Key Takeaways

-

LayerZero is an omnichain interoperability protocol facilitating secure, censorship-resistant messaging across 70+ blockchains.

-

The protocol has processed over $50 billion in volume and 130 million messages via immutable smart contracts.

-

ZRO is a fixed-supply utility token (1 billion cap) with 38.3% dedicated to the community.

-

ZRO holders participate in a unique on-chain fee-switch referendum every six months.

-

Strategic partners including a16z, Sequoia, and Tether support the protocol’s long-term infrastructure.

Quick Facts

-

Ticker Symbol: ZRO

-

Chain: Omnichain (Deployment on Ethereum, Arbitrum, BNB Chain, Avalanche, etc.)

-

Contract Address: 0x6985884c4392d348587b19cb9eaaf157f13271cd (EVM)

-

Circulating Supply: ~250,000,000 (Based on initial unlock data)

-

Total Supply: 1,000,000,000

-

Primary Use Case: Governance, protocol fee alignment, and cross-chain utility.

What Is LayerZero (ZRO)?

LayerZero is a decentralized, omnichain interoperability protocol designed to allow different blockchains to communicate seamlessly. In the current industry, blockchains often function as isolated ecosystems. LayerZero acts as a messaging layer that enables these "islands" to share data and assets without relying on centralized intermediaries.

LayerZero explained simply is a network of immutable smart contracts called "Endpoints." Since its V1 launch in 2022 and V2 in 2024, the protocol has achieved significant scale, with over 200 applications sending more than 130 million messages. For those wondering what is LayerZero, it is essentially a permanent piece of digital infrastructure that ensures data packets moving between chains cannot be tampered with or censored. This has led to the protocol handling over $50 billion in total volume across more than 70 blockchains.

How Many ZRO Are There?

The ZRO price and market dynamics are governed by a transparent and fixed supply model.

-

Max vs. Circulating Supply: ZRO has a fixed total supply of 1,000,000,000 tokens. No further tokens can be minted.

-

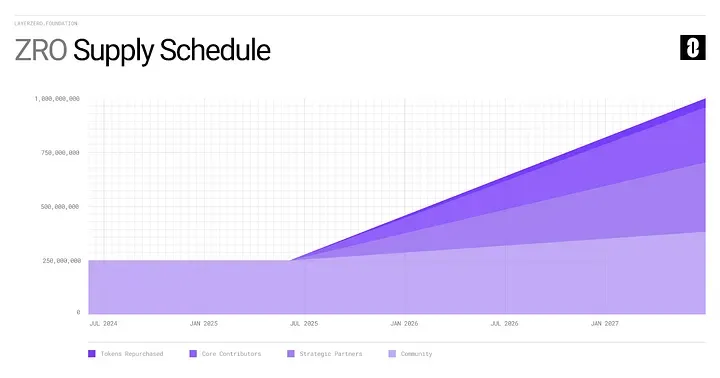

Token Allocation:

-

38.3% Community: This includes retroactive initiatives (8.5% claimed at launch), future initiatives (15.3%), and ecosystem growth (14.5%).

-

32.2% Strategic Partners: Investors and advisors under a 3-year vesting schedule (1-year lock followed by 2-year monthly unlock).

-

25.5% Core Contributors: The development team, also subject to a 3-year vesting period.

-

4.0% Repurchased: Tokens bought back by LayerZero Labs and pledged to the community.

-

-

Inflationary or Deflationary: The supply is capped. If the community votes to activate the "fee-switch," protocol fees are collected and burned, which could introduce deflationary characteristics.

Source:LayerZero

What Does ZRO Do?

The primary ZRO use case is to transition LayerZero into a publicly owned, immutable infrastructure.

-

Governance Referendums: Every six months, ZRO holders participate in an on-chain referendum to vote on the "fee-switch." This allows the community to decide if the protocol should collect fees.

-

Protocol Fees: If the fee-switch is active, fees equal to the cost of verification and execution are collected. These fees are subsequently burned, aligning token holders with protocol usage.

-

Ecosystem Alignment: ZRO serves as the foundational asset for developers building Omnichain Applications (OApps) and Omnichain Fungible Tokens (OFTs), ensuring they are stakeholders in the network's security.

