In the dynamic and often turbulent world of cryptocurrency, the XPR Network (XPR) has carved out a distinct niche for itself, aiming to bridge the gap between traditional finance and the burgeoning realm of decentralized applications. With its focus on high performance, zero gas fees, and a compliance-ready infrastructure, XPR Network presents a compelling proposition for both developers and users. But as we navigate through 2025 and look toward the end of the decade, the critical question for investors is whether this innovative Layer-1 blockchain is poised for significant growth or if it will struggle to gain traction in an increasingly competitive market. This in-depth analysis will explore the XPR Network's fundamentals, examine its market performance, and provide a detailed XPR price prediction for 2025 to 2030, offering insights for those considering it as an investment.

Summary Box (Fast Facts)

-

Ticker Symbol: XPR

-

Current Price: ~$0.004404

-

Market Cap: ~$124.46M

-

Total Supply: ~31.19B

-

ATH / ATL Price: $0.1007 (Apr 27, 2020) / $0.0005508 (Oct 19, 2023)

-

All-Time ROI: N/A

-

Availability on Phemex: No (as of writing)

What Is XPR Network?

XPR Network is a high-performance Layer-1 public blockchain that utilizes a Delegated Proof-of-Stake (DPoS) consensus mechanism. It is designed to be a highly scalable and sustainable platform for decentralized applications (dApps) and peer-to-peer payments. A key differentiator for XPR Network is its focus on creating a seamless and user-friendly experience, aiming to eliminate the complexities often associated with blockchain technology. One of its most notable features is the absence of gas fees for end-users, which significantly lowers the barrier to entry for mainstream adoption.

The network is engineered to be a bridge between traditional finance (TradFi) and decentralized finance (DeFi). It achieves this by offering features like on-chain identity verification and alignment with the ISO 20022 standard, a global messaging standard for financial transactions. This strategic positioning makes XPR Network an attractive platform for financial institutions and businesses looking to leverage blockchain technology in a compliant manner. The ecosystem includes tools for developers to build a wide range of applications, from token creation and NFT marketplaces to lending markets and exchanges.

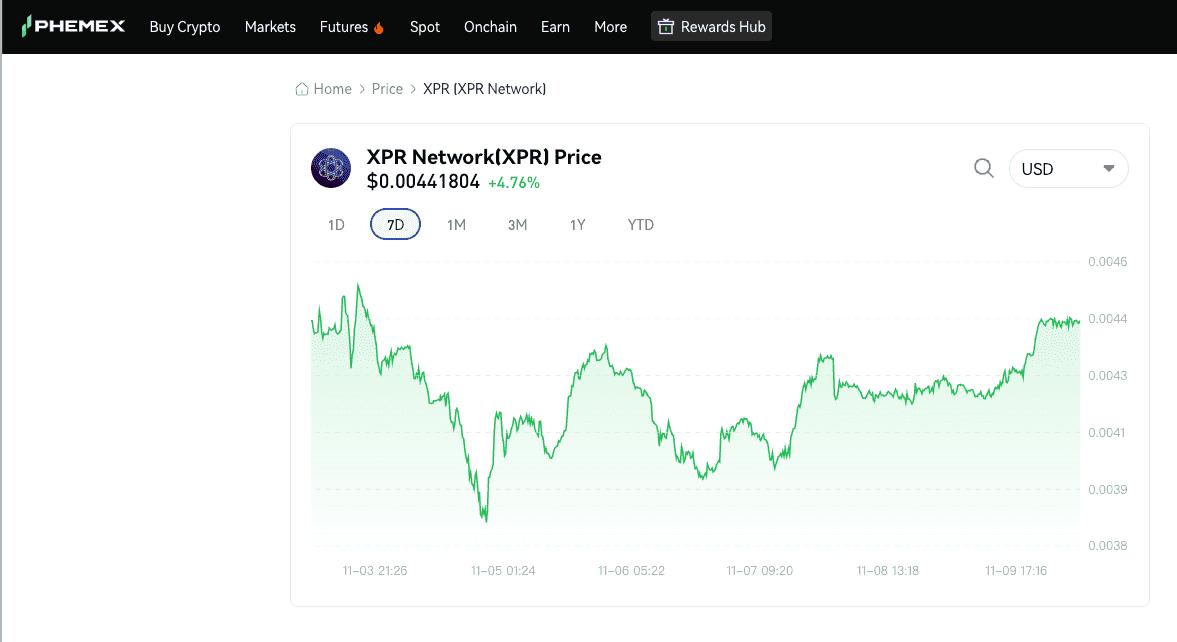

Current Price & Market Data (as of November 2025)

As of November 2025, XPR is trading at approximately $0.004203. The cryptocurrency has experienced a slight increase of 0.05% in the last 24 hours. Over the past week, however, the price has seen a more significant decrease.

