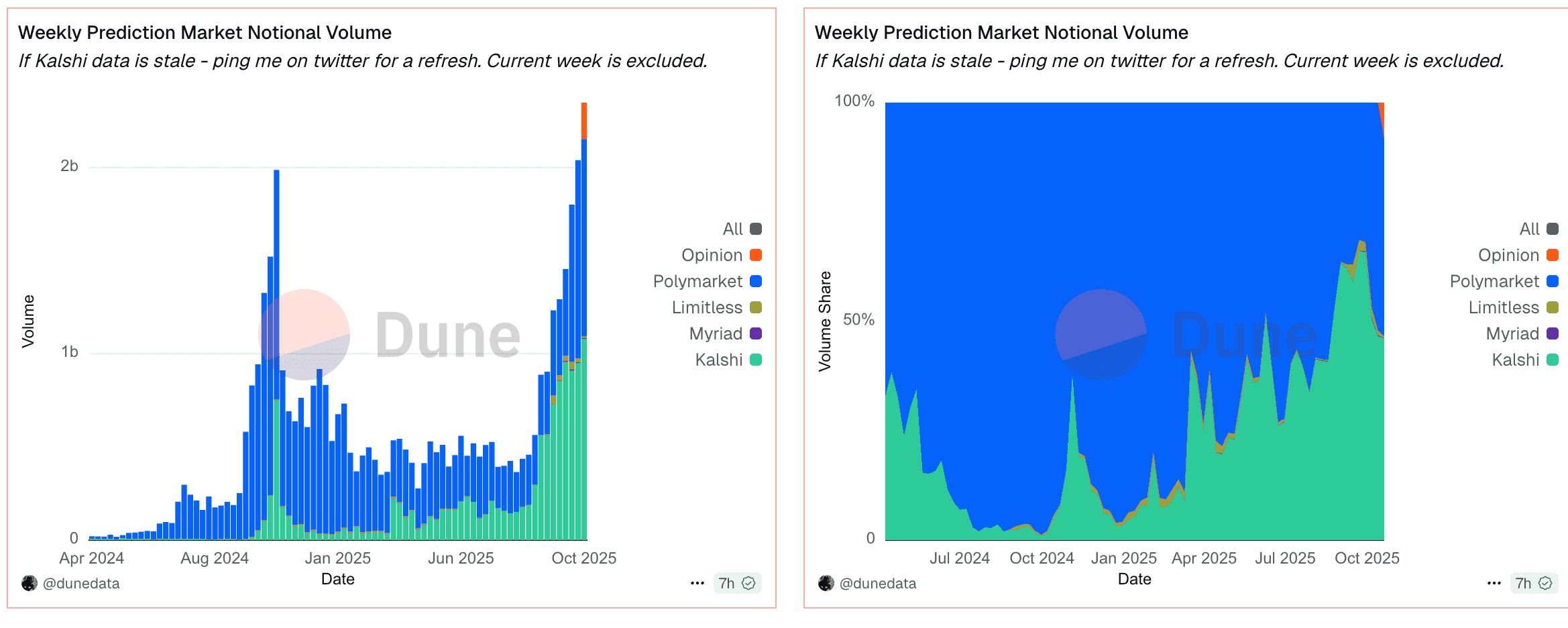

In the world of crypto, no narrative is more potent than a fundamental paradigm shift. We are in the midst of one right now, and its scale has become staggering. In a single week in late October 2025, the combined notional volume on prediction markets soared past $2.34 billion. This is not a niche market anymore. This is a financial arena with liquidity and activity rivaling that of established altcoin spot markets.

At the heart of this explosion are two titans, each armed with billion-dollar valuations and fundamentally different philosophies. On one side stands Kalshi, the fortress of compliance, backed by Sequoia and Andreessen Horowitz. On the other stands Polymarket, the engine of decentralization, a crypto-native behemoth. For months, the narrative was simple: Polymarket was the dominant, high-volume leader, while Kalshi was the smaller, regulated player methodically building its base.

The latest on-chain data shatters this narrative. In that same blockbuster week, Kalshi posted a staggering 1.05 billion. The challenger has, for the first time, met the champion on equal footing. This is no longer a simple comparison; it's the analysis of a convergence, a clash of titans on a direct collision course to dominate the future of information itself.

