Key Takeaways

-

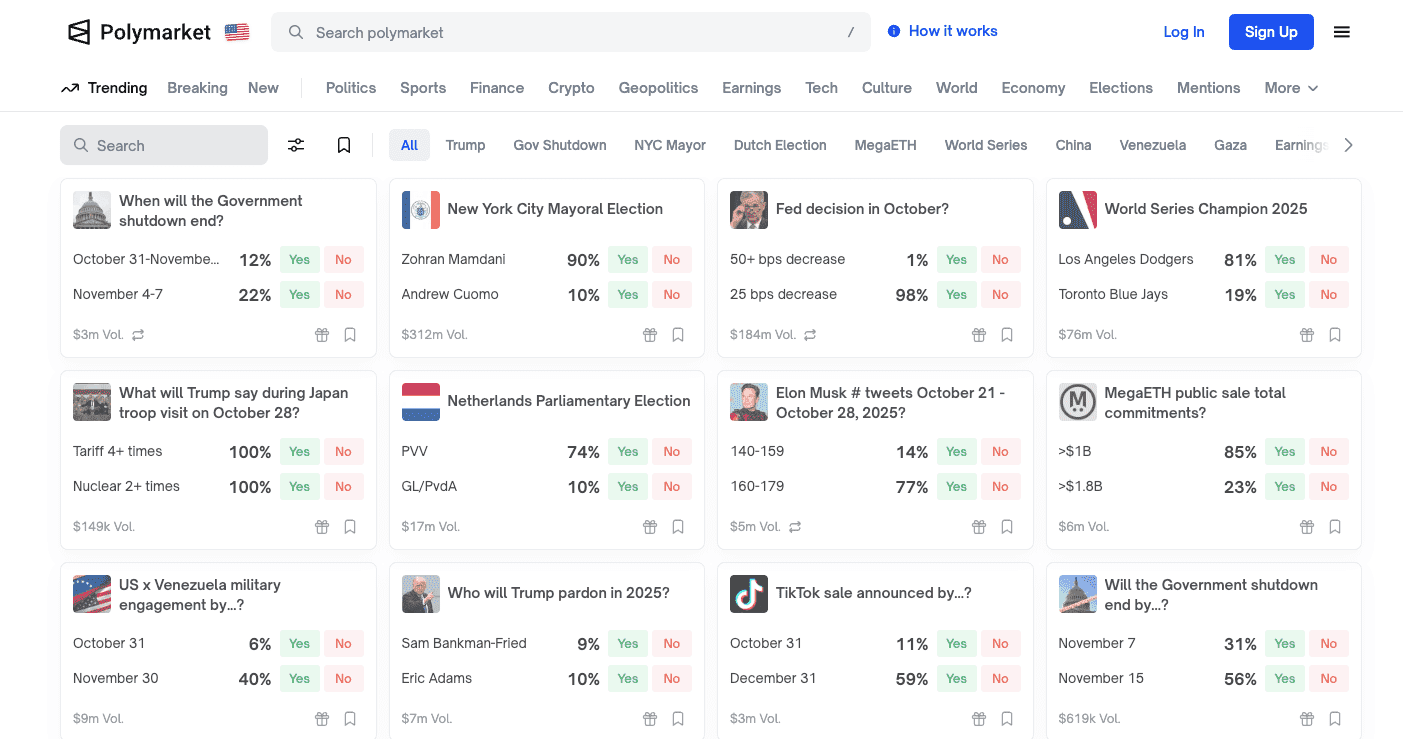

What is Polymarket?: Polymarket is the world’s largest decentralized prediction market, allowing users to trade on the outcomes of real-world events, from political elections to economic reports.

-

How It Works: Users buy and sell shares representing event outcomes, with prices between $0 and $1 reflecting the market's real-time probability estimate. It operates on a peer-to-peer basis, not against "the house."

-

Underlying Technology: Built on the Polygon network, a Layer-2 scaling solution for Ethereum, Polymarket offers fast transactions and low fees, making it accessible for high-volume trading.

-

Upcoming Token: While the platform currently uses USDC, the team has confirmed plans to launch a native token (potentially named POLY) and conduct an airdrop for users after its official, regulated relaunch in the United States.

