Introduction: Bitcoin’s Critical Juncture in 2025

Bitcoin enters the second half of 2025 at a pivotal moment. After a significant rise earlier in the year, reaching six figures for the first time, the market now faces a mix of macroeconomic factors, shifting regulations, and on-chain dynamics. As of mid-2025, Bitcoin trades in the $100,000–$110,000 range, following a new all-time high near $112K in May. The pressing question is: What’s next for BTC?

This analysis examines Bitcoin’s prospects for the rest of 2025, looking at inflation trends, interest rate policies, and the regulatory landscape, including U.S. crypto bills. We will also explore crucial on-chain metrics, technical analysis of BTC/USDT, whale activity, and trading strategies for managing volatility.

While 2025 has been favorable for Bitcoin, ongoing vigilance is essential. We’ll provide data-driven insights to guide both short-term traders and long-term investors in timing their entries and exits amid ever-shifting market conditions. Let’s break down the factors influencing Bitcoin’s future moves.

Macro Landscape: Inflation, Interest Rates, and Global Market Sentiment

Bitcoin's performance in 2025 is closely linked to the macroeconomic landscape, often referred to as “digital gold.” It tends to thrive when investors seek alternatives to fiat currencies or liquidity is high, but struggles when interest-bearing assets become more attractive or risk appetite declines. Key factors affecting Bitcoin include inflation trends, central bank interest rates, currency strength, and global market sentiment.

By mid-2025, U.S. inflation has dropped to around 2.3%, near the Fed's target, which is a double-edged sword for Bitcoin. While lower inflation could result in rate cuts from the Fed, encouraging investments in risk assets like Bitcoin, it also means less urgency for Bitcoin as an inflation hedge. If inflation unexpectedly rises, Bitcoin may see renewed interest as a protective asset.

With the Fed's policy rate around 5%, a weakening dollar (down about 10% year-to-date) makes alternative assets like Bitcoin more attractive. Concerns about U.S. fiscal health contribute to this shift. Globally, shifts in central bank policies and potential increases in liquidity could further support Bitcoin's value.

In the equity markets, with the S&P 500 recovering and tech stocks booming, overall risk sentiment is positive, benefiting Bitcoin as investors return to riskier assets amid a "risk-on" environment.

Geopolitical factors influence market sentiment. In 2025, moderate geopolitical risks have kept volatility low, but any significant shock, like a conflict in Eastern Europe or an emerging market debt crisis, could impact Bitcoin differently—either driving safe-haven flows or a broad risk-off sentiment leading to initial sell-offs.

The rising U.S. debt and fiscal deficit are notable macro concerns. Historically, increased borrowing pressures rates and the dollar, or leads to easier monetary policy, making Bitcoin a potential “canary in the coal mine.” Its rise alongside rising yields amid a deteriorating fiscal balance signals a search for safety in a world of monetary excess.

Currently, inflation is under control, rate hikes appear to be over, and rate cuts may be approaching, creating a generally favorable environment for BTC/USDT. The backdrop isn’t as explosive as in 2020, but a strategic demand boost from Bitcoin's supply shock post-2024 halving could lead to a strong second half of 2025. Some analysts suggest Bitcoin targets of $120K to $150K if macro conditions remain favorable.

Traders should monitor key dates like Fed meetings, CPI releases, and U.S. fiscal news, along with the U.S. Dollar Index, which could influence Bitcoin’s price movements. Overall, current macro trends are supportive of Bitcoin's performance.

Regulatory Overhang & Opportunity

The period from 2024 to 2025 marks a shift from regulatory fears to opportunities for Bitcoin, particularly in the U.S. The advancement of three significant bills—CLARITY, GENIUS, and the Anti-CBDC Act—offers a more favorable policy environment.

-

CLARITY Act: This legislation clarifies the distinction between securities and commodities, solidifying Bitcoin's status as a commodity. It would reduce the regulatory fears stemming from SEC actions against exchanges, allowing for greater institutional participation in Bitcoin markets.

