In the early hours of August 27, 2025, the decentralized derivatives exchange HyperLiquid became the stage for a dramatic capital "hunt." The platform's XPL pre-market contract witnessed a staggering price surge of over 200% within a mere few minutes. This rapid escalation triggered the forced liquidation of a significant number of short positions, while a select group of "whale" addresses collectively reaped nearly $38 million in profits from the intense volatility. This incident not only exposed potential vulnerabilities within HyperLiquid's platform mechanisms but also underscored the inherent extreme risks prevalent in the broader DeFi market.

A Five-Minute Frenzy: The Anatomy of a "Harvest"

Based on on-chain data monitoring and various media reports, the core sequence of events unfolded as follows:

05:35 AM (UTC): The Initial Thrust

An address, subsequently dubbed "Whale A" (0xb9c…6801e), abruptly injected a substantial amount of USDC into HyperLiquid. Utilizing 3x leverage, this address initiated a massive long position on the XPL token. The aggressive buying spree swiftly cleared the entire order book, causing the XPL price to embark on a near-vertical ascent.

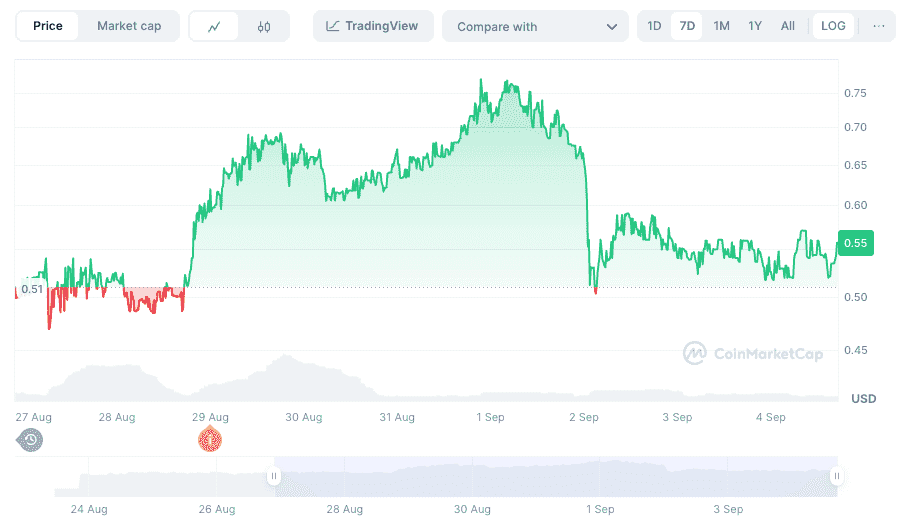

05:36 – 05:37 AM (UTC): The Price Explosion

Under the powerful impetus of Whale A's buying pressure, the XPL price surged from approximately $0.60 to a peak of about $1.80 within roughly two minutes—a gain exceeding 200%. This sharp price increase triggered a cascade of liquidations for numerous short positions. Notably, address 0xC2Cb incurred losses of approximately $4.59 million, while 0x64a4 lost around $2.00 million.

Rapid Profit-Taking: The Swift Exit

As the price reached its zenith, Whale A executed a swift closure of its positions, securing approximately $16 million in profit in just one minute. Concurrently, two other "whale" addresses, operating in apparent coordination, also took profits at the elevated price levels. Ultimately, these three addresses collectively amassed close to $38 million in gains.

Post-Event Holdings: A Lingering Presence

Intriguingly, even after concluding its primary profit-taking operations, Whale A retained a substantial long position of 15.2 million XPL tokens, valued at over $10.2 million. This indicates a potential desire to continue influencing subsequent market movements.

Unmasking the Manipulation: The Coordinated "Stop-Loss Hunt"

On-chain analysts have meticulously pointed out that this incident was, in essence, a classic "stop-loss hunting" strategy. Far from being an impromptu operation by a single address, it represented a meticulously planned and coordinated effort. At least four primary addresses were involved, collectively netting approximately $46.1 million in profits.

