The crypto market in early October 2025 saw a sharp pullback – Bitcoin briefly tumbled nearly 10% in one day, erasing about $280 billion from the total market cap. This dip was driven by a mix of macroeconomic jolts (like a sudden U.S.–China trade tariff shock), technical profit-taking after recent all-time highs, and a wave of leveraged long liquidations. Investor sentiment, which had flipped to “greed” during Uptober’s rally, quickly cooled back to neutral as volatility spiked. Analysts largely view the downturn as a healthy correction within an ongoing uptrend rather than a definitive end to the bull market. However, there are cautionary flags – if key price levels fail to hold or macro conditions worsen, this dip could morph into the start of a broader bear phase.

In this article, we’ll break down what happened, why it happened, and how to tell if a crypto dip is just a dip or the onset of a bear market. We’ll also map out bullish vs. bearish scenarios from here, provide a simple framework to distinguish temporary corrections from true downtrends, and share tips for trading and managing risk during turbulent markets.

What Happened in Early October 2025? – A Snapshot of the “October 2025 Crypto Dip”

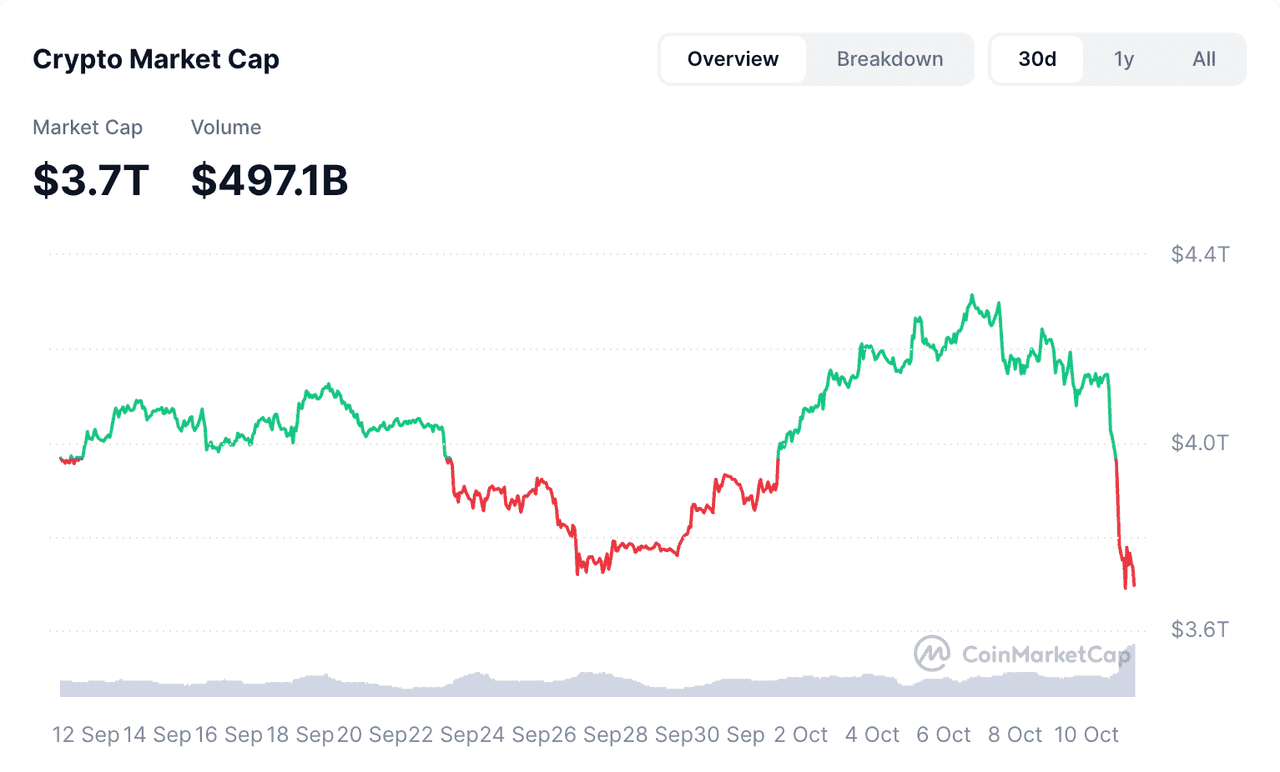

After a strong start to “Uptober” 2025, when Bitcoin and Ethereum hit record highs, the crypto market experienced a sharp decline between October 9th and 11th.

