In the relentless march of decentralized finance, there are moments that serve as inflection points—pivotal decisions that signal a protocol's transition from a rebellious experiment into a mature, enduring piece of global financial infrastructure. The Uniswap Foundation's recent proposal to establish DUNI, a new legal entity for its governance organization under Wyoming's innovative DUNA framework, is precisely one of those moments.

On the surface, the proposal seems like administrative housekeeping: allocate $16.5 million in UNI to a new entity to cover past tax liabilities and establish a legal defense fund. Yet, beneath this seemingly mundane request lies a profound reckoning with the core paradox of DeFi: how does a protocol that prides itself on being a "decentralized, ownerless" public good, navigate the very real-world challenges of legal liability, taxation, and effective treasury management in a system built for centralized entities?

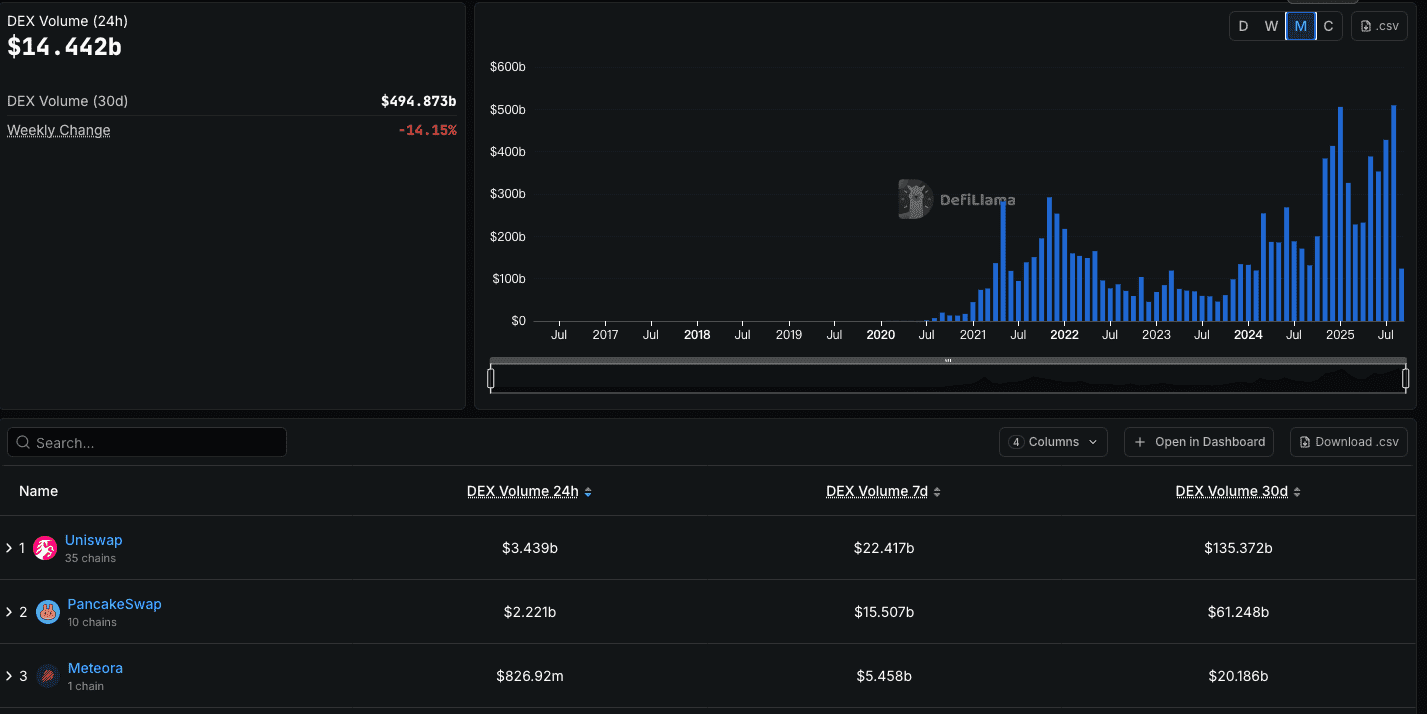

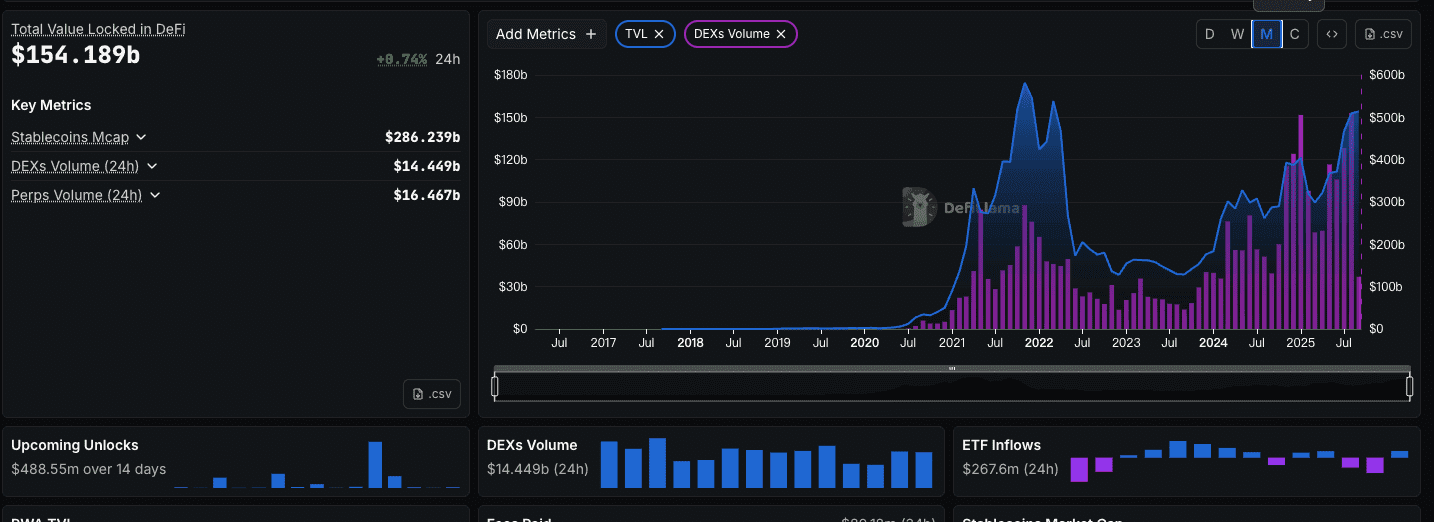

The creation of DUNI is far more than a legal maneuver. It is a strategic masterstroke, a necessary compromise, and a flashing beacon for the entire DeFi industry. It represents the moment the largest and most important decentralized exchange, having reclaimed its throne with a staggering $111.8 billion in monthly volume in August 2025, acknowledges that pure, unshielded decentralization is no longer a viable long-term strategy in the face of a rapidly maturing regulatory landscape.

Why is this happening now? What are the profound benefits and hidden risks of wrapping a decentralized DAO in a corporate shell? And what does Uniswap's journey, compared to the paths of competitors like PancakeSwap, Aerodrome, and Hyperliquid, tell us about the future of DEX governance and survival? This is not just a story about a legal entity; it is a story about the future of DeFi itself.

