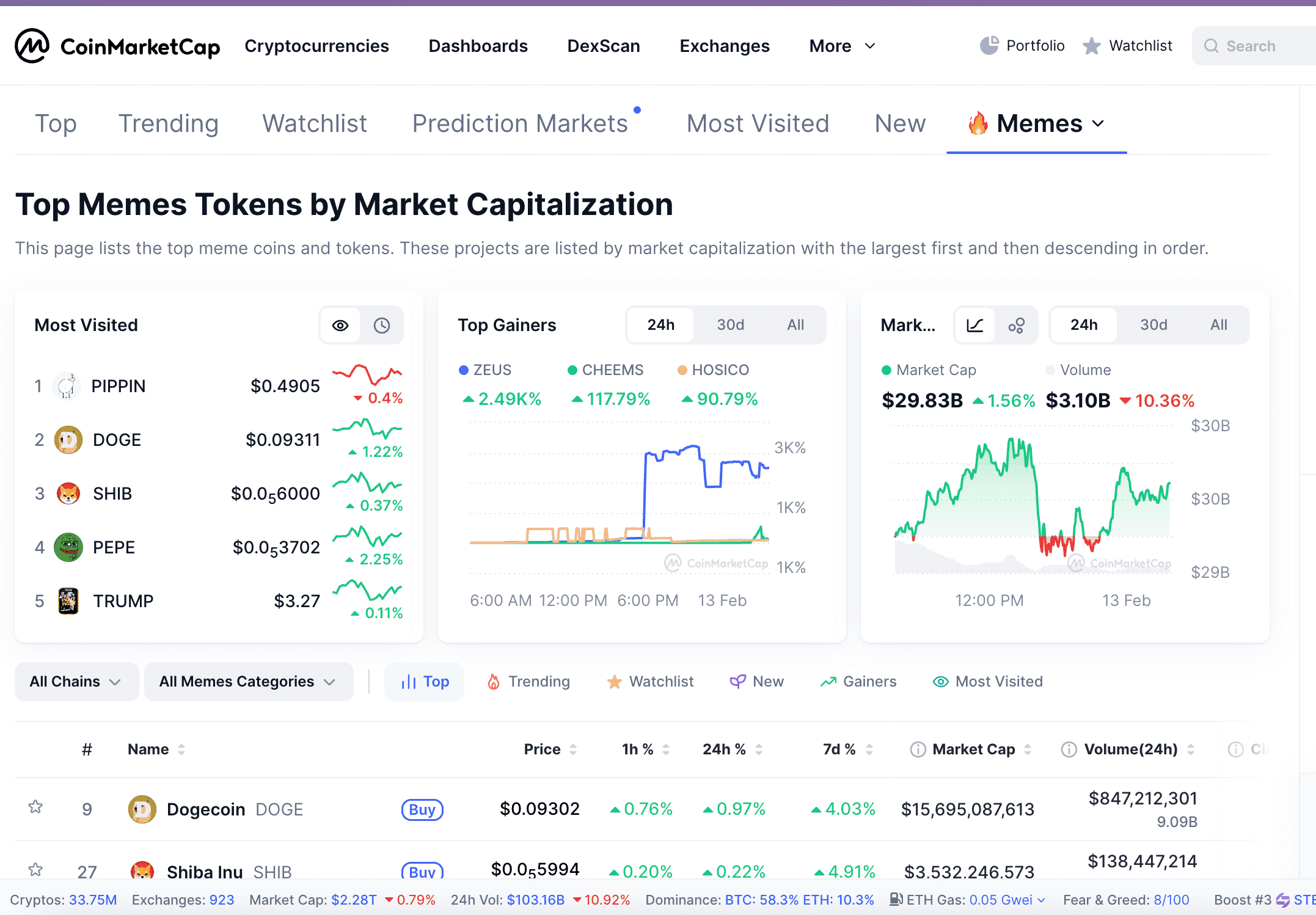

The cryptocurrency market is currently navigating a period of complex divergence. While the global crypto market capitalization has seen a marginal contraction of 0.79%, settling at 29.83B, reflecting a 1.56% increase within the last 24 hours.

This comprehensive analysis examines the technical structure of leading assets like PEPE and SHIB, the emergence of low-cap outliers, and the institutional-grade risk management infrastructure required to navigate these high-beta markets on Phemex.