-

GENIUS Act: Establishing a federal framework for stablecoins, this act could lead to increased trust and liquidity in crypto markets. A regulated stablecoin market may challenge Tether’s dominance, enhancing trading conditions for BTC/USDT and integrating crypto with traditional finance.

-

Anti-CBDC Act: This act signals a U.S. rejection of a central bank digital currency, favoring private digital currencies instead. President Trump’s supportive stance toward crypto and changes in regulation could further foster a positive environment for Bitcoin.

Overall, the regulatory landscape in mid-2025 appears more favorable, making it likely that positive news will lead to market rallies. Traders should monitor upcoming votes and regulatory developments while remaining aware of any potential risks.

On-Chain Metrics That Matter Right Now

While macro and regulatory factors shape the landscape for Bitcoin, on-chain metrics provide insight into network health and investor behavior. As of mid-2025, several key on-chain indicators are noteworthy:

-

Long-Term Holder Supply (HODL Waves): Over 70% of Bitcoin's circulating supply hasn't moved in over a year, indicating strong accumulation by HODLers, including ETFs and corporations. This behavior typically signals conviction in future price upside and reduces circulating supply, which can amplify price moves.

-

Exchange Reserves & Flows: A decline in Bitcoin held on exchanges suggests accumulation, while increases imply potential sell pressure. Throughout 2025, major exchanges have seen net outflows, aligning with the HODL trend. Notably, a significant outflow occurred after Bitcoin surpassed $109K, showing traders' confidence.

-

Whale Holdings and Distribution: Whales, who can sometimes be defined as entities holding ≥1,000 BTC, significantly influence the market. As of mid-2025, the number of whale addresses increased from ~1,944 to ~2,014 within a week, indicating new or existing whales adding to their holdings.

A July report noted a 4.23% rise in addresses with over $10 million in BTC, suggesting that large players are preparing for higher prices. Furthermore, addresses with $100K-$1M and $1M-$10M also saw increases, indicating smaller whales and high-net-worth individuals are accumulating BTC as well.

However, some whales are distributing amid high prices, with significant movements from long-dormant wallets sparking market concerns. A striking case involved two wallets inactive for 14 years moving 20,000 BTC, which raised speculation about possible selling. The market, however, showed resilience by stabilizing after a brief dip.

Whale shorting activity is also noteworthy, with at least one large whale opening an over $80M short position post a $134M short in June. Such leveraged shorts can heighten volatility and contribute to price movements, with analysts suggesting potential for a short squeeze above $110K.

-

Miner Metrics: Miners traditionally impact the market through selling pressure, but their role has lessened due to institutionalization. The Bitcoin hash rate has reached all-time highs, indicating miner confidence, though rising difficulty requires higher prices to maintain profit margins post-halving. No significant spikes in miner selling have been observed recently, with many miners accumulating BTC instead.

-

Network Usage and Activity: Active addresses and transaction counts show growing adoption. As of mid-2025, active addresses often exceed hundreds of thousands. The Lightning Network capacity has grown to over 5,000 BTC, enhancing Bitcoin's usability for small payments. This growth contributes positively to the narrative of Bitcoin’s utility, which is essential for long-term demand.

Key takeaways: On-chain data indicates strong accumulation and reduced supply, with bullish signals heading into late 2025. There's no major warning sign of impending corrections, such as spikes in exchange reserves or large whale deposits. These trends support a positive outlook, with indications of potential price surges similar to past cycles. Traders should watch for changes in exchange inflows and whale activities to gauge market conditions effectively. Overall, mid-2025 on-chain metrics depict a bullish sentiment in the Bitcoin market.

