The year 2025 has been nothing short of transformative for the Solana ecosystem. After navigating market cycles with resilience, Solana has decisively cemented its status as a top-tier Layer 1 blockchain, celebrated for its lightning-fast transaction speeds, remarkably low fees, and a vibrant, rapidly expanding community. This growth is not speculative hype; it's anchored in a robust foundation of real-world utility, primarily driven by a sophisticated suite of Decentralized Finance (DeFi) applications.

As of 2025, the Solana network boasts a staggering $9.621 billion in Total Value Locked (TVL) across its protocols. This impressive figure signals deep market confidence and highlights the immense economic activity taking place. At the heart of this activity are innovative DeFi projects that process billions in daily volume, lock up significant liquidity, and create compelling use cases for SOL, the network's native token. These applications are the engine of a powerful virtuous cycle, where dApp success directly fuels the demand, utility, and ultimately, the value of SOL.

This article will explore the top DeFi projects that are the cornerstones of the Solana ecosystem, analyzing how their immense growth and specific functionalities are fundamentally driving the value of the Phemex SOL price.

The Flywheel Effect: How DeFi Success Translates to SOL Value

Before diving into individual protocols, it's essential to understand the powerful, symbiotic relationship between Solana's dApps and the value of SOL. This "flywheel effect" is a core tenet of the ecosystem's success and operates through several key mechanisms:

-

Transaction Fees (Gas): Every single action within a DeFi protocol—a token swap, a loan origination, a liquidity deposit—is a transaction recorded on the Solana blockchain. Each of these transactions requires a small fee paid in SOL. While individual fees are tiny, the cumulative effect of millions of daily actions creates immense, utility-driven demand for SOL. With the chain processing $1.33 million in fees daily, this mechanism ensures a constant need for the token.

-

Reducing Circulating Supply (TVL): When users deposit assets into DeFi protocols, those funds are "locked" to facilitate lending, staking, or market making. A vast portion of this TVL is held in SOL itself or SOL-based derivatives like liquid staking tokens (LSTs). As billions of dollars worth of SOL are locked within these protocols, the effective circulating supply on the open market diminishes, which can apply upward pressure on its price.

-

SOL as Premier Collateral: Across Solana's lending markets, SOL has been firmly established as a blue-chip collateral asset. Users wishing to borrow stablecoins or other digital assets must often deposit their SOL as security. This elevates SOL's function from a simple gas token to a productive, yield-bearing financial asset, significantly increasing its appeal to long-term holders.

-

Ecosystem Growth and Network Effects: Successful DeFi protocols act as powerful magnets, attracting more users, developers, and institutional capital to the Solana ecosystem. This growth generates a powerful network effect: more liquidity leads to better trading prices, which encourages more users to join, which in turn incentivizes more developers to build on Solana. This cycle continuously strengthens the network's position and fundamental value.

With this framework in mind, let's examine the titans of Solana DeFi that are making this happen.

