In the often-chaotic and self-referential world of cryptocurrency, moments of true external validation are rare and profoundly significant. They serve as signposts, marking the transition of a technology from a niche experiment to a piece of critical global infrastructure. The recent, separate announcements that both Chainlink and Pyth Network—the two titans of the blockchain oracle space—have entered into collaborations with the U.S. Department of Commerce represent one of the most important of these signposts to date.

This is not just another partnership announcement. This is a handshake across a chasm that has long separated the permissionless world of decentralized finance (DeFi) from the established, regulated heart of institutional power. When a U.S. government department, responsible for fostering economic growth and technological competitiveness, formally engages with the very data pipes that power DeFi, it signifies a fundamental change in the narrative. The oracle, once a purely crypto-native concept, is being recognized for what it truly is: a foundational element of the next generation of data and financial plumbing.

But why is this happening now? What does this convergence mean for the future of both crypto and traditional systems? And perhaps most tellingly, why has the U.S. government chosen to engage with two distinct and philosophically different contenders in Chainlink and Pyth? The answers to these questions reveal not only the maturation of the oracle sector but also the divergent paths these two giants have taken to arrive at the same, incredibly important table. This is the story of two different solutions to the same problem, both of which have now become too important for the world’s leading economic power to ignore.

The Convergence - Why Washington Needs the Oracles (And Why They Need Washington)

The collaboration between crypto projects and a government entity is a two-way street, born from a convergence of distinct but complementary needs. To understand its significance, we must first analyze the motivations of both parties.

From Washington's Perspective: Future-Proofing the Data Economy

The U.S. Department of Commerce, particularly through its agencies like the National Institute of Standards and Technology (NIST), is tasked with setting the standards that underpin technological innovation and U.S. economic leadership. For decades, this meant standardizing everything from weights and measures to the protocols of the early internet. Today, that mandate extends to the burgeoning world of distributed ledger technology.

The government’s interest is not in speculating on the price of oracle tokens; it is in understanding and eventually standardizing the secure, reliable, and tamper-proof delivery of data. They recognize several critical imperatives:

-

Standardizing a New Data Paradigm: The modern economy runs on data. Financial markets, supply chains, insurance, and even climate science depend on the timely and accurate flow of information. As these industries begin to explore blockchain technology for efficiency and transparency, the question of how to get real-world data onto these chains becomes a matter of national technological interest. How can a smart contract governing a crop insurance policy reliably know the local rainfall? How can a tokenized U.S. Treasury bond receive accurate interest rate data? Oracles are the answer, and the Department of Commerce needs to understand the technology to help shape the standards that will govern it.

-

Maintaining Technological Supremacy: In a world of geopolitical competition, leadership in foundational technologies is paramount. Blockchain and Web3 represent a new frontier. By proactively engaging with the leading infrastructure providers like Chainlink and Pyth, the U.S. government is not just observing; it is actively participating in the development of the next internet stack, ensuring it understands the architecture and can foster an environment where American innovation can lead.

-

Risk Mitigation and National Security: As tokenized assets and on-chain financial products become more systemic, the reliability of the oracles that power them becomes a matter of financial stability. A faulty oracle could trigger cascading liquidations in a DeFi protocol, and in the future, could disrupt markets for tokenized securities or commodities. Government agencies need to understand the failure modes, the security models, and the potential vulnerabilities of this critical infrastructure.

The collaboration, therefore, is an act of foresight. It is the U.S. government doing its due diligence on a technology that is clearly on a trajectory to become a fundamental part of the global economic machine.

From the Oracles' Perspective: The Ultimate Stamp of Legitimacy

For Chainlink and Pyth, the benefits are more immediate and profound. This collaboration is the single greatest de-risking event in their history.

-

Unparalleled Validation: A formal working relationship with the U.S. Department of Commerce is an irrefutable stamp of legitimacy. It elevates them from being merely "crypto projects" to being recognized as serious, enterprise-grade technology providers. This validation is priceless when approaching large, conservative institutions in traditional finance (TradFi), insurance, and other highly regulated industries.