The Genesis of the Problem - A History of Uniswap's Success and Vulnerability

To understand the necessity of DUNI, we must first appreciate the history of Uniswap. Born in 2018 from Hayden Adams' vision of a fully automated, on-chain market maker, Uniswap was the epitome of the "code is law" ethos. Its V1 and V2 smart contracts were immutable, unstoppable, and truly permissionless. Anyone could create a market, anyone could provide liquidity, and no one, not even its creators, could turn it off. This radical decentralization was its superpower, leading to an explosion of innovation known as "DeFi Summer" in 2020.

The launch of the UNI governance token in September 2020 was the protocol's first step into the complex world of community ownership. It created the Uniswap DAO, a sprawling, global collective of token holders theoretically responsible for stewarding the protocol's future. The Uniswap Foundation (UF) was later established as an independent entity to support the growth of the ecosystem, funded by a grant from the DAO.

However, this structure created a critical ambiguity.

-

The protocol was decentralized and immutable.

-

The DAO was a decentralized, amorphous collection of token holders.

-

The Foundation was a centralized, traditional entity.

Who was truly responsible? If the DAO voted to, for instance, implement a new fee structure, who would be legally responsible for the tax implications of that revenue? If a regulator decided to take action against "Uniswap," who would they serve papers to? The token holders? The Foundation? The largest delegates?