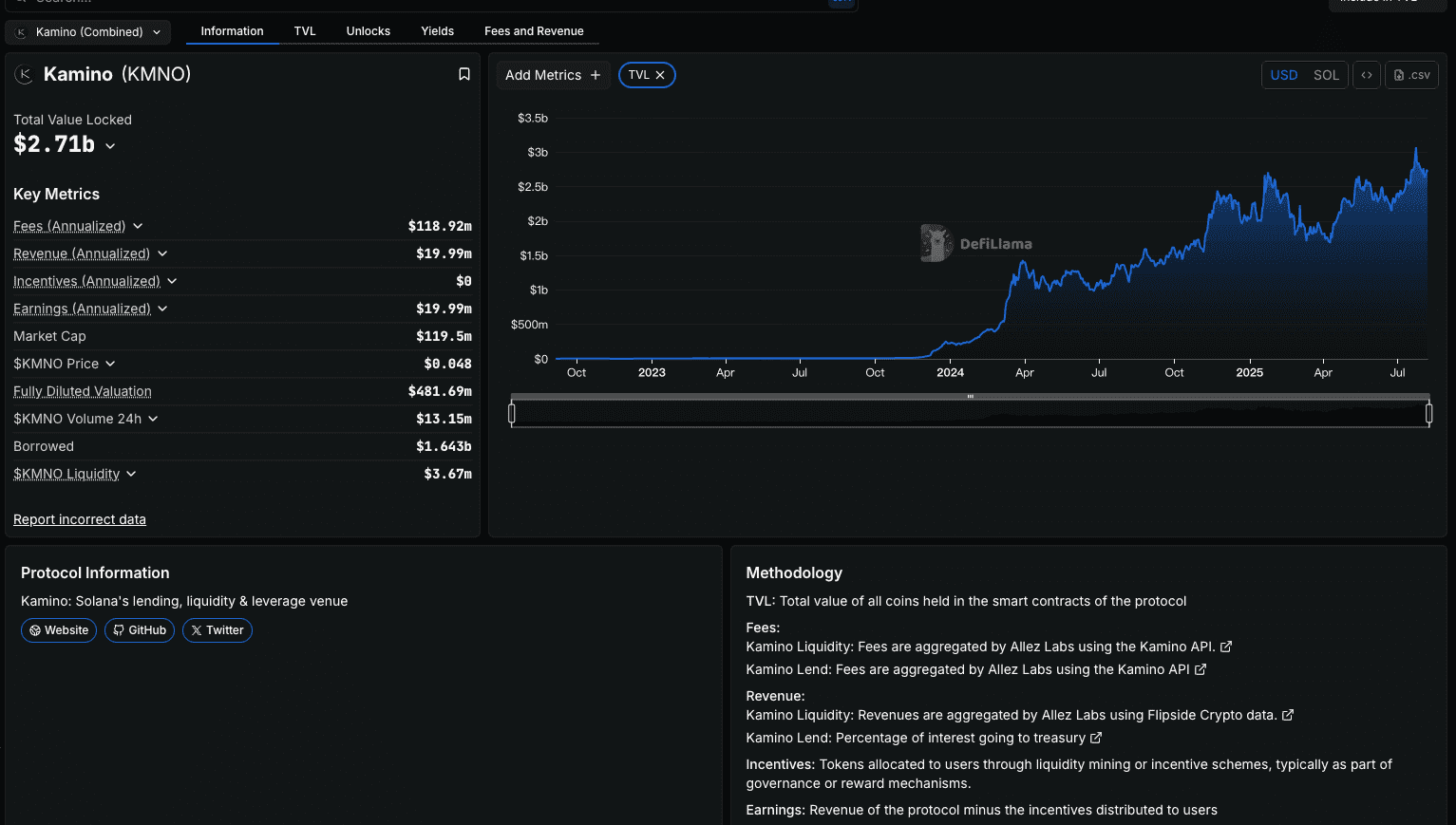

1. Kamino Finance: The Premier Hub for Liquidity and Lending

Reigning at the top of Solana's DeFi rankings, Kamino Finance is an undisputed giant, commanding a colossal $2.7 billion in TVL. Kamino has masterfully evolved into a one-stop-shop for yield optimization, seamlessly integrating automated liquidity vaults, peer-to-peer lending, and leveraged strategies into a single, intuitive platform. Users can deposit their assets, including SOL and its liquid staking derivatives, into sophisticated vaults that automatically manage concentrated liquidity positions on decentralized exchanges, maximizing the fees and rewards earned.

How Kamino Drives SOL's Value:

As the largest protocol by value locked, Kamino is a monumental force for SOL. Its primary impact stems from its function as a "liquidity black hole," attracting and securing a significant portion of the ecosystem's capital. With billions supplied by users, a large percentage of which consists of SOL-based assets, Kamino directly contributes to reducing SOL's freely traded supply on the market.

Furthermore, its integrated "Lend" market creates a powerful, persistent use case for SOL as premier collateral. This creates intrinsic demand for holding SOL that goes far beyond simple speculation or paying for gas. The composability it enables is a game-changer: a user can stake their SOL with a provider like Jito, receive JitoSOL, deposit that into a Kamino vault to earn yield, and then use their vault position as collateral to borrow stablecoins. This multi-layered utility makes holding SOL incredibly capital-efficient and attractive, with each step generating more on-chain transactions and contributing to the network's $2.86 million in daily revenue. Platforms like Kamino build trust in the ecosystem's capabilities, which is a key factor supporting the long-term Phemex SOL price.