ZRO vs. Bitcoin

While Bitcoin is often viewed as "digital gold," ZRO serves as the "logistics layer" for the multi-chain world.

| Feature | Bitcoin (BTC) | LayerZero (ZRO) |

| Primary Use Case | Store of Value / Digital Currency | Omnichain Interoperability & Governance |

| Network Type | Layer-1 Blockchain | Messaging Protocol (Layer-0) |

| Consensus/Security | Proof of Work (Miners) | Endpoints & Decentralized Verifier Networks |

| Supply Dynamics | Fixed (21 Million) | Fixed (1 Billion) |

| Governance | Social Consensus / Hard Forks | On-chain Referendums (Fee-switch) |

| Transaction Focus | Asset Transfer (BTC) | Cross-chain Messaging & Data |

Comparing ZRO vs. Bitcoin highlights the difference between a standalone asset and a protocol designed to connect all assets across the blockchain spectrum.

The Technology Behind ZRO

LayerZero's infrastructure is built to be permanent and tamper-proof.

-

Endpoints: These are immutable smart contracts residing on each supported chain. They handle the sending, verifying, and receiving of messages.

-

DVNs (Decentralized Verifier Networks): These act as independent security layers. Applications can choose which DVNs they trust to verify their messages, creating a modular security environment.

-

LayerZero v2: The 2024 upgrade introduced improved gas efficiency and "Pre-Crime" security, which allows the protocol to stop malicious transactions before they are finalized on the destination chain.

-

Zero Network: LayerZero is also expanding into TradFi with the "Zero" network, utilizing zero-knowledge proofs to facilitate institutional adoption with high throughput and low costs.

Team & Origins

LayerZero Labs was co-founded by Bryan Pellegrino (CEO), Ryan Zarick (CTO), and Caleb Banister. Their goal was to move beyond the limitations of "bridge" technology toward a more robust messaging standard.

The project has attracted significant institutional support. News about ZRO often highlights its strategic partners, which include industry giants like Tether, ARK Invest, and Citadel Securities. These partners participate in a three-year vesting framework, indicating a long-term commitment to the protocol’s development as a standard for digital asset transfer.

Key News & Events

-

Token Launch (June 20, 2024): ZRO became claimable, marking the protocol’s move toward decentralization.

-

Sybil Filtering Success: LayerZero implemented a rigorous filtering process, including self-reporting and bounty hunting, to ensure that tokens were distributed to "durable" users rather than automated bots.

-

TradFi Expansion: The announcement of the Zero network, backed by partners like the Intercontinental Exchange (ICE), signals a move to integrate blockchain with Wall Street structure.

-

Protocol Growth: Reaching the milestone of 70+ supported blockchains and $50 billion in cumulative volume.

Monitoring these milestones is helpful for those looking to trade ZRO during periods of high ecosystem activity.

Is ZRO a Good Investment?

Evaluating the ZRO investment potential involves looking at its role as a fundamental piece of blockchain infrastructure.

Opportunities:

-

Widespread Adoption: With over 54,000 OApp contracts deployed, LayerZero has high developer "stickiness."

-

Institutional Backing: The involvement of major financial firms provides a level of institutional credibility rare in the altcoin space.

-

Fixed Supply: The cap of 1 billion tokens prevents long-term supply inflation.

Risks:

-

Vesting Schedules: Significant portions of the supply held by partners and contributors will unlock over the next three years.

-

Market Volatility: As with all crypto assets, the ZRO price is subject to broader market trends and regulatory shifts.

Disclaimer: Crypto trading involves risks; only invest what you can afford to lose. This information is for educational purposes and does not constitute financial advice.

How to Buy ZRO on Phemex?

If you want to participate in the LayerZero ecosystem, you can trade ZRO on Phemex by following these steps:

-

Register/Login: Access your Phemex account.

-

Deposit Assets: Transfer USDT or other supported assets to your Spot wallet.

-

Market Search: Navigate to the "Markets" tab and search for the ZRO/USDT trading pair.

-

Execute: Review the current ZRO price and place your Buy order.

For a more comprehensive walkthrough, visit our dedicated "How to buy ZRO" page.

FAQs

1. Who controls the LayerZero protocol?

LayerZero is designed as immutable infrastructure. While LayerZero Labs led development, the ZRO token launch handed governance over the fee-switch and protocol alignment to the community.

2. Is ZRO a deflationary token?

ZRO has a fixed supply. It can become deflationary if the community votes to activate the fee-switch, which causes protocol fees to be burned.

3. What chains does LayerZero support?

As of now, LayerZero supports over 70 blockchains, including major networks like Ethereum, BNB Chain, Polygon, Arbitrum, and many emerging Layer-2 solutions.