In the hyper-competitive arena of cryptocurrency trading, the greatest profits—the true alpha—are often captured in the moments before a token is widely known, before it hits the mainstream spot markets. For most traders, this crucial period of early price discovery is a black box, a missed opportunity they only read about after the fact. They are left to chase pumps, becoming exit liquidity for the insiders.

But what if you could be on the inside?

What if you could trade a highly anticipated token like MONUSDT or KITEUSDT days before it was available anywhere else? This is the strategic advantage offered by Phemex Pre-Market Perpetual Futures. This isn't a theoretical concept; it's a live, proven trading environment where the most informed traders gain their edge.

This is not another product manual. This is The Playbook.

This definitive guide will move far beyond a simple "what is" to provide a masterclass in "how to win." We will use the real-world examples of our recent pre-market launches—KITEUSDT, MONUSDT, MMTUSDT, and MEGAUSDT—to dissect the core concepts, outline actionable strategies for different trader profiles, and provide a clear framework for managing the unique risks. By the end of this playbook, you will understand not just what this product is, but how to wield it as a powerful weapon in your trading arsenal.

Breaking It Down: From Theory to Reality

The name "Pre-Market Perpetual Futures" can seem complex, but it represents the fusion of three powerful financial concepts. We will deconstruct it piece by piece, using our live market launches to make every concept concrete.

Part 1: The "Pre-Market" Edge - Trading Before Day One

This is the core innovation and your primary source of alpha. "Pre-Market" refers to a dedicated trading environment for a futures contract before the underlying token is officially listed for spot trading on any major centralized (CEX) or decentralized (DEX) exchange. In essence, you are trading in an information vacuum where price is not yet established.

-

Evidence in Action: As we saw with the MEGAUSDT pre-market, traders on Phemex were able to build long or short positions and react to pre-launch news, community sentiment, and airdrop claim data for days. They were not waiting for the spot market to open; they were actively participating in the price discovery that would determine that opening price. This is the fundamental shift from being a price-taker to a price-maker.

Part 2: The "Perpetual" Mechanic - No Expiry Dates

A common question is, "How long can I hold perpetual futures?" The answer lies in the name. Unlike traditional futures that have a set expiry date, a "Perpetual" contract is designed to be held indefinitely, as long as a trader maintains sufficient margin to cover their position.

This is made possible by a crucial mechanism: the Funding Rate. This is a small, periodic payment exchanged between long and short position holders to keep the contract's price tethered to the underlying asset's estimated value (the Index Price).

-

If the contract price trades above the Index Price (bullish sentiment), the funding rate is positive, and longs pay shorts.

-

If the contract price trades below the Index Price (bearish sentiment), the funding rate is negative, and shorts pay longs.

-

Evidence in Action: A trader who went long on KITEUSDT in our pre-market at an early price can hold that position indefinitely. They can hold it through the pre-launch volatility, through the moment of spot listing, and into its life as a standard perpetual contract, without ever needing to worry about the contract expiring. They become a long-term holder of a leveraged position established at a pre-market valuation.

Part 3: The "Futures" Framework - Trading on Prediction

Finally, this is a "Futures" product. This means you are not buying or selling the underlying token itself. Instead, you are entering into a contract to speculate on its future price direction. This framework unlocks two essential tools for professional traders:

-

Leverage: The ability to open a position that is larger than your capital, amplifying both potential profits and potential losses.

-

Two-Way Trading: The ability to go long (betting the price will go up) or go short (betting the price will go down).

-

Evidence in Action: If a trader conducted their research and was bearish on MMTUSDT's initial valuation due to tokenomics or competitive analysis, they could have opened a short position in the Phemex pre-market. This would allow them to profit if the price declined before or immediately after its official spot listing—an opportunity completely unavailable to spot-only traders who can only buy.

The Strategic Advantage: Case Studies in Capturing Alpha

Understanding the mechanics is one thing; seeing the strategic edge in action is another. Let's move from theory to tactical analysis with case studies from our recent launches.