This ambiguity was a feature in the early, "wild west" days of DeFi. It provided a form of plausible deniability. But as Uniswap grew into a financial behemoth processing over a trillion dollars in lifetime volume, this ambiguity transformed from a shield into a glaring vulnerability. Every success magnified the target on its back.

The most critical issue became the "fee switch." The Uniswap protocol has a built-in mechanism that would allow the DAO to divert a small portion of the LP fees to the DAO treasury. Activating this switch would provide the DAO with a sustainable revenue stream, funding future development and security. However, for years, this powerful tool has remained dormant. Why? The primary reason has been legal uncertainty. Activating the fee switch could be interpreted by regulators, particularly the SEC, as turning UNI tokens into securities, as holders would then be profiting from the efforts of a common enterprise. The lack of a clear legal entity to receive and manage these funds, and to shield participants from liability, created a state of perpetual paralysis.

The DUNI Solution - Wyoming's DUNA Framework as a Shield and a Sword

The DUNI proposal is a direct and elegant solution to this paralysis. It leverages a pioneering piece of legislation from the state of Wyoming: the Decentralized Unincorporated Nonprofit Association (DUNA) framework.

A DUNA is a novel legal structure designed specifically for DAOs. It grants a DAO legal personhood, allowing it to enter into contracts, open bank accounts, and, most importantly, pay taxes. Critically, it also provides a liability shield for its members (the token holders). This means that if the DAO were to face legal action, the lawsuit would be against the DUNA entity itself, not the individual token holders.

The proposal is to create DUNI, a Wyoming DUNA, which would effectively serve as the legal and financial arm of the Uniswap DAO's governance.

Why is this a game-changer?

-

It De-Risks DAO Participation: The single greatest barrier to sophisticated participation in DAO governance is personal liability. No large fund, family office, or even responsible individual wants to expose their entire net worth to potential legal action simply for voting on a governance proposal. The DUNA framework erects a corporate veil, protecting token holders and encouraging more professional and active participation in governance.

-

It Solves the Tax Problem: The allocation of $16.5 million in UNI to DUNI is not just about funding; it's about settling the past and preparing for the future. It allows the organization to address any historical tax liabilities accrued by the DAO's activities and establishes a compliant structure for managing future tax obligations. This is a crucial step towards operating as a legitimate, long-term financial entity.

-

It Unlocks the Fee Switch: This is the ultimate prize. The Uniswap Foundation's announcement explicitly states that adopting the DUNA framework "will pave the way for Uniswap to turn on its protocol fee." With DUNI as the legal recipient of these fees, the DAO can finally activate its sustainable revenue stream without thrusting its token holders into a legal gray area. This transforms the DAO from a grant-dependent organization into a self-sustaining economic engine.

The establishment of DUNI is, therefore, both a shield and a sword. It is a shield that protects participants from liability and a sword that allows the DAO to finally capture the value it creates.

The Broader Landscape - A Comparative Analysis of DEX Governance

Uniswap's move towards a formal legal structure is not happening in a vacuum. It is a response to the evolving competitive landscape and the different paths its rivals have taken.