Technical Analysis of BTC/USDT

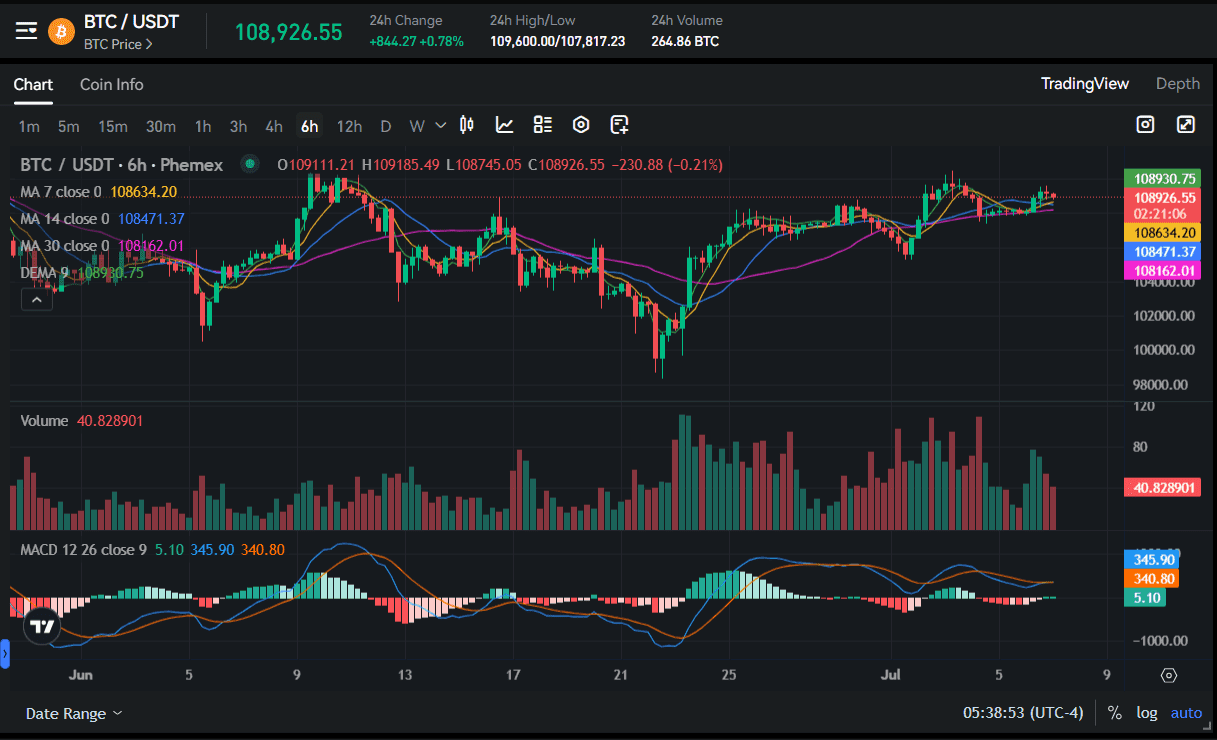

Now, let's analyze the technical aspects of Bitcoin (BTC/USDT) to anticipate its potential direction in the upcoming weeks and months. As of July 2025, Bitcoin has experienced a strong uptrend, with key price movements reflecting consolidation below the critical resistance of $110K–$112K.

Trend Analysis & Chart Structure: On higher time frames, BTC/USDT is in an established uptrend, marked by higher highs and lows since the 2022 bear market. The 2024 halving propelled Bitcoin to new all-time highs (ATHs) of around $111-112K. Currently, the price is consolidating between $100K and $110K, with multiple rejections around the $110K level forming a potential triple top pattern.

Key Resistance Levels:

-

110,000 - 112,000: A major supply zone that has capped price movements. A daily close above $112K could lead to a bullish breakout and further upside momentum.

-

117,000 - 120,000: Potential next targets if $112K is breached, with $117K being a key level based on short-term holder cost basis.

-

$143,000: A speculative target if the price decisively breaks $114K, potentially aligning with Fibonacci extensions.

Key Support Levels:

-

107,500 - 108,000: An immediate support band where bulls have historically intervened, coinciding with the 50-day moving average.