This definitive analysis will dissect the user questions that matter most, integrate the latest market-shattering news, and use granular on-chain data to explore the core question: as these two giants converge, who is best positioned to win this multi-billion-dollar war?

The Core Questions: Legitimacy, Regulation, and Risk

Before diving into features, we must address the single most important cluster of questions that users ask, as revealed by search data: Is Kalshi legal? Is Polymarket legal? Is it safe? Is it considered gambling? These are not trivial concerns; they are the central axis around which this entire narrative revolves, and the two platforms have fundamentally different answers.

-

Kalshi's Answer is Unambiguous Clarity: Kalshi's entire business model is built on answering "yes" to the legality question. It is a CFTC (Commodity Futures Trading Commission) regulated Designated Contract Market (DCM). This is a critical distinction that cannot be overstated. It means that under US federal law, Kalshi is not considered a gambling site but a legitimate financial exchange, on par with other derivatives markets like those for oil or gold futures. This is the bedrock of its strategy, allowing it to operate openly in many US states, forge partnerships with traditional financial institutions, and require identity verification (like a SSN for US users) as part of its robust compliance protocol.

-

Polymarket's Answer is Strategic Evolution: For years, Polymarket operated outside the US for American users, following a settlement with the CFTC. Its legality was rooted in the borderless, permissionless nature of decentralized protocols. However, this is the crux of the 2025 story: Polymarket is executing a strategic return to the US. Through a game-changing maneuver involving the sports betting giant DraftKings, which acquired the CFTC-regulated exchange Railbird, Polymarket is set to provide the clearing infrastructure for a new, regulated US entity. This represents a pivot from a purely decentralized philosophy to a hybrid model, aiming to capture the best of both worlds without compromising its core global protocol.

The Incumbent's Surge: How Kalshi Weaponized Sports and Politics

For a long time, Kalshi was seen as the slow-and-steady tortoise to Polymarket's hare. Its strategy of compliance, while building a powerful institutional moat, seemed to limit its growth. The data from the second half of 2025 reveals a stunning turn of events: the tortoise has strapped on a rocket engine.