-

Bitcoin’s Plunge: After peaking at roughly $126,000 on October 7, Bitcoin (BTC) fell nearly 10% intraday on October 10, briefly dipping below $108,000. By Friday morning, it recovered slightly to the $112k–$121k range.

-

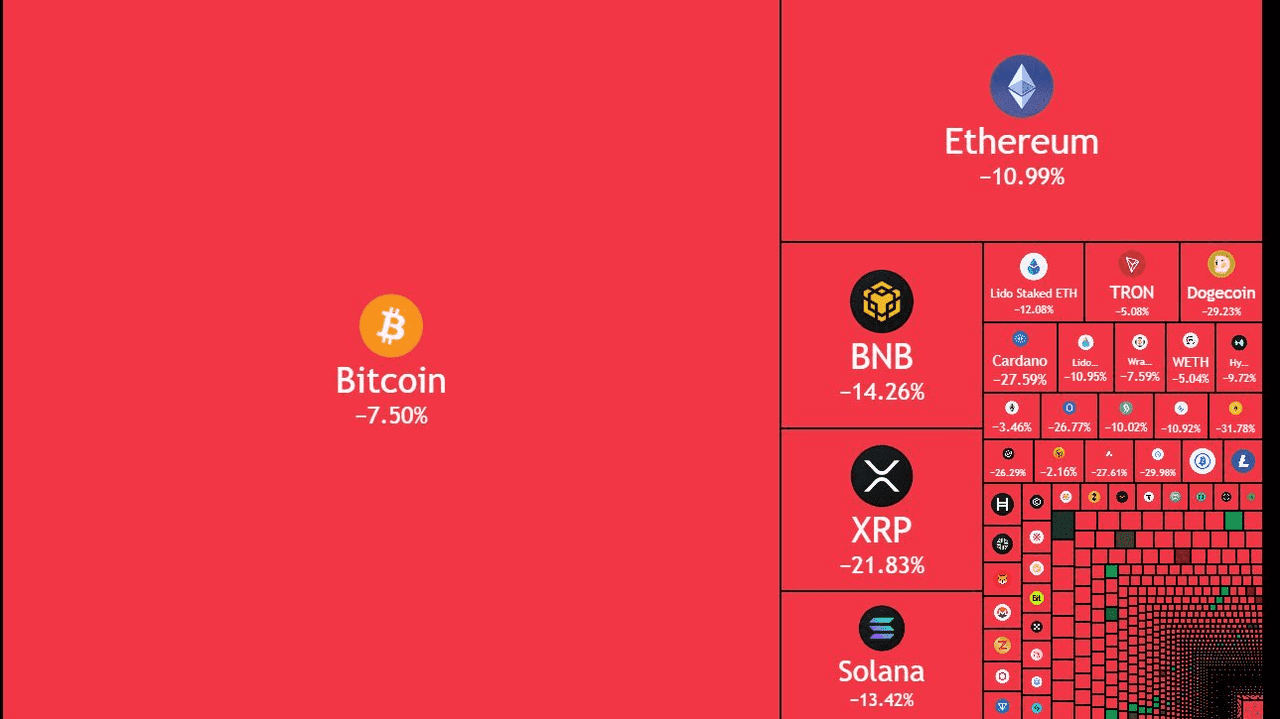

Altcoins & Sectors Hit Hard: The sell-off affected many sectors, especially memecoins and AI tokens, both dropping around 30%. While some mid-cap altcoins, like Zcash (ZEC), gained over 30%, many others fell significantly. Approximately 75 of the top 100 cryptocurrencies saw declines.

-

Market Cap & Volume: About $730 billion disappeared from the total crypto market cap, which fell to around $3.75 trillion. Daily trading volume spiked to $206 billion as investors reacted to the downturn.

-

Derivatives Liquidations: The price drop triggered over $19 billion in long position liquidations, catching over-leveraged traders off guard. This led to intensified forced selling.