-

105,000 - 106,000: A crucial support level with both the 100-day and 200-day SMAs converging, indicating significant buyer interest.

-

$100,000 (Psychological): The six-figure mark itself is major psychological support now. Bitcoin only sustainably moved above $100K in Q2 2025, so if it revisits that level, expect a battle. Holding $100K is crucial to maintain the bullish narrative and a breakdown below could trigger a cascade of stop-losses and a sentiment shift.

Chart Patterns & Indicators: Bitcoin may be forming a bullish flag on the daily chart, with potential resistance at $112K. A breakout could target around $162K, based on the March–May rally. The RSI has recently cooled to around 55, indicating moderate momentum. While weekly RSI remains in bullish territory, there are bearish divergences to note, suggesting caution as price approaches $110K.

-

Moving Averages: Bitcoin is above key moving averages (50D, 100D, 200D), indicating an uptrend. A golden cross occurred in early 2024, making these averages significant support. A drop below $105K could signal a trend change.

-

Volume Profile: Trading volume has risen during uptrends but decreased during consolidation, indicating a healthy pattern. However, recent pushes to $110K lacked volume support, indicating potential buyer fatigue. A breakout will likely require a volume surge.

-

Futures & Funding: Funding rates in the perpetual futures market are neutral, with no signs of extreme euphoria. Large shorts may fuel a price rise if they are forced to cover, but a spike in funding after a breakout could lead to a short-term shakeout.

Likely Scenarios:

-

Bullish Breakout: A breakout above $112K could lead to a sharp rally, with targets of $120K-$125K and potentially as high as $180K-$250K by late 2025.

-

Range Continues: Bitcoin may trade between $105K and $110K for a while, building energy for potential movement.

-

Bearish Breakdown: A drop below $105K could lead to significant support around $100K, with potential further declines to the high $80Ks or low $90Ks, reflecting typical cycle corrections. A retracement to $90K-$95K could be a strong buying opportunity.

Whale Watch: Smart Money Behavior in the Current Market

In financial markets, following the “smart money” can provide an advantage. For Bitcoin, smart money often refers to large holders or institutional players—commonly known as whales. By analyzing their behavior through on-chain data and disclosures, traders can align their strategies with those who hold significant market influence.

As of mid-2025, whale activity shows a trend of accumulation. The number of addresses holding ≥1,000 BTC has risen to about 2,100, indicating new whales emerging or existing ones consolidating. Additionally, addresses with ≥$10 million in value increased by 4.23% after Bitcoin prices briefly exceeded $110K, suggesting that large investors see current prices as a good buying opportunity.

Institutional investment is also notable, with firms like BlackRock, Fidelity, and ARK collectively amassing substantial BTC holdings, contributing to a total of ~$94.17 billion in spot Bitcoin ETFs by May 2025. Companies such as MicroStrategy continue to add Bitcoin to their treasuries, reinforcing this accumulation trend.

On the flip side, some whales are hedging or taking profits, evidenced by old wallets moving ~20K BTC after years of dormancy. Additionally, significant short positions have been noted, indicating some skepticism about current prices, which could lead to a short squeeze if prices rise.

Whales also engage in complex strategies, utilizing derivatives markets and influencing prices to achieve their goals. Monitoring whale behavior during market dips is crucial, as their actions often indicate broader market trends.