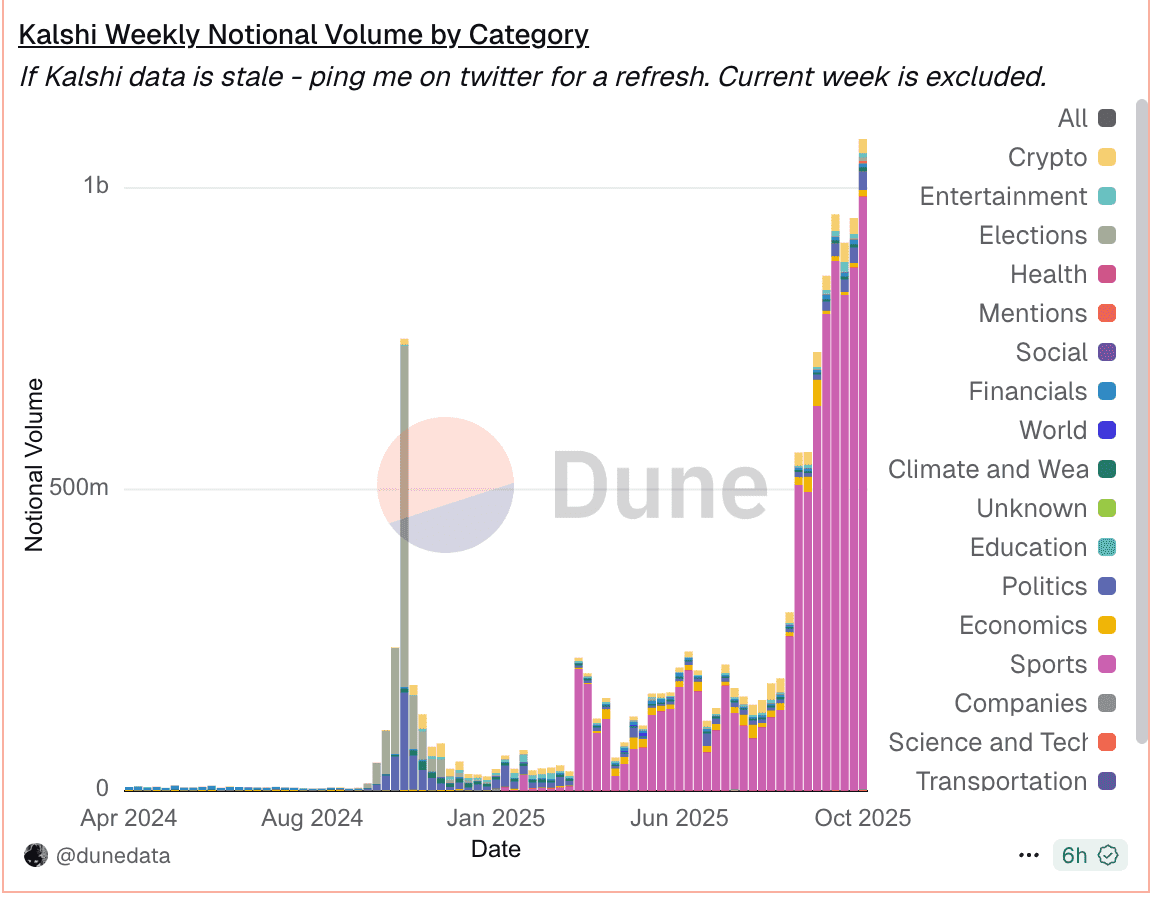

Kalshi's recent explosion in volume, culminating in its billion-dollar week, is not an accident. A granular look at the "Kalshi Weekly Notional Volume by Category" chart from Dune Analytics reveals the engine of this growth: a masterful, three-pronged assault on high-volume verticals.

-

The Sports Revolution (Purple Area): As astutely noted by Delphi Digital, Kalshi's primary growth driver has been its aggressive and successful expansion into sports markets. The purple section of the chart is the largest single contributor to its recent volume surge. By offering regulated contracts on verifiable, non-ambiguous outcomes (e.g., "Will Team X win the championship?" or "Will Player Y score more than Z points?"), Kalshi has directly tapped into the massive, pre-existing market for sports betting, but reframed it within a financial exchange framework. This attracts a different, often more analytical, type of user than traditional sportsbooks, turning passionate sports knowledge into a tradable financial skill.

-

The Political Arena (Yellow Area): During election cycles and major geopolitical events, political outcomes become one of the highest-demand assets for speculation and hedging. Kalshi's regulated status makes it a trusted venue for significant capital to be deployed on these markets. The massive yellow spikes in the chart directly correspond to periods of high political tension, demonstrating its role as a real-time barometer for events of global significance. This reliability is critical for users who are hedging real-world financial portfolios against political risk.

-

The Economic Bedrock (Orange Area): While less volatile, markets on core economic data like CPI inflation and Federal Reserve interest rate decisions form the stable, professional base of Kalshi's volume. This is the core product for their institutional and hedging user base—corporations hedging against inflation, or fund managers expressing a view on monetary policy. This category, while not always the largest, provides the platform with its deep-seated legitimacy in the financial world.

Kalshi's recent success is a story of focused execution. It identified the three largest addressable markets it could legally pursue—sports, politics, and economics—and built a deep, liquid product suite to dominate them. This strategy is precisely what attracted its staggering $12 billion valuation proposals from the bluest-chip VCs: Sequoia, a16z, Paradigm, and Coinbase Ventures. They are not betting on a crypto app; they are betting on the future of the regulated derivatives market itself.