-

Bridging the Chasm to TradFi: For years, the dream of "institutional DeFi" and tokenized Real-World Assets (RWAs) has been hampered by a perception of crypto as an unregulated "Wild West." This collaboration provides a powerful counter-narrative. It signals to a Wall Street bank, a pension fund, or a global logistics company that this technology is not only viable but is being taken seriously at the highest levels of government. It lowers the career risk for executives looking to innovate with blockchain.

-

Shaping the Future of Regulation: By working directly with government bodies, these oracle networks move from being subjects of potential future regulation to being active participants in the conversation. They have an opportunity to educate policymakers, demonstrate the robustness of their technology, and help shape a regulatory framework that is informed and sensible, rather than reactionary and stifling.

This pact is a strategic masterstroke, transforming their public perception and opening doors that were previously firmly shut. It is the culmination of years of building, a definitive signal that the oracle problem is not just being solved, but that its solutions have reached institutional-grade maturity.

A Tale of Two Oracles - Divergent Philosophies, Convergent Goals

The most fascinating aspect of this development is that the Department of Commerce is engaging with both Chainlink and Pyth. This is not an accident. It reflects the fact that these two projects represent two fundamentally different, yet equally valid, philosophical and architectural approaches to solving the oracle problem. To understand their differences is to understand the maturation of the entire sector.

Chainlink: The Decentralized, Bottom-Up Behemoth

Launched in 2017, Chainlink is the original incumbent and the undisputed market leader by most metrics. Its history and design philosophy are rooted in the core ethos of crypto: radical, bottom-up decentralization.

