Centralization has brought about the services that made the internet useful for us. But when we are surfing the net for free, scrolling social media endlessly or booking a taxi ride with a few taps, the tech giants behind these apps capture, store and own not just our personal information but every action we take online.

This centralized control of data puts all parties from individuals to corporations and governments at risk.

Firstly, these tech gatekeepers feed on and monetize our data for targeted advertisements. As many of these firms are monopolistic, we have no choice but to adhere to their terms and conditions for lack of market competitors.

Secondly, all the assets or things of value netizens build up on the internet–from content to social networks and credibility–are controlled by the gatekeepers. The value of, say, your YouTube videos, is mostly harvested by YouTube in the form of advertising dollars; sure, you get a cut of it, but disproportionately less than is due the creator of that content.

Another example: if you have a large social network on Facebook, you cannot easily move it to another platform, say, Instagram. The social capital you built up is locked up on one platform.

Finally, centralized models of data storage also create single points of failure that can be easily attacked. In 2021, the data of over 500 million Facebook users were hacked and sold on a hacking forum.

In a November 2021 international report by cybersecurity research and marketing consultancy CyberEdge, 68.2% of government organizations surveyed stated that they had been compromised by one or more cyber attacks within the past 12 months.

What is Ethereum?

Ethereum is an open-source blockchain developed in 2015 by the then 19-year-old Canadian-Russian programmer Vitalik Buterin, who saw the possibilities behind Bitcoin’s design for much more than just the store and transfer of money.

When Satoshi Nakamoto introduced Bitcoin in a 2008 white paper, it got him thinking, if blockchain technology can be used to decentralize money, why can’t it be used to decentralize other things?

After all, if a blockchain is at the core just a record of data maintained across multiple computers in a peer-to-peer, distributed network–which is what Bitcoin is, then surely it can store other types of non-monetary data…like property titles, social connections and endorsements, fan ratings, medical records, personal IDs, and more?

The current version of internet we use now is based on a client-server model where client computers are connected to a dedicated, centrally managed server that stores and controls access to data; what blockchains like Ethereum promise is a decentralized model (right) where data is stored across multiple computers without the need for any single server.

Data that is stored in a decentralized model means that:

- It’s not controlled by any one party

- It cannot be as easily hacked since it is not stored on one single server

- It can be transferred from one platform or app to another; value can be transferred fluidly across the digital world without barriers

To continue with the examples in the previous section, if social media apps were decentralized, we can bring our social capital anywhere with us. This also means we cannot be de-platformed for saying the “wrong” things.

If Google were decentralized, our search behavior and user data cannot be harvested to tailor ads that manipulate our purchasing decisions.

“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly.” – Vitalik Buterin

However, it would be inefficient for different apps to build their own blockchains; each would have to set up their own platforms, use a different programming language, and so on.

Buterin wanted to create a common platform for the development of these decentralized apps (DApps)–and thus Ethereum was born in 2015.

The mushrooming of decentralized apps

Just like how Apple ushered in a mobile app boom when it launched its App Store in 2008, Ethereum ushered in a decentralized app (DApp) boom when it went live, enabling developers to create applications that expanded the use of blockchain to myriad uses.

A DApp is an open-source software program just like the apps we currently have on our smartphones and computers–where it differs is that DApps’ operations are maintained by a distributed network of computer nodes instead of a single server. And at the heart of a DApp is a smart contract–a computer program that automatically carries out a set of rules when certain conditions are met.

Imagine that you want to buy a digital book from someone on the other side of the world. Your main issue will be trust. If you first wire the money to this person, what guarantee do you have that the seller will actually send you the product?

Conversely, the seller also risks not receiving any payment if they send you the book first. One solution is an intermediary or trusted escrow service that holds the payment and only releases it upon proof that the product has been delivered. Of course, the escrow company will likely charge fees in exchange for their service. Yet, even in this situation you must still trust and hope that the intermediary will act in good faith as they too could choose to keep your money and run.

Employing a smart contract on the Ethereum network eliminates all of these concerns. A code that automatically sends you a copy of the book once a specified amount of funds has been transferred to a target account is a much more effective solution. Besides the buyer and the seller, no additional parties are required, no extra fees are collected, and everything happens automatically with public transaction records verifiable on the blockchain.

Many DApps currently fall under the category of DeFi, short for decentralized finance–the umbrella term for all the financial stuff that one can do without banks. These include lending and borrowing protocols such as Uniswap, Aave and Compound.