The dominant address, 0xb9c…6801e, began accumulating XPL long positions in tranches as early as August 24. It then unleashed its concentrated buying power in the early hours of the 27th, single-handedly propelling the market into an explosive rally. Other accompanying addresses had strategically established their long positions beforehand, subsequently closing them in phases as the price soared, thereby locking in their profits. Analysis revealed a high degree of consistency in the funding sources for these addresses; all obtained margin through cross-chain lending platforms, and their operational patterns exhibited striking similarities, strongly indicating a coordinated effort.

Platform Design Flaws: A Breeding Ground for Manipulation

HyperLiquid's inherent design also provided fertile ground for this type of market manipulation. Several key aspects contributed to its vulnerability:

Pre-Market Contracts and Limited Circulation: At the time of the incident, XPL was still in its pre-launch "warm-up" phase for pre-market contract trading. The actual circulating supply in the market was extremely limited, which created an opportune environment for whales to leverage their substantial capital advantage to manipulate prices.

Absence of External Oracles: The platform's internal pricing mechanism did not integrate external oracles for price anchoring. This crucial omission meant that the price could be solely determined by internal buying and selling activities within the platform, making it susceptible to isolated manipulation.

Thin Liquidity: As a pre-market trade for a nascent cryptocurrency, the order book depth was inherently shallow. When whales injected immense capital, coupled with leverage, their buying actions were amplified, creating an artificial demand surge. This, in turn, triggered a vicious cycle: "price increase -> short liquidations -> forced buying from liquidation orders -> further price increase."

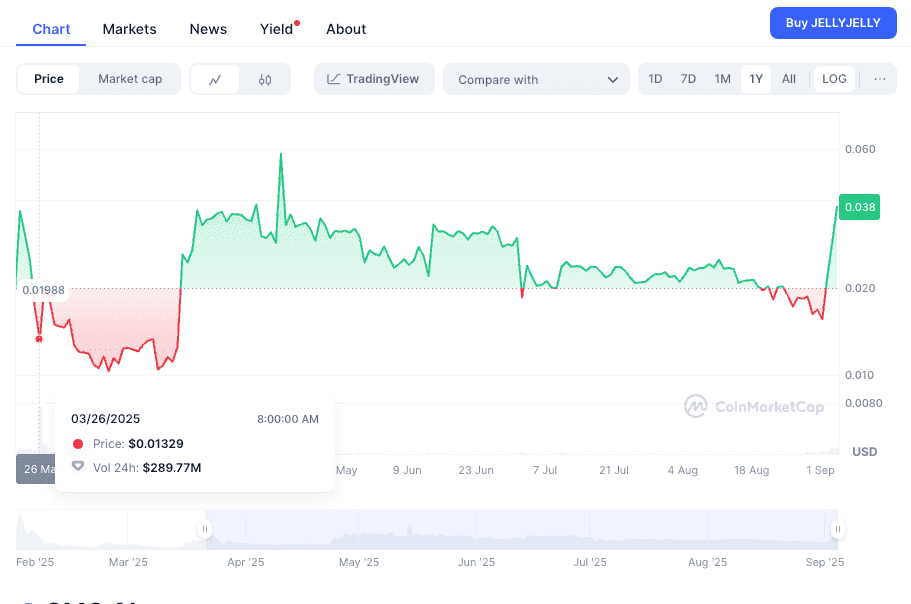

History Rhymes: The JELLYJELLY Incident's Echo

The XPL incident is not an isolated occurrence. On March 26, 2025, HyperLiquid experienced a strikingly similar price manipulation event involving the JELLYJELLY token. In that instance, a "whale" address initially initiated a massive sell-off of JELLYJELLY, causing its price to plummet and forcing the platform's Liquidity Pool (HLP) into a passive short position. Subsequently, the address rapidly reversed its strategy, buying aggressively to drive up the price, resulting in a loss of nearly $12 million for the HLP treasury. HyperLiquid was eventually compelled to delist the trading pair and compensate affected users.