Case Study 1: Leading the Price Discovery on MONUSDT

The greatest alpha in crypto is generated during periods of maximum uncertainty. In the information vacuum before a spot market provides a clear, liquid price, a battle between bulls and bears takes place.

The pre-market for MON Protocol on Phemex served as the primary, public venue for its initial price discovery. The chart generated on our platform became the key reference point for the entire crypto community—from influencers on Twitter to analysts in trading groups—as they tried to gauge the token's opening value. While others were guessing, Phemex traders were trading. They were at the center of the action, absorbing information, expressing their views with capital, and shaping the very price that the rest of the market would later follow. This is the difference between reading the news and making the news.

Case Study 2: Trading the Pre-Launch Volatility of MEGAUSDT

New token launches are defined by extreme volatility. They are driven by a chaotic mix of genuine hype, airdrop claim mechanics, influencer marketing, and last-minute news. While a spot trader can only buy and hope the price goes up, a futures trader can profit from the entire spectrum of market emotion.

The pre-market for Mega Protocol saw significant price swings based on pre-launch news and sentiment shifts. A savvy, active trader could have employed a multi-leg strategy. They might have gone long on initial positive sentiment, taken profit at a local top, and then opened a short position to capitalize on the predictable pre-launch price correction. This ability to capture alpha in both directions is a profound advantage that turns market chaos into opportunity.

Case Study 3: Hedging Airdrop Allocations with KITEUSDT Shorts

This is an advanced, professional strategy that highlights the true power of pre-market futures. Consider an early-stage investor, airdrop farmer, or team member who is set to receive a large allocation of KITE tokens upon its launch. They are long the asset but cannot sell it yet. They are completely exposed to the risk of the token's price crashing on launch day.

With Phemex Pre-Market Futures, this individual can execute a sophisticated hedge. They can open a short position on KITEUSDT equivalent to the size of their upcoming token allocation.

-

If the price of KITE crashes upon launch, the loss on their tokens is offset by the profit from their short position.

-

If the price of KITE moons upon launch, the profit on their tokens is offset by the loss on their short position.

In either scenario, they have effectively locked in a sale price for their tokens before they are even liquid, transforming high-stakes risk into a calculated business decision.

A Trader's Guide: How to Execute on Phemex

This section is your practical, step-by-step guide to engaging with these markets.