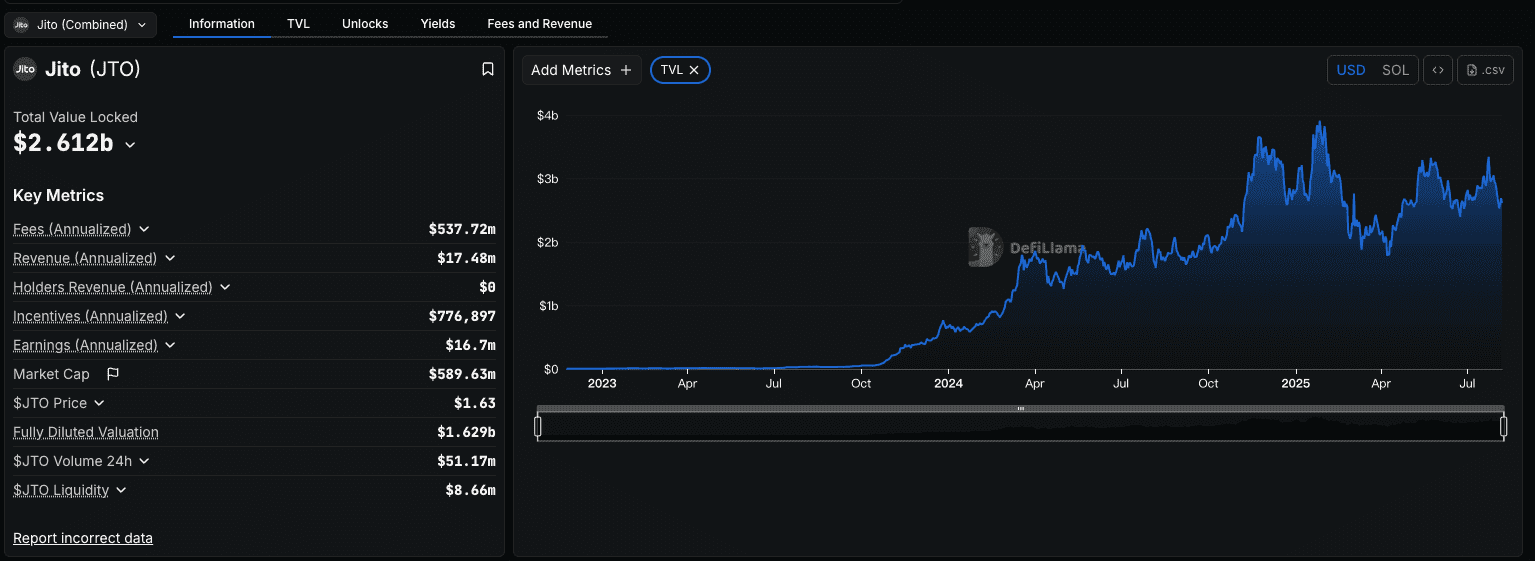

2. Jito & Marinade Finance: The Liquid Staking Revolution

Liquid staking is one of DeFi's most important innovations, and on Solana, Jito and Marinade Finance are the clear leaders. Together, they command an incredible 4.4 billion TVL(2.615B for Jito and $1.811B for Marinade). These protocols solve a critical dilemma for investors: how to help secure the network through staking without sacrificing the liquidity of their capital.

The process is elegant. Users stake their SOL tokens with Jito or Marinade and instantly receive a liquid receipt token—JitoSOL or mSOL. These tokens represent the user's underlying staked SOL and automatically accumulate staking rewards over time. The real power is that JitoSOL and mSOL are fully functional assets that can be used across the entire Solana DeFi landscape—as collateral on Kamino, as liquidity on Jupiter, or for other yield-generating strategies. Jito enhances this by distributing MEV (Maximal Extractable Value) rewards to its stakers, offering an additional layer of yield.