-

Volatility Spikes: Implied volatility for Bitcoin options surged, indicating traders expected bigger price swings, with short-term metrics poised for a breakout.

-

Sentiment U-Turn: Market sentiment, which had been high days before, shifted to cautious optimism by October 10-11, as the Fear & Greed Index fell to the low-50s. Despite geopolitical and economic uncertainties, investors remained somewhat optimistic long-term but more guarded in the short run.

In summary, early October’s crypto dip was a rapid correction after a strong rally, marked by high volatility and widespread sell-offs. Next, we'll examine the key drivers behind this downturn.

Crypto Market Cap Plunge (source)

Why Did Crypto Prices Dive? – Key Drivers of the October 2025 Dip

On October 10, U.S. President Donald Trump announced a significant tariff increase on Chinese imports, sparking a trade war that shook global markets. The news led to a sharp risk-off reaction, with Bitcoin plunging nearly 10% and the S&P 500 index dropping around 2.7%. This geopolitical shock raised concerns over global economic stability, prompting investors to flee from volatile assets like crypto.

The impact on crypto was reminiscent of similar episodes in 2025, where prior tariff threats and rising bond yields also triggered sell-offs. Bitcoin had surged over 95% year-to-date by early October, making the market susceptible to correction. Over-leveraged traders were forced to liquidate positions as prices fell, resulting in over $600 million in long liquidations in one day. Key support levels around $120,000 were crucial; breaking below them led to further declines.

Additionally, some savvy traders shorted Bitcoin and Ethereum ahead of the drop, indicating that certain market players anticipated the correction. Rising implied volatility suggested that traders were preparing for significant market movements, which often leads to further volatility.

Despite the recent drop, many on-chain metrics remain strong, leading experts to view this as a correction rather than a trend reversal.

On-Chain Demand & Accumulation: Long-term holders are not panic selling; Bitcoin exchange balances are declining, indicating accumulation. Both retail and institutional investors continue to buy on dips, suggesting confidence despite short-term traders capitulating.

Institutional Inflows Steady: Institutional involvement has been increasing, highlighted by record inflows into crypto ETFs, with U.S. spot Bitcoin ETFs absorbing nearly $1.2 billion on Oct 6. After the dip, hundreds of millions flowed into Bitcoin ETFs, indicating that big players are maintaining or increasing their exposure.

Crypto Market Sentiment & Equity Links: Market sentiment has cooled to neutral, showing caution without capitulation. The recent crypto dip coincided with a slight dip in the stock market, indicating that some of the weakness is simply a natural consolidation after significant gains. Pullbacks are normal and may be healthy as the market prepares for the next upward movement.

Analyst Views: Temporary Correction or Bear Market Beginnings?

As prices fluctuate, analysts are weighing in on whether this dip is a temporary correction or the start of a bear market. The prevailing view among many experts is that it's a "temporary correction," supported by several key points:

-

Bullish Structure Intact: Many believe the recent pullback is a healthy adjustment within a broader bullish trend. BTC recently hit a historic high, making some profit-taking inevitable.

-

Leverage Reset: Ryan Lee, chief analyst at one exchange, argues that the correction serves to "reset" the market by flushing out excess leverage. This could lead to a more stable price recovery.

-

Medium-Term Optimism: Despite macroeconomic challenges like rising yields, analysts maintain a bullish outlook, viewing this phase as healthy consolidation. Strong institutional flows and on-chain demand support this view, though volatility may persist.

-

Technical Levels to Watch: Riya Sehgal highlighted critical levels for BTC between $120K and $120.8K. A break below ~$120K could warrant further declines, while a recovery above ~$122.5K may boost upward momentum. Similar observations apply to ETH.

-

On-Chain Support: Data from Glassnode indicates that Bitcoin's growth came from genuine demand. They noted significant support around $117K, suggesting buyers are likely to defend that area.

-

Bearish Perspectives: Not all are optimistic. John Glover from Ledn cautioned that failing to break above ~$125K could signal the start of a bear market, while a successful breach might lead to higher targets.

In summary, current evidence leans toward the "temporary correction" view, citing strong fundamentals and limited technical damage. Traders should monitor key factors to differentiate between a routine correction and a bear market moving forward.