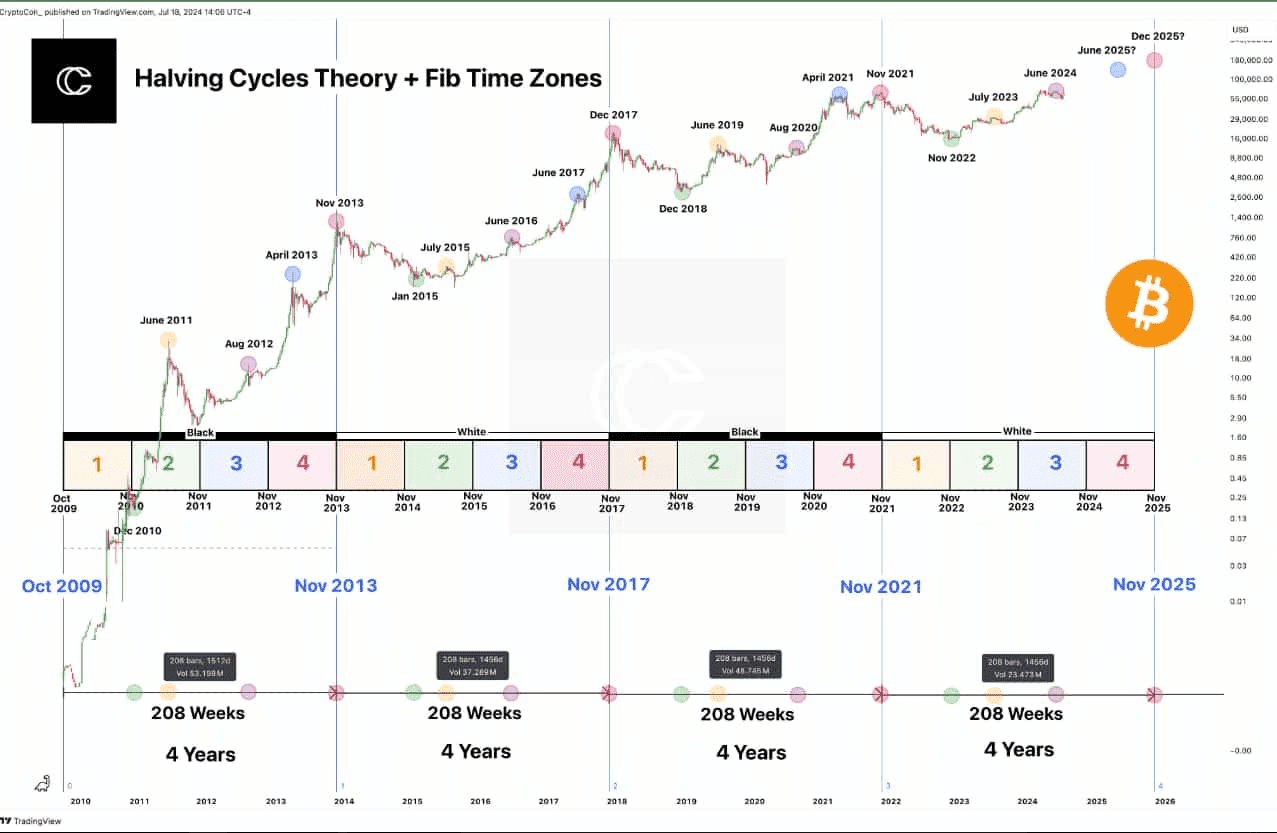

Price Prediction: BTC in Late 2025 and Beyond

Predicting Bitcoin's price for late 2025 is complex, but we can draw on various analyses to outline potential scenarios. Notable models include:

-

Stock-to-Flow (S2F): This controversial model anticipates prices surpassing $100K post-2024 halving, with some estimates as high as $288K.

-

Logarithmic Regression Bands: These suggest a slower but consistent upward trend, with late 2025 targets around $200K-$250K.

-

Fibonacci Extensions: Using historical lows and highs, targets range from $139K to around $171K based on different calculations.

-

Mayer Multiple or MVRV extremes: Historically, Bitcoin prices at cycle peaks have been 3-5x above the 200-day moving average, suggesting late 2025 prices could be $150K-$240K based on projections.

Beyond 2025 – Looking to Next Cycle: Many are curious what happens after this cycle peak. If one subscribes to the four-year cycle theory anchored around halvings, then after a 2025/26 top, Bitcoin might see a correction/bear market in 2026-2027, then a base in 2028 (around the next halving), and a new bull in 2029-2030. Each cycle historically brings diminishing percentage returns but still significant growth in absolute terms. For instance, if this cycle peak is ~$200K, a subsequent bear might bottom around, say, $60K-$80K (just hypothetical), and the next cycle could aim for maybe $500K+ (ARK’s lower band of $500K by 2030 fits that narrative).

