 months. This structure ensures that the team and early investors are incentivized to contribute to the project's success over a prolonged period.

-

Public Sale Tokens: In contrast, the 25 million YB from the public sale were fully unlocked at the Token Generation Event (TGE), providing immediate market liquidity.

-

Liquidity Incentives: These rewards are released dynamically over time to continuously incentivize participation in the protocol.

This deliberate tokenomic design, balancing immediate availability with long-term lockups, demonstrates a focus on sustainable growth rather than short-term hype. The YB token itself is not deflationary (it has no burn mechanism); its value is derived directly from its utility within the ecosystem.

What Does YB Do?

The YB token is the lifeblood of the Yield Basis ecosystem, serving critical functions in governance, incentive alignment, and revenue sharing. The primary Yield Basis use case can be divided into two main categories: staking for emissions and locking for governance and fees.

Staking ybBTC for YB Rewards

When a user deposits BTC into Yield Basis, they receive a receipt token called ybBTC. This token represents their underlying claim on the liquidity position. Users can choose to simply hold ybBTC to earn the trading fees generated by their liquidity (paid in BTC). Alternatively, they can stake their ybBTC tokens in the protocol to earn rewards in the form of newly emitted YB tokens. This creates a direct incentive for users to contribute to the protocol's total value locked (TVL).

Locking YB for veYB: Governance and Real Yield

For users who want deeper involvement, the protocol offers a vote-escrowed model, similar to Curve's renowned system. Users can lock their YB tokens for a chosen period to receive veYB (vote-escrowed YB). Holding veYB grants two powerful benefits:

-

Governance Power: veYB holders can participate in protocol governance by voting on key proposals. This could include decisions on fee adjustments, adding new forms of collateral, or directing ecosystem funds. This mechanism decentralizes control and gives the most committed users a say in the project's future.

-

Protocol Fee Sharing: This is arguably the most compelling feature. A portion of the trading fees generated by the entire protocol is collected and distributed to veYB holders. Crucially, these fees are paid out in Bitcoin (BTC), providing holders with a "real yield" derived from the protocol's organic activity, rather than inflationary token emissions.

This dual-utility system creates a dynamic where users can choose between earning inflationary YB rewards or locking their tokens for a share of the protocol's real revenue and a voice in its governance.

YB vs. Anoma (XAN): Application vs. Infrastructure

To better understand Yield Basis's place in the market, it's helpful to compare it to a project with a different scope, like Anoma (XAN). This comparison highlights the difference between a specialized DeFi application and a broad, foundational Web3 infrastructure.

| Feature | Yield Basis (YB) | Anoma (XAN) |

| Technology & Scope | An ERC-20 token on Ethereum powering a DeFi protocol with a 2x leverage mechanism. | A universal, intent-centric coordination layer (Layer-1) designed to connect all blockchains. |

| Use Case | Highly specialized: governance and earning rewards from IL-free liquidity provision. | Broad: network security, fee payments, and incentivizing solvers who execute user intents across chains. |

| Primary Goal | To perfect a single DeFi function: providing liquidity without impermanent loss. | To become the foundational operating system for all of Web3, enabling seamless cross-chain coordination. |

In summary, Yield Basis is an expert tool designed to do one thing exceptionally well. Anoma, on the other hand, is building the fundamental operating system for a new, interconnected generation of decentralized applications.

The Technology Behind YB

Yield Basis’s claim of eliminating impermanent loss is not a subsidy or a gimmick; it's the result of a novel economic and architectural design. To understand it, we must first grasp the core problem and then explore the protocol's elegant solution.

The Core Problem: Why Impermanent Loss Occurs

In a traditional AMM like Uniswap V2, liquidity is provided for a pair of assets (e.g., BTC and a stablecoin) according to the formula x * y = k. When the price of BTC rises, the AMM sells some of it for the stablecoin to maintain the constant k. When the price falls, it buys more. This constant rebalancing means the value of an LP position grows proportionally to the square root of the price (√p), whereas simply holding BTC means its value grows linearly with the price (p). This gap between p and √p is impermanent loss. You effectively sell too early on the way up and buy too much on the way down, underperforming a simple hold strategy.

The Yield Basis Solution: 2x Compounding Leverage

Yield Basis eliminates this √p drag by introducing leverage. The system is designed to maintain a constant 2x compounding leverage, which translates to a 50% debt-to-value ratio.

Here is the step-by-step user flow:

-

A user deposits 1 BTC.

-

The protocol automatically borrows an equivalent value of crvUSD (Curve's native stablecoin) from a dedicated Collateralized Debt Position (CDP).

-

Both the user's BTC and the borrowed crvUSD are deposited as liquidity into a Curve BTC/crvUSD pool.

-

The resulting Curve LP token is then used as the collateral for the crvUSD loan.

Because the position is 2x leveraged, the √p growth of the LP token value is multiplied, causing it to scale linearly with p. This cancels out the IL drag, ensuring the user's position tracks the value of holding BTC 1-to-1, all while earning trading fees from the Curve pool.

The Engine: The Rebalancing-AMM and Virtual Pool

The true innovation lies in how the protocol maintains this precise 2x leverage at all times without active management. It achieves this through a symbiotic relationship with arbitrageurs, facilitated by a Rebalancing-AMM and a Virtual Pool.

This system creates a market-driven mechanism where arbitrageurs are financially incentivized to keep the protocol in balance.