Dip vs. Bear: A Simple Framework to Tell the Difference

For crypto investors, it’s critical to gauge whether a price dip is a buy-the-dip opportunity or an omen of a longer bear market. While there’s no crystal ball, here’s a straightforward framework (using trends, macro, sentiment, and volume) to differentiate a temporary correction from a bear market start:

-

Trend & Technical Structure: The trend remains intact during temporary dips, often pulling back 10-20% while forming higher lows and highs. If critical support levels break (like Bitcoin staying below $110K), it signals a potential bear market. Watch the 200-day moving average; dips typically bounce off it, while bear markets struggle below it.

-

Macro Alignment: Corrections usually occur under neutral-to-positive macro conditions. If the economic backdrop turns negative (like rising interest rates), a downturn may indicate broader risk-off sentiment. Keep an eye on the Federal Reserve’s policies, as changes can impact crypto positively or negatively.

-

Market Sentiment & Psychology: Corrections often see moderate fear, allowing for healthy resets in sentiment. True bear markets feature sustained pessimism and panic, with the Crypto Fear & Greed Index staying in extreme fear for long periods.

-

Volume & Participation: Trading volume spikes during corrections but stabilizes afterward. In bear markets, volume remains low, signaling waning interest. Leadership often shifts from previous high-fliers to laggards.

-

Duration & News Flow: Corrections are typically short-lived and linked to specific news events, while bear markets last months, with ongoing negative news. If recovery stalls for weeks, you may face a prolonged downturn.

Evaluating these factors together is essential. For instance, if you observe a technical pullback with mixed macro conditions, cautious sentiment, and normalizing volume, it leans towards "just a dip." Conversely, if Bitcoin breaks supportive levels while experiencing negative sentiment and low volume, it indicates a bear market. Monitor these metrics to navigate the current market regime effectively.

Crypto Liquidations on Oct 10 & 11

What Could Happen Next? – Scenarios for Recovery vs. Downturn

Crypto markets are at a crossroads. Let’s map out two broad scenarios: one where this correction finds a bottom and the bull run resumes (Recovery), and one where the downturn deepens into a bear market (Downturn). Considering both will prepare you for whichever way the market breaks next.

Scenario A: Short-Term Correction & Recovery (“Back to Uptober”)

In this optimistic scenario, the October dip is swiftly followed by a stabilization and renewed uptrend. Here’s what could drive a recovery in the coming days and weeks:

-

Macro Relief or Dovish Signals: If the U.S. Federal Reserve signals a dovish stance at the late-October FOMC meeting, it would boost risk assets, including crypto. Easing interest rates and improving U.S.-China trade relations would foster investor confidence.

-

Technical Bounce & Short Squeeze: If Bitcoin stays above $110K and Ethereum above $3,800, and then break key resistance levels, buying pressure could trigger a short squeeze. This could lead to a rapid price increase, as investors rush to buy the dip.

-

Continued Institutional & On-Chain Strength: Continued ETF inflows and signs of major players accumulating crypto would bolster market confidence. Positive regulatory developments could also support this bullish thesis.

-

Sentiment Flip Back to Greed: A quick rise in the Fear & Greed Index back into greed territory would reflect restoring confidence. Increased retail participation and outperforming altcoins would signal a recovery.

-

New Highs by Year-End: Under these conditions, analysts’ bullish targets could come back into play. We might hear talk of Bitcoin aiming for $135K or higher (Standard Chartered’s analyst indeed projected $135K soon, and even $200K by year-end in a bullish case). Ethereum could push past $5K in a continued bull run scenario. Essentially, the narrative would resume that 2025 is a bull market year and the October dip was just a mid-cycle breather.

Scenario B: Extended Downturn or Bear Market Initiation

In this more pessimistic scenario, the recent dip isn’t quickly bought, and instead we slide further into a pronounced downtrend. Factors that might lead to an extended crypto winter include:

-

Macro Deterioration & Risk-Off: If economic conditions worsen—such as the Federal Reserve maintaining high interest rates or escalating U.S.–China trade tensions—investors may prefer cash or safe havens over crypto, leading to a prolonged bear market.

-

Mounting Fear & Capitulation: A sustained downturn can psychologically affect investors, leading to increased pessimism. The Fear & Greed Index may drop into extreme fear, and negative narratives could dominate media coverage. Capitulation events may occur, compounding the downturn.

