Key Takeaways

-

A Unified Supernetwork: Hemi is a modular Layer-2 protocol that treats Bitcoin and Ethereum not as separate silos, but as components of a single, interoperable supernetwork.

-

Innovative Technology: Its core is the Hemi Virtual Machine (hVM), which embeds a full Bitcoin node within an EVM, enabling smart contracts to interact with Bitcoin's state natively.

-

Unlocking Bitcoin DeFi (BTCFi): Hemi allows developers to build dApps using native Bitcoin for complex financial operations like staking, lending, and escrow without relying on centralized or risky bridges.

-

Superior Security: The network uses a novel Proof-of-Proof (PoP) consensus mechanism to anchor its state to the Bitcoin blockchain, achieving "superfinality" where transactions become as secure as Bitcoin's own.

-

Available on Phemex: HEMI is available for both spot and futures trading on Phemex, offering users a secure platform to engage with this forward-thinking project.

Summary Box (Quick Facts)

-

Ticker Symbol: HEMI

-

Chain: Ethereum

-

Contract Address: 0xeb964a1a6fab73b8c72a0d15c7337fa4804f484d

-

Circulating Supply: 977.5M

-

Max Supply: 10B

-

Primary Use Case: Interoperability, Bitcoin DeFi (BTCFi), Governance

-

Current Market Cap: $159.76M

What Is Hemi?

For years, the blockchain industry has operated with a fundamental divide between its two largest networks. Bitcoin established itself as the pinnacle of security and a store of value, but with minimal programmability. Ethereum, conversely, became the hub for smart contracts and developers but never attained Bitcoin's level of security. Hemi explained simply, is the project designed to permanently erase this divide.

Rather than follow the old playbook of building centralized bridges or compromising on security, Hemi introduces a new model. It is a Layer-2 (L2) protocol that integrates Bitcoin and Ethereum into a single supernetwork. By deploying a modular approach and embedding a full Bitcoin node directly into an Ethereum-compatible Virtual Machine (the hVM), Hemi creates an environment where the states of both blockchains coexist natively. This innovation paves the way for truly interoperable decentralized applications (dApps), unlocking the next generation of Bitcoin DeFi.

How Many HEMI Are There?

The Hemi ecosystem is powered by its native utility token, HEMI. The tokenomics are designed to support long-term growth and decentralization.

-

Max vs. Circulating Supply: HEMI has a fixed maximum supply of 10 billion tokens. The circulating supply is currently 977.5 million tokens.

-

Token Distribution: The total supply is strategically allocated to foster a healthy ecosystem: 32% to the community and ecosystem, 28% to investors and partners, 25% to the team, and 15% to the Hemispheres Foundation.

What Does HEMI Do?

The HEMI token is integral to the functioning and governance of the Hemi network. It serves several critical functions within the ecosystem, making it a multifaceted utility token.

-

Governance: HEMI holders can participate in the protocol's governance, voting on proposals for network upgrades and changes.

-

Network Security and Staking: Users can stake HEMI to help secure the network. Participants in the consensus mechanism are rewarded in HEMI for their contributions.

-

Gas Fees: The HEMI token will be used to pay for transaction fees on the network.

The primary HEMI use case is to facilitate the seamless interaction between the Bitcoin and Ethereum blockchains, enabling a wide range of new applications.

Hemi vs. Ethereum

While Hemi integrates with Ethereum, its fundamental approach and goals set it apart, particularly in its relationship with Bitcoin.

| Feature | Hemi | Ethereum |

| Technology | Layer-2 protocol that leverages both Bitcoin and Ethereum. Uses a unique Proof-of-Proof (PoP) consensus. | A standalone Layer-1 blockchain with its own Proof-of-Stake consensus mechanism. |

| Use Case | Specialized focus on interoperability between Bitcoin and Ethereum to unlock Bitcoin DeFi (BTCFi). | A general-purpose smart contract platform for a wide range of decentralized applications (dApps). |

| Speed and Fees | Designed for faster transaction speeds and lower costs as a Layer-2 solution. | Can experience network congestion and higher fees, although Layer-2 solutions help mitigate this. |

| Decentralization & Security | Inherits security from the Bitcoin blockchain through its PoP mechanism, offering high decentralization. | A highly decentralized and secure network, but its security is independent of Bitcoin's. |

The Technology Behind Hemi

Hemi's groundbreaking approach to decentralized interoperability is made possible by its sophisticated architecture, which includes several key technological innovations:

-

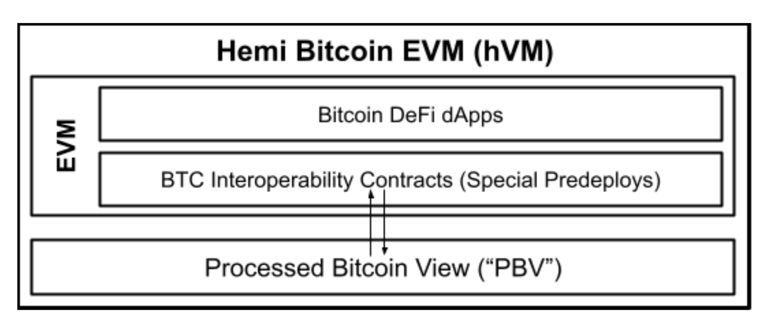

Hemi Virtual Machine (hVM): At the project's core is the hVM, an execution environment that integrates a fully operational Bitcoin node directly within what otherwise functions like a standard EVM. This allows smart contracts to natively read and interact with Bitcoin's state—like confirmations, UTXOs, and block headers—using familiar languages like Solidity. This removes the reliance on risky external oracles or intermediaries.

