A Bitcoin ATM (sometimes abbreviated as BATM) is a kiosk ATM machine specifically for Bitcoin. However, it is not uncommon to have access to other cryptocurrencies. Essentially, these types of ATMs allow individuals to directly buy and/or sell Bitcoin along with other available cryptos. They first appeared in 2013, and over the years they have grown into a global network of machines that provide convenient access to crypto. This article explains how Bitcoin ATMs work, how to use them safely, and what has changed in the market up to 2025. It covers the basics of how Bitcoin ATMs function, the steps for purchasing or cashing out BTC, fees and compliance, and the factors driving their adoption.

Types of Bitcoin ATM Machines

How Many Bitcoin ATMs Are There?

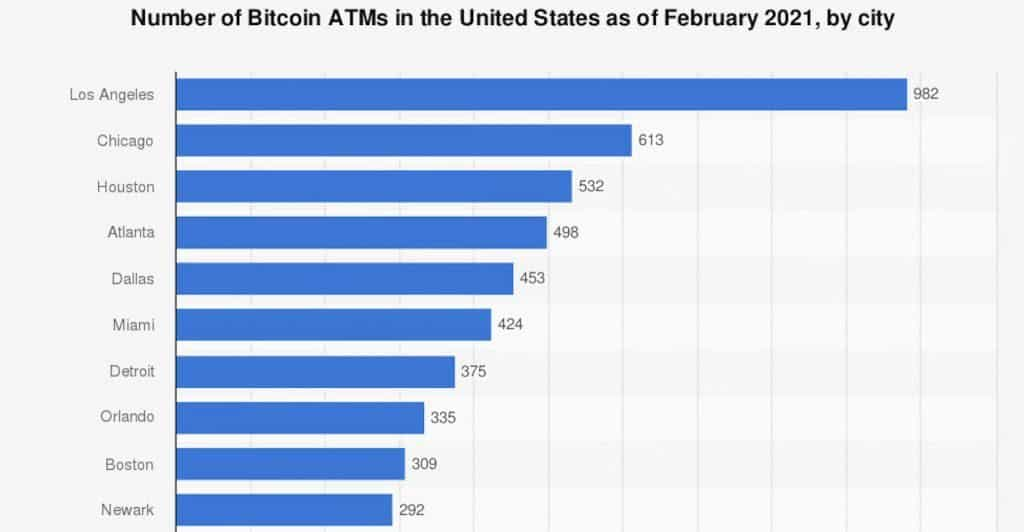

The number of Bitcoin ATMs worldwide has grown every month since 2015, reaching over 23,000 Bitcoin ATMs by August 2021. However, the market is vastly concentrated in the United States, with the United States being home to approximately 22,000 of those ATMs. In the United States, the geographic distribution of Bitcoin ATMs is quite spread out.

Ranking of the top 10 cities in the United States with the most Bitcoin ATMs 2021. (Source: coinatmradar.com)

In the early 2010s, Bitcoin ATMs were a novelty. The first public Bitcoin ATM was installed in Vancouver, Canada in October 2013. Since then the number of machines has grown dramatically. According to Coin ATM Radar (a widely cited BTM directory), by mid‑2024 there were around 36,000–40,000 Bitcoin ATMs worldwide, down slightly from the peak of nearly 39,000 machines in 2022. The decline reflected consolidation in the industry and some operators exiting due to regulatory or profitability issues. New installations slowed in late‑2022 and 2023 during a broader crypto bear market, though growth resumed modestly in 2024.

Where are BTMs located?

-

United States: The U.S. is by far the largest market, hosting more than 80 % of global Bitcoin ATMs. States with large metro areas—like California, Florida, Texas and New York—have thousands of machines. Some states require operators to register as money services businesses (MSBs) and implement anti‑money laundering measures.

-

Canada: Canada is the birthplace of the first BTM and still has several hundred machines, mostly in major cities. Regulation varies by province, and some require ATM operators to register with financial authorities.

-

Europe: Countries like Spain, Germany, Poland and Austria lead the European market. Adoption is spotty due to different national laws. For example, Germany demands ATM operators obtain a banking license.