How Liquid Staking Drives SOL's Value:

The influence of Jito and Marinade on SOL's value is profound. First, they dramatically increase the incentive to buy and stake SOL. By eliminating the opportunity cost associated with locking up tokens, they make staking a far more compelling financial decision, which directly fuels demand for SOL. The fact that over $4.4 billion in SOL is staked through just these two protocols is a powerful testament to this effect.

Second, these protocols significantly bolster Solana's security and decentralization. They strategically delegate the SOL they hold across a broad set of over 100 high-performing network validators, preventing any single entity from gaining excessive influence. A more secure and decentralized network is fundamentally more valuable and trustworthy.

Finally, the LSTs they create (mSOL and JitoSOL) are the lifeblood of the entire DeFi engine, forming the largest markets on lending platforms and the deepest liquidity pools on exchanges. This deep integration creates a hyper-efficient ecosystem where capital is constantly working, generating millions of transactions and solidifying the essential utility of SOL. This robust activity is a strong fundamental indicator supporting the Phemex SOL price.

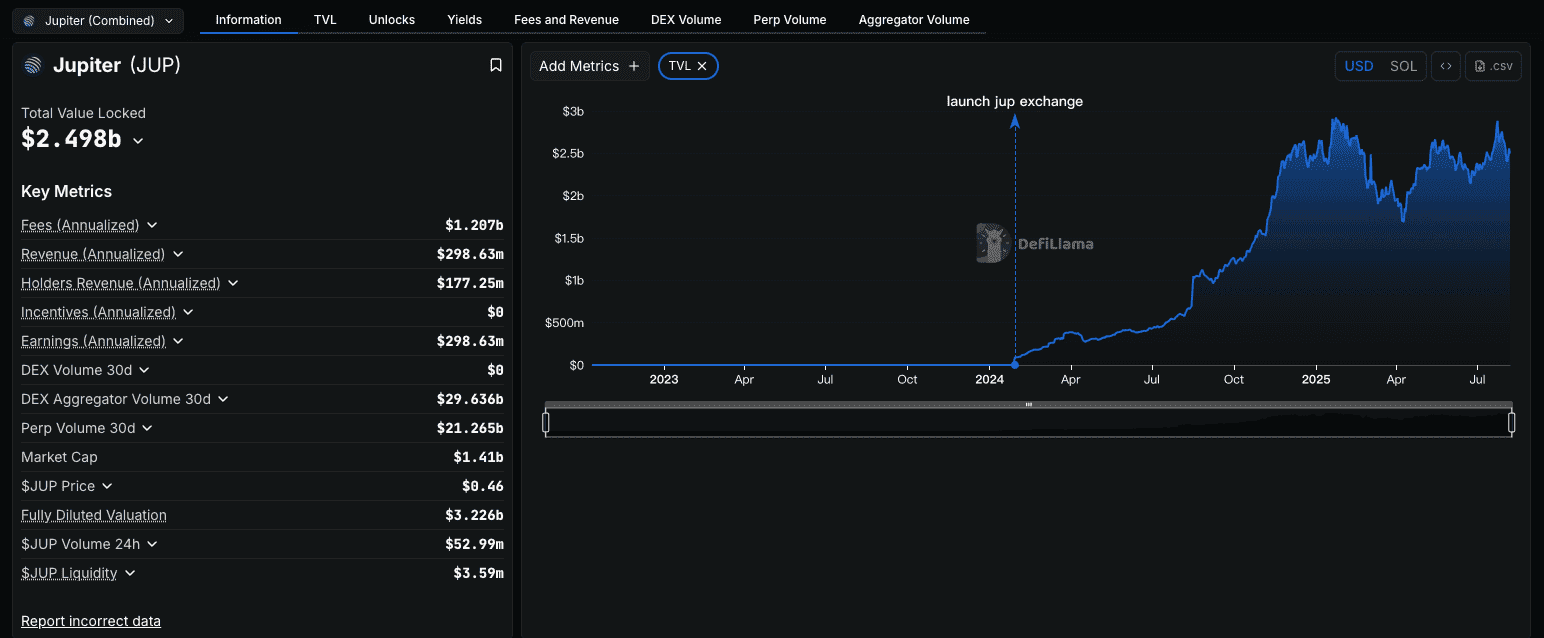

3. Jupiter: The Indispensable Aggregation Layer

No analysis of Solana DeFi would be complete without Jupiter. While it ranks third by TVL with $2.493 billion, its true dominance lies in its role as the network's central nervous system for trading. Jupiter is a DEX aggregator, meaning its core function is to find the absolute best price for any token swap by intelligently scanning and routing orders across every major liquidity source on Solana. Its engine can split a single trade into multiple parts across different pools to guarantee the most efficient execution with minimal slippage.

In 2025, Jupiter's influence is staggering. It processes a colossal 266.12 million spot trading volume and generates 3.49 million in fees in just 24 hours. This makes it one of the most-used applications in all of cryptocurrency.

How Jupiter Drives SOL's Value:

Jupiter's impact on SOL is direct and immense. As the de facto transaction router for the ecosystem, it is responsible for a massive share of the network's total transaction count. Every single one of the millions of swaps it facilitates requires SOL for gas, making Jupiter a perpetual firehose of utility-driven demand for the token.

Beyond raw volume, Jupiter serves as the Grand Central Station for Solana's liquidity. By seamlessly connecting disparate pools of assets, it makes the entire DeFi ecosystem more efficient, accessible, and cheaper to use for everyone. This hyper-efficiency is a magnet for capital and users, growing the overall economic pie for every protocol on the network. With its expansion into a launchpad for new projects and perpetuals trading, Jupiter is constantly adding new layers of utility that generate more on-chain activity, forever feeding the flywheel that drives value for SOL.