The Reigning Champion: Polymarket's Dominance in the Digital Zeitgeist

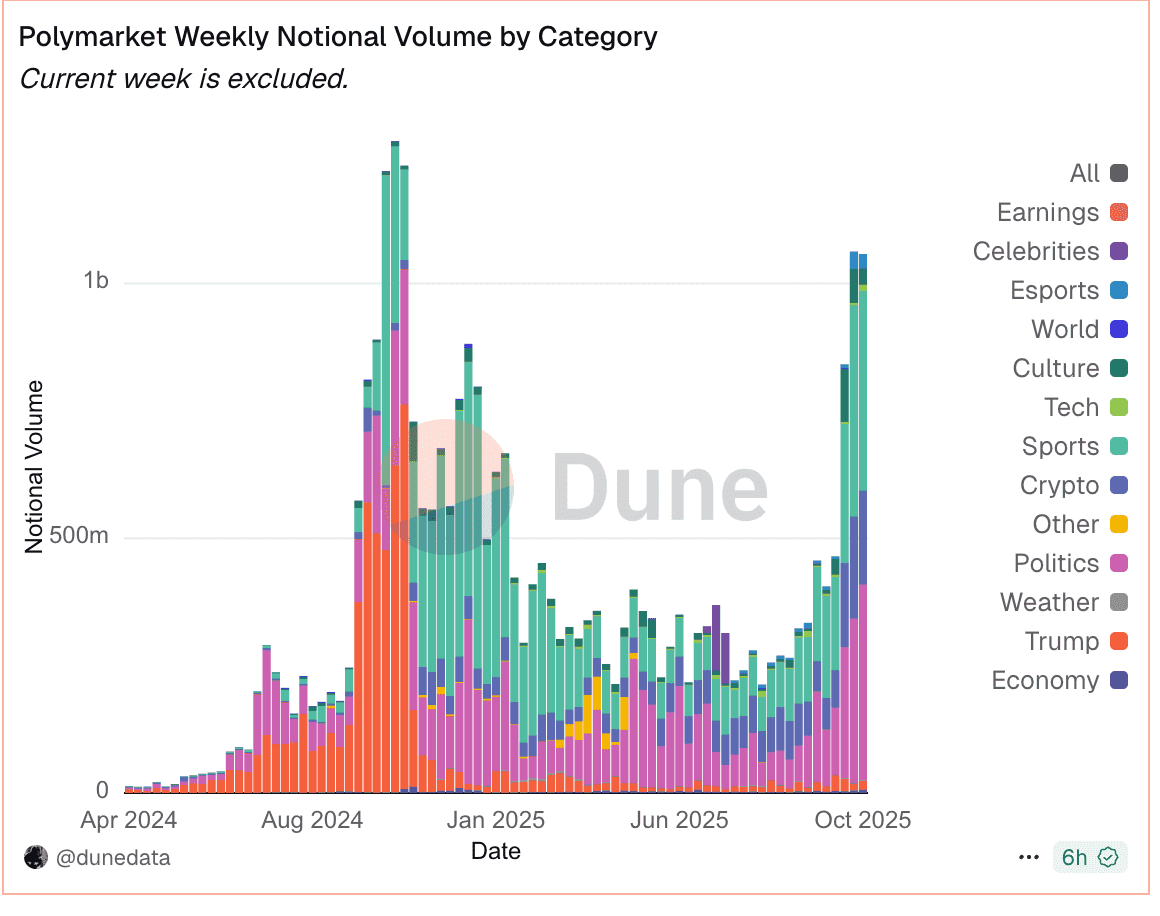

While Kalshi's rise is the story of the moment, it's crucial to understand the scale of Polymarket's long-standing dominance. The Dune Analytics charts show that for the vast majority of the past year, Polymarket (the blue area) has consistently commanded an overwhelming 75-90% of the total weekly market share. Its billion-dollar week was not an anomaly; it was business as usual.

Polymarket's strength lies in its ability to act as the world's "zeitgeist engine." Its permissionless nature allows it to instantly create a liquid market for any topic capturing the global conversation. The "Polymarket Weekly Notional Volume by Category" chart is a perfect illustration of this strategy:

-

Crypto and Politics as Cornerstones: The two largest and most consistent volume drivers are Crypto-specific events (e.g., ETF approvals, protocol developments, token price targets) and Politics. The massive spikes in volume, such as the one in late 2024, are almost entirely driven by these two categories. This is Polymarket's home turf, where its crypto-native user base has a distinct informational edge and a high appetite for risk.

