In the world of crypto, traders are accustomed to tracking a universe of assets. But for the savvy trader, one of the most important tickers to have on their screen isn't a cryptocurrency at all—it's MSTR, the stock of MicroStrategy.

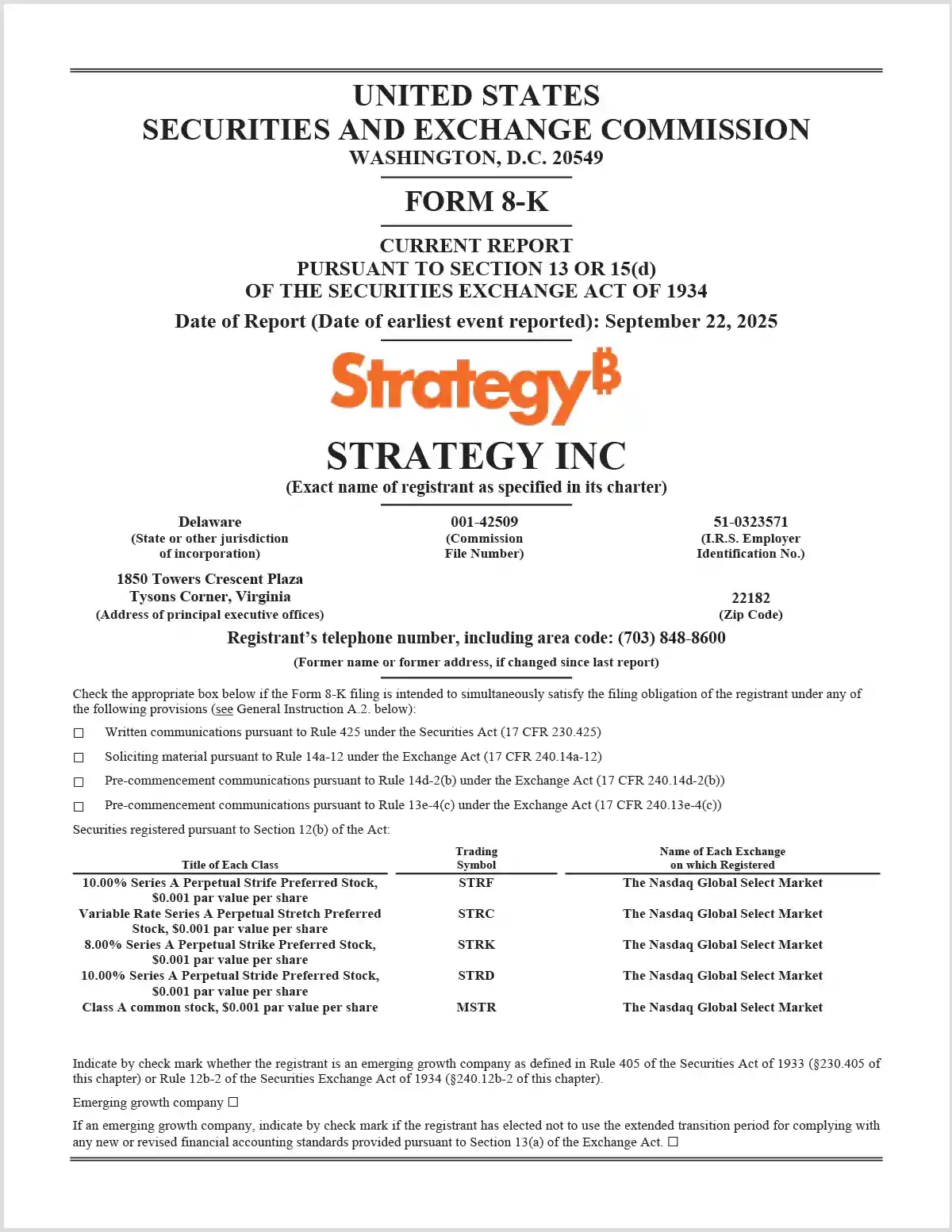

To the uninitiated, this seems strange. Why would a crypto trader, focused on decentralized, 24/7 markets, pay attention to a legacy tech stock on the Nasdaq? The answer is simple: For traders on platforms like Phemex, tracking MSTR provides a unique lens into institutional sentiment and leveraged market dynamics. Under its Executive Chairman, Michael Saylor, the company has transformed itself into the world's foremost leveraged Bitcoin holding company.