-

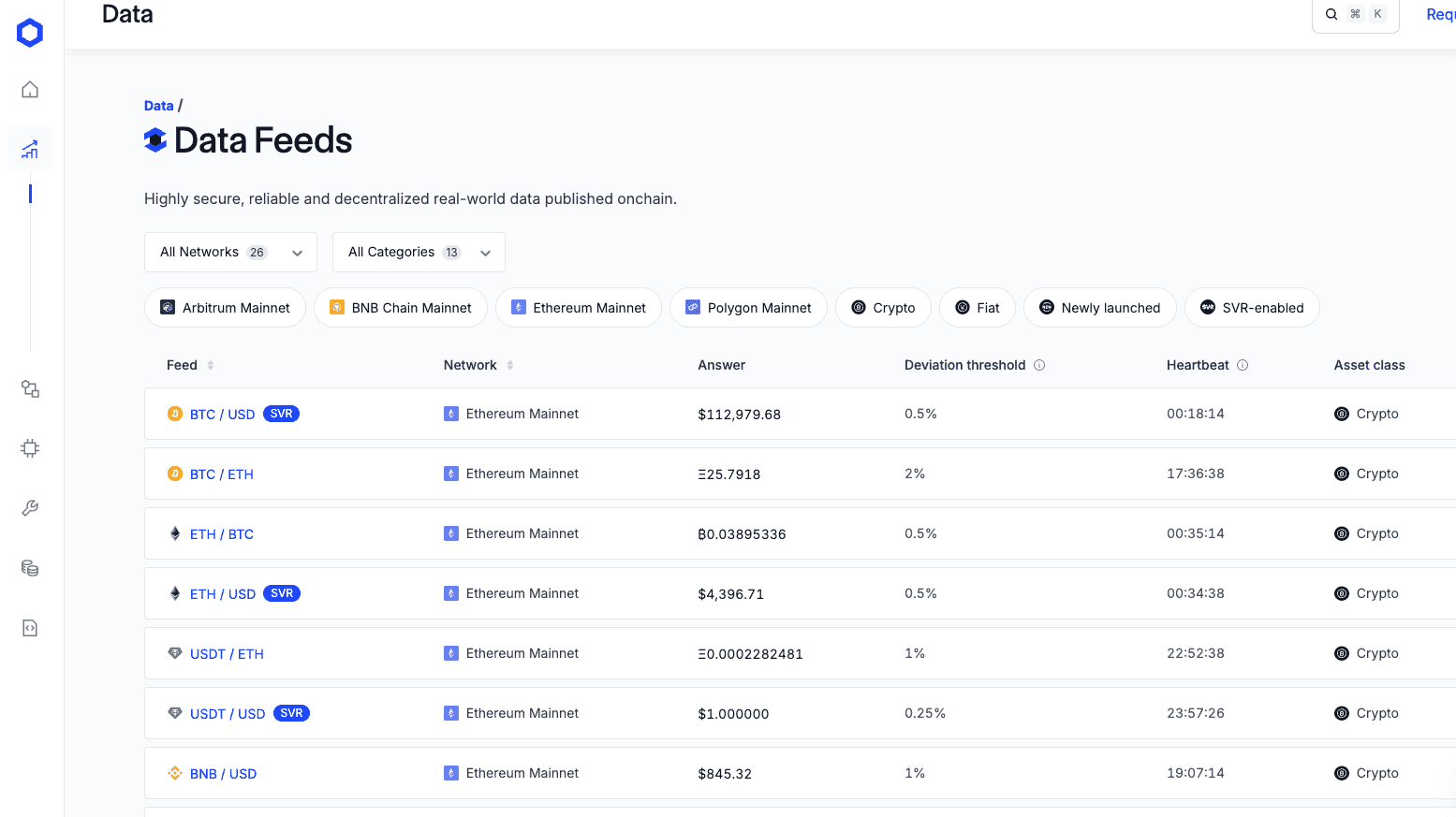

Architectural Model: Chainlink’s core model is a decentralized network of third-party node operators. When a smart contract requires a piece of data (e.g., the price of ETH/USD), it makes a request to the Chainlink network. A diverse set of independent, geographically distributed node operators all fetch this data from multiple premium data aggregators (like Bloomberg, Reuters, Kaiko). They then report their findings back on-chain, where the values are aggregated into a single, trusted answer. Outliers are discarded, and nodes are crypto-economically incentivized through staking (via LINK tokens) to be honest and reliable. Malicious or faulty nodes can be slashed, losing their staked tokens.

-

Development History & Philosophy: Chainlink’s growth has been methodical and relentless. It followed a classic grassroots strategy, first integrating with nearly every credible project in the DeFi space, becoming the indispensable "picks and shovels" provider of the industry. Its philosophy is built on the idea that trust should not be placed in any single entity. Trust is an emergent property of a large, economically secured, and transparently decentralized network. The network itself is the product.

-

Partnership Ecosystem: Reflecting its bottom-up strategy, Chainlink’s partnership list is a sprawling testament to its network effect. It began with crypto-native dApps and L1/L2 blockchains. From there, it methodically expanded into the enterprise world, forging landmark partnerships with giants like SWIFT (for interbank messaging), DTCC (the world's largest securities settlement system), and major cloud providers. The collaboration with the U.S. government is the logical, final step in this upward journey from the permissionless grassroots to the heights of global institutions. Their journey was from the outside in.

Pyth Network: The High-Frequency, Top-Down Challenger

Pyth is a newer entrant, born from a completely different environment: the world of high-frequency trading (HFT) and traditional finance. Incubated by Jump Crypto, Pyth was designed from the ground up to solve the specific needs of modern, fast-paced financial markets, launching initially on the high-throughput Solana blockchain.