-

Negative or Absent Fundamentals: In a bear market, fundamentals can turn negative. Consistent outflows from crypto funds, regulatory setbacks, or issues facing major crypto players could amplify bearish sentiment. Signs of miners or long-term holders dumping assets may also increase market supply.

-

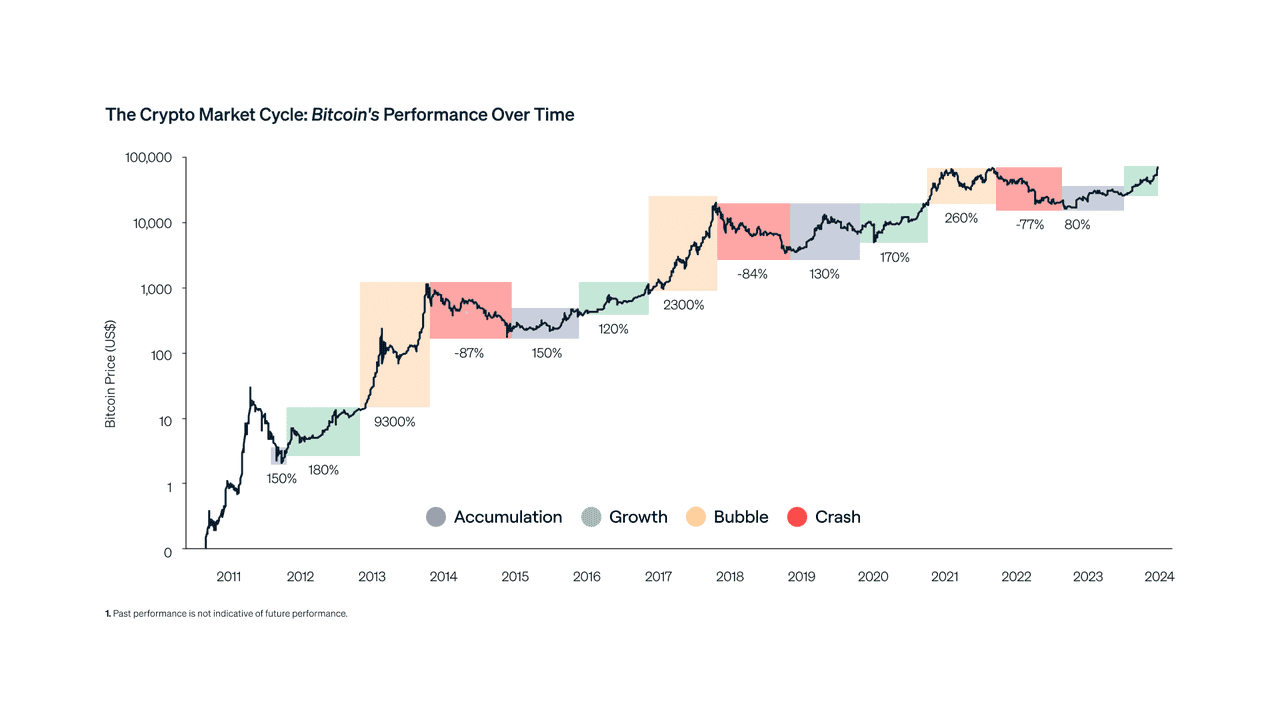

Historical Cycle Pattern: Some analysts suggest Bitcoin follows four-year cycles. If a bear market starts in late 2025 as predicted, traders might preemptively sell, accelerating the downturn.

In the downturn scenario, we’d likely see crypto entering a multi-month decline, perhaps chopping lower into 2026. However, even in bears there are relief rallies. Active traders can try to short the rips and take profit on capitulations, but that’s advanced. For most, the strategy might shift to preservation (stablecoins, yield on cash, etc.) until clear bottoming signals emerge.

Which scenario will it be? It’s too soon to call definitively. A lot hinges on upcoming events – notably the late October Fed meeting, any resolution or escalation of the tariff issue by November, and whether Bitcoin can regain $120K or not.