-

Latin America: Brazil, Mexico, Colombia and Argentina host dozens to hundreds of BTMs. Demand is driven by inflation fears and remittances. Regulatory frameworks are evolving.

-

Asia-Pacific: Growth has been slower. Hong Kong and Singapore have a handful of machines; Japan and South Korea have strict regulations requiring full registration. India banned most crypto-related services for a time, limiting ATM deployment.

Who Are The Providers & Operators Of Crypto & Bitcoin ATM Machines?

Just like banks have their own ATMs, and how crypto exchanges have their own platforms, individual companies also operate their own Bitcoin ATMs. Essentially, Bitcoin ATM providers are third-party companies that sell the machines to merchants (like regular stores and businesses) that want to install an ATM at or for their business.

| 12 Popular Bitcoin ATM Providers |

| Bitcoin Depot |

| Coinsource |

| RockItCoin |

| Bitnovo |

| BitVending |

| Cryptospace |

| General Bytes |

| Genesis |

| Lamassu |

| LocalCoin |

| Netcoins |

| Satoshiware NQ |

As we can see from the table above, there are many different Bitcoin ATM participants in the market. First, Bitcoin Depot is a United States located multi-cryptocurrency ATM Network that offers users the ability to instantly buy and sell Bitcoin, Litecoin, and Ethereum. Second, Coinsource Bitcoin ATM, which claims itself as the world’s leader in Bitcoin ATM services, is another customer-focused financial services company that provides access to the cryptocurrency world. Besides providing a fast, easy, and secure way to buy and sell cryptocurrencies using cash at many US locations, they have also begun building a compliance and consumer protection program, along with support services to attract more clients. Third, RockItCoin Bitcoin ATM, which is a cash-based Bitcoin ATM machine that allows customers to buy and sell Bitcoin using cash.

There is a market for these operators because traditional bank ATMs are unlikely to allow Bitcoin software and selections to be featured on their machines. This makes sense since banks historically have put up walled gardens around their banking services.

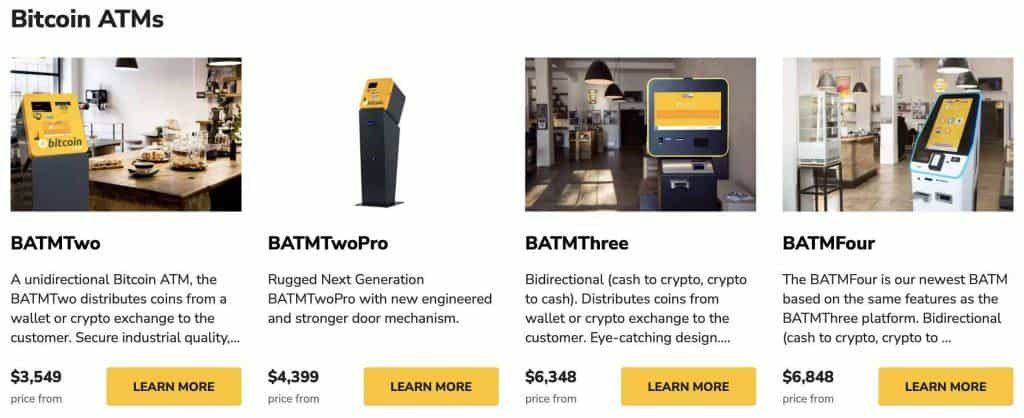

Who Are Making The Bitcoin ATMs?

Bitcoin ATM manufacturers are the companies that build the actual machines. Genesis Coin is the world’s largest manufacturer of cryptocurrency machines and commands 40% of the market. Genesis offers three machines: Genesis1 (two-way), Satoshi (one or two-way), and Finney3 (one-way or two-way not disclosed). Genesis machines are specifically designed for the buying and selling of Bitcoin, and not other cryptocurrencies. Genesis1 is their flagship model with almost 15,000 machines delivered.