-

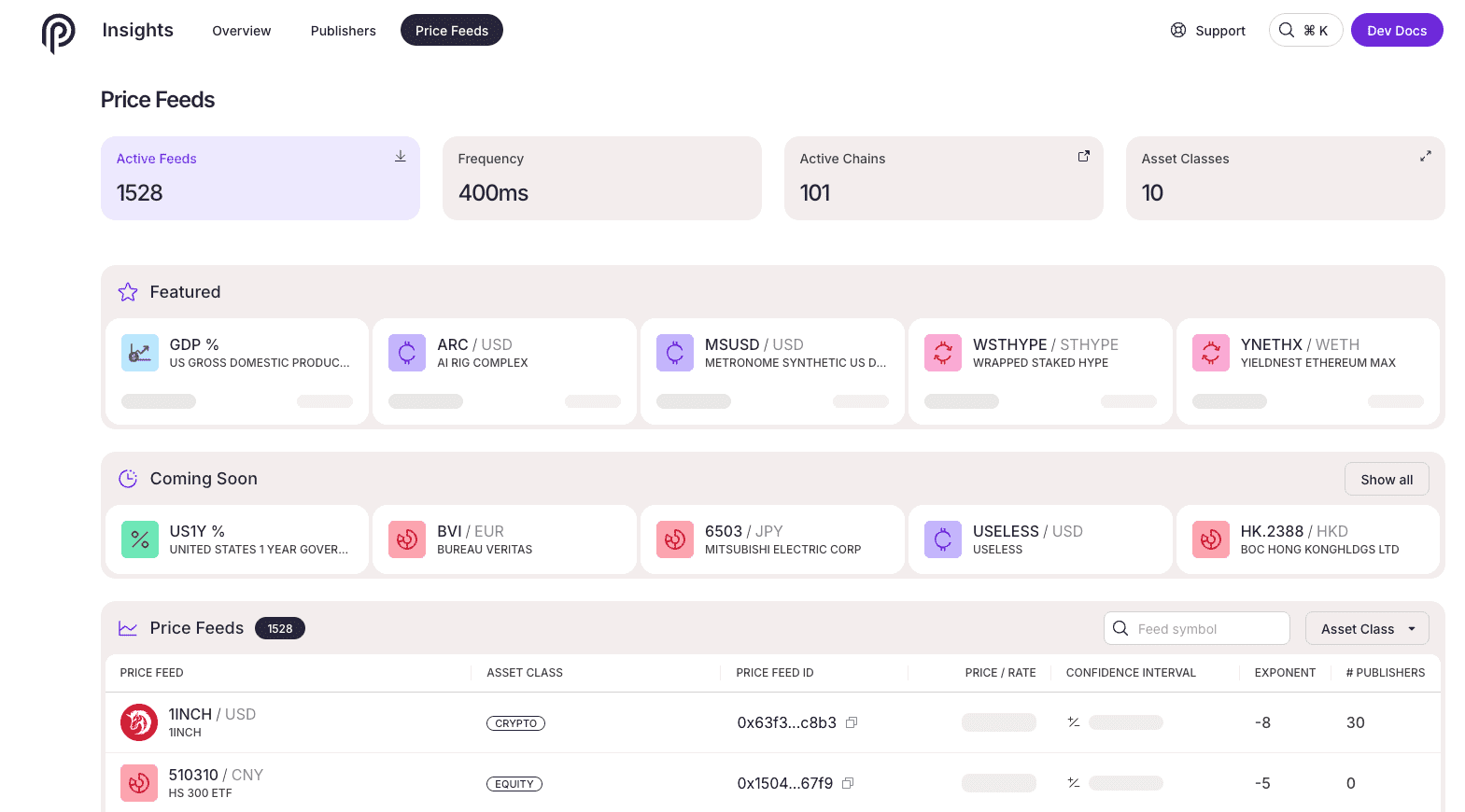

Architectural Model: Pyth employs a radically different first-party publisher model. Instead of a network of third-party nodes fetching data, Pyth gets its data directly from the source. It has onboarded over 100 of the world's most prominent financial institutions—including exchanges like Cboe and LMAX, trading firms like Jane Street and Virtu Financial, and HFT firms—to act as direct data publishers. These institutions publish their proprietary price data directly to Pythnet, a specialized appchain. The data is then aggregated on Pythnet, and users on any connected blockchain can "pull" the latest aggregated price on-demand.