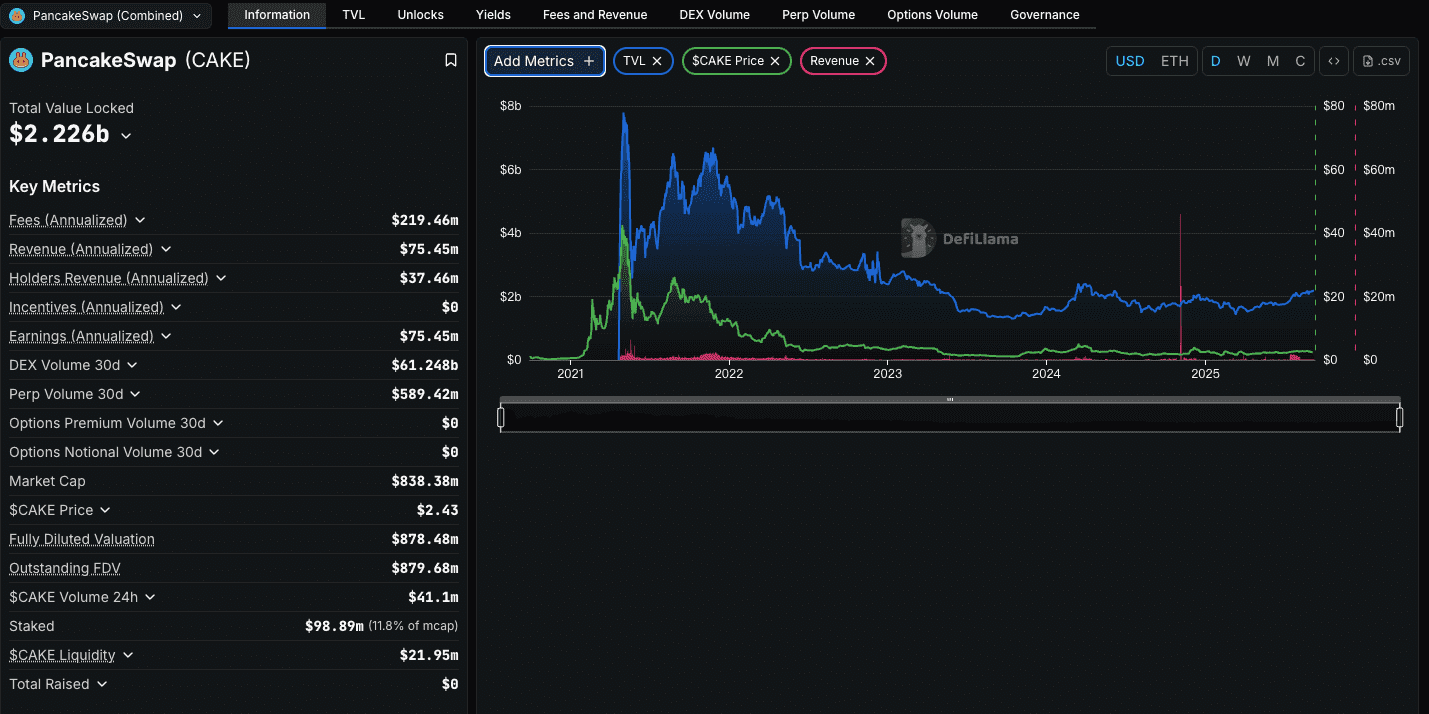

PancakeSwap: The Pragmatic, Centralized Approach

PancakeSwap, the dominant DEX on the BNB Chain, has always taken a more pragmatic and centralized approach. While it has a DAO and a governance token (CAKE), its development and strategic direction have been heavily guided by a core, albeit anonymous, "Kitchen" team. This centralized leadership allows for rapid decision-making and product iteration, a key reason for its early success. However, it comes at the cost of true decentralization and exposes the core team to significant regulatory risk, which is a trade-off Uniswap has always been hesitant to make. DUNI is Uniswap's attempt to achieve PancakeSwap's operational effectiveness without sacrificing its decentralized ethos.

