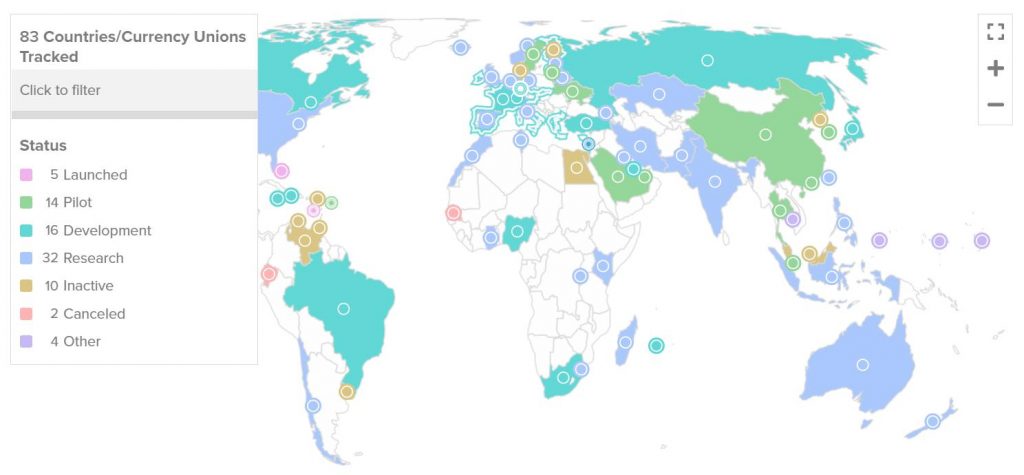

As cryptocurrencies such as Bitcoin, Ethereum, and a plethora of altcoins have risen in popularity over the past four years, the concept of creating digital currencies for countries to use themselves has also come to the spotlight. This comes especially as central bankers ask themselves whether it makes sense to create their own digital money. At the moment 81 countries (representing over 90% of global GDP) are now exploring CBDCs.

On the other hand, cryptocurrencies are very special and are an innovation that has the potential to lift people out of poverty and to bank the unbanked. Also, their features are not easy to replicate, and each crypto has its own unique properties.

Although sovereign digital currencies may be able to replicate some of these features by using blockchain technology, they will not be able to fully implement some of the most attractive features of cryptos, i.e., anonymity, decentralization, and governance.

What is a Central Bank Digital Currency (CBDC)?

A Central Bank Digital Currency (CBDC) is the digital form of a country’s fiat currency that is also a claim on the central bank. Instead of printing money, the central bank issues electronic coins or accounts backed by the full faith and credit of the government.

The wake-up call for CBDCs came following the announcement of Facebook’s Libra project. Before this, central banks were looking at digital currencies with caution and at a distance. This was because they saw them as limited in size and scale and not fully relevant to monetary policy and financial stability. However, as hindsight is 20/20, they were wrong.

Read What Is a Central Bank Digital Currency? to learn more.

How are CBDCs Different From Cryptocurrencies?

While cryptocurrencies (like Bitcoin or Ethereum) are decentralized and run on their own blockchain, CBDCs are controlled by the entity issuing them, which will either be the central bank or the government.

Some of the major differences between CBDCs and cryptos include:

- First, CBDCs use a permissioned blockchain network while cryptocurrencies use a permissionless one.

- Second, the identity of CBDC users is known while cryptocurrency users remain anonymous.

- Third, the issuing authorities like central banks will decide on the rules for CBDCs while for crypto networks the users control the network by making consensus decisions.

- Fourth, at the moment CBDCs can only be used for payments, transactions, and other wholesale activities, while cryptocurrencies can be used as payments as well as speculative investment assets.

What are some advantages of using CBDCs?

Central Bank Digital Currencies have many advantages, and actually many countries today are already using digital money in their daily lives without necessarily realizing it. According to the IMF, CBDCs are more cost-efficient than physical cash as they have lower transaction costs; they can promote financial inclusion, which means those who are unbanked can get easier and safer access to money on their phone; they can compete with private companies that need incentives to meet transparency standards and limit illicit activity, and they can help monetary policy flow more quickly and seamlessly.

This graphic by the American think tank Atlantic Council shows the status of central bank digital currency development worldwide. (Source: Atlantic Council)

However, many people ask the question: why don’t banks just use cryptocurrencies? The answer is always this: one of the most well-known issues in crypto and cryptocurrency markets is their volatility. In addition, they are unregulated. And although stablecoins make up for a good alternative, recent news tells us they aren’t fully reliable and audited either. Therefore, it’s not easy and not yet viable to just import cryptocurrencies into the economy and replace the traditional banking system.

While CBDCs are similar to stablecoins, they are regulated and more likely to be backed by a reserve asset (fiat, gold, or other items) to maintain their value.

CBDC and crypto trends in the global economy

There are many reasons to explore virtual currencies. Of course, a big part of this assessment depends on the economic situation within a country. Recently, there have been numerous announcements by various countries saying they will start exploring digital currencies as well as putting forward crypto legislation.

What is Digital Yuan?

For example, China recently developed its own version of a CBDC called the Digital Yuan. Potentially, as a reason to ensure their CBDC is adopted throughout the country, they have put up huge restrictions, nearing an all-out ban on cryptocurrencies. A while back, the Bank of England also published a report on creating a CBDC in the near future. Although the country hasn’t put an outright ban on cryptocurrencies, some payments to crypto exchanges are being banned by several local banks of England. A similar situation is also unfolding in India. RBI, the central bank of India, recently announced a plan for creating Digital Rupee. As a result, direct transfers to Indian crypto exchanges have also been blocked by many banks.

On the other hand, countries that have in some ways adopted cryptocurrencies don’t have any plans to develop CBDC. While El Salvador is the only country to support this statement, nations with crypto-friendly regulations like Singapore, Switzerland, and Malta haven’t considered launching their own digital currency.

Conclusion

CBDCs are in some ways antithetical to cryptocurrencies because they are developed and controlled by a central entity. However, CBDCs have the potential to move the world closer to digital currencies, which can then pave a way for further cryptocurrency adoption.

Read More

- What Is a Central Bank Digital Currency?

- What Are Virtual Currencies: Weakening of Cash

- What is Cryptocurrency & How It Differs From Digital Cash

- What Are Govcoins? Reclaiming the State’s Power

- Digital Payments and Currencies

- DeFi vs. CeFi: Understand The Differences

- What is Cryptocurrency & How does it Work?

- Why Does Bitcoin Have Value?