-

Regulatory Progress: Polymarket is preparing for a regulated return to the U.S. market after acquiring a CFTC-registered exchange, signaling a strong focus on compliance and long-term growth.

Introduction

In a world saturated with opinions, polls, and expert analyses, finding a single source of truth can feel impossible. Information is often fragmented, biased, or outdated by the time it reaches the public. What if there was a way to aggregate the collective knowledge of thousands of individuals into a clear, actionable, and constantly updated forecast? This is the problem that Polymarket, the world’s leading decentralized prediction market, aims to solve.

This guide will provide a comprehensive overview of what Polymarket is, how its technology functions, and why it has become a go-to source for real-time probabilities on a global scale. We will explore the platform’s unique mechanics, its upcoming token launch, and provide insights into the news about Polymarket that is shaping its future. Whether you are a seasoned trader or new to cryptocurrency, this article will help you understand this innovative platform and how you can prepare to trade POLY on Phemex.

What Is Polymarket? Explained for Beginners

At its core, Polymarket is an information market where users can bet on the outcomes of future events. Think of it as a stock market, but instead of trading shares of a company, you trade shares representing the outcome of a specific event. These events cover a vast range of topics, including:

-

Politics: "Will Donald Trump win the 2028 Presidential Election?"

-

Economics: "Will the U.S. inflation rate be above 3% next quarter?"

-

Technology: "Will TikTok be banned in the U.S. this year?"

-

Pop Culture: "Will the highest-grossing film of the year surpass $1.5 billion globally?"

The platform’s core mission is to seek truth by aggregating diverse perspectives. Studies have shown that prediction markets are often more accurate than individual pundits or traditional polls because they harness the "wisdom of the crowds." By putting real money on the line, participants are incentivized to conduct thorough research and make informed decisions, filtering out noise and bias. The resulting market price for an outcome becomes the most accurate, real-time probability available.

Unlike traditional betting platforms where you bet against "the house," Polymarket is a peer-to-peer marketplace. Every trade has a counterparty—another user on the platform. This decentralized structure ensures that the platform remains neutral and cannot ban users for being too successful.

How Does Polymarket Work?

Understanding how to navigate Polymarket is straightforward. The platform is designed to be intuitive, even for those unfamiliar with trading.

1. Share-Based Trading

For any given market, Polymarket creates shares for each possible outcome. In a simple "Yes/No" market, you can buy "Yes" shares if you believe the event will happen or "No" shares if you believe it won't.

2. Prices Equal Probabilities

This is the most critical concept. Share prices on Polymarket always range between $0.00 and $1.00 (denominated in USDC, a stablecoin). This price directly represents the probability of that outcome occurring, as determined by market participants.

-

Example: If "Yes" shares for "Will the Miami Heat win the 2025 NBA Finals?" are trading at $0.18, the market is signaling an 18% probability of that outcome.

These prices are not set by Polymarket; they are a direct result of supply and demand from traders. If new information emerges that favors the Miami Heat, more people will buy "Yes" shares, driving the price up to reflect the increased probability.

3. Making Money on Markets

If you believe the market's probability is wrong, you have an opportunity to profit. Continuing the example:

-

If you think the Heat's true chances are much higher than 18%, you would buy "Yes" shares at $0.18.

-

If the Heat win the finals, the market resolves, and each "Yes" share becomes worth $1.00. Your profit would be 1.00 - $0.18).

-

Conversely, all "No" shares would become worthless.

A key feature is that you are never locked into your position. You can sell your shares at any time before the market resolves to lock in profits or cut losses. For instance, if the price of your "Yes" shares rises to $0.40 after a key player returns from injury, you could sell them and realize a profit immediately without waiting for the season to end.

Polymarket's Future Tokenomics: The POLY Airdrop

As of writing, Polymarket does not have its own native cryptocurrency. The platform operates exclusively using USDC for all trading and settlement, ensuring price stability for market participants. However, this is set to change.

In late 2025, Polymarket's Chief Marketing Officer, Matthew Modabber, officially confirmed that a native token is planned. "There will be a token, there will be an airdrop," he stated, generating significant excitement within the crypto community.

