In the fast-evolving world of decentralized finance (DeFi), Aerodrome Finance (AERO) has rapidly emerged as a critical player, particularly within the burgeoning Base ecosystem. As the primary liquidity hub on this Coinbase-backed Layer 2 network, Aerodrome has captured significant attention from investors and traders alike. This article provides an in-depth analysis of Aerodrome Finance, offering a comprehensive price prediction for 2025 to 2030 and exploring the fundamental drivers that could influence its future growth.

Summary Box (Fast Facts)

-

Ticker Symbol: AERO

-

Current Price: $1.25

-

Chain: Base

-

Contract Address: 0x940181a94a35a4569e4529a3cdfb74e38fd98631

-

Market Cap: $1.1B

-

Total Supply: 1.71B

-

ATH / ATL Price: $2.33 (Dec 07, 2024) / $0.006 (Dec 15, 2023).

-

All-Time ROI: Information not readily available

What Is Aerodrome Finance?

Aerodrome Finance is a next-generation automated market maker (AMM) that functions as the central liquidity hub for the Base blockchain. Launched as a fork of Velodrome Finance, it aims to address the common DeFi challenge of fragmented liquidity by creating a seamless and efficient trading environment. At its core, Aerodrome facilitates token swaps, allows users to provide liquidity to various pools, and engages in yield farming.

The platform's innovative approach lies in its "vote-escrowed" (ve) tokenomics model. By locking their AERO tokens, users receive veAERO, an NFT that grants them governance rights. These veAERO holders can then vote on which liquidity pools receive AERO token emissions, and in return, they earn the trading fees generated from those pools. This creates a powerful incentive for long-term holding and active participation in the protocol's governance, aligning the interests of token holders, liquidity providers, and the platform itself.

Current Price & Market Data (as of August 18, 2025)

As of today, Aerodrome Finance (AERO) is trading at approximately $1.25. The token has experienced a slight decline of 4.5% in the last 24 hours but has shown strong positive momentum over the past week and month with gains of 13% and 39% respectively.

AERO currently holds a market capitalization of $1.1 billion, ranking it among the top 75 cryptocurrencies. The 24-hour trading volume stands at a healthy $96.82 million, indicating strong liquidity and active market participation. The token's all-time high was recorded on December 7, 2024, at $2.33, while its all-time low was $0.006 on December 15, 2023.

Price History & Performance Overview

Aerodrome Finance's journey began with its launch in February 2024, with the AERO token initially priced at a modest $0.091. However, it quickly gained traction, surging to $2.02 even before its official launch, signaling strong early market interest. Investor optimism peaked in December 2024, when AERO hit its all-time high of $2.33.

Like many cryptocurrencies, AERO has experienced significant volatility, with its price influenced by broader market trends, exchange listings, and developments within the Base ecosystem. Notably, a recent integration with Coinbase's main application in August 2025 led to a seven-month high, underscoring the impact of increased accessibility and visibility on the token's performance.

Whale Activity & Smart Money Flows

Recent on-chain data reveals significant and bullish whale activity in Aerodrome Finance. Over the last month, smart money investors have increased their AERO holdings by 22% to over 16.34 million tokens, while whale holdings have also grown. One recent transaction saw a single whale purchase 3.59 million AERO for $5.05 million. This pattern of accumulation by sophisticated investors is often seen as a bullish signal, suggesting a strong belief in the token's long-term potential.

Furthermore, data from on-chain analytics platforms shows a trend of AERO tokens moving off exchanges, which typically indicates that investors are holding their assets for the long term rather than preparing to sell. This reduction in exchange supply, coupled with increasing whale holdings, points to a potential supply squeeze that could drive prices higher.

