In the euphoric heights of a bull market, narratives tend to simplify. Price action becomes the ultimate arbiter of truth, and green candles have a way of silencing even the most legitimate concerns. Yet, bubbling just beneath the surface of Ethereum's recent all-time highs, a fierce and fundamentally important debate has erupted. It is a debate that cuts to the very core of how we measure the health and value of a blockchain network.

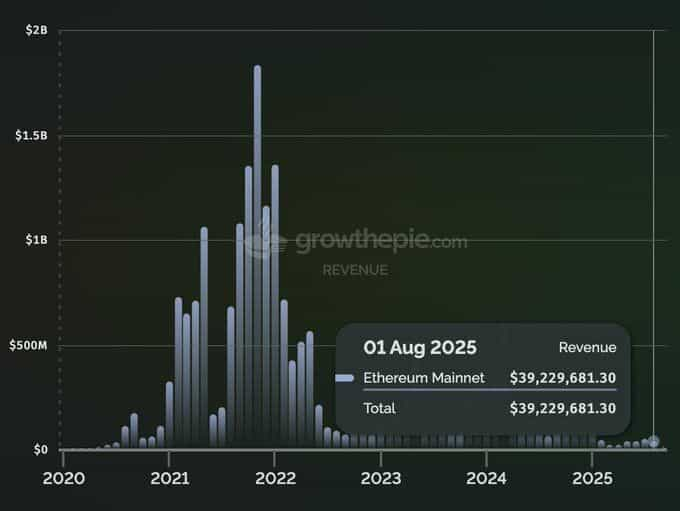

The catalyst was a stark observation, powerfully articulated by Messari's enterprise research manager, AJC. On September 7th, he pointed out a jarring paradox: while the price of ETH soared to new peaks in August 2025, the Ethereum network's own revenue for the month was a mere $39.2 million. This figure is not just low; it is a catastrophic collapse when viewed in context. It represents a 75% year-over-year decrease from August 2023's $157.4 million and a 40% drop from August 2024's $64.8 million. In fact, it was the fourth-lowest monthly revenue figure for Ethereum since January 2021, a period when ETH's price was a fraction of its current value.

AJC's lament was clear: "Ethereum's fundamentals are collapsing, but it seems everyone only cares about the ETH price going up, regardless of whether the network is healthy." The post went viral, sparking a firestorm of discussion. Why? Because the timing is exquisitely poignant. In the midst of a bull market, with institutional capital pouring into the ecosystem through new "coin-stock" treasury plays and Wall Street's gaze firmly fixed on ETH, the network's own economic engine appears to be sputtering.

Is Ethereum becoming, as some have poetically suggested, a "selfless, altruistic flag," pointing the way for others while becoming tattered itself? Is this precipitous drop in revenue a fatal flaw, a sign of a network in terminal decline being masked by speculative price action?

The answer is far more complex and, ultimately, far more bullish than the headline numbers suggest. The decline in Ethereum's revenue is not an accident or a sign of failure. It is a feature, not a bug. It is the direct, calculated, and intended consequence of a multi-year strategic pivot that is transforming Ethereum from a monolithic "world computer" into the foundational settlement and data availability layer for a multi-trillion-dollar decentralized economy. To understand this, we must look beyond the monthly revenue chart and dissect the history, technology, and philosophy that has led to this pivotal moment.

A Brief History of a Deliberate Evolution

The current revenue situation cannot be understood as a snapshot in time. It is the culmination of a long and deliberate journey to solve the blockchain industry's most persistent demon: the scalability trilemma.

In its infancy, Ethereum was envisioned as a singular "world computer." Every transaction, every smart contract execution, every DeFi trade was meant to happen directly on the mainnet. This "monolithic" approach was revolutionary, but it quickly ran into the hard limits of physics and computer science. As demand grew, the network became congested, and transaction fees (gas) soared to unsustainable levels, pricing out all but the most high-value use cases. The Ethereum community was faced with a choice: remain a niche, expensive network for "whales," or find a way to scale to accommodate global demand.

The path chosen was not to simply make the base layer faster, which would have compromised decentralization. Instead, the Ethereum Foundation and the broader developer community committed to a rollup-centric roadmap. This was a fundamental philosophical shift. The vision was no longer for the mainnet (Layer 1) to do everything. Instead, the L1 would specialize in what it does best: providing unparalleled, decentralized security and data availability. The actual execution—the transactions, the computations, the user activity—would be pushed out to a thriving ecosystem of Layer 2 scaling solutions, or "rollups."

This roadmap has been methodically executed through a series of landmark technical upgrades:

-

The Merge (September 2022): This historic transition from Proof-of-Work to Proof-of-Stake was primarily about energy efficiency and changing ETH's monetary policy. However, it also laid the crucial groundwork for future scaling upgrades by simplifying the consensus mechanism.