Say you can’t get a business loan because the bank does not like your business idea or your credit score. With DApps, you can go straight to a pool of lenders from anywhere in the world with just a smartphone and an internet connection.

What is ether (ETH): Ethereum Gas Fees Explained

There are three main stakeholders in the Ethereum blockchain ecosystem:

- Users

- DApp developers/builders

- Stakers (formerly known as “miners” before Ethereum transitioned to proof-of-stake.)

Every action done by the DApp smart contracts require computational power to execute. Users have to pay a fee to get this computational work done, but it is not not in the form of dollars using credit cards or other online payment methods, but Ethereum cryptocurrency called ether (ETH).

This payment in the form of ETH also means that DApp developers do not need to go through the hassle of integrating with third-party payment providers in order to get paid–they can get paid directly in ETH and cash it out in fiat money.

Where does this ETH come from? It comes from the computational work done by the computer nodes who validate the smart contract transaction. These “validators” each deposit 32 ETH to activate the software that enables them to store data, process transactions, and add new blocks to the blockchain. When new blocks are created, new ETH coins are created.

The next section explains the three main parts to this entire Ethereum ecosystem that makes everything work–it’s a technical but not-overly-so explanation.

The technology behind Ethereum

1) Ethereum Virtual Machine

Once a new smart contract code is created and added to the blockchain, it then gets executed in a simulated computer environment called the Ethereum Virtual Machine (EVM). But these smart contracts only state the rule–if X, then Y. Something else is needed to process and carry out this rule.

2) Nodes or validators

This “something else” are the thousands of decentralized computers/nodes, which maintain the EVM and compute the smart contracts, so long as the network receives the required fee (known as gas). Otherwise, the contract is terminated.

3) The Ethereum blockchain

Once this computational work is done and the transaction is complete, it gets added to the Ethereum blockchain, the third and final component. Any activity performed on Ethereum, whether it’s moving funds between wallets or using a DApp, is stored on its blockchain as a data transaction.

To have this data transaction added to the blockchain, a fee needs to be paid to a validator–this is the ether cryptocurrency. Gas fees (or transaction fees) operate on an auction-style system. People who pay higher gas fees to their transactions generally get them added to the blockchain faster.

Limitations of the Ethereum Blockchain

Ironically, because of its success (almost 3,000 out of the 4,000 existing DApps are built on Ethereum), Ethereum has been facing serious congestion issues, which has in turn caused sky-high gas gas fees (when a popular NFT collection was launched by the Bored Ape Yacht Club brand back in May 2022, a user who purchased a $25 NFT had to pay $3,300 in fees.)

This is known as the problem of “scalability” whereby it can only process 15 transactions per second. To put this into perspective, imagine if Instagram ran on the Ethereum blockchain–only 15 likes can be approved every second.

In response to this, various “layer-2” solutions have been developed as a sort of “flyover” to lessen the traffic on the main Ethereum blockchain. Ethereum itself is also trying to upgrade its blockchain to address this mission-critical problem, by transitioning from its original design to a new one. This transition (called the “Merge”) is one of the most-anticipated events in the crypto world.

To use the right technical terms, it is moving from a Proof-of-Work to a Proof-of-Stake consensus mechanism; while Proof-of-Work offers time-tested security (which is what Bitcoin uses, and it has never been hacked), Proof-of-Stake is much more scalable–meaning it can not only process an expected 100,000 TPS, but do it cheaper and in a more energy-efficient manner.

At the same time, many other blockchains are giving Ethereum a run for its money. Some of the biggest “Ethereum killers” include Solana, Cardano, Near Protocol, Polkadot and Avalanche. These blockchains differ in how they approach the challenge of scalability–Solana, for example, relies on a combination of both software and hardware innovation, while Near Protocol uses a highly technical concept of distributed database management called ‘sharding’ which splits up the blockchain into different paths.

What is becoming apparent, however, is that each approach comes with a trade-off. Solana, for example, is much more scalable than Ethereum with reportedly 65,000 TPS, but this is in part due to centralization in order to achieve greater efficiency. This degree of centralization, in turn, created single points of failure resulting in 12 outages–in the first six months of 2022 alone.

Who is behind Ethereum?

Vitalik Buterin first proposed Ethereum in his 2013 white paper, which outlined the goal to build decentralized applications. He subsequently dropped out of his computer science program at the University of Toronto after receiving a $100,000 grant from the Thiel Foundation to work on Ethereum full-time. Ethereum was subsequently co-founded by eight individuals including Buterin, two of whom have gone on to establish competing blockchains.