-

A Diverse Long-Tail of Culture: Beyond the core pillars, Polymarket thrives on a diverse "long-tail" of markets that regulated entities could never touch in a timely manner: "Celebrities," "Culture," "Tech" drama (like the OpenAI saga), and even niche community-driven events. This ensures that it is always relevant, no matter what is trending, making it a real-time mirror of internet culture itself. This speed and breadth create a powerful network effect; users know that for any breaking news story, a market will likely exist on Polymarket first.

Polymarket's strategic pivot to re-enter the US via the DraftKings partnership, coupled with the imminent launch of its POLY token and airdrop, is a move to solidify its dominance. The token launch will galvanize its massive user base, decentralize governance, and allow the community to share in the protocol's success. The B2B infrastructure play gives it a crucial foothold in the regulated US market without compromising its global protocol. This is why it can command a $15 billion target valuation in its latest funding discussions.

A Deep Dive Comparison: Strategy, Markets, and Users

The summary table provides a quick overview, but the strategic differences run much deeper.

| Feature | Kalshi | Polymarket |

| Core Philosophy | Regulatory Compliance | Permissionless Access |

| Primary Volume Drivers | Sports, Politics, Economics | Crypto, Politics, Culture |

| Market Composition | Curated, High-Volume Verticals | Diverse, Long-Tail, User-Generated |

| Target User | Institutional, Hedgers, US Retail | Crypto-Natives, Global Users, Info Arbitrageurs |

| Regulatory Moat | Direct CFTC License | Decentralization & Hybrid Strategy |

| Key Advantage | Trust & Legitimacy | Speed & Breadth |

Battlegrounds: Curated Verticals vs. The Infinite Market

Kalshi's approach is vertical. It aims to be the absolute best-in-class, most liquid venue for a select number of high-value markets. Its success is measured by its ability to dominate the sports and political categories. Polymarket's approach is horizontal. It aims to offer a market on everything. Its success is measured by its ability to capture the entire spectrum of human interest, from the profound to the profane.

The Tale of Two Users

A Kalshi user might be a professional trader hedging an S&P 500 portfolio by taking a position on a CPI inflation contract. They value the regulatory certainty and the direct link to their bank account. A Polymarket user might be a crypto-native analyst betting on the outcome of the next major Ethereum upgrade, funding their position instantly from their MetaMask wallet. The former seeks risk mitigation in a familiar framework; the latter seeks alpha in a rapidly evolving information landscape.

The Arbitrage Opportunity: Where the Two Worlds Meet

For sophisticated traders, the existence of these two parallel universes creates a fascinating opportunity: arbitrage. Often, the price of a contract on the same event (e.g., an election outcome) will differ slightly between Kalshi's regulated US market and Polymarket's global crypto market. An astute trader can buy the "underpriced" contract on one platform and sell the "overpriced" contract on the other to lock in a small, low-risk profit. The existence of these arbitrage opportunities is a sign of a maturing market, where different user bases price risk and information in slightly different ways.

The New Battlegrounds: Politics, Media, and Legacy Finance

The explosive growth of Kalshi and Polymarket has not gone unnoticed. The ultimate validation of the prediction market thesis is the entry of powerful new forces, transforming the landscape from a two-player game into a multi-front war.

The Political Elephant: Truth Predict and the Trump Factor

The most dramatic new development is the entry of a political and media giant: Truth Social. The platform, majority-owned by Donald Trump and his family, is launching a crypto-based betting service named "Truth Predict," positioning it as a direct competitor to Polymarket.

Operated by the publicly traded Trump Media & Technology Group (TMTG), the service will allow users to bet crypto on outcomes in sports, politics, and economics—for example, "Will Taylor Swift release a new original song by Oct 2nd?" This move aims to capitalize on the narrative that prediction markets are a more efficient "source of truth" than traditional polls, a concept that gained mainstream traction during the 2024 election. As TMTG's CEO Devin Nunes stated, "With Truth Predict, we are democratizing information, allowing the American people to translate free speech into actionable foresight through the wisdom of the crowd."

However, the story is far more complex than simple competition. The Trump family's financial interests are deeply, and controversially, intertwined with the entire prediction market sector.

-

In January 2025, Donald Trump Jr. joined Kalshi as a strategic advisor.