The second leading Bitcoin ATM manufacturer is General Bytes, which is headquartered in Prague, Czech Republic, and Bradenton, Florida, USA. General Bytes sells four BATM models: BATMTwo, BATMTwoPro, BATMThree, and BATMFour. In addition, the company also offers a software called CAS that allows BATM operators to manage their fleet of General Bytes BATMs. The company’s goal is to become the leading Bitcoin and blockchain technology provider.

We can see that the market is very competitive, with many manufacturers and operators looking to enter the space and take their cut. As businesses slowly think about including cryptocurrency payments for their products, they may consider having these machines in their shops. This will only contribute to greater crypto adoption.

How To Use A Bitcoin ATM?

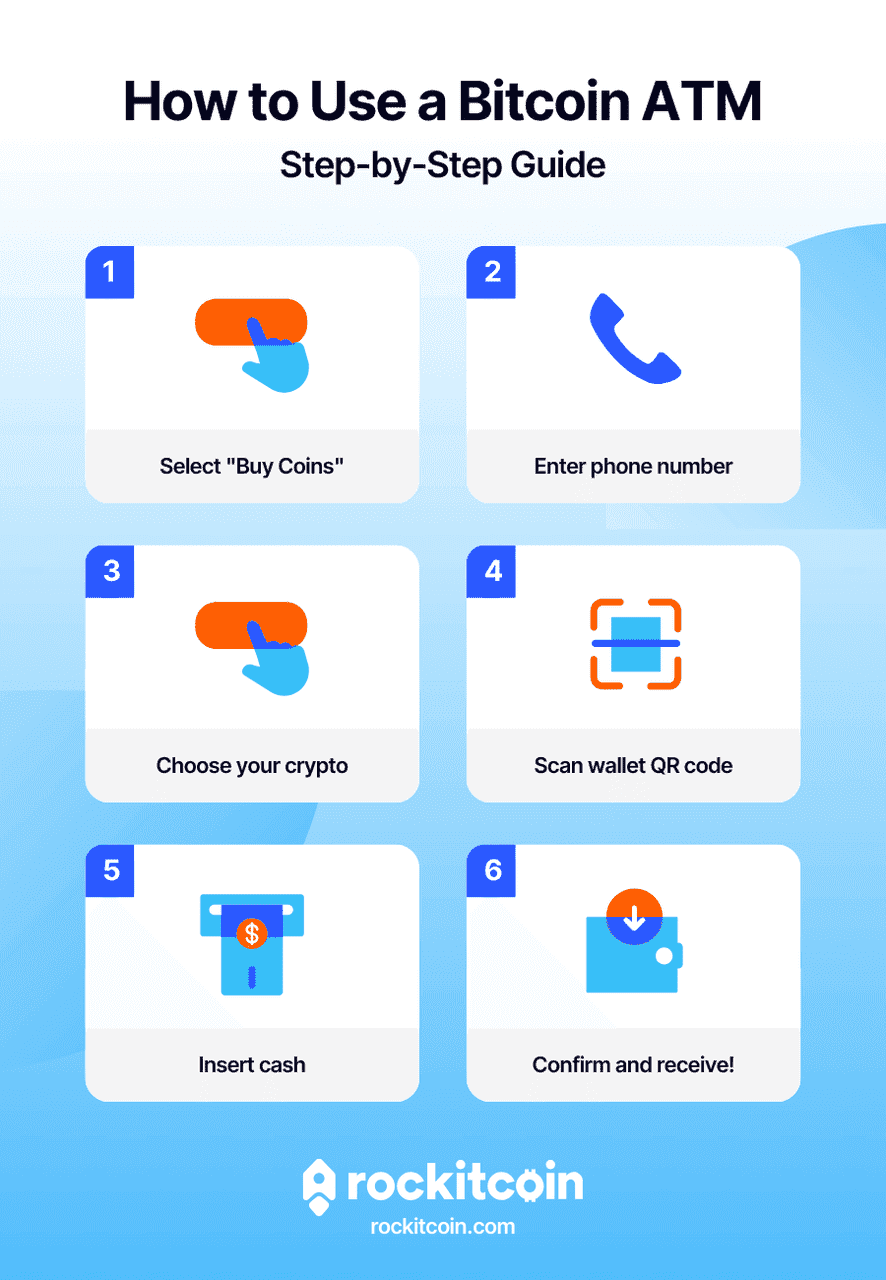

Although not all Bitcoin ATMs are the same, the standard process is that an individual may have to first create an account with the ATM provider, of course, depending on the service operator. Then, when engaging with the screen the user can select “buy or sell,” choose their cash limit, scan a crypto wallet, insert cash, and complete the transaction. This is just the basic experience of interacting with a Bitcoin ATM.