XPR Network currently holds a market capitalization of around $124.55 million, placing it at rank #278 on CoinMarketCap. The 24-hour trading volume is approximately $2.7 million.

The current price is significantly lower than its all-time high of $0.1007, reached on April 27, 2020. Conversely, it has shown substantial growth from its all-time low of $0.0005508 on October 19, 2023.

For a live and interactive view of XPR's price movements, investors can utilize charts from platforms like CoinGecko or TradingView.

Price History & Performance Overview

The price journey of XPR Network has been a volatile one, mirroring the broader trends of the cryptocurrency market. Launched in April 2020, the native token, XPR, reached its all-time high of $0.1007 in the same month. This early peak was followed by a prolonged bear market, with the token's value declining significantly.

The year-over-year performance has been a mixed bag. For instance, looking back from late 2025, XPR has seen a remarkable increase of over 420% in the past year, rewarding long-term holders who weathered the volatility. However, its performance in the shorter term, such as the last 90 days, has shown a decrease of around 43%, highlighting the asset's volatility profile.

Key events that have influenced XPR's price include listings on various cryptocurrency exchanges, strategic partnerships, and key developments within the XPR Network ecosystem, such as the launch of a grants program and a full suite of native dApps. As with any cryptocurrency, its price is also heavily influenced by the overall market sentiment, particularly the price movements of Bitcoin. The network has impressively maintained 100% uptime since its mainnet launch, a testament to its reliability.

Whale Activity & Smart Money Flows

Analyzing the on-chain activity of large holders, often referred to as "whales," can provide valuable insights into the potential future price movements of a cryptocurrency. While specific real-time data on XPR whale wallets is not as widely reported as for larger-cap coins, the general principles of whale tracking can be applied.

Monitoring the flow of XPR tokens to and from major exchanges can be a key indicator. A significant outflow of XPR from exchanges to private wallets could suggest that large holders are accumulating and intend to hold for the long term, which is generally a bullish signal. Conversely, large inflows to exchanges might indicate that whales are preparing to sell, potentially leading to downward pressure on the price.

Platforms like blockchain explorers for the XPR Network can be used to track the holdings of the top wallets. An increase in the concentration of XPR in the top wallets could be a sign of accumulation by "smart money." It's also important to monitor for any significant changes in the number of wallets holding a substantial percentage of the total supply. While direct reports on XPR are scarce, the broader crypto market has seen significant whale activity, with large transactions often preceding major price movements. For example, spikes in whale transactions on the XRP network have been noted to precede rallies, a dynamic that could be mirrored in similar ecosystems.

On-Chain & Technical Analysis

Technical analysis of XPR's price chart reveals several key levels of support and resistance that traders should be aware of. Support levels represent price points where buying pressure is historically strong enough to prevent the price from falling further, while resistance levels are where selling pressure tends to be strong. Currently, XPR faces a significant resistance level around $0.005.

Various technical indicators can provide further insights into the market sentiment for XPR. The Relative Strength Index (RSI), which measures the speed and change of price movements, can indicate whether the asset is overbought or oversold. As of early November 2025, the RSI for XPR is around 40.22, suggesting a neutral momentum. Other indicators like the MACD have shown a bearish crossover, hinting at weak conviction from buyers.

A comprehensive technical overview combining popular indicators like moving averages, oscillators, and pivot points currently presents a "strong sell" signal in some real-time gauges. However, it's crucial to combine on-chain data, such as transaction volume and active addresses, with these technical indicators to get a more holistic view. A surge in trading volume accompanying a price increase, for example, can be a strong confirmation of a bullish trend.