Despite platform updates to its leverage and liquidation mechanisms following the JELLYJELLY incident, the recurrence of the XPL event indicates that HyperLiquid's system remains significantly vulnerable when confronted with attacks initiated by "whales" exploiting funding and systemic loopholes.

Victims and Reflection: A Warning for the DeFi Market

The direct victims of this incident were primarily ordinary traders holding hedging or value-preserving positions, whose low-leverage short positions were mercilessly liquidated amidst the extreme market conditions. In stark contrast, HyperLiquid's Liquidity Pool (HLP) only gained approximately $47,000 during the event, while the manipulating "whales" became rich overnight. This colossal disparity in profit and loss highlights the extreme imbalance in information, capital, and risk distribution within the DeFi market.

This incident serves as yet another stark warning for all participants in decentralized finance. For trading platforms, it necessitates a critical re-evaluation of their risk control measures. This includes strengthening liquidity depth, integrating external oracles for cross-market price anchoring, and implementing more stringent restrictions on individual transactions and leverage. For ordinary investors, it is imperative to fully recognize the immense risks inherent in the DeFi market, especially when dealing with emerging tokens and pre-market contract trading, and to exercise extreme caution in their participation.

Beyond the Hunt: Unpacking the Broader Implications

The HyperLiquid XPL incident, while a specific event, resonates with broader themes that are critical for the long-term health and credibility of the decentralized finance ecosystem. It is not merely about a few opportunistic traders but about the structural integrity and fairness of platforms designed to be transparent and permissionless.

The Illusion of Decentralization vs. Centralized Vulnerabilities:

One of the core tenets of DeFi is decentralization, promising a landscape free from the single points of failure and manipulative practices often associated with traditional finance. However, as the XPL incident painfully demonstrates, the decentralized nature of a protocol does not automatically equate to immunity from sophisticated manipulation. The "whale" addresses, acting in concert, effectively created a centralized force within a decentralized system. This raises fundamental questions about what true decentralization entails beyond the mere absence of a central entity. If a few large players can single-handedly dictate market movements and exploit systemic weaknesses, the spirit of decentralization is arguably compromised.

The Oracle Dilemma: A Critical Link in DeFi Security:

The absence of external oracles on HyperLiquid's XPL pre-market contract was a significant contributing factor to its vulnerability. Oracles are the bridge between the blockchain and the real world, providing external data – such as accurate market prices from multiple sources – to smart contracts. Without robust oracle integration, a platform's internal price discovery mechanism becomes an isolated island, easily influenced by internal order book dynamics. This incident serves as a stark reminder that while internal liquidity is important, it must be balanced with external validation to prevent price discrepancies and manipulation. Future decentralized derivatives platforms must prioritize multi-source, decentralized oracle solutions to ensure price integrity and prevent isolated market anomalies.

Liquidity, Leverage, and Market Depth: A Dangerous Trio:

The confluence of thin liquidity, high leverage, and a nascent pre-market contract created a particularly volatile cocktail. In markets with limited depth, even moderate capital can cause disproportionately large price swings. When this is coupled with high leverage, the potential for rapid liquidations – and the subsequent cascading effect – is significantly amplified. For platforms, this means a delicate balancing act. While offering high leverage can attract traders, it also magnifies systemic risk, especially for new or illiquid assets. There's a clear need for more dynamic risk parameters, perhaps adjusting leverage limits based on an asset's market cap, trading volume, and order book depth, to protect users and the platform itself.

Regulatory Gaps in the Decentralized Wild West:

The XPL incident, much like its JELLYJELLY predecessor, highlights the current regulatory vacuum in the DeFi space. While traditional financial markets have robust mechanisms to detect and prevent market manipulation, wash trading, and insider trading, the decentralized nature of these platforms makes enforcement challenging. This incident will undoubtedly add fuel to the ongoing debate about how to regulate DeFi without stifling innovation. While self-regulation and community governance are ideals, events like this suggest that a more defined framework might be necessary to protect retail investors and ensure market fairness. The challenge lies in developing regulations that are adaptable to the rapidly evolving DeFi landscape and do not inadvertently push innovation offshore.