Gavin Wood, who served as the first CTO at the Ethereum Foundation, authored the yellow paper defining the EVM and developed the Solidity programming language in which most Ethereum smart contracts are written, went on to co-found Polkadot (DOT) since leaving Ethereum in 2016. Charles Hoskinson helped establish the Ethereum Foundation in Switzerland, but left the project shortly after to found another “Ethereum killer” Cardano (ADA).

Ethereum Coin (ETH) Price History [Updated Sep 2022]

Ethereum all-time price history (Source: CoinMarketCap)

Ethereum all-time price history (Source: CoinMarketCap)

While the price of Ethereum’s ETH coin has performed well in the long-term, it has fallen significantly in the short-term. The coin rose from $1,563 on February 28, 2021 to $2,633 in February 2022, and peaked at $4,805 in November 2021.

It has since sharply fallen by roughly 75%. As of Sep 2022, Ethereum is trading for $1,264, mirroring the downward trend of Bitcoin as global market sentiment turns bearish.

This has been a bit disappointing for Ethereum bulls–prices were expected to rise much more given it has just completed its long-anticipated upgrade to a proof-of-stake blockchain otherwise known as the “Merge.” However, fears surrounding more interest rate hikes by the US Federal Reserve have impacted not just the crypto but broader financial markets.

Read: What is the Ethereum Merge all about?

Ethereum is currently ranked #2 by market cap.

How To Buy Ethereum?

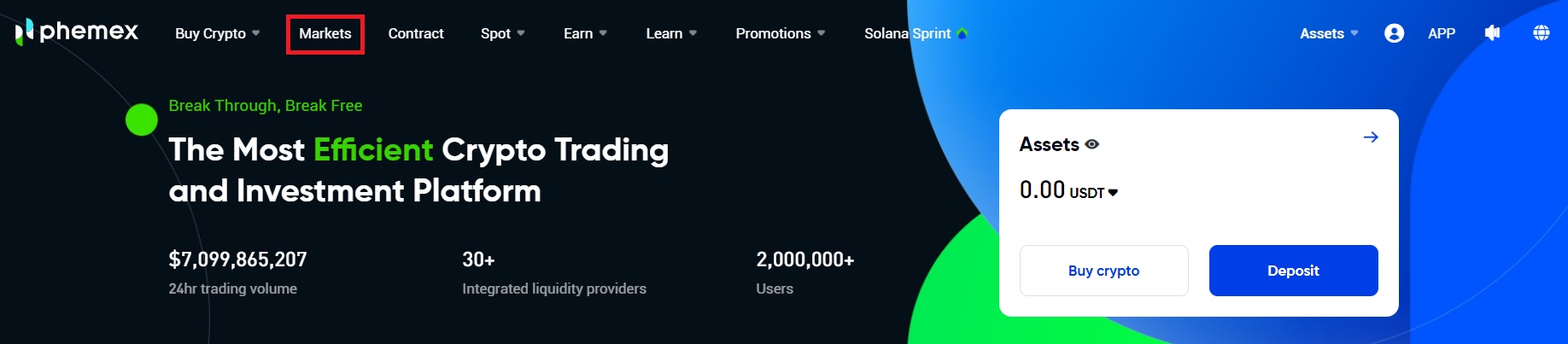

Phemex offers both spot and contract trading for investors to choose from. However, for beginning crypto buyers, spot trading is recommended. To buy ETH on Phemex, follow the instructions below.

The first step to buying cryptocurrency on Phemex is to register for a trading account (and earn a cool $180 Welcome bonus while you’re at it) by clicking on this button below:

After you’ve set up your account, navigate to Markets on the homepage.

On the Markets tab enter ETH into the search bar on the top right, immediately after, the ETH/USDT trading pair will appear below – select Trade to move on to the next step.

You will then be redirected to the Phemex trading platform for the ETH/USDT pair. To do a simple spot trade we recommend doing a market order where you can buy ETH at the market price. To do so, select Market, enter the amount of USDT you want to buy of ETH, and click Buy ETH.

And that’s it! For a start, you can:

- Start trading it if price appreciates

- Put it to work and earn passive income via the Phemex Earn program (which can give an APY of up to 18.8%)

- Later on, you can experiment with buying NFTs with your ETH on marketplaces such as OpenSea or use it to earn more crypto by playing blockchain games hosted on Ethereum.