Key Takeaways

-

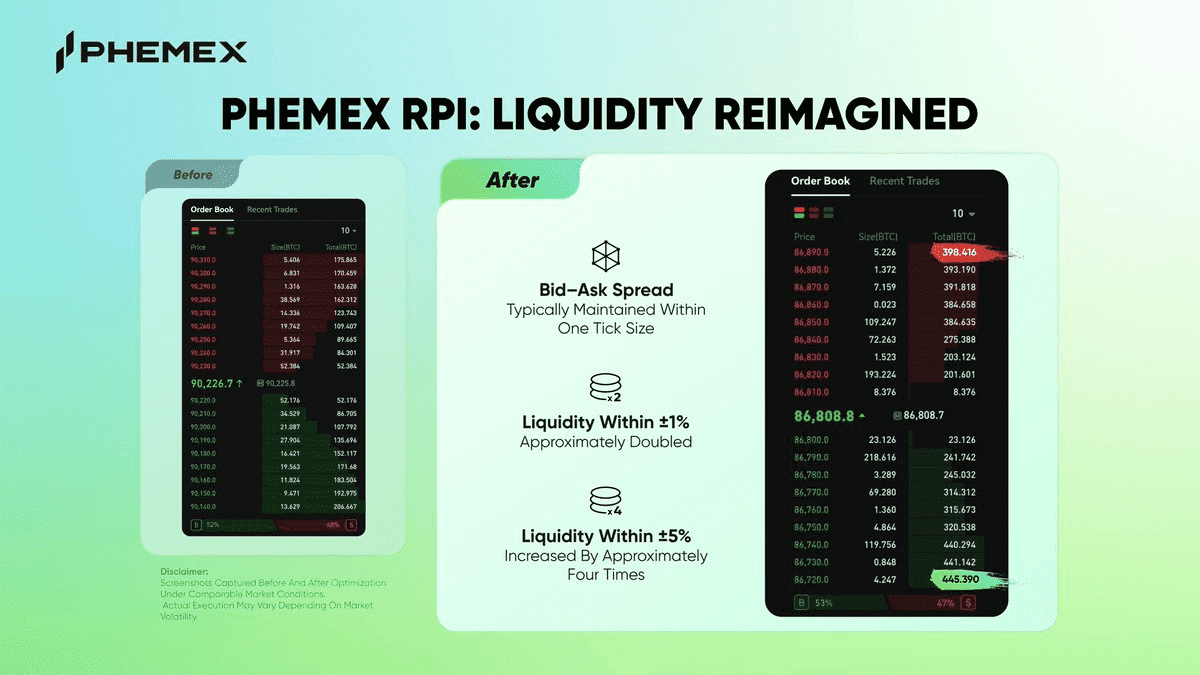

Tighter spreads for cleaner entries: Phemex RPI is designed to keep the bid–ask spread within 1 tick size, helping reduce the “spread tax” on frequent trades.

-

Stronger near-price liquidity: At within 1% depth, liquidity improves by 50%, supporting more stable fills and less price impact during active trading.

-

Deeper liquidity when markets get wild: At within 5% depth, liquidity is doubled, helping the order book stay more resilient during volatility spikes.