Details regarding the token's mechanics, such as its maximum vs. circulating supply and whether it will be inflationary or deflationary, have not yet been released. The team has indicated that its priority is first completing its regulated launch in the U.S. market. Once that milestone is achieved, the focus will shift to the token. Modabber referenced the token model of Hyperliquid—a platform known for prioritizing long-term utility over short-term hype—as a potential inspiration. This suggests the future Polymarket (POLY) token will likely be designed with a sustainable ecosystem in mind, potentially focusing on governance rights, fee reductions, or staking rewards for holders. The airdrop is expected to reward early and active users of the platform, although specific criteria have not been announced.

Polymarket vs. Traditional Polling: A New Era of Forecasting

One of the most powerful Polymarket use cases is its ability to outperform traditional polling in accuracy and timeliness.

-

Real-Time Data vs. Time Lag: Legacy polls capture a snapshot of public opinion at a specific moment but are often days or even weeks old by the time they are published. Polymarket, on the other hand, reflects sentiment in real-time. As news breaks, market prices adjust within seconds, providing a dynamic and continuous forecast.

-

Financial Incentives Drive Accuracy: Poll respondents have no stake in the outcome, leading to less considered or even disingenuous answers. On Polymarket, participants are financially incentivized to be correct. This "skin in the game" encourages deep research and data-driven predictions, filtering out uninformed opinions.

-

The Wisdom of Crowds: As highlighted by James Surowiecki in his book The Wisdom of Crowds, aggregating the knowledge of a diverse group of people often produces a more accurate result than any single expert. Prediction markets like Polymarket are a perfect embodiment of this principle. Research from academic projects like the Iowa Electronic Markets has consistently shown that prediction markets outperform traditional polling in forecasting political outcomes.

By providing a constantly updating picture of public sentiment, Polymarket offers a degree of accuracy that legacy methods cannot match, making it a valuable tool for journalists, researchers, and decision-makers.

Polymarket vs. Bitcoin: A Comparison

| Feature | Polymarket (Platform) | Bitcoin (BTC) |

| Primary Use Case | An information and prediction market for forecasting real-world events. Its purpose is utility-driven. | A decentralized digital currency designed as a peer-to-peer electronic cash system and a store of value. |

| Technology | Operates as a decentralized application (dApp) on the Polygon network, a Layer-2 for Ethereum. | A standalone Layer-1 blockchain with a Proof-of-Work consensus mechanism. |

| Speed and Fees | High throughput and extremely low transaction fees, enabling rapid, cost-effective trading. | Slower transaction confirmation times (around 10 minutes per block) and variable fees that can be high during network congestion. |

| Asset Type | It is a platform, not a currency. Its upcoming POLY token will likely be a utility or governance token for its ecosystem. | A scarce, fungible cryptocurrency often referred to as "digital gold." |

| Decentralization | Relies on the security and decentralization of the Ethereum and Polygon networks. | Considered the most decentralized and secure cryptocurrency network due to its vast global network of miners. |

The Technology Behind Polymarket

Polymarket's efficiency and scalability are built on a robust technical foundation.

-

Consensus Mechanism: As a dApp on Polygon, Polymarket leverages the underlying security of the Ethereum network. Polygon utilizes a Proof-of-Stake (PoS) consensus mechanism for its own network, which allows for faster and more energy-efficient transaction processing.

-

Layer-2 Scaling: The decision to build on Polygon is crucial. Ethereum, while highly secure, can be slow and expensive. Layer-2 solutions like Polygon act as an "express lane," processing transactions on a separate, faster chain and then bundling them to be settled on the main Ethereum blockchain. This gives Polymarket users the best of both worlds: Ethereum's security with high-speed, low-cost performance.

-

Smart Contracts and Infrastructure: The entire market creation, trading, and resolution process is automated through smart contracts. These self-executing contracts ensure that the rules of each market are enforced transparently and without the need for a central intermediary, guaranteeing that winning shares are paid out correctly.

Team, Origins, and Regulatory Journey

Polymarket was founded in 2020 by Shayne Coplan with the vision of creating a globally accessible, censorship-resistant information market. Headquartered in New York, the platform quickly gained traction and attracted significant backing from prominent figures in the technology and crypto industries.