-

The Dencun Upgrade (March 2024): This is the single most important technical event for understanding the current revenue paradox. Dencun introduced EIP-4844, also known as "Proto-Danksharding." In simple terms, it created a new, separate channel for Layer 2s to post their transaction data to the Ethereum mainnet. This new data channel, using "blobs," is dramatically cheaper than the old method of cramming data into the calldata of a standard transaction.

The Dencun upgrade was an explicit, deliberate act of economic engineering. Its stated purpose was to lower the cost for L2s to operate by 10-100x. Since the fees L2s pay to the L1 are a primary source of Ethereum's network revenue, the Dencun upgrade was designed to decrease Ethereum's revenue. It was a conscious sacrifice of short-term L1 fee income to enable the long-term strategic vision of a thriving L2 ecosystem.

The L2 Question - Vampires Sucking Blood or a Symbiotic Engine of Growth?

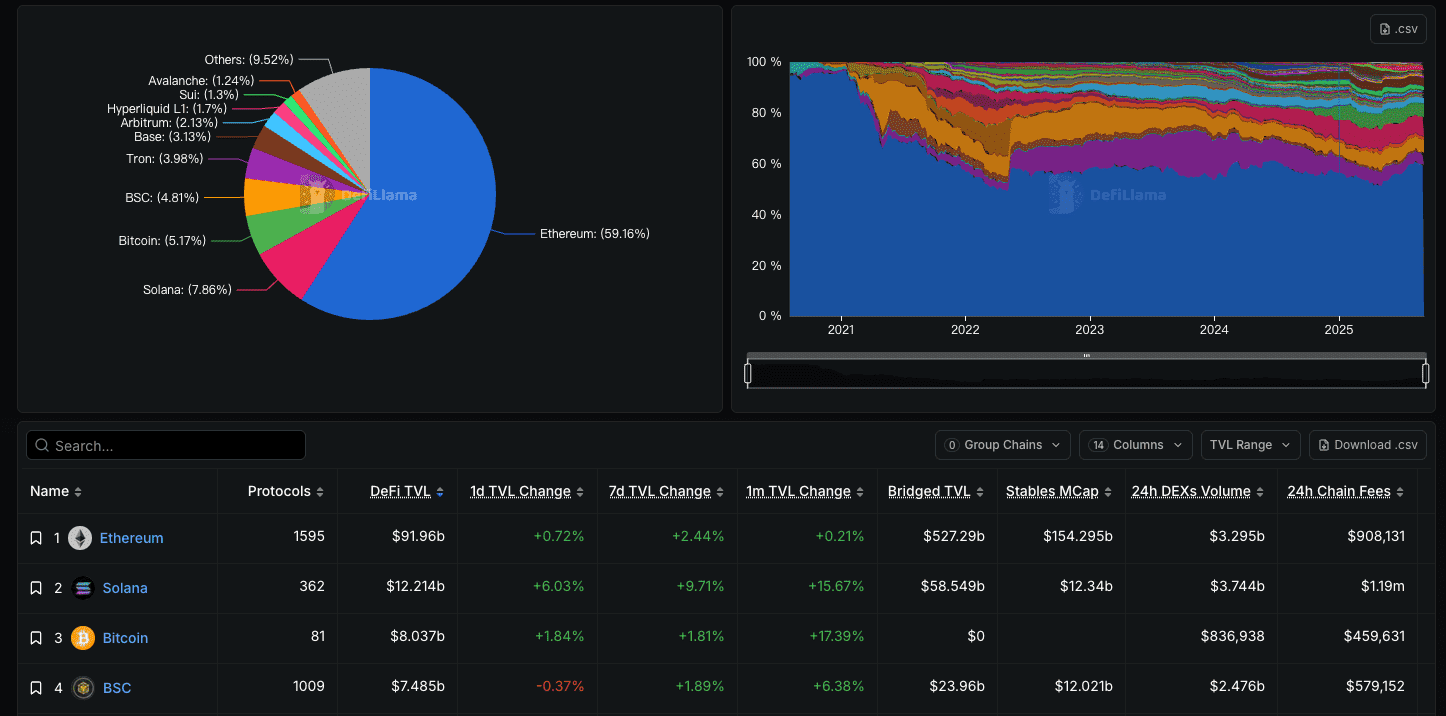

The direct consequence of the Dencun upgrade has been an explosion of activity on L2s like Arbitrum, Optimism, and most recently, the phenomenal growth of Base. This leads to the central question in the debate: Are these L2s "vampires" sucking the lifeblood out of Ethereum, or are they "symbiotes" contributing to its overall health?