-

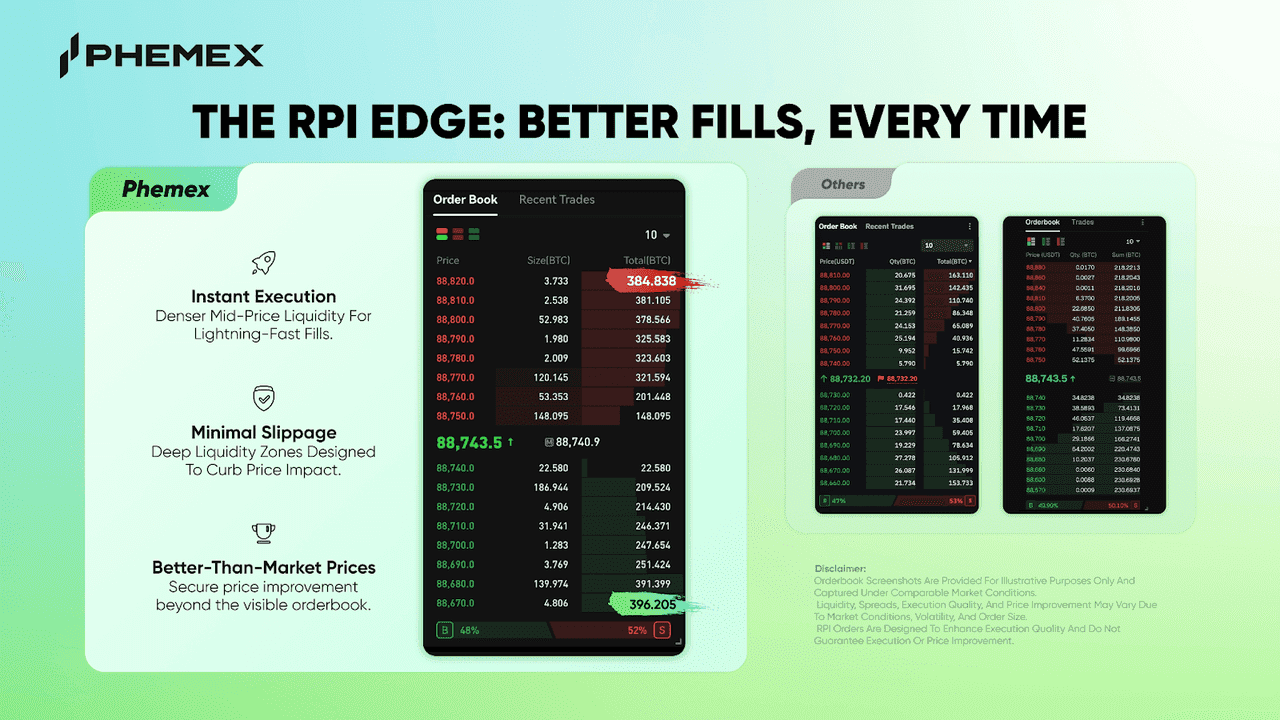

Better execution experience for retail traders: RPI aims to deliver denser mid-price liquidity, minimal slippage, and potential price improvement beyond what’s visible in the order book.

-

Wide coverage across markets: Phemex reported RPI ecosystem upgrades and liquidity benchmarking across 210+ trading pairs, including major contracts like BTC, ETH, and SOL.

If you’ve traded crypto long enough, you’ve felt it: markets get jumpy, spreads widen, and your entry (or exit) gets worse than you expected. That “tiny difference” between the price you wanted and the price you got adds up fast, especially if you trade actively.

Phemex built Retail Price Improvement (RPI) to target that exact problem: improving liquidity quality and pricing efficiency for retail traders by upgrading how liquidity is provided and how certain orders interact in the matching engine.

In late 2025, Phemex’s RPI ecosystem upgrade was followed by a liquidity audit that showed a major jump in order book depth across core pairs, with up to 5.5× benchmark levels on SOLUSDT, alongside strong multiples on ETHUSDT and BTCUSDT as well.

This article will explain what RPI is, what the performance data actually means, and why execution-focused traders should care.

The “hidden tax” of trading: spreads + slippage

On many platforms, high volatility doesn’t just move price as it also increases friction:

-

Wider spreads (you buy higher / sell lower)

-

Thinner books (your order moves price more)

-

More slippage (fills drift away from your intended level)

Phemex likes to put it this way: “Stop paying the ‘hidden tax’ of slippage.” RPI is designed to reduce that friction by strengthening liquidity where it matters most - close to the mid-price.

What is Phemex RPI?

RPI (Retail Price Improvement) is a specialized order type designed to enhance liquidity quality and pricing efficiency for retail traders.

At a high level, the system is built around a simple idea: retail traders benefit when the order book is denser, more stable, and more competitively priced particularly near the top of book.

The key mechanics

Phemex RPI orders follow three defining rules:

-

Exclusive matching: RPI orders only match with orders placed by non-algorithmic users and do not execute against OpenAPI orders.

-

Post-only (maker-only) behavior: RPI orders are strictly Post-Only, meaning they provide liquidity instead of taking it.

-

Lowest priority at the same price: Even at an identical price level, RPI orders are filled after non-RPI orders at that price.

This structure is meant to strengthen the book for retail execution while keeping ordering and queue logic consistent and predictable. Phemex RPI orders are excluded from API order book data. On the Trading Page Order Book, RPI orders appear normally on the trading interface (with some handling for crossed RPI orders).

Additionally, Phemex RPI orders will not match with each other, even if crossed, and crossed RPI orders can be hidden on the trading interface while remaining active in the matching engine.

RPI performance: what Phemex reported after the ecosystem upgrade

Phemex announced a major upgrade to its RPI order system, citing deeper institutional liquidity partnerships and a market audit conducted in late 2025.

The audit described its comparison method as public order book depth (±0.1% from mid-price) relative to top-tier exchange averages.