Source: Hemi Whitepaper

-

Hemi Bitcoin Kit (hBK): To accelerate development, Hemi offers the hBK, a dedicated toolkit with developer-friendly APIs and libraries. It simplifies complex Bitcoin operations, allowing developers to query Bitcoin's state and build Bitcoin-aware applications more rapidly and reliably.

-

Proof-of-Proof (PoP) Consensus: Hemi uses a hybrid consensus mechanism that links the network's state to the Bitcoin blockchain. Decentralized participants known as PoP Miners periodically publish Hemi's state proofs into Bitcoin transactions. This process anchors Hemi's history to Bitcoin's Proof-of-Work, meaning that to alter Hemi's finalized blocks, an attacker would have to successfully attack Bitcoin itself. This gives Hemi transactions "superfinality."

-

A Multi-Node Architecture: The network is operated by several specialized nodes:

-

Bitcoin-Secure Sequencers (BSS): Manage the consensus layer and produce new blocks on the Hemi L2.

-

Bitcoin Finality Governors (BFGs): Orchestrate the security relationship by analyzing Bitcoin for Hemi's state proofs and determining the network's finality status.

-

PoP Miners: Secure the network by embedding the state proofs into the Bitcoin blockchain.

-

What Can Be Built with Hemi?

By merging Bitcoin’s security and Ethereum’s programmability, Hemi enables an entirely new class of dApps that were previously impossible. Examples include:

-

Trustless Bitcoin (Re)Staking Protocols: Enable native Bitcoin or Bitcoin-derived assets to be used to secure other protocols, generating yield.

-

Non-Custodial BTC Escrow and Lending: Create lending markets that use native BTC as collateral without ever needing to wrap it or send it to a custodian.

-

Non-Custodial Exchanges: Allow users to trade Bitcoin-based assets like BRC-20s, Runes, and Ordinals without the assets ever leaving the Bitcoin network.

-

Bitcoin MEV Marketplaces: Connect Bitcoin users and miners in a marketplace where transaction fees can be paid in any asset, enabling advanced transaction ordering.

Team & Origins

Hemi was co-founded by two prominent figures in the blockchain industry: Jeff Garzik, an early Bitcoin core developer, and Maxwell Sanchez, the inventor of the Proof-of-Proof consensus protocol. Hemi Labs, the company behind the project, completed a $15 million funding round in September 2024, co-led by prominent investors including Breyer Capital and Big Brain Holdings.

Is HEMI a Good Investment?

Discussing the HEMI investment potential requires looking at its unique market position. For years, the only way to use BTC in DeFi was through wrapped versions like WBTC, which introduced centralization and custody risks. The rise of Bitcoin L2s aims to solve this, but many solutions make trade-offs in security or programmability.

Hemi's approach is different. By treating Bitcoin and Ethereum as components of one supernetwork, it aims to offer the best of both worlds without compromise. Its technology allows it to offer a general-purpose platform that natively incorporates Bitcoin’s ledger into an EVM environment. This technical superiority, combined with its experienced team and strong investor backing, gives it a powerful competitive edge.

However, as with any cryptocurrency, investing in HEMI carries risks. The crypto market is volatile, and the L2 space is highly competitive.

Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.

How to Buy HEMI on Phemex

For those interested in acquiring HEMI, Phemex offers a secure and user-friendly platform. If you're wondering how to buy Hemi, you can follow the steps outlined on the dedicated page on Phemex's website. To get started, you will need to create a Phemex account, complete the necessary verification, and fund your account. From there, you can navigate to the spot or futures market to trade Hemi.

Ready to Trade?

Ready to explore the future of Bitcoin DeFi? Trade HEMI Now on Phemex or dive deeper into crypto concepts at the Phemex Academy.

FAQs

What problem does Hemi solve?

Hemi addresses the lack of interoperability and programmability between Bitcoin and Ethereum. It allows developers to build applications that leverage Bitcoin's security and liquidity with Ethereum's smart contract capabilities, unlocking the potential for native Bitcoin DeFi.

What is Proof-of-Proof (PoP)?

Proof-of-Proof is Hemi's unique consensus mechanism that allows it to inherit Bitcoin's security. It works by having decentralized miners periodically publish Hemi's network state to the Bitcoin blockchain, ensuring Hemi's transaction history is ultimately secured by Bitcoin's massive hash power.

Can I use actual Bitcoin on Hemi?

Yes, one of Hemi's main advantages is that it allows for the use of native Bitcoin in DeFi applications. Through its hVM and architecture, you can lend, stake, and use your Bitcoin in various dApps without needing to convert it into a wrapped or synthetic asset.