On-Chain & Technical Analysis

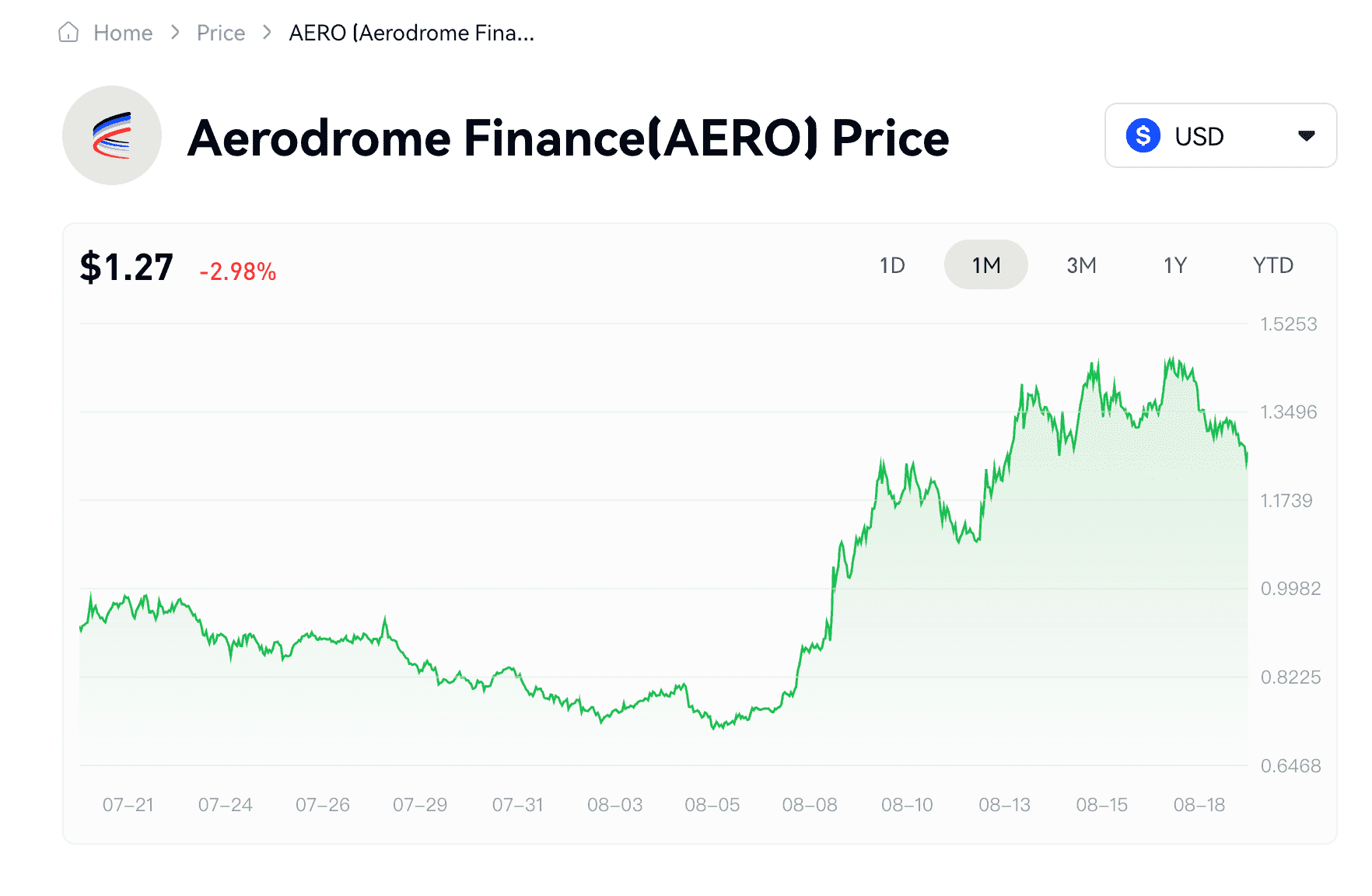

Aerodrome Finance (AERO), the liquidity hub of the Base network, has been one of the hottest DeFi tokens this summer. Since early August, AERO’s price has surged from $0.75 on August 7 to a peak of $1.46 on August 17, before pulling back to consolidate around $1.25 today. This powerful rally has fueled speculation that AERO may be preparing for its next big move. With solid fundamentals and the price consolidating just under key resistance, AERO is at a pivotal point.

From a technical standpoint, the daily chart shows AERO has broken out of previous resistance at $1.12 and is attempting to establish a new support level. Several indicators suggest bullish momentum, including a "golden cross" pattern that formed in July when the 50-day moving average crossed above the 200-day moving average. However, the Relative Strength Index (RSI) is in the overbought territory on some timeframes, which could signal a short-term pullback is possible before the next leg up.

Key support and resistance levels to watch are:

-

Support: $1.20, with a stronger accumulation zone around $1.00 and a long-term trendline at $0.75.

-

Resistance: $1.46 (the recent peak) and the all-time high of $2.33.

Short-Term Price Prediction (2025–2026)

Based on the current technical posture and market sentiment, three primary scenarios emerge for AERO in the near term.

Bull Case: Breakout Targeting $1.60+

If AERO stabilizes above the current consolidation zone and breaks the $1.46 resistance with strong volume, bullish momentum could extend toward the 1.60-2.00 range. A successful push past these levels would open the door to retest the all-time high of $2.33. Analysts suggest that continued growth of the Base ecosystem could even push AERO towards a high of $3.04 by the end of 2026.

Neutral Case: Choppy Consolidation at 1.20-1.46

If buying pressure is not sufficient for a breakout, the price may continue to range between $1.20 and $1.46 as traders digest recent gains. This period of consolidation would allow the market to build a stronger base before its next major move. Range traders might look to buy near support and sell near resistance, while watching for volume spikes that could anticipate the direction of the eventual breakout.

Bear Case: Bearish Retracement Toward $1.00

Should AERO fail to hold the $1.20 support level, momentum could shift bearishly. A break below this level on heavy volume could trigger a correction, with $1.00 being the next key psychological and technical support zone. In a more significant market downturn, a retest of the strong support at $0.75 is possible, which could present an accumulation opportunity for long-term bulls.

Long-Term Price Forecast (2027–2030)

Looking further ahead, the long-term outlook for Aerodrome Finance is largely tied to the success of the Base network and the broader adoption of DeFi. Base has ambitious goals for 2025, aiming for 25 million users and $100 billion in on-chain assets, which would directly benefit Aerodrome.