Its stock, MSTR, has become one of the most closely watched Bitcoin proxies in the world, creating a fascinating dynamic when analyzing the MSTR vs Bitcoin relationship. It often moves with more volatility and offers unique trading dynamics that cannot be found even in the spot Bitcoin market itself. For Phemex traders who live and breathe market volatility, understanding the mechanics of MicroStrategy stock is no longer optional. It's a source of critical market intelligence and potential alpha.

While we've previously covered MicroStrategy and Michael Saylor's groundbreaking impact on crypto adoption, this article will dive deeper. We won't focus on history; we'll focus on the instrument. This is a trader's guide to MSTR, updated with the latest market-moving intelligence.

The Transformation: An Unrelenting Bitcoin Acquisition Vehicle

MicroStrategy's transformation began in August 2020 when it adopted Bitcoin as its primary treasury reserve asset. What started as a defensive move against fiat inflation has evolved into an aggressive and relentless acquisition strategy.

The scale of this strategy has accelerated dramatically. According to a direct statement from Michael Saylor on September 21, 2025, the company now holds a staggering 639,835 BTC. This war chest, acquired for a total cost of approximately 47.3 billion, gives them average purchase price of 73,971 per Bitcoin.

This relentless accumulation, funded by cash flow, stock offerings, and billions in debt, has fundamentally altered the company's identity. Saylor has explicitly stated that MicroStrategy is a "Bitcoin development company." Consequently, the MSTR stock price has almost entirely decoupled from its software business and is now overwhelmingly correlated with the price of Bitcoin.

The Trader's Thesis: MSTR as a Leveraged Bitcoin Instrument

The single most important concept to understand is this: MSTR often behaves like a leveraged bet on Bitcoin. When Bitcoin rallies, MSTR tends to rally even harder. Conversely, when Bitcoin falls, MSTR often falls further. This amplified volatility comes from a deliberate corporate finance strategy involving debt-fueled acquisitions and operational leverage from its underlying software business.

The "Saylor Premium": A Real-Time Gauge of Institutional Conviction

One of the most fascinating dynamics is the "MSTR Premium"—the price the market is willing to pay for MSTR stock over and above the value of the Bitcoin it holds. This premium exists for several reasons, but recent news has crystallized its primary driver: institutional conviction, spearheaded by Michael Saylor himself.

The Core Narrative: Institutional Hoarding

In a recent CNBC interview, Saylor laid out the core bullish narrative driving the entire Bitcoin space. He stated that institutional demand is now outstripping all available supply. He pointed to two key facts:

-

ETF Absorption: Large players like BlackRock are "absorbing the entire natural supply" of Bitcoin on behalf of their institutional clients.

-

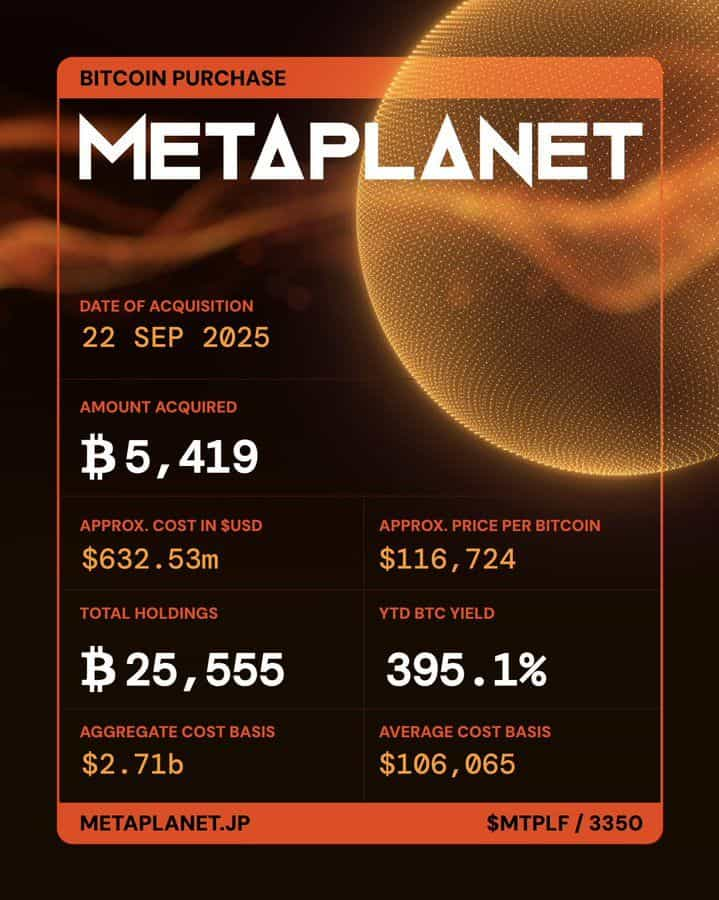

Corporate Demand: Approximately 180 other Bitcoin reserve companies are collectively buying even more than miners can produce.