However, the customer may also have to do other actions on their phone or with their identification, such as KYC. But why would Bitcoin ATMs require an ID? This is because of the greater scrutiny and security concerns that are growing over the industry.

Can You Sell Bitcoin At These ATMs?

The selling process is slightly different than buying. It also varies case-by-case depending on the machine. But generally speaking, for example, on the screen, the user can tap sell, choose the cash limit, enter the amount to be sold, input their phone number, take the printed out QR code, send Bitcoin to that QR code, return to the machine, hit redeem, then scan the printed out QR code, and complete the transaction. However, if there are particular steps to follow, the user should merely follow the instructions displayed on the screens, as they are quite intuitive.

Step-by-step usage of Bitcoin ATM (source)

Steps To Buy Bitcoin With A Bitcoin ATM

-

You verify your identity through an one-time-password sent to your mobile or email. Again, this varies from machine to machine.

-

You decide if you want to buy or sell BTC (if you have the option).

-

To buy, you must choose the amount you want to in terms of BTC or your target fiat currency.

-

You then deposit the fiat currency into the machine.

-

Several things may happen depending on the machine:

-

A QR code may appear on the screen for you to scan

-

A QR code may be printed off corresponding to your new BTC wallet.

-

The machine will ask and scan the QR code of your pre-existing wallet.

-

You input your email address to have a QR code sent to you.

To sell, you must send the appropriate amount of BTC to the address displayed on the screen. Once the transaction is confirmed, you will receive the agreed fiat sum. How long this takes depends on the machine.

Bitcoin ATM fees

Advantages and Disadvantages of Using Bitcoin ATMs

Pros

-

Speed and convenience: Immediate purchase or cash-out with simple interface; no bank account needed.

-

Privacy: Option to buy small amounts anonymously (if allowed by law) using cash.

-

Accessibility for the unbanked: Serves people who cannot open bank accounts or prefer cash.

-

Physical presence: The tangibility of cash and the machine may reassure novices compared to online-only exchanges.

Cons

-

High fees: BTMs often charge significantly more than online exchanges. Over time, these fees add up.

-

Limited availability outside major cities: Rural areas may not have machines.

-

Lower limits: Daily purchase/sell limits may cap at a few thousand dollars.

-

Risk of scams: Criminals sometimes use BTMs in schemes (e.g., telling victims to deposit cash to pay fake fines). Always verify the purpose of your transaction.

-

Regulatory complexity: You may be asked for ID or denied service depending on local rules.