The Vampire Argument (The Surface-Level View):

The argument that L2s are harming Ethereum is simple and intuitive. It goes like this: every transaction that now happens on Base or Arbitrum is a transaction that could have happened on the Ethereum mainnet. These L2s are siphoning off users, developers, and, most critically, the fee revenue that once accrued to the L1. The on-chain data seems to support this: L1 transaction counts have stagnated while L2 transaction counts have gone parabolic. From this perspective, L2s are direct competitors that are cannibalizing the mainnet's business.

The Symbiotic Argument (The Deeper, Strategic View):

This argument requires looking at the relationship through a more sophisticated lens. L2s are not competitors to Ethereum; they are its customers and its strategic partners, contributing to the health of the ecosystem in ways that are far more profound than direct L1 gas fees.

-

L2s Pay for Security: This is the most crucial point. L2s like Arbitrum and Base are not independent entities floating in the void. Their very security and integrity depend on posting their transaction data and state proofs back to the Ethereum L1. They are paying customers of Ethereum's security services. While the "blob fees" they pay post-Dencun are lower than the old calldata fees, they still represent a consistent and growing source of demand for Ethereum's blockspace. As the L2 economy grows, the aggregate fees paid to the L1 will continue to provide a substantial security budget for the network's validators.

-

L2s Expand the Total Addressable Market: The vampire argument assumes a zero-sum game. The reality is that the vast majority of activity on L2s simply could not exist on the L1. The high fees of the mainnet made applications in gaming, social media, micro-transactions, and low-value NFT mints economically unviable. L2s have unlocked a massive new design space, expanding the total economic bandwidth of the Ethereum ecosystem by orders of magnitude. They are bringing in new users and use cases that would have otherwise gone to alternative L1s or never existed at all.

-

L2s Create Structural Demand for the ETH Asset: This is a vital, often overlooked point. The health of the Ethereum network is not just measured by its fee revenue, but by the demand for its native asset, ETH. L2s are massive drivers of structural demand for ETH:

-

Gas: L2 users still need ETH (or a wrapped version) to pay for transactions on the L2.

-

Sequencer Operations: The sequencers that order and batch L2 transactions must hold and spend ETH to post their data to the L1.

-

DeFi Collateral: ETH is the undisputed reserve asset and premier collateral within the DeFi ecosystems of nearly every major L2. The growth of DeFi on Base and Arbitrum directly translates to more ETH being locked and utilized.

-

In this light, L2s are not vampires. They are the fulfillment of Ethereum's strategic roadmap. They reduce direct L1 transaction revenue but massively increase the L1's utility as a global settlement layer and drive immense, sustainable demand for the ETH asset itself.

A Comparative Analysis - Different Chains, Different Strategies

To further contextualize Ethereum's situation, it's essential to compare its modular strategy with the monolithic approaches of its competitors.