Highlight metrics from the late-2025 audit

-

BTCUSDT: Liquidity depth reported at 2× the industry benchmark

-

ETHUSDT: Liquidity reported at 5× average market liquidity

-

SOLUSDT: Liquidity reported at 5.5× compared to high-performance standards

-

Top 12 trading pairs: Aggregate liquidity reported at ~3× baseline top-tier requirements

-

Breadth: Competitive liquidity performance cited across 210+ trading pairs

If you’re confused on how to interpret “order book depth ±0.1% from mid,” just think of it as a practical liquidity lens. The ±0.1% band measures how much real size is available close to the current market price which is the zone that most affects: market orders and “aggressive” limit orders, stop-triggered executions during fast moves, and entries/exits for active strategies. More depth near mid-price typically means less price impact and more consistent fills, especially when the market is moving quickly.

RPI is an execution upgrade, not a marketing metric

Phemex’s RPI upgrade is framed around delivering a denser order book, more aggressive pricing, and narrower spreads, with “price improvement” that can exceed what’s visibly quoted in the book. Let’s translate that into real trader benefits.

1. Tighter spreads (lower friction on every trade)

Even if your strategy is great, spreads can quietly destroy your edge especially on frequent entries/exits. A more competitive top-of-book environment helps reduce the cost you pay just to get in and out.

2. Less slippage when volatility hits

In fast markets, thin books get punched through. More depth in the “near-mid” region helps cushion that impact so executions are less likely to cascade into worse and worse fills. That’s exactly the scenario that Phemex had in mind when developing RPI. On some other platforms high volatility means high slippage, but Phemex RPI is positioned as a way to redefine that liquidity experience for retail traders.

3. Better fills for active styles

RPI-enhanced liquidity conditions are most relevant if you do any of the following: scalp or trade short timeframes, trade breakouts where entry precision matters, run systematic “click-trading” around levels, and manage larger positions where depth matters on exits.

4. A retail-first interaction model

Phemex RPI orders interact exclusively with non-algorithmic participants and do not execute against OpenAPI orders. This allows the feature to bypass high-frequency API algorithms to support a transparent, high-performance environment for retail users.

The 3 execution KPIs traders care about

When traders say an exchange “feels good to trade on,” they can mean several things. Three of the most significant are directly targeted by and improved upon through Phemex RPI.

-

Bid-Ask Spread within 1 tick size: A tight bid–ask is the first layer of execution quality. When the bid and ask sit within one tick, traders are not “paying extra” just to enter and exit. This is especially important for high-frequency manual trading, scalping, and breakout entries.

-

Within 1% depth, liquidity improves by 50%: Depth close to price matters when you’re trading size, or when volatility spikes and stops trigger. Stronger 1% depth helps reduce price impact and keeps fills closer to your intended level.

-

Within 5% depth, liquidity is doubled: This is the “shock absorber.” Deep liquidity further from mid-price helps the market stay stable during larger moves, cascading liquidations, or sudden news candles in which thin books on competitor exchanges can get swept fast.

Taking advantage of Phemex RPI as a trader

If you’re a retail trader, the practical play is simple:

-

Trade supported USDT-M / USDC-M perpetuals (especially higher-liquidity pairs where depth improvements are meaningful).

-

Pay attention to execution quality over time:

-

Compare your typical slippage during volatility events

-

Watch spread behavior during fast candles

-

Review average entry/exit efficiency in your trading journal

-

-

Use execution-friendly habits to amplify the benefit:

-

Prefer limit orders where appropriate

-

Avoid “panic market orders” into thin moments when possible

-

Break large orders into smaller clips when markets are moving

-

RPI is best thought of as venue-level execution infrastructure because it enhances the environment you trade in from behind-the-scenes, especially when conditions get stressful.

Conclusion

Phemex RPI is built around one goal: better execution for retail traders through denser liquidity near the mid-price, minimized slippage, and price improvement beyond what’s visibly quoted. And after the RPI ecosystem upgrade, Phemex reported major depth improvements across core markets plus liquidity strength maintained over 210+ pairs.

If your trading results depend on tight entries, clean exits, and minimizing hidden costs, execution quality matters as much as your strategy, and Phemex RPI is designed to make that execution environment more retail-friendly.

Disclaimer

Cryptocurrency and derivatives trading involve substantial risk and may not be suitable for everyone. Liquidity improvements can reduce spreads and slippage under certain conditions, but they do not eliminate market risk, volatility, or the possibility of losses. This article is for informational purposes only and is not investment advice.