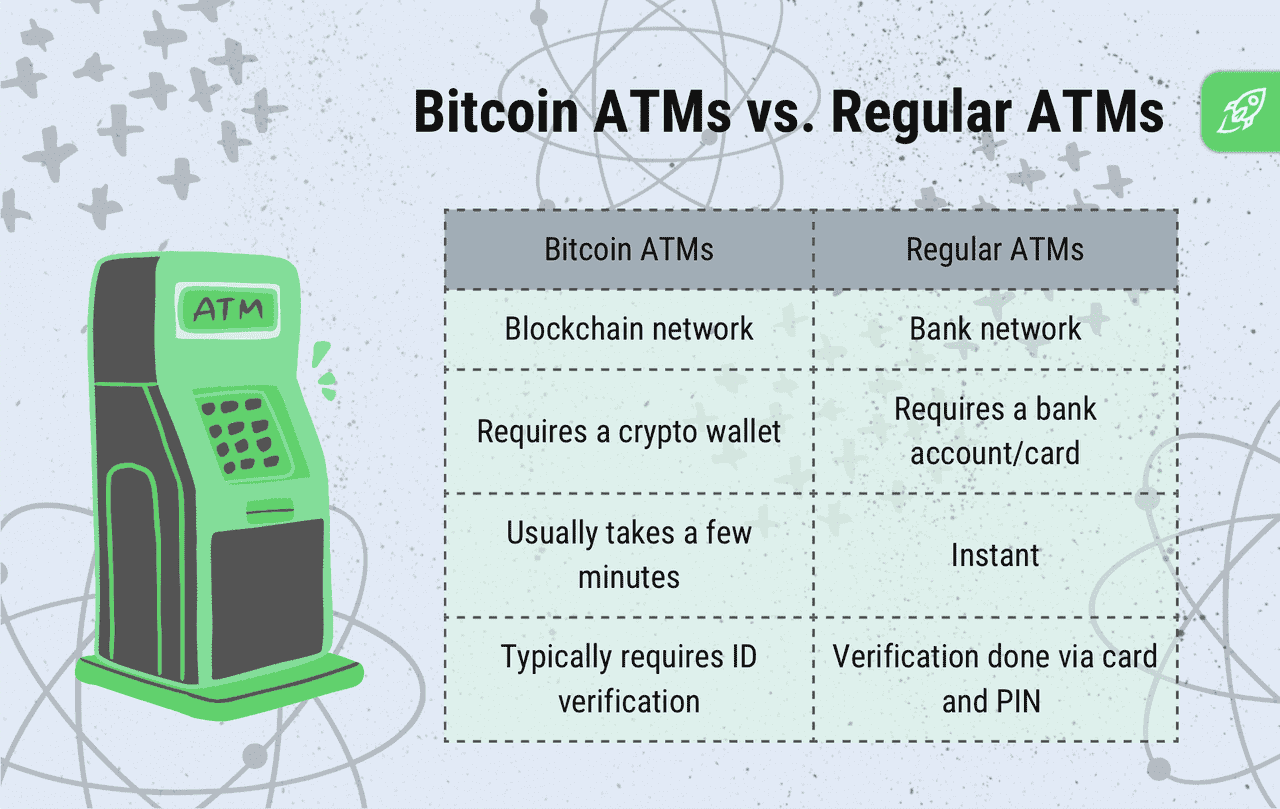

Bitcoin ATM vs. Fiat ATM (source)

Bitcoin ATMs vs. Crypto Exchanges

Bitcoin ATM’s are connected to exchanges. When using one, you are essentially buying or selling your chosen coin on an exchange. However, you’re interacting with a physical machine in a specific location rather than online. The price difference between using an online exchange and an ATM is generally around 5-10%. This means that ATMs cost 5-10% more to buy, and selling means you receive 5-10%. Unlike crypto exchanges that can take a few hours to verify your account and transaction, Bitcoin ATM purchases are instant.

Despite the premium that must be paid, many are attracted by these machines’ convenience and ease. They allow for a more visual and straightforward financial transaction that most are already familiar with. In addition, machines do not require any confusing registration processes or the need to learn about online trading interfaces.

When selling through an online exchange like Phemex, the platform’s spot markets offer more control over the price you are transacting with. You can also take advantage of limit orders and stop orders if you are not happy with current market prices.

Conclusion

Bitcoin and cryptocurrency ATMs not only offer an easy and familiar way to buy and sell cryptocurrencies, but they also provide an immediate connection between cash and cryptocurrencies that are not easily found within the cryptocurrency world. Moreover, these machines bring a physical and familiar element to a largely digitized industry. With this in mind, it would be no surprise to see that the use of BATMs became just as normalized as regular ATMs.

Bitcoin ATMs provide a bridge between the physical cash world and the digital realm of cryptocurrencies. They have democratized access to Bitcoin, enabling people to buy or sell it quickly without a bank account. While fees are higher and compliance requirements vary, BTMs remain a convenient option for many users - especially those seeking privacy, speed and accessibility. As the crypto industry matures, Bitcoin ATMs will likely become more mainstream, integrated and regulated. Whether you’re a novice wanting to acquire your first small amount of bitcoin or a seasoned user needing quick liquidity, understanding how BTMs work empowers you to use them confidently and safely.