The Future is Bright: What's Next for Solana DeFi?

While the current titans are impressive, the innovation on Solana is not slowing down. The future points towards even greater integration with the real world and more complex financial products. Key trends to watch include the tokenization of Real-World Assets (RWAs), such as real estate or private credit, which could bring trillions of dollars of value on-chain. Furthermore, the rise of DePIN (Decentralized Physical Infrastructure Networks) for services like wireless data, computation, and energy is a natural fit for Solana's high-throughput architecture and will create entirely new economies powered by SOL.

How to Get Started with Solana DeFi

Jumping into Solana's vibrant DeFi ecosystem is easier than you think. Here’s a simple guide to get started:

-

Set Up a Solana Wallet: The first step is to get a self-custody wallet that supports the Solana network. Popular and user-friendly choices include Phantom, Solflare, and Backpack.

-

Acquire SOL Tokens: You will need SOL to pay for transaction fees and to use as your primary asset in DeFi. You can easily acquire SOL on a trusted exchange and send it to your new wallet. You can always check the live Phemex SOL price to find a good entry point.

-

Explore the Protocols: Once your wallet is funded, you can start exploring! Navigate directly to the web applications of Kamino, Jito, or Jupiter. Connect your wallet with a single click and you can begin staking, swapping, or providing liquidity. Always start with small amounts to familiarize yourself with the process.

Conclusion: An Ecosystem Forging Real, Lasting Value

The leading DeFi projects on Solana—Kamino, Jito, Marinade, and Jupiter—are far more than just applications. They are fundamental pillars of a new, transparent, and efficient digital economy being built on the Solana blockchain. By locking billions in capital, generating millions in daily transactions, and enabling unparalleled capital efficiency, they have forged an undeniable and powerful link between their own success and the intrinsic value of the SOL token.

The data speaks for itself. With 2.61 million active addresses engaging with the network in a single day and a TVL that continues to climb, Solana's DeFi ecosystem is well past the experimental stage. It is a mature, thriving, and highly functional economy. This maturation, powered by world-class innovation, provides one of the strongest fundamental arguments for the long-term growth and value accretion of SOL. As these platforms continue to evolve and onboard the next wave of users, the demand for SOL as the essential fuel for this vibrant economy will only continue to grow.