-

Scenario 1: BTC Price Rises

-

The value of the LP collateral increases, while the crvUSD debt remains fixed. This causes the debt-to-value ratio to fall below 50%.

-

The Rebalancing-AMM detects this imbalance and automatically offers a profitable swap opportunity to the market.

-

An arbitrageur seizes this chance by executing a single swap. In the background, this transaction triggers the protocol to flash-borrow crvUSD, mint additional LP tokens, increase its debt to the new 50% target, and repay the flash loan, leaving a small profit for the arbitrageur.

-

-

Scenario 2: BTC Price Falls

-

The value of the LP collateral decreases, causing the debt-to-value ratio to rise above 50%.

-

The Rebalancing-AMM again offers a profitable trade, but in the opposite direction.

-

An arbitrageur takes the trade. This time, the protocol atomically removes a slice of the LP position, repays the excess crvUSD debt to return to the 50% ratio, and rewards the arbitrageur.

-

This elegant, hands-off mechanism ensures the system is constantly self-correcting in a capital-efficient manner, powered entirely by external market participants seeking profit. It’s what allows Yield Basis to deliver on its promise of IL-free liquidity provision.

Team & Origins

Yield Basis was founded by Michael Egorov, a prominent and highly respected figure in the DeFi space, best known as the founder of Curve Finance. This strong leadership provides the project with immense credibility and a deep well of technical expertise. The conceptualization began in early 2025, with the protocol officially debuting in September 2025 and launching its native YB token in October 2025. The close ties to the Curve ecosystem are a significant advantage, allowing Yield Basis to integrate seamlessly with Curve's deep liquidity and robust stablecoin, crvUSD.

Key News & Events

-

October 2025: The YB token officially launched, marking its debut on the open market. It was listed on several major exchanges, including Phemex, where spot trading began on October 15, 2025.

-

Initial Price Movement: Following its launch, the Yield Basis price experienced significant volatility. This is a common pattern for new tokens as the market seeks price discovery and early participants take profits.

-

Token Unlocks: The project adheres to a public vesting schedule. The first major unlock event for team and investor tokens occurred in April 2026 (6 months post-TGE), an important milestone to watch for its potential impact on circulating supply.

For the most current news about Yield Basis, traders should follow the project's official channels and keep an eye on market data platforms.

Is YB a Good Investment?

Evaluating the Yield Basis investment potential requires a careful analysis of its strengths, weaknesses, and the inherent risks of the DeFi landscape. (This section is for informational purposes and is not financial advice).

Potential Strengths:

-

Innovative and Practical Solution: The protocol solves a genuine, long-standing problem in DeFi. Eliminating impermanent loss is a powerful value proposition that could attract significant capital.

-

Experienced and Credible Founder: Michael Egorov's leadership and the connection to Curve Finance lend the project a level of trust and expertise that few new protocols possess.

-

Real Yield Mechanism: The veYB model, which distributes protocol fees in BTC, offers a sustainable and attractive source of real yield, appealing to long-term investors over speculators.

Potential Risks and Challenges:

-

Smart Contract Risk: Like any DeFi protocol, Yield Basis is subject to the risk of bugs or vulnerabilities in its code. An exploit could lead to a loss of user funds.

-

System Complexity: The intricate mechanics of the rebalancing system, while innovative, are complex. Unforeseen edge cases or black swan market events could test the protocol's resilience.

-

Dependency on crvUSD: The protocol's stability is intrinsically linked to the health and peg of Curve's crvUSD stablecoin. A de-pegging event could have cascading effects.

-

Oracle Risk: The rebalancing mechanism relies on accurate, real-time price feeds (oracles) for BTC. A failure or manipulation of this oracle could disrupt the system's ability to maintain its target leverage.

-

Market Volatility: As a relatively new asset, the Yield Basis price is subject to high volatility, influenced by broader market trends, token unlocks, and competitive pressures.

Conclusion: Yield Basis presents a compelling and technologically impressive solution to a major DeFi pain point. Its success will depend on its ability to maintain security, attract sustained liquidity, and compete in a crowded market.

Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.

How to Buy YB on Phemex

For traders looking to get started, Phemex offers a seamless experience. To learn the steps, visit our detailed guide on "How to buy Yield Basis." You can also directly go to the platform to trade Yield Basis on our Spot and Futures markets.

FAQs

1. What is the core problem that Yield Basis solves?

Yield Basis is engineered to eliminate impermanent loss (IL), which is the financial shortfall a liquidity provider can experience in a traditional AMM when the price of the assets diverges, compared to simply holding them.

2. Who is the founder of Yield Basis?

The protocol was founded by Michael Egorov, who is also the creator of Curve Finance, one of the largest and most influential protocols in decentralized finance.

3. How does Yield Basis actually eliminate impermanent loss?

It uses a 2x compounding leverage mechanism, pairing user-deposited BTC with borrowed crvUSD. This ensures the liquidity position's value tracks the price of BTC 1-to-1, neutralizing the mathematical drag (√p scaling) that causes IL in other AMMs.

4. What is the role of arbitrageurs in the protocol?

Arbitrageurs are essential to the system's health. They are financially incentivized by the protocol's Rebalancing-AMM to execute trades that automatically correct any deviation from the target 50% debt-to-value ratio, ensuring the system remains balanced.

5. What is the difference between staking ybBTC and locking YB for veYB?

Staking ybBTC earns you inflationary rewards in the form of new YB tokens. Locking YB tokens for veYB grants you governance rights and a share of the protocol's real trading fees, paid out in BTC.