-

Development History & Philosophy: Pyth’s philosophy is rooted in expertise and reputation. It posits that for financial data, the most trustworthy source is the entity that creates or trades the asset itself. Who knows the true price of a stock better than the exchange it trades on or the market maker that provides its liquidity? Trust, in the Pyth model, is placed in the verifiable quality and reputation of the data providers. Speed and accuracy for fast-moving assets are prioritized, reflecting its HFT origins.

-

Partnership Ecosystem: Pyth’s partnership strategy was the inverse of Chainlink’s. It started from the top down. Its initial focus was on building an unparalleled consortium of Wall Street and institutional data providers. Once this foundation of high-quality, low-latency data was established, it then expanded its services to the DeFi ecosystem across dozens of blockchains. Its collaboration with the U.S. government is a natural extension of its strategy of working directly with the world’s most established and reputable institutions. Their journey was from the inside out.

Different Paths to the Same Table - What the Dual Engagement Signifies

The U.S. Department of Commerce's decision to work with both Chainlink and Pyth is a masterstroke of technological due diligence. It demonstrates a sophisticated understanding that the oracle space is not a monolith. They are not simply picking a "winner"; they are studying the entire field and its dominant design patterns.

Chainlink represents the decentralized aggregator model. Its strength lies in its robustness, censorship resistance, and its ability to provide trusted data for a vast array of use cases, even those where a clear "first-party source" doesn't exist (e.g., decentralized weather data, sports results, or complex financial derivatives). It is a general-purpose, public utility for truth.

Pyth represents the first-party publisher model. Its strength lies in its speed, precision, and capital efficiency for a specific but massive use case: high-frequency financial market data. It is a specialized, high-performance tool for modern finance.

By engaging both, the government can study the trade-offs firsthand:

-

The resilience of a decentralized, crypto-economically secured network vs. the verifiable accuracy of reputable, centralized sources.

-

The "request-response" model's cost and latency vs. the "pull-on-demand" model's efficiency.

-

The security assumptions of a bottom-up system vs. the reputational trust of a top-down system.

This dual engagement validates the entire market. It proves that the industry has matured beyond a single, one-size-fits-all solution. A healthy, competitive ecosystem with multiple high-quality approaches is a sign of a robust and developing technology sector, making it a much safer and more interesting space for institutional and governmental involvement.

Conclusion: Crossing the Rubicon into a New Reality

The pact between Chainlink, Pyth, and the U.S. Department of Commerce is a true "crossing the Rubicon" moment for cryptocurrency. It marks an irreversible step away from the industry's isolated, often adversarial past and toward a future of integration and collaboration with the core institutions that shape the global economy.

This development is not merely symbolic. It is a catalyst. It provides the political and institutional air cover for a wave of TradFi adoption. It reframes the narrative around crypto infrastructure from a risky bet to a strategic necessity. And it validates the years of tireless building by both the Chainlink and Pyth communities, proving that their vastly different approaches have both led to the creation of technology that is undeniably vital.

The future of oracles is not a zero-sum game where one network wins and the other loses. The future is multi-oracle, where different applications will choose the data provider whose architecture and trust model best fits their specific needs. A decentralized insurance protocol might rely on Chainlink's robust network to verify weather data, while a high-frequency derivatives exchange on a performant L2 might use Pyth's low-latency price feeds for its trading pairs.

The handshake in Washington is not the end of the story. It is the beginning of a new chapter—a chapter where decentralized oracles are no longer just a component of DeFi, but a recognized, indispensable, and standardized part of the world's critical data infrastructure, bridging the digital and physical worlds with cryptographic truth.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. The views expressed are solely those of the author(s) and do not necessarily reflect the official policy or position of Phemex. Cryptocurrency trading involves substantial risk and is not suitable for all investors. Investors should consider their financial situation and consult with a financial advisor before making any investment decisions. Phemex is not responsible for any direct or indirect losses arising from the use of this information.