Phemex has just announced it will lower its taker fees from 0.075% to 0.06% for all contract trades. Phemex is making this move to fulfill its goal of making crypto derivatives trading more accessible to all.

Background To Crypto Derivatives

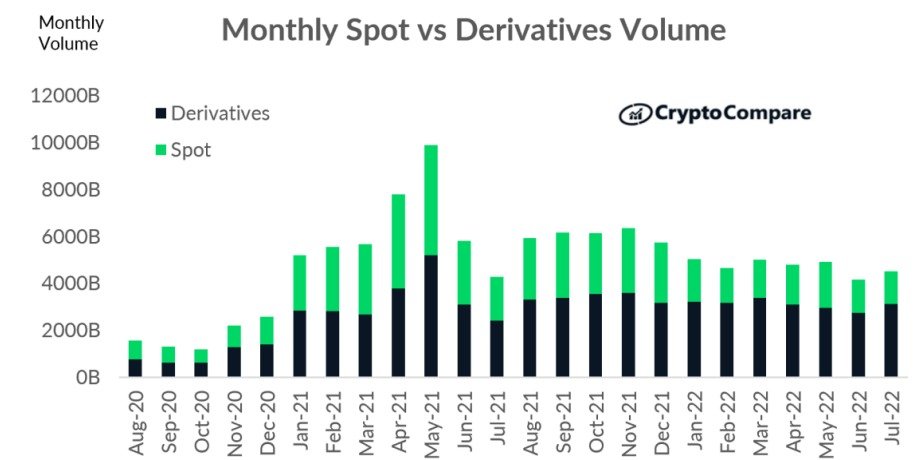

The crypto derivatives market on exchanges such as Phemex rose to $3 trillion in July 2022. Moreover, derivatives trading accounts for approximately 60% of all crypto trading. Crypto derivatives are a vast market with many exchanges providing competing services.

(Source: Derivatives volume, in black, significantly outpaces that of spot volume)

Performing these types of trading activities can cost traders very high fees on many exchanges. To prosper, crypto exchanges must lower cost-prohibitive barriers and remain competitive with the market. Now that Phemex has lowered its taker fees by 20%, institutional and retail traders alike will have 20% extra in funds that would have otherwise been spent on taker fees. In summary, Phemex contracts are now cheaper and more accessible to the vast majority of traders.

How Does This Stack Up With The Industry?

Phemex’s new maker and taker fees of 0.01% and 0.06% are on par or better than other centralized exchanges. For example, Phemex’s new maker fees are 50% lower than Binance, Bitget, OKX, and Kucoin – and Phemex’s new taker fees now match those of Bybit, Bitget, and Kucoin. In summary, Phemex’s fee adjustments will increase its competitiveness and allow it to help its traders achieve financial freedom.

Lower Fees In Practice

To demonstrate how this plays out in practice, let’s use an example with the BTCUSD trading pair – “A trader buys BTCUSD contracts using a Market order.” Remember that for BTC, one contract is worth $1. So if you buy 100 BTCUSD contracts at 1$ per contract, under our new contract trading fee structure, you’ll be charged $0.06. Previously, however, you would have been charged $0.075.

So to celebrate these lower fees, starting on August 19th we’re hosting a special Fee Slasher event in which all traders on Phemex will be able to enjoy the updated fee structure as well as a 50% rebate on all contract trading fees. There’s also a $50,000 prize pool of rebates that will be distributed to traders on a first-come, first-serve basis. So hurry up and start making some trades!