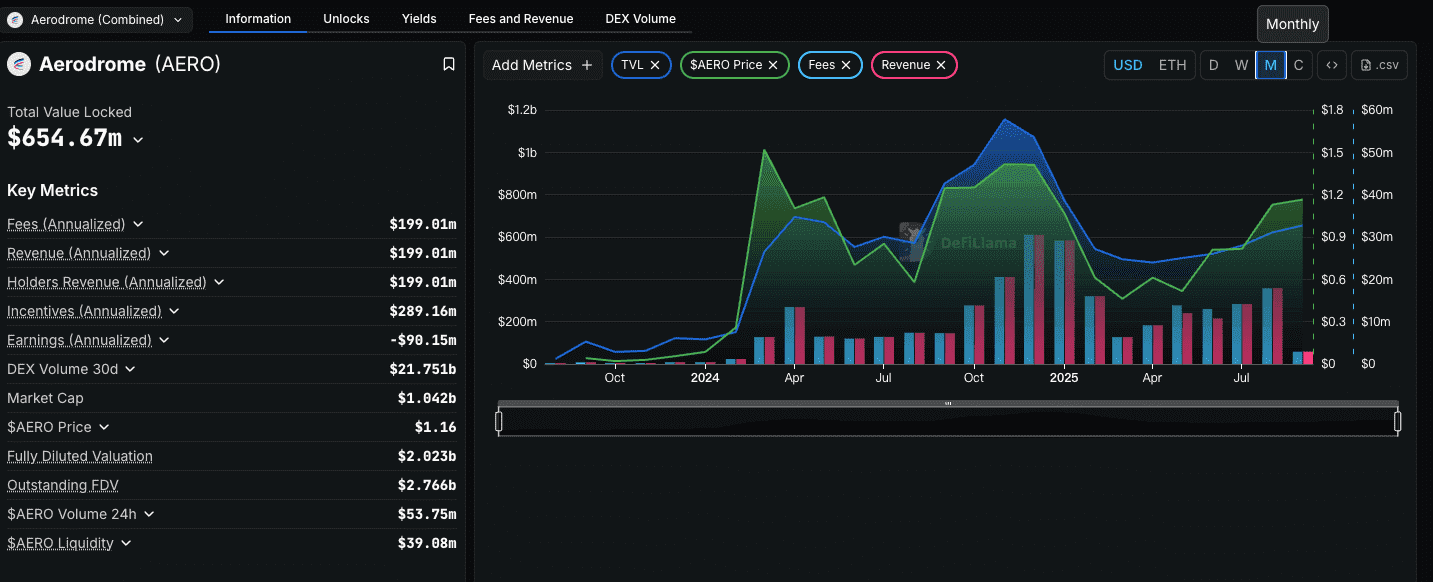

Aerodrome: The Modern "Vote-Escrow" Model

Aerodrome, the leading DEX on the Base network, represents the cutting edge of DeFi economic design. It is built on the "vote-escrow" (ve) model pioneered by Curve, where token holders lock their tokens (AERO) in exchange for voting power to direct emissions (rewards) to specific liquidity pools. This creates a vibrant, competitive meta-game where protocols bribe AERO lockers to vote for their pools. This model is incredibly effective at bootstrapping liquidity and creating a sustainable fee-driven model for the DAO from day one.

However, the legal status of these bribes and the revenue generated by the DAO remains a significant gray area. Aerodrome's success highlights the economic power of what Uniswap is trying to unlock with the fee switch, but it does so without the robust legal framework that DUNI aims to create. Uniswap is choosing to solve the legal problem first, before fully embracing these complex economic games.

