Introduction

The Consumer Price Index (CPI) is a vital economic indicator that measures inflation, influencing monetary policy and financial markets, including cryptocurrencies. For traders and investors, understanding CPI’s impact on Bitcoin (BTC) and other digital assets is essential to navigate market volatility. This guide explores CPI’s definition, its effects on crypto, and various scenarios to illustrate its influence, providing a foundation for informed trading decisions in 2025 and beyond.

What is CPI?

The Consumer Price Index (CPI) tracks price changes for a basket of goods and services, such as food, housing, and transportation. Compiled by the Bureau of Labor Statistics (BLS), it compares current prices to a base period, yielding a percentage change (e.g., 0.2% month-over-month). The Federal Reserve uses CPI to guide interest rate decisions, with high readings prompting hikes to curb inflation and low readings supporting cuts to stimulate growth.

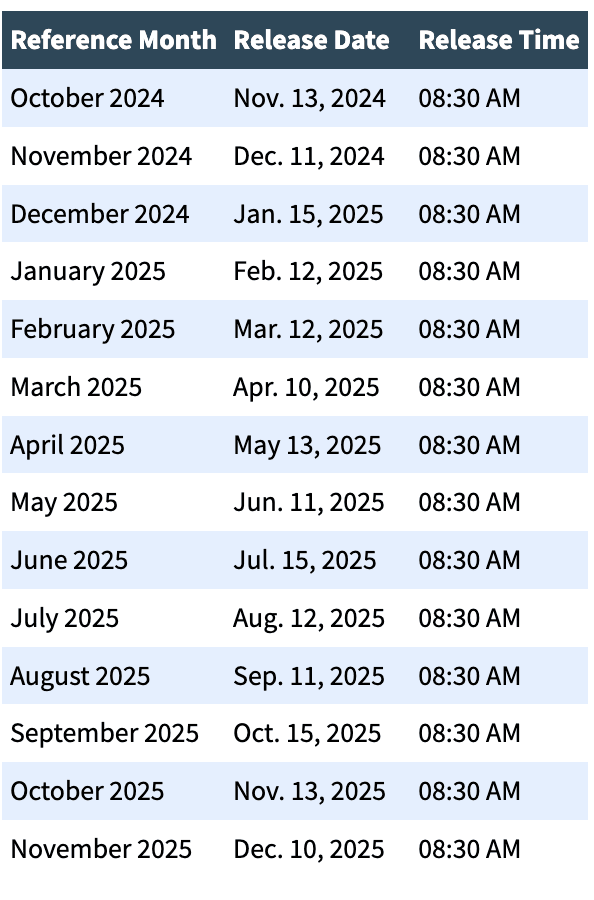

The CPI is released monthly by the BLS, typically mid-month, such as on June 11, 2025. This regular schedule allows markets to anticipate data-driven shifts, making it a consistent factor for crypto traders. For crypto, CPI shapes dollar strength and investor risk appetite, influencing BTC and altcoin valuations.

Schedule of Releases for the Consumer Price Index in 2025 (Source)

How CPI Affects Cryptocurrency

CPI influences cryptocurrency markets through several mechanisms:

Inflation Expectations

-

High CPI: Signals rising inflation, often leading to rate hikes that strengthen the US dollar. This can reduce demand for risk assets like BTC, lowering prices.

-

Low CPI: Indicates controlled inflation, potentially weakening the dollar and boosting crypto prices as investors seek alternative assets.

Monetary Policy

Rate hikes in response to high CPI increase borrowing costs, pressuring crypto prices. Conversely, rate cuts following low CPI enhance liquidity, supporting price gains.

Investor Sentiment

High CPI may trigger caution, reducing risk appetite, while low CPI can encourage investment in crypto as a hedge against fiat devaluation.

Scenarios of CPI Impact

High Inflation Scenario

-

If CPI Rises Sharply: A CPI above 3% annually may lead to aggressive rate hikes. This strengthens the dollar, reducing BTC demand and potentially lowering prices. Investors may shift to safer assets like bonds.

-

Why: Higher rates increase borrowing costs, dampening risk appetite and favoring traditional investments.

Low Inflation Scenario

-

If CPI Falls: A CPI below 2% annually suggests controlled inflation, prompting accommodative policy. This weakens the dollar, boosting BTC prices as investors seek higher returns.

-

Why: Lower rates increase liquidity, encouraging investment in risk assets like crypto.

Stable Inflation Scenario

-

If CPI Remains Stable: A CPI of 2-3% annually supports consistent policy, stabilizing crypto markets. BTC prices may see moderate fluctuations, ideal for long-term investors.

-

Why: Stable conditions balance risk and reward, reducing extreme volatility.

Other Key Economic Indicators

Beyond CPI, other US indicators influence crypto markets:

-

Producer Price Index (PPI): Tracks producer cost changes, often foreshadowing CPI shifts. Rising PPI may signal future inflation, impacting crypto similarly to CPI.

-

Initial Jobless Claims: Reflects labor market health. Lower claims suggest economic strength, potentially leading to tighter policy and lower crypto prices.

-

Consumer Sentiment Index: Measures confidence. In April 2025, it dropped to 86.0, a low since 2011, signaling caution that may reduce crypto demand.

Understanding Economic Data Releases

Economic data releases can drive crypto market volatility. To prepare:

-

Monitor Forecasts: Check consensus expectations to anticipate reactions.

-

Analyze History: Study past market responses to similar data.

-

Track Policy: Understand how data influences central bank decisions.

Trading Strategies for Economic Data

Navigate CPI and other data releases with these strategies:

-

Pre-Release Preparation: Review forecasts. If CPI is expected to exceed consensus, consider short positions; if below, plan long positions.

-

Post-Release Actions: Act on data surprises. A low CPI may warrant buying BTC; a high CPI may suggest selling.

-

Volatility Management: Use options to hedge price swings. Call options suit low CPI scenarios; put options fit high CPI.

-

Risk Management: Set stop-loss orders to limit losses and diversify to reduce exposure.

Further reading: Hedging Bitcoin: 5 Risk Management Strategies in Crypto Trading

Conclusion

The Consumer Price Index (CPI) and related economic indicators are pivotal in shaping cryptocurrency markets. By understanding CPI’s role in inflation, monetary policy, and investor sentiment, traders can anticipate price movements and adapt strategies. Whether facing high, low, or stable inflation, staying informed about these indicators is crucial for success in the dynamic crypto landscape. Explore further resources in Phemex Academy to deepen your market knowledge and keep up to date with all the major events in crypto.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry inherent risks due to market volatility, regulatory uncertainty, and technological factors. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. Phemex does not endorse or guarantee the performance of any token or project.