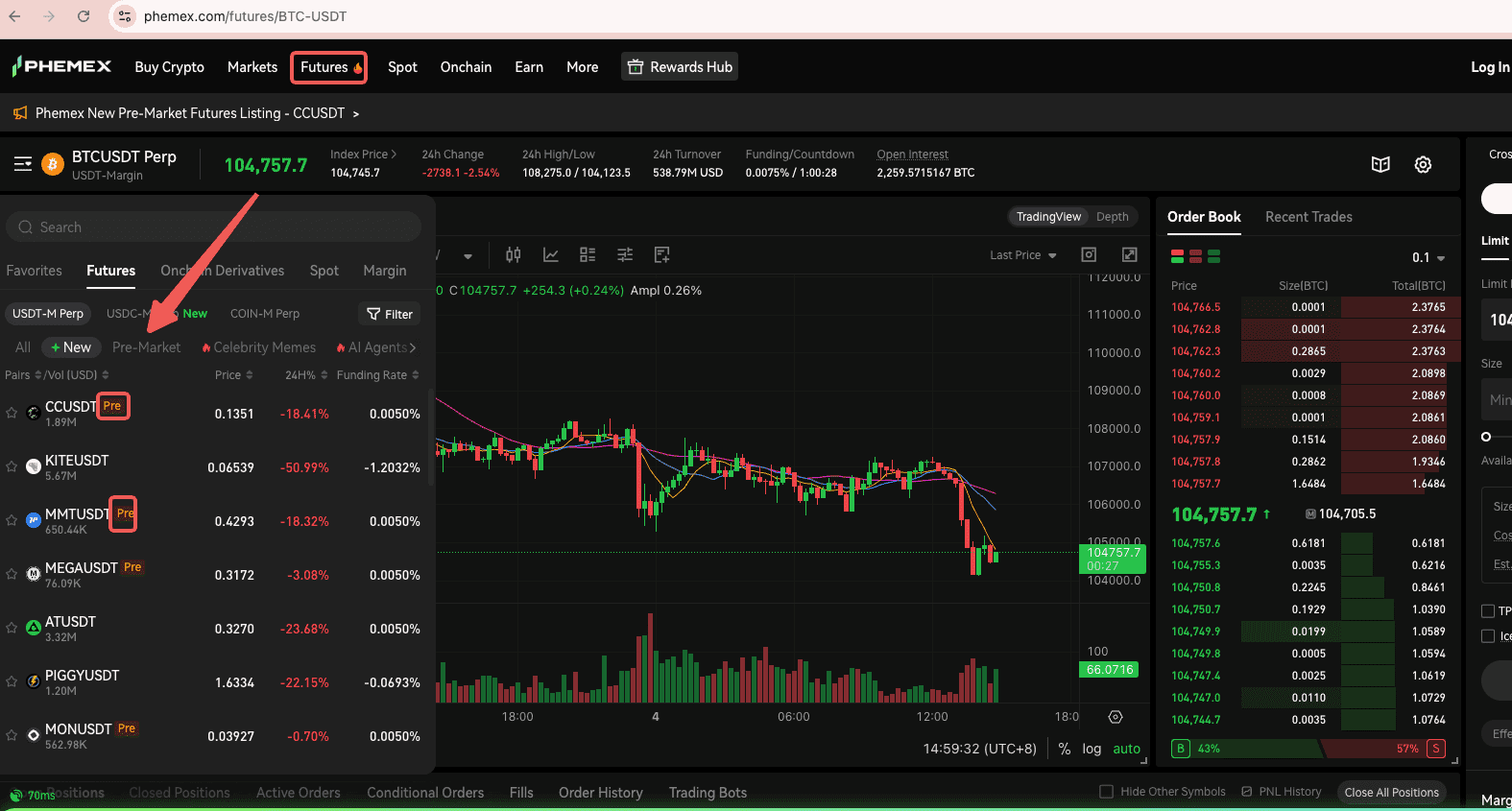

Step 1: Finding the Pre-Market Section in the Futures Tab:

Navigate to the "Futures" trading section on Phemex. Below the main asset classes (USDT-M Perp, USDC-M Perp), you will find a filter bar. Click on the "Pre" filter. This will exclusively display all currently active Pre-Market Perpetual Futures contracts.

Step 2: Understanding the Pre-Market Trading Interface:

While familiar, the interface has key nuances:

- Index Price: Unlike a standard perpetual, there is no spot price to reference. The Index Price is a composite, calculated from multiple off-chain sources, typically Over-The-Counter (OTC) markets, to create a fair estimated value.

- Mark Price: This is the price used for calculating your PnL and triggering liquidations. In a volatile pre-market, the Mark Price is crucial for preventing unfair liquidations due to a single large wick on the last traded price.

- Pro-Tip: Pay close attention to the spread between the Index Price and the Last Price. A large deviation can signal significant short-term speculative pressure and a potential funding rate opportunity.

Step 3: Placing Your First Order (Long or Short):

The process is the same as for a standard perpetual contract. You can choose your leverage, set your order type, and input your desired position size.

-

Pro-Tip: Given the potentially wider spreads and lower liquidity in the opening hours of a pre-market, using Limit Orders instead of Market Orders is the professional's choice. It guarantees your entry price and prevents costly slippage.

Step 4: Managing Your Position & The Critical Transition Period:

This is the most important part to understand. What happens when the token finally lists on a spot market?

- Settlement: Trading on the pre-market contract will be paused temporarily at a pre-announced time. The final hour of trading is often used to calculate a final Time-Weighted Average Price (TWAP) for settlement.

- Conversion: The pre-market contract is then seamlessly settled and converted into a standard Perpetual Futures contract. Your position remains open.

- New Index Price: The contract's Index Price source is switched from the OTC composite to the now-liquid spot price from major exchanges.