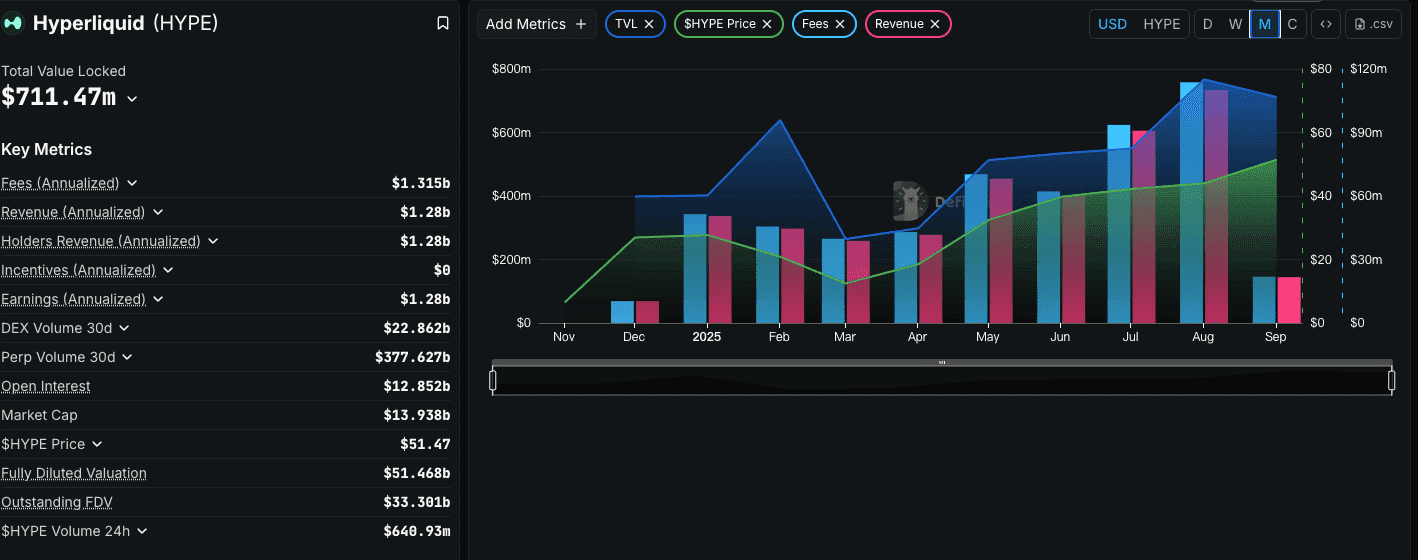

Hyperliquid: The "App-Chain" and the Centralization Spectrum

Hyperliquid represents a completely different end of the spectrum. As a perpetuals DEX built on its own dedicated app-chain, it is inherently more centralized than a protocol like Uniswap built on a general-purpose L1 like Ethereum. Its governance and fee mechanics are controlled by a core team, providing maximum performance and efficiency at the cost of permissionlessness. The recent competition to launch its native stablecoin, USDH, was a fascinating display of "governance-by-dealmaking," where a centralized entity solicits proposals from other major players.

Hyperliquid's model is optimized for a specific product vertical and is not trying to be a neutral, public good in the same way Uniswap is. Uniswap's challenge is far more complex: how to maintain its status as a neutral, foundational layer while still being able to act decisively and manage its resources effectively. DUNI is the answer to that challenge.

The Unspoken Truths and the Path Forward for DeFi

The DUNI proposal is more than a solution for Uniswap; it is a message to the entire DeFi industry. It is a pragmatic acknowledgment of several uncomfortable truths.

Truth *1: Pure Anonymity is Not a Long-Term Strategy for Blue-Chip Protocols.

While anonymity can be a powerful tool for bootstrapping a new project, a protocol aiming for a multi-trillion-dollar market cap and integration with the traditional financial system cannot exist in the shadows forever. Sooner or later, the real world, with its laws and taxes, will come knocking. Proactively establishing a compliant legal interface is a sign of maturity, not a betrayal of crypto's ideals.

Truth *2: Governance Requires Accountability, and Accountability Requires Structure.

A DAO composed of millions of pseudonymous token holders is a powerful concept, but it is often an ineffective operational body. Effective treasury management, strategic planning, and legal defense require a dedicated, accountable entity. A legal wrapper like a DUNA provides this structure without re-centralizing control over the protocol itself. It separates the operational arm from the legislative body (the DAO).

Truth *3: The Future is Hybrid.

The future of successful DeFi protocols will not be purely on-chain or purely off-chain. It will be a hybrid model. The core logic of the protocol—the automated market maker, the lending pool—will remain as immutable, on-chain code. But the governance, treasury, and legal functions that surround this core will increasingly be housed in sophisticated, purpose-built legal entities that can interface with the traditional world. DUNI is the blueprint for this hybrid future.

The Potential Downsides and Criticisms

Of course, this move is not without its risks. Critics may argue that creating a legal entity, even a decentralized one, creates a single point of failure and a clear target for regulators. They might suggest that it represents a slippery slope towards re-centralization, where the decisions of the DUNI entity's managers could begin to carry more weight than the votes of the DAO. These are valid concerns. The success of this model will depend entirely on the commitment of the community and the managers of DUNI to uphold the supremacy of the DAO's governance votes. The DUNA must always be the servant of the DAO, never its master.

Conclusion: A Necessary Armor for the Coming Battles

In August 2025, Uniswap did not just reclaim its market share; it signaled its intent to lead DeFi into its next phase of maturation. The DUNI proposal is the single most important strategic decision the protocol has made since the launch of the UNI token. It is a pragmatic, necessary, and forward-looking move to equip the world's most important decentralized exchange with the armor it needs to survive and thrive in the coming decades.

It is an acknowledgment that to interface with the old world, you must speak at least some of its language. By adopting a legal framework, Uniswap is not surrendering its decentralized soul; it is giving that soul a body that can withstand the pressures of a world that is still learning to understand it. This move paves the way for a self-sustaining, legally compliant, and operationally effective Uniswap DAO, ready to finally unlock its full economic potential.

The rest of the DeFi world should be watching closely. The path that Uniswap is forging today—the path of pragmatic decentralization—will likely become the standard that all other blue-chip protocols will have to follow if they wish to endure. The era of hiding in the shadows is over. The era of building enduring, hybrid institutions has begun.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. The views expressed are solely those of the author(s) and do not necessarily reflect the official policy or position of Phemex. Cryptocurrency trading involves substantial risk and is not suitable for all investors. Investors should consider their financial situation and consult with a financial advisor before making any investment decisions. Phemex is not responsible for any direct or indirect losses arising from the use of this information.

Register to get $180 Welcome Bonus!

Register to get $180 Welcome Bonus!