The Retail Investor's Plight: Education and Due Diligence:

The most vulnerable in these "hunts" are often retail investors, lured by the promise of high returns but often lacking the sophisticated tools, capital, and market understanding of professional traders or "whales." This incident underscores the critical importance of investor education. Users need to understand not only how to execute trades but also the underlying mechanics of the platforms they are using, the risks associated with pre-market contracts, the implications of thin liquidity, and the potential for market manipulation. The mantra of "Do Your Own Research (DYOR)" has never been more relevant. Furthermore, platforms have a responsibility to clearly communicate these risks, perhaps through more prominent warnings or educational resources, especially for high-risk products.

The Evolving Landscape of DeFi Security:

While the immediate focus is on the financial losses, the XPL incident also serves as a case study in the evolving nature of DeFi security. Beyond smart contract vulnerabilities and rug pulls, market manipulation tactics represent a significant and ongoing threat. Platforms need to invest not only in code audits but also in advanced anomaly detection systems that can identify unusual trading patterns, large concentrated positions, and coordinated activities that might signal manipulation. This could involve leveraging AI and machine learning to analyze on-chain data in real-time and flag suspicious behavior.

The Role of Transparency: A Double-Edged Sword:

One of the celebrated aspects of blockchain is its transparency, where all transactions are recorded on a public ledger. This transparency was instrumental in dissecting the XPL incident, allowing analysts to track whale movements and identify the coordinated strategy. However, this same transparency can also be a double-edged sword. Sophisticated actors can use this public information to identify potential targets – such as concentrated short positions – and strategically plan their "hunts." While transparency is essential for accountability, it also necessitates platforms and users to be more sophisticated in their risk management and operational security.

The Path Forward for HyperLiquid and Other DeFi Platforms:

For HyperLiquid, specifically, this incident demands a thorough and transparent post-mortem. While they have addressed previous incidents, the recurrence of similar manipulation suggests that more fundamental changes might be required.

-

Enhanced Oracle Integration: Implementing a robust, multi-source decentralized oracle network for all trading pairs, especially pre-market contracts, is paramount. This would anchor prices to external reality, making internal manipulation significantly harder.

-

Dynamic Risk Management: Introducing dynamic leverage and margin requirements that adapt to market conditions, asset liquidity, and volatility. This could mean lower leverage for new or illiquid assets.

-

Liquidity Bootstrapping Mechanisms: Exploring mechanisms to ensure adequate liquidity for new pre-market contracts, perhaps through incentivized liquidity provision or staged rollouts, to prevent thin order books from becoming easy targets.

-

Whale Activity Monitoring and Alerts: Implementing sophisticated on-chain monitoring systems to detect and flag unusually large orders, rapid price movements, and coordinated activities across multiple addresses. While outright blocking might contradict decentralization principles, alerts could allow for community vigilance or even temporary trading pauses in extreme cases.

-

Clearer Disclosures and User Education: Providing unambiguous warnings about the risks associated with pre-market or highly volatile assets, and offering comprehensive educational resources to help users understand complex derivatives and market dynamics.

Conclusion: A Maturing but Still Perilous Frontier

The HyperLiquid XPL contract market anomaly is a sobering reminder that the decentralized finance frontier, while promising, remains fraught with peril. It underscores the ongoing tension between innovation, security, and market fairness. While the underlying technology of DeFi offers unprecedented opportunities, human ingenuity, both constructive and malicious, will continue to test its boundaries.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. The views expressed are solely those of the author(s) and do not necessarily reflect the official policy or position of Phemex. Cryptocurrency trading involves substantial risk and is not suitable for all investors. Investors should consider their financial situation and consult with a financial advisor before making any investment decisions. Phemex is not responsible for any direct or indirect losses arising from the use of this information.