1. Macro Context: Extreme Fear vs. Speculative Appetite

One of the most striking data points in today's market is the Fear & Greed Index, which has plunged to a level of 8/100 (Extreme Fear). Historically, such low readings indicate widespread market apprehension, often driven by macroeconomic uncertainty or regulatory shifts.

However, the "Memes" sector dashboard on CoinMarketCap reveals a "Risk-On" sub-current. Despite the global "Extreme Fear" sentiment, the meme sector's 24-hour volume reached $3.10B. This suggests that while broader market participants are de-risking, speculative capital is concentrating in high-volatility assets.

Key Market Dominance Metrics:

Bitcoin (BTC) Dominance: 58.3%

Ethereum (ETH) Dominance: 10.3%

Sector Trend: Speculative rotation into low-cap outliers like ZEUS (+2,490%) and CHEEMS (+117.79%) highlights a market looking for idiosyncratic growth opportunities amidst a sluggish macro backdrop.

2. Technical Deep-Dive: Established Leaders (PEPE & SHIB)

While "Top Gainers" like ZEUS capture headlines, the majority of meme liquidity remains anchored in established assets.

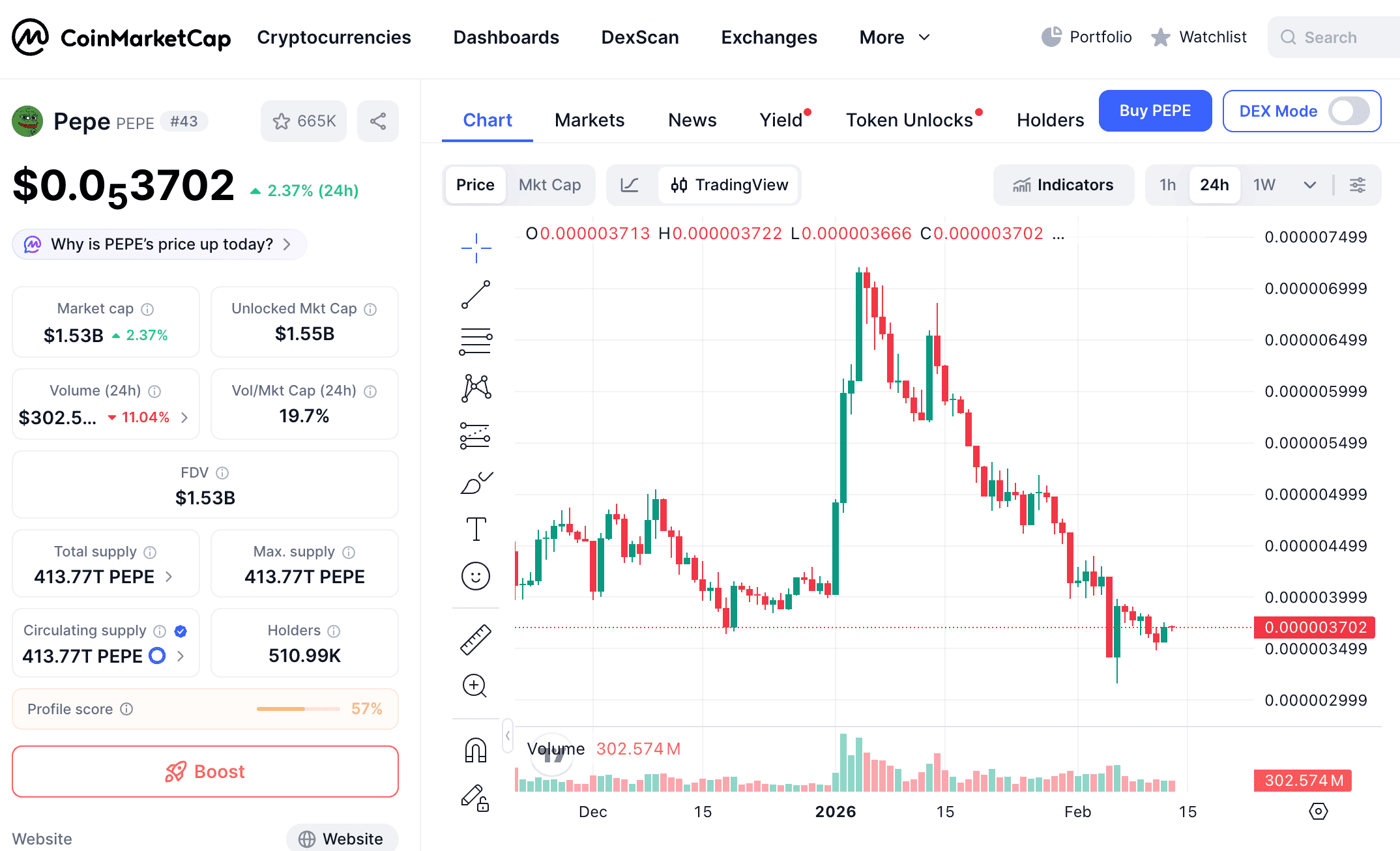

Pepecoin (PEPE): Momentum vs. Volume Divergence

PEPE is currently the momentum leader among top-tier meme assets, trading at $0.0₅3702, up 2.25% in the last 24 hours.