Conclusion: Preparing for a Bitcoin Market Build-Up

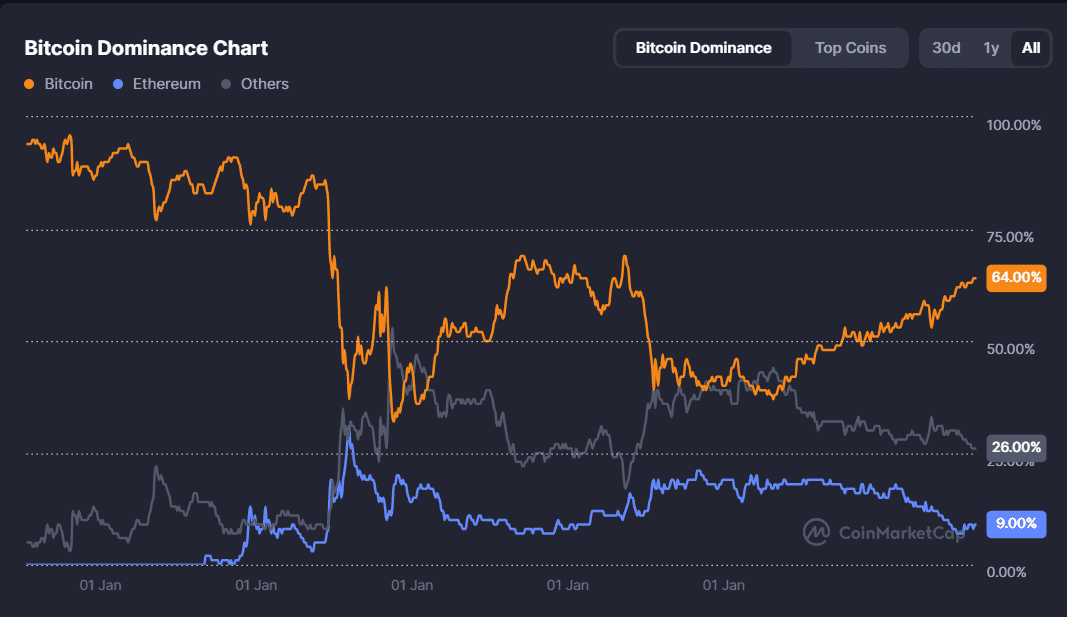

Bitcoin in 2025 represents a significant evolution, shaped by global trends, regulatory changes, and on-chain fundamentals. The current environment is favorable for Bitcoin, with pro-crypto legislation attracting institutional capital and major countries, like the U.S., promoting digital asset innovation.

Economically, there’s an expectation of lower interest rates and increased liquidity, conditions under which Bitcoin tends to excel. Concerns about fiat currency debasement further bolster its appeal as a non-sovereign store of value. On-chain metrics show strong signals: long-term holders are retaining supply, exchanges are low on coins, and savvy investors are buying on dips.

However, volatility remains a key aspect of crypto trading. To navigate the market successfully, traders should focus on:

-

Risk Management: Allocate wisely, implement stop-loss orders, and avoid over-leverage, as sharp corrections can occur.

-

Stay Informed: Monitor economic indicators, legislative developments, and market movements to make informed decisions.

-

Plan Your Strategy: Maintain a clear strategy whether day trading or holding long-term, using methods like dollar-cost averaging or range-trading.

-

Psychological Preparedness: Stay disciplined and grounded amidst market fluctuations, focusing on data rather than emotions.

As Bitcoin matures and integrates into the broader financial landscape, it presents new opportunities and challenges for traders. The journey from a fringe experiment to a recognized asset class highlights its growing acceptance and potential for long-term value. In this evolving market, adaptability and strategic insight will be crucial for success.