-

In August 2025, venture firm 1789 Capital, where Trump Jr. is a partner, invested in Polymarket. As part of the deal, he also joined Polymarket's advisory board.

This places the former President's son in advisory roles at two direct, billion-dollar competitors, all while his family's company launches a third. This has drawn sharp criticism regarding potential conflicts of interest. "No one is saying the president’s family in a capitalist country can’t be capitalists," said Jeff Hauser of the Revolving Door Project, a government watchdog. "But Polymarket is subject to intense political controversy, so it reflects a significant and avoidable conflict of interest." Critics argue this creates an opportunity for the Trump family to profit from policy changes pushed by the Trump administration. The White House has denied that the President or his family would ever be involved in a conflict of interest.

This web of relationships is set against the backdrop of Polymarket's turbulent journey with US regulators. In November 2024, under the Biden administration, CEO Shayne Coplan's residence was raided by the FBI as the DOJ investigated potential violations of their 2022 settlement. However, after Trump's return to the White House in January 2025, the regulatory climate shifted. By July, Bloomberg reported the DOJ had closed its investigation without charges, clearing a path for Polymarket's return. Zach Hamilton, founder of crypto startup Sarcophagus, told WIRED, "If you’re trying to point to one reason why [crypto prediction markets] are able to come back to the US, it’s the Trump administration—it’s Donald Trump."

The Financial Leviathan: CME Group's Inevitable Entry

While Truth Predict attacks from the media and political flank, another giant is approaching from the world of traditional finance: the CME Group. As the world's largest financial derivatives exchange, their plan to launch event contracts on sports and economics by year-end is a monumental development.

CME's entry transforms the landscape from a battle between innovative startups into a three-way war that includes a legacy financial titan. This move will:

-

Massively Validate the Sector: It signals to the entire financial world that event contracts are a legitimate and significant new asset class.

-

Intensify Competition: CME brings immense liquidity and unparalleled institutional trust, posing a direct and existential threat to Kalshi's core institutional user base.

-

Spur Innovation & M&A: The pressure from CME will force Kalshi and Polymarket to innovate even faster and could trigger a wave of mergers and acquisitions.

What This Means for Phemex Users

As a platform at the forefront of financial innovation, we at Phemex are watching these developments with immense interest. This isn't just a fascinating spectator sport; it's the emergence of a powerful new investable theme: the infrastructure of information.

For our users, this translates into several key opportunities:

-

The POLY Token Opportunity: The upcoming launch and airdrop of Polymarket's POLY token will be one of the most anticipated events of the year. It represents a direct way to invest in the growth of the dominant prediction market protocol. A successful token can create a powerful flywheel of user incentives, liquidity provision, and protocol growth. Phemex will be closely monitoring this launch for potential listing opportunities.

-

Investing in Foundational Infrastructure: The RWA and oracle tokens that support the prediction market ecosystem (like Chainlink, which is essential for resolving many of these markets) will become even more critical as the sector grows and institutional players demand ever-higher standards of data reliability.

-

Staying Ahead of the Curve: The strategies being pioneered by Polymarket and Kalshi—from hybrid regulatory models to new forms of B2B infrastructure—provide a blueprint for the future of crypto. Understanding this battle is key to identifying the next wave of innovation.

Conclusion: Two Philosophies, One Future

The battle between Polymarket and Kalshi is more than a competition for market share; it's a referendum on the future of financialized information.

Kalshi represents the path of integration, meticulously building a bridge for the traditional financial world to cross into the digital age. Its recent surge, powered by a brilliant expansion into sports, proves that the regulated model can achieve massive, mainstream scale.

Polymarket represents the path of disruption, leveraging decentralized technology to build a new, parallel system from the ground up, and now, cleverly bridging back to the regulated world on its own terms. Its continued dominance in market share and its finger on the pulse of the digital world give it a powerful, enduring moat.

The data shows a market that has exploded into a true duopoly, with two champions trading billion-dollar blows. The entry of giants like CME Group confirms that the war is just beginning. For investors, traders, and builders, one thing is certain: the once-niche world of prediction markets is now center stage, and it's poised to be one of the most exciting and consequential arenas in all of crypto.