-

2027: Predictions suggest AERO could reach a potential high of $6.14.

-

2028: Continued growth could see the price climb to $11.70.

-

2029: By this point, AERO could be trading at around $20.95.

-

2030: Some of the more optimistic forecasts project a potential price of $35.15 and even as high as $45.

It is crucial to remember that these are speculative forecasts and not financial advice. The cryptocurrency market is highly volatile, and a variety of factors can influence long-term price movements.

Fundamental Drivers of Growth

Several key factors underpin the potential for Aerodrome Finance's long-term growth:

-

Dominant Position on Base: As the primary decentralized exchange (DEX) on the rapidly growing Base network, Aerodrome is well-positioned to capture a significant share of on-chain activity.

-

Innovative Tokenomics: The veAERO model encourages long-term holding and active participation, creating a sustainable and community-driven ecosystem. Beyond governance, tapering emissions add a deflationary edge to its tokenomics.

-

Strong Backing: Being at the heart of the Coinbase-supported Base ecosystem provides a significant degree of credibility and potential for integration with one of the world's largest crypto exchanges.

-

Growing User Base and Ecosystem: The Base network has seen a dramatic increase in daily active users and developer activity, surpassing even established chains in some metrics. This influx of users directly benefits Aerodrome through increased trading volumes and liquidity.

-

Strategic Partnerships: Collaborations with other DeFi projects and platforms enhance Aerodrome's visibility and user acquisition.

Key Risks to Consider

Despite its promising outlook, investing in Aerodrome Finance is not without its risks:

-

Dependence on the Base Ecosystem: AERO's success is intrinsically linked to the growth and adoption of the Base network. Any slowdown or issues with Base could negatively impact Aerodrome.

-

Intense Competition: The DEX landscape is highly competitive, with established players also operating on the Base network.

-

Token Inflation: The continuous emission of new AERO tokens to incentivize liquidity could lead to price dilution if not met with sufficient demand from new buyers and lockers.

-

Regulatory Uncertainty: The evolving regulatory landscape for DeFi poses a potential risk to all projects in the space.

-

Smart Contract Vulnerabilities: As with any DeFi protocol, there is always the risk of smart contract bugs or exploits.

Analyst Sentiment & Community Insights

Analyst sentiment surrounding Aerodrome Finance is largely positive, with many highlighting its strong fundamentals and strategic position within the Base ecosystem. Technical indicators on various timeframes are also showing buy signals, with the current sentiment rated as "Bullish" according to the Fear & Greed Index.

Community sentiment on platforms like Reddit and X (formerly Twitter) is generally bullish, with users expressing optimism about the project's future. The increasing number of "big whale" orders and negative spot netflow on exchanges further indicates a positive outlook from larger market participants.

Is Aerodrome Finance a Good Investment?

Aerodrome Finance presents a compelling investment case for those bullish on the future of DeFi and the Base network. Its innovative tokenomics, dominant market position, and strong community support are all positive indicators. However, it's important to acknowledge the inherent risks, including market volatility, competition, and regulatory uncertainty.

Disclaimer: This article is for informational purposes only and should not be considered financial advice.

The Aerodrome Finance investment potential remains promising heading into 2025–2030. Its ability to maintain its position as the leading liquidity hub on Base will be a key determinant of its long-term success.

Why Trade Aerodrome Finance on Phemex?

Phemex stands out as a top-tier centralized exchange renowned for its security, high performance, and user-centric approach to innovation. For traders looking to gain exposure to promising assets like Aerodrome Finance, Phemex offers a comprehensive suite of tools and products designed for every type of investor.

Core Products & Tools:

-

Spot Trading: Instantly buy and sell over 100 different cryptocurrencies with deep liquidity and competitive fees.

-

Futures Contracts: For more experienced traders, Phemex provides access to perpetual contracts with up to 100x leverage on a wide range of popular coins.

-

Trading Bots: Automate your trading strategies with AI-powered bots, allowing you to capitalize on market movements 24/7.

-

Phemex Earn: Generate passive income on your crypto holdings through flexible and fixed savings products with attractive yields.

-

Phemex Launchpool: Participate in new and exciting token launches. By staking assets like USDT, you can earn rewards from up-and-coming projects before they hit the open market.

Aerodrome Finance (AERO) is listed on Phemex, available for both spot and futures trading. This allows users to not only invest in the long-term potential of AERO but also to capitalize on short-term price movements.

Ready to capitalize on AERO's next move? Whether you're a long-term holder looking to buy the dip or a short-term trader aiming to profit from volatility, Phemex provides all the tools you need for your strategy.

Sign up on Phemex and start trading AERO today!

Unlock Passive Income with Phemex Earn

Want to do more with your crypto? Phemex Earn offers a secure and easy way to grow your portfolio. Earn competitive, high-yield APYs on a wide range of assets, including Bitcoin, Ethereum, stablecoins, and more.

It’s the smartest way to put your assets to work while you trade, hold, or simply watch the market.

See the Latest APYs and Start Earning Today!