- Trading Resumes: Trading re-opens, now as a normal perpetual contract.

Navigating the Risks: The Professional's Checklist

Power demands responsibility. Pre-market trading is a high-alpha, high-risk environment. Here’s how professionals manage those risks.

Liquidity Risk & Mitigation:

- Risk: In the first hours of trading for a new contract like MMTUSDT, the order book may be thinner than for a major asset. This means large market orders can cause significant "slippage."

- Mitigation Strategy: Use Limit Orders to control your entry and exit prices. Scale into positions gradually rather than entering with a single large order.

Volatility Risk & Mitigation:

-

Risk: As seen in the -10.44% 24-hour change for MONUSDT, pre-market assets can be extremely volatile.

-

Mitigation Strategy: Use lower leverage than you normally would. A 3-5x leverage in a pre-market can feel like 20-30x on a major asset. Always use stop-losses and define your maximum acceptable loss before entering a trade.

Index Price Risk & Mitigation:

- Risk: The Index Price for a pre-market contract is derived from several off-chain sources. There is a risk that this price may deviate significantly from the eventual spot listing price.

- Mitigation Strategy: Do not treat the pre-market Index Price as an absolute truth. It is a reference, not a guarantee. Your primary edge comes from your own fundamental analysis of the project's potential valuation.

Trader Personas & Strategies: The "Who & How"

This product is not for everyone. It is a specialized tool for three distinct types of traders. Which one are you?

For the Alpha Hunter: A Research Framework

This trader aims to profit from an information edge. Their strategy is built on deep, fundamental research before the market opens. Their checklist includes:

- Tokenomics Deep Dive: What is the Fully Diluted Valuation (FDV)? What is the initial circulating supply? What is the vesting schedule for insiders?

- Airdrop Analysis: How many tokens are being airdropped? Are there cliffs or linear unlocks? This helps predict initial sell pressure.

- Community & Narrative: Is the hype genuine and community-driven, or is it artificial and influencer-driven?

For the Volatility Trader: A Technical Analysis Setup

This trader is less concerned with the project's long-term value and more with profiting from short-term price swings. Their toolkit includes:

- Short Timeframes: They operate on 1-minute to 15-minute charts.

- Key Indicators: Volume-Weighted Average Price (VWAP) is critical for understanding the "average" price where volume is trading. Short-term moving averages can help identify micro-trends.

- Order Book Dynamics: They watch the order book intently, looking for large orders ("walls") that could act as temporary support or resistance.

For the Hedger: A Risk-Mitigation Playbook

This trader is focused on risk management. As discussed in our KITEUSDT case study, their goal is to lock in a price for an asset they already have exposure to. Their process is:

- Calculate Allocation: Determine the exact size of their future token allocation.

- Determine Hedge Size: Open a short position of equal or similar value on the Phemex pre-market.

- Manage the Basis: Monitor the difference between the futures price and their expected spot price, and close the hedge when their tokens become liquid and they can sell them on the spot market.

Why Phemex: The Proven Venue for Pre-Market Trading

In this new and exciting field, your choice of exchange matters more than ever. Theory is important, but results are everything.

With the successful, stable, and seamless launch of four major pre-market contracts—KITEUSDT, MONUSDT, MMTUSDT, and MEGAUSDT—Phemex has incontrovertibly proven that we are a reliable and leading platform in the pre-market trading space. Our robust infrastructure ensures a smooth trading experience and a transparent transition to standard perpetuals. While other platforms may talk about pre-market, Phemex has a track record of delivering it.

Conclusion: Your New Edge

Pre-Market Perpetual Futures are no longer a theoretical product. They are a live, proven tool on Phemex that gives traders a tangible, data-backed edge. Other platforms can teach you what pre-market trading is. This playbook is designed to teach you how to win at it.

The era of passively waiting for a token to appear on spot markets is over for the professional trader. The new frontier is about actively participating in price discovery, capitalizing on early volatility, and leveraging information asymmetry to your advantage. This is the future of futures trading, and it is happening now on Phemex.