Metaplanet has acquired 5419 BTC for ~$632.53 million at ~$116,724 per bitcoin and has achieved BTC Yield of 395.1% YTD 2025.

Metaplanet has acquired 5419 BTC for ~$632.53 million at ~$116,724 per bitcoin and has achieved BTC Yield of 395.1% YTD 2025.

This narrative of a supply shock driven by insatiable institutional demand is the fundamental story that justifies the MSTR premium. Investors are paying a premium not just for the BTC on the balance sheet, but for Saylor's strategic position at the forefront of this institutional wave.

From Corporate Adoption to National Legitimization

Further justifying this premium, Saylor is now moving beyond corporate boardrooms and into the halls of power. In September 2025, he joined prominent Bitcoin community members and U.S. Senators like Ted Cruz and Marsha Blackburn on Capitol Hill. Their goal: to lobby for a proposed "Strategic Bitcoin Reserve" that would see the U.S. government acquire one million BTC over five years.

For traders, this is a critical development. It signals that the MSTR story is also a bet on the potential for nation-state adoption, a catalyst of immense scale. Saylor's central role in these high-level discussions is a key intangible asset that investors are pricing into the MSTR stock.

Actionable Intelligence: How Crypto Traders Can Use MSTR

Watching MSTR provides actionable data for your crypto trading strategies.

1. MSTR as a High-Beta Directional Bet

MSTR's leveraged nature makes its price movements a powerful confirming indicator. If Saylor's prediction of a year-end Bitcoin price rise materializes, MSTR is positioned to outperform BTC on a percentage basis.

2. Pairs Trading: Trading the Premium Itself

This advanced strategy involves betting on the direction of the premium. For example, if you believe the excitement from the Capitol Hill meeting has pushed the premium to unsustainable levels, you could short MSTR while taking an equivalent long position in Bitcoin Futures.

The key takeaway is that these dynamics create unique trading opportunities. On Phemex, you can take advantage of the underlying BTC volatility through our deep liquidity in BTC futures and spot trading pairs.

A Balance of Risks and Catalysts

MSTR's leverage is a double-edged sword. While the potential rewards are high, traders must be acutely aware of the risks, balanced against powerful future catalysts.

The Bear Case: What to Watch For

-

Magnified Price Corrections: The primary risk is that in a Bitcoin downturn, MSTR's stock will fall further and faster than Bitcoin itself.

-

Debt and Solvency Risk: With a high average purchase price of $73,971, a significant and prolonged drop below this level could create a negative market narrative and raise concerns about the company's ability to service its massive debt load.

-

Competition from Spot Bitcoin ETFs: ETFs offer a simpler, non-leveraged way to get pure Bitcoin exposure and will continue to compete for capital.

-

"Key Man" Risk: The entire strategy is inextricably linked to Michael Saylor.

The Bull Case: A Major Future Catalyst

Balancing these risks is a colossal potential catalyst on the horizon: inclusion in the S&P 500 Index.

In a September 2025 CNBC appearance, Saylor stated he is "confident" that MicroStrategy will be added to the S&P 500. For traders, the importance of this cannot be overstated. Inclusion would force trillions of dollars in passive index funds to buy MSTR stock, creating a massive, non-discretionary inflow of capital. This potential event provides a powerful long-term bullish thesis that underpins the stock.

Conclusion: An Essential Tool in the Modern Trader's Kit

MicroStrategy (MSTR) has successfully engineered itself into one of the most fascinating assets at the intersection of traditional finance and the digital asset world. Bolstered by an aggressive institutional hoarding narrative and the political push for nation-state adoption, it represents far more than a software company's stock; it is a complex, leveraged, and highly dynamic proxy for Bitcoin.

For the Phemex crypto trader, MSTR is not a distraction; it is an extension of the crypto market. By watching its price action and understanding the powerful narratives and future catalysts driving it, you gain a powerful lens through which to view institutional sentiment and market risk appetite. In today's interconnected markets, ignoring MicroStrategy stock is ignoring a vital piece of the puzzle.

Ready to Act on Market Volatility?

The analysis of MSTR demonstrates the immense opportunities that market volatility can present. Whether you're bullish on the institutional narrative or watching for potential corrections, Phemex provides the tools you need to act.

Ready to trade Bitcoin on Phemex?