Short-Term Price Prediction (2025–2026)

Predicting the future price of any cryptocurrency is inherently challenging due to market volatility. The following scenarios for XPR Network are based on potential fundamental catalysts that could shape its performance over the next 12 to 24 months.

| Scenario | Price Prediction (2025-2026) | Key Fundamental Drivers |

| Bull Case | $0.007 – $0.015 | A broad market bull run, coupled with major partnership announcements or significant dApp adoption on the XPR Network, could ignite a strong rally. Successful marketing that clarifies its unique value proposition away from XRP would also be a major catalyst. |

| Neutral Case | $0.003 – $0.005 | In the absence of major catalysts and with the broader crypto market moving sideways, XPR's price would likely consolidate. Growth would be steady but not explosive, reflecting gradual ecosystem development without headline-grabbing news. |

| Bear Case | $0.0015 – $0.0025 | A significant market-wide downturn, negative regulatory news impacting DeFi, or a failure for XPR Network to gain meaningful traction could trigger a sell-off. Lingering brand confusion with XRP could also continue to hamper investor confidence. |

Technical Analysis Outlook

From a technical standpoint, several key levels and indicators will be critical for traders to watch as these scenarios potentially unfold.

-

Bullish Confirmation: The primary hurdle for XPR is the significant psychological and technical resistance level around $0.005. A decisive breakout above this price point, especially on high trading volume, would serve as a strong confirmation of the bull case. A subsequent long-term bullish signal to watch for would be a "golden cross," where the 50-day moving average crosses above the 200-day moving average, suggesting sustained upward momentum.

-

Neutral Indication: The neutral, or consolidation, scenario would be characterized by the price remaining range-bound between established support and resistance levels. Technical indicators like the Relative Strength Index (RSI) would likely hover around the 50 mark, signaling a balance between buying and selling pressure. During this phase, moving averages would flatten and move sideways, confirming a lack of a definitive trend.

-

Bearish Warning: A confirmation of the bearish scenario would involve a breakdown below critical long-term support levels. A powerful bearish signal would be a "death cross," where the 50-day moving average crosses below the 200-day moving average. Additionally, a sustained bearish crossover on the MACD indicator combined with the RSI dropping into oversold territory (below 30) would signal strong downward pressure, potentially leading the price to retest its historical lows.

Long-Term Price Forecast (2027–2030)

Looking further ahead, the long-term success of XPR Network will hinge on its ability to execute its vision and gain widespread adoption.

The potential for ecosystem growth is a significant factor. If XPR Network can attract a vibrant community of developers building innovative dApps on its platform, the utility and demand for the XPR token will naturally increase. Its focus on bridging the gap with traditional finance could be a major catalyst for growth, particularly if it can secure partnerships with established financial institutions.

Competition in the Layer-1 blockchain space is fierce, with established players and new entrants all vying for market share. XPR Network will need to continue to innovate and differentiate itself to stay ahead.

Given these factors, long-term price predictions are highly speculative. However, some models project a potential average price of around $0.005551 by 2030. Another, more optimistic forecast based on technical analysis projects a price of $0.0287 by late 2030. It's important to remember that these are just projections and not financial advice.

Fundamental Drivers of Growth

Several fundamental factors could drive the long-term growth of XPR Network:

-

Tech Differentiation: The network's core features, such as zero gas fees, high transaction speeds (up to 4,000 TPS), and human-readable usernames, provide a user-friendly and cost-effective alternative to other blockchains.

-

Network Adoption and DeFi Integration: In a significant move to boost its DeFi capabilities, XPR was listed on MetalX, a DeFi platform within its ecosystem, enabling yield generation and cross-chain interoperability. This contributed to its Total Value Locked (TVL) surging to $69.3 million, remarkably close to the XRP Ledger's TVL despite a vast difference in market cap.

-

Integrations & Partnerships: The network continues to expand its utility through infrastructure upgrades and strategic integrations. Recent updates include a faster block explorer and the integration of HBAR into its LOAN Protocol. Furthermore, the prominent dApp analytics platform, DappRadar, has joined the network as a block producer, lending significant credibility.

-

ISO 20022 Compliance: A key strategic move is the network's alignment with the ISO 20022 standard. This ensures seamless communication with traditional banking systems, positioning XPR Network as an ideal choice for financial institutions looking to adopt blockchain technology.

-

Role in Staking and Governance: The XPR token is central to the network's security and governance. Token holders can stake their XPR to earn rewards and participate in the governance of the protocol by voting for block producers, with staking participation recently reaching over 700,000 accounts.