Polymarket founder and CEO Shayne Coplan (Michael M. Santiago/Getty Images)

In May 2024, Polymarket announced it had raised $70 million across two funding rounds, with investors including Ethereum co-founder Vitalik Buterin and Peter Thiel’s Founders Fund. This strong venture capital support underscored the market's confidence in Polymarket's long-term vision.

However, the platform's journey has included significant regulatory challenges. In January 2022, Polymarket settled with the Commodity Futures Trading Commission (CFTC) for $1.4 million and agreed to cease offering markets to U.S. users. Rather than exiting the market permanently, Polymarket has since pursued a path of compliance. This led to the recent acquisition of QCX, a CFTC-registered derivatives exchange, positioning the platform for a fully regulated relaunch in the United States. This strategic move demonstrates a commitment to sustainable growth and regulatory adherence.

Key News & Events Shaping Polymarket's Future

-

January 2022 - CFTC Settlement: Polymarket agrees to a $1.4 million fine and blocks U.S. users, marking a pivotal moment that shifted the company's strategy toward regulatory compliance.

-

May 2022 - J. Christopher Giancarlo Joins: The former CFTC Commissioner, known as "Crypto Dad," was appointed chairman of Polymarket's advisory board, lending significant regulatory credibility to the project.

-

May 2024 - Major Funding Rounds: The platform secures $70 million in funding from high-profile investors like Vitalik Buterin and Founders Fund, fueling its technological development and expansion plans.

-

September 2025 - Regulated U.S. Launch Filing: Through its acquisition of QCX, Polymarket submits a regulatory filing indicating its intent to list products for U.S. users as early as October 2, 2025, signaling its imminent return to the American market.

-

October 2025 - Token and Airdrop Confirmed: The CMO confirms plans for a future token launch and airdrop, set to occur after the platform re-establishes its U.S. operations.

Is Polymarket a Good Investment?

Evaluating the Polymarket investment potential requires looking at both the platform's success and the future prospects of its unreleased token.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves significant risks; only invest what you can afford to lose.

Strengths:

-

Market Leadership: Polymarket is the dominant player in the decentralized prediction market space, with a strong brand and a loyal user base.

-

Proven Product-Market Fit: The platform has demonstrated massive trading volumes, especially around major global events, proving there is substantial demand for its services.

-

Strong Backing: Support from top-tier VCs and influential figures in the crypto space provides both capital and credibility.

-

Proactive Regulatory Strategy: The move to re-enter the U.S. market via a regulated entity is a significant positive, potentially opening it up to a much larger user base and reducing long-term regulatory risk.

Risks:

-

Regulatory Uncertainty: While its U.S. strategy is promising, the global regulatory landscape for prediction markets and cryptocurrencies remains complex and subject to change.

-

Competition: As the sector grows, new competitors could emerge, challenging Polymarket's market share.

-

Tokenomics Unknowns: The value of the future POLY token is entirely dependent on its design, utility, and distribution. Without these details, any investment in the token remains speculative.

Conclusion:

Polymarket has established itself as a resilient and innovative leader in the information markets sector. Its upcoming regulated launch in the U.S. and the planned token airdrop are major catalysts that could drive significant growth. While risks remain, the platform's strong fundamentals and forward-looking strategy make it a project worthy of close attention.

FAQs about Polymarket

1. What is Polymarket used for?

Polymarket is used to trade on the outcomes of future events. It serves as a powerful tool for forecasting, as the market prices reflect the collective, financially-incentivized wisdom of its users, providing real-time probabilities.

2. How do I prepare for the Polymarket (POLY) token airdrop?

While official details have not been released, airdrops typically reward early and active platform users. Engaging with the Polymarket platform (where legally accessible) could be a potential way to qualify. Stay updated by following official announcements from the Polymarket team.

3. Is Polymarket legal in the U.S.?

After a 2022 settlement with the CFTC, Polymarket has been inaccessible to U.S. users. However, the company is preparing for a fully regulated relaunch in the U.S. market, which is expected to go live in late 2025.

4. What is the difference between Polymarket and a traditional sportsbook?

On a sportsbook, you bet against "the house," which sets the odds and profits from your losses. On Polymarket, you trade with other users in a peer-to-peer market. This allows you to sell your position at any time and ensures the platform remains a neutral facilitator of trades.