Chart Observation: The 4-hour chart shows PEPE testing a critical support zone between $0.0₅3500 and $0.0₅3700. After a sharp correction from its January peak of $0.0₅7500, the asset is attempting to form a "double bottom" pattern.

Volume Analysis: We observe a 11.04% decrease in 24-hour volume (0.0₅4000 resistance may be the next logical step.

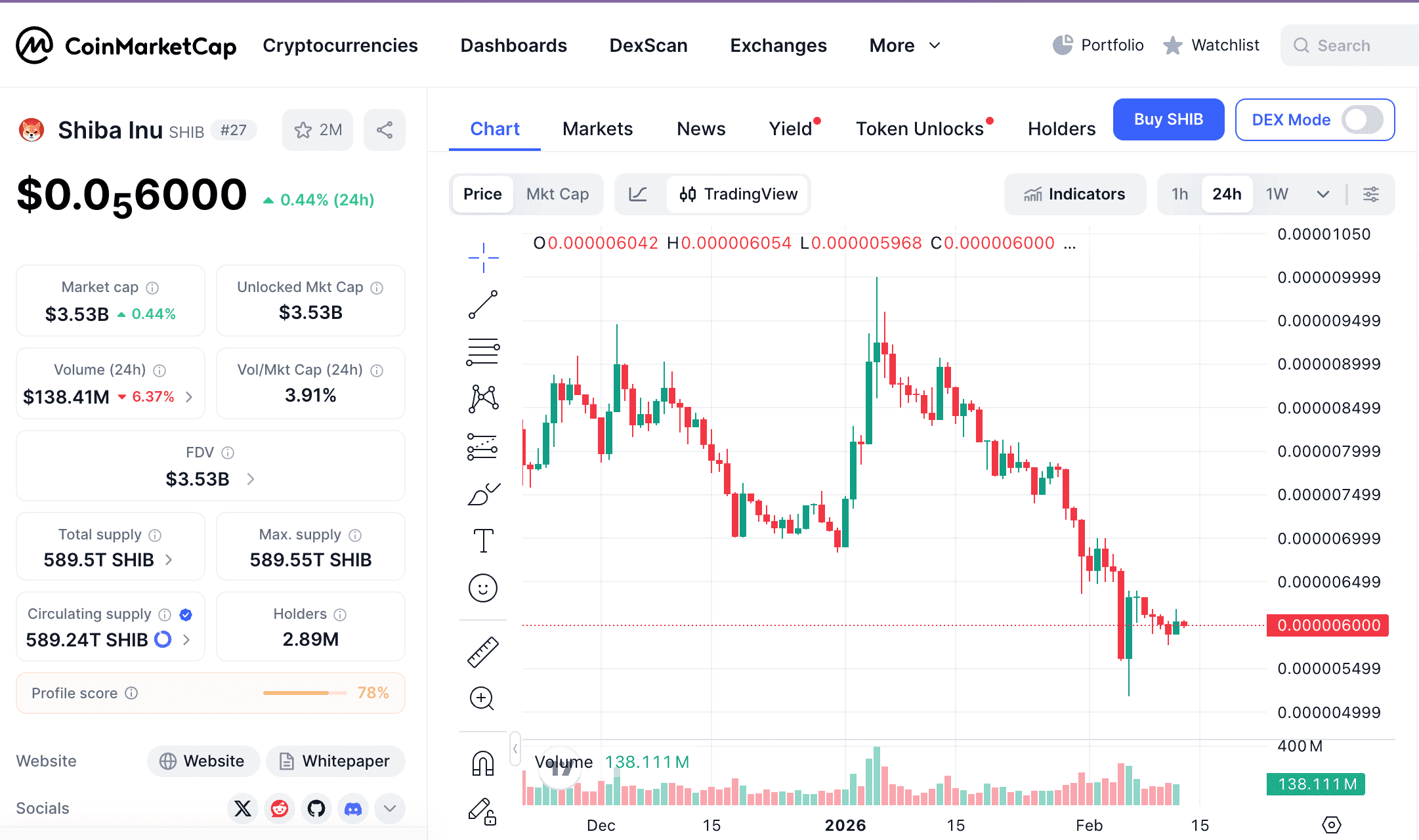

Shiba Inu (SHIB): The Ecosystem Pivot

Shiba Inu (SHIB) continues to demonstrate its role as a liquidity heavyweight, currently priced at 3.53B.