Key Risks to Consider

Despite its potential, investing in XPR Network is not without its risks:

-

Competitive Threats: The Layer-1 blockchain space is highly competitive. XPR Network faces stiff competition from established players like Ethereum, Solana, and Cardano, as well as a host of other emerging platforms.

-

Branding and Name Controversy: The network has faced criticism regarding its name, with some accusing it of leveraging the brand recognition of the more established XRP. A parody social media account recently highlighted this, sparking a debate on XPR's differentiation strategy. While its focus on compliance offers a distinct value proposition, this perception as an "XRP clone" could pose a reputational risk and affect retail sentiment.

-

Regulatory Impact: The regulatory landscape for cryptocurrencies is still evolving. Any adverse regulations could negatively impact the adoption and price of XPR, particularly given its focus on compliance with traditional financial standards.

-

Liquidity and Market Sentiment: Despite ecosystem growth, the network has shown low turnover (2.21%), which could indicate thin liquidity risks. The broader market sentiment is also a crucial factor; a negative turn could lead to sell-offs and impact investor confidence.

Analyst Sentiment & Community Insights

The sentiment surrounding XPR Network appears to be mixed. Some technical analyses indicate a bearish short-term outlook, with a majority of indicators pointing towards a "sell" or "strong sell" signal. However, other analyses, particularly those considering a longer time horizon, project potential for growth.

Community sentiment on platforms like Reddit and Twitter can be a valuable, albeit often biased, source of information. The recent name controversy sparked significant discussion, highlighting a key challenge the project needs to overcome in its public perception. However, there is also a loyal community of holders who are optimistic about the project's long-term potential, citing its strong fundamentals and recent ecosystem developments.

Google Trends can also provide insights into the level of public interest in XPR Network over time. An increase in search volume can sometimes precede a price rally.

Is XPR Network a Good Investment?

Disclaimer: This article is for informational purposes only and should not be considered financial advice.

The decision of whether or not to invest in XPR Network depends on an individual's risk tolerance and investment goals. The project has a compelling use case, aiming to solve some of the key challenges facing the blockchain industry, such as high fees and poor user experience. Its focus on compliance and bridging the gap with traditional finance could be a significant advantage in the long run.

However, the cryptocurrency market is notoriously volatile, and XPR is no exception. The token's price has experienced significant fluctuations in the past and is likely to do so in the future. The project also faces intense competition from other Layer-1 blockchains and must overcome branding challenges to establish a unique identity.

The XPR Network investment potential remains speculative heading into 2025–2030. For investors who believe in the long-term vision of a user-friendly and compliant blockchain that can seamlessly integrate with the traditional financial system, XPR may be a project worth considering. However, it is crucial to conduct thorough research and invest only what you can afford to lose.

Why Trade XPR Network on Phemex?

Phemex stands out as a top-tier centralized cryptocurrency exchange, renowned for its robust security, high-speed trading engine, and a suite of innovative tools designed for both novice and professional traders. The platform offers a seamless and user-friendly experience, making it an ideal choice for those looking to trade a wide variety of digital assets.

Core Products & Tools:

-

Spot Trading: Phemex provides instant access to hundreds of cryptocurrency assets with deep liquidity, allowing for efficient and timely execution of trades.

-

Futures Contracts: For more experienced traders, Phemex offers high-leverage perpetual contracts (up to 100x) on a wide range of popular cryptocurrencies, enabling them to amplify their trading strategies.

-

Trading Bots: The platform features AI-powered trading bots that can automate trading strategies, helping users capitalize on market opportunities 24/7.

-

Phemex Earn: Users can grow their crypto holdings through Phemex's Earn program, which offers both flexible and fixed savings products with competitive interest rates.

-

Pre-Market Perpetual Futures: Get early exposure to new futures before they officially launch. A Pre-Market Perpetual Future is a perpetual future available for trading before the underlying asset is listed for spot trading, allowing traders to take advantage of volatility in trending tokens for profit opportunities.

While XPR Network is not currently listed on Phemex, the exchange is continuously expanding its offerings. Given XPR Network's focus on building a robust and compliant ecosystem, it represents the kind of project that could be featured on a forward-looking platform like Phemex in the future. By keeping an eye on Phemex's new listings, traders can position themselves to be among the first to trade promising assets on a secure and reliable exchange.