Bitcoin performance over time (source)

Navigating the Dip with Phemex: Tools to Use in Turbulent Times

Whether this dip ends up being temporary or the start of a downturn, crypto traders need to adjust strategies for higher volatility and uncertainty. On Phemex, several features can help you weather the storm and position smartly. Let’s explore how you can make the most of Phemex’s offerings during choppy market conditions:

Phemex On-Chain Earn Shines in Dips and Bears

When markets chop or trend lower, capital preservation and steady yield beat swing-for-the-fences bets. Phemex On-Chain Earn lets you stake supported assets directly on proof-of-stake networks like Ethereum and Solana without leaving your Phemex account. The platform handles the on-chain operations and reward distribution for you, so you earn native staking yield with one-click simplicity. That means no separate Web3 wallet setup, gas configuration, or validator wrangling - just subscribe and start accruing rewards, with transparent tracking and institutional-grade protections built in.

In volatile phases, the key advantage is that On-Chain Earn removes trading and liquidation risk from the equation: your assets aren’t in leveraged positions or exposed to intraday whipsaws, instead you’re earning protocol rewards on-chain while prices sort themselves out. If you’re sitting out a downtrend or waiting for confirmation, parking a portion of your portfolio here can steadily compound your holdings instead of letting them idle. Phemex curates on-chain staking strategies (e.g., ETH, SOL and other supported networks) and surfaces estimated APRs, TVL, and redemption terms right on the product page, so you can choose yields that fit your risk tolerance and time horizon.

Flexibility matters in uncertain markets: subscribe/unsubscribe through your account, and unstaking follows the blockchain’s native rules—no obscure off-chain lockups. That design, plus one-click access and clear reward visibility, makes it practical to keep “dry powder” productive while retaining the option to redeploy into trades when conditions improve. In uncertain markets, keeping all capital in high-risk trades isn't ideal. If you're holding crypto long-term, Phemex Earn (both On-Chain and regular Savings) lets you earn passive yield by depositing idle assets into interest-bearing products. For instance, parking some of your portfolio in USDT or USDC flexible savings can provide steady returns even during market fluctuations.

Automate Dip Trading with Phemex Trading Bots (Grid Strategy)

In choppy, range-bound markets, grid trading is effective for capturing profits. Phemex's Trading Bots automate buy and sell orders at set intervals. For example, you can configure a bot to execute trades between specific price boundaries, systematically buying low and selling high.

Why Bots Help: Bots eliminate emotional trading, ensuring your strategy is executed 24/7 without panic. This smooths out returns over time, especially during consolidation phases.

Other Bots (DCA): Phemex also offers dollar-cost averaging bots, allowing you to accumulate more Bitcoin or Ether gradually without stressing about market timing. This hands-free approach helps you build a stronger position at an attractive cost basis during price dips. Automation through these bots enables prudent strategies without constant market monitoring.

Risk Management Tools: Stop-Loss, Leverage Control & Hedging

Turbulent markets demand tight risk management, and Phemex offers essential tools for every trader:

Stop-Loss and Take-Profit Orders: Always set a stop-loss to limit losses. For instance, if you expect a bounce in Bitcoin, set a stop-loss at your invalidation point (e.g., below $115k). Phemex allows attaching these orders to positions, ensuring automatic closure at predetermined prices to protect against quick downturns. Similarly, set take-profit levels to lock in gains and avoid second-guessing during volatile swings.

Leverage Management: In high-volatility periods, be cautious with leverage when trading futures. Consider using lower leverage (2x or 3x) instead of higher levels to allow for wider margins of error. Smaller position sizes relative to your equity can also help you survive market fluctuations. Keep an eye on your Margin Ratio in Phemex’s UI to avoid liquidation risks.

Hedging Strategies: Use Phemex's various contract types to hedge your portfolio. For instance, if you hold Bitcoin but fear short-term declines, open a short position on BTC futures. This way, gains from the short can offset losses in your long-term holdings, providing peace of mind. Consider options or inverse contracts as additional hedging methods.

Portfolio Diversification: Don’t put all your eggs in one basket. Diversify your portfolio with different assets listed on Phemex, including lower-risk options or stablecoins. A mix of Bitcoin and some altcoins can mitigate overall risk and ensure your portfolio remains resilient if one asset performs poorly.