On-Chain Strength: SHIB maintains a massive holder base of 2.89 million, which provides a "liquidity floor" that newer meme coins lack.

Technical Outlook: SHIB is currently defending the $0.0₅6000 psychological support. A holding pattern at this level is critical; a breakdown could lead to a retest of the 0.0₅6500 trendline resistance. The 24-hour volume of $138M suggests that the market is in a "wait-and-see" mode regarding Shibarium’s upcoming utility updates.

3. The "Meme Macro": Understanding Unit Bias and Retail Attention

The "Most Visited" assets today—PIPPIN, DOGE, SHIB, PEPE, and TRUMP—reveal a clear trend: retail attention is focused on assets with strong social sentiment and "unit bias."

What is Unit Bias?

Unit bias is the psychological tendency for investors to prefer owning "millions" of a lower-priced token (like SHIB or PEPE) rather than a small fraction of a high-priced token (like BTC). In a market defined by Extreme Fear, this bias becomes more pronounced as retail traders seek asymmetric upside potential with smaller capital outlays.

4. Trading Infrastructure: Why Platform Performance Matters

In a high-volatility environment where tokens like ZEUS can move 2,000% in a single session, the technical infrastructure of your exchange is your most critical tool for risk mitigation.

Execution Speed and Latency

High-beta trading requires millisecond-level precision. Phemex’s trading engine is engineered to handle 300,000 transactions per second (TPS). This ensures that when you execute a market order during a "God Candle" or a sudden dump, your fill price is as close as possible to the quoted price, minimizing the "slippage" that often plagues decentralized exchanges (DEXs).

Liquidity Depth

Meme coins are notoriously volatile because their order books can be "thin." Phemex provides deep liquidity for PEPE-USDT, SHIB-USDC, and DOGE-USDT pairs. Deep liquidity ensures that even large trades can be executed without significantly moving the market price against the trader.

Phemex Onchain: Accessing Emerging Assets

For traders looking to explore early-stage tokens before they reach the main spot market, Phemex Onchain offers a bridge to decentralized liquidity. This allows users to trade emerging meme assets across multiple chains while benefiting from the security protocols of a centralized ecosystem.

5. Strategic Risk Management Framework

Given the 8/100 Fear Index, defensive trading is paramount. Phemex offers advanced tools to automate your risk management:

Conditional Take-Profit/Stop-Loss (TP/SL): Never enter a meme coin trade without a predefined exit. Setting a Stop-Loss at the time of entry is the only way to protect against the 50-80% "flash crashes" common in this sector.

Trailing Stops: For assets in a parabolic move (like the current trend in ZEUS), a trailing stop allows you to capture the upside while automatically locking in profits if the trend reverses by a specific percentage.

Cross vs. Isolated Margin: When trading PEPE or SHIB with leverage (up to 100x on Phemex), using Isolated Margin can limit your risk to a specific position, preventing a single volatile move from affecting your entire account balance.

Conclusion: The Path Through Late February

The data from February 13 suggests a meme coin sector that is acting as a "liquidity sponge" during a time of broader market fear. While the Extreme Fear (8/100) reading serves as a warning of potential macro headwinds, the technical resilience of PEPE and the explosive moves in low-cap outliers demonstrate that speculative interest remains high.

As a trader, success in this environment is not just about identifying the next "breakout," but about utilizing the speed, liquidity, and safety tools provided by Phemex to manage the inherent risks of the meme coin supercycle.

Disclaimer: Cryptocurrencies, especially meme coins, are subject to extreme market risk and price volatility. This analysis is for informational purposes only and does not constitute financial, investment, or trading advice. Meme coins often lack fundamental utility and their value can be driven entirely by social media sentiment. Always conduct your own research (DYOR) and never trade more than you can afford to lose. Past performance of assets like ZEUS, PEPE, or SHIB does not guarantee future results.