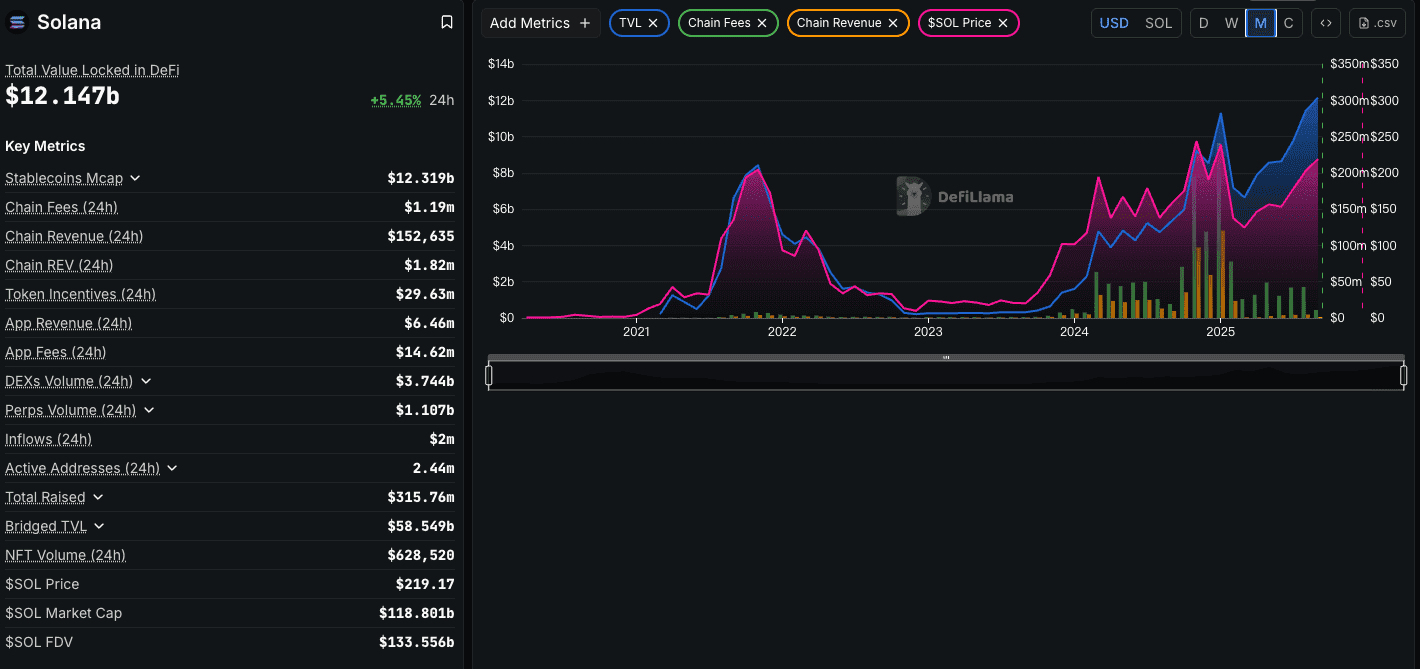

- Solana: Solana represents the primary alternative philosophical path: the "monolithic" or "integrated" blockchain. It aims to do everything on a single, hyper-performant L1. As a result, its network fee revenue is a more direct reflection of total network activity. While this can lead to impressive headline revenue numbers during periods of high activity, it comes with a trade-off in decentralization and a different set of scaling challenges. Solana is betting it can scale a single layer to infinity; Ethereum is betting that a modular system of a secure L1 and multiple L2s is a more resilient and ultimately more scalable architecture.

-

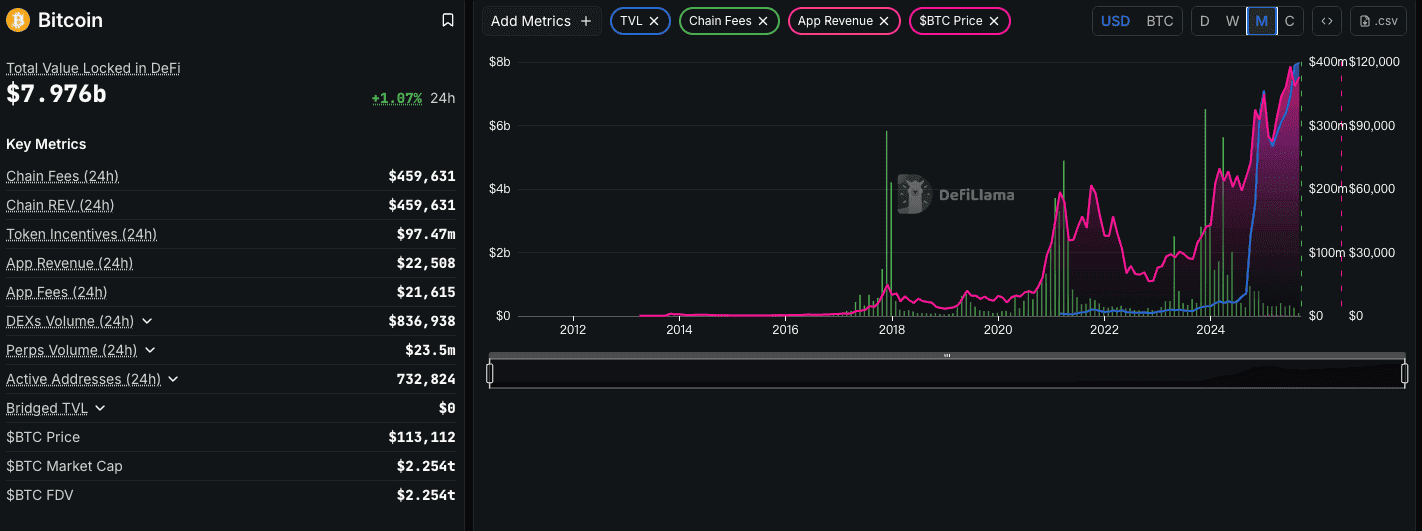

Bitcoin: Bitcoin is not trying to be a world computer. Its primary purpose is to be the world's most secure system for storing and transferring value. Its fee revenue is a direct payment for this specific service. While its fee market is crucial for its long-term security, it's not designed to support a complex dApp ecosystem. Comparing Ethereum's revenue to Bitcoin's is an apples-to-oranges comparison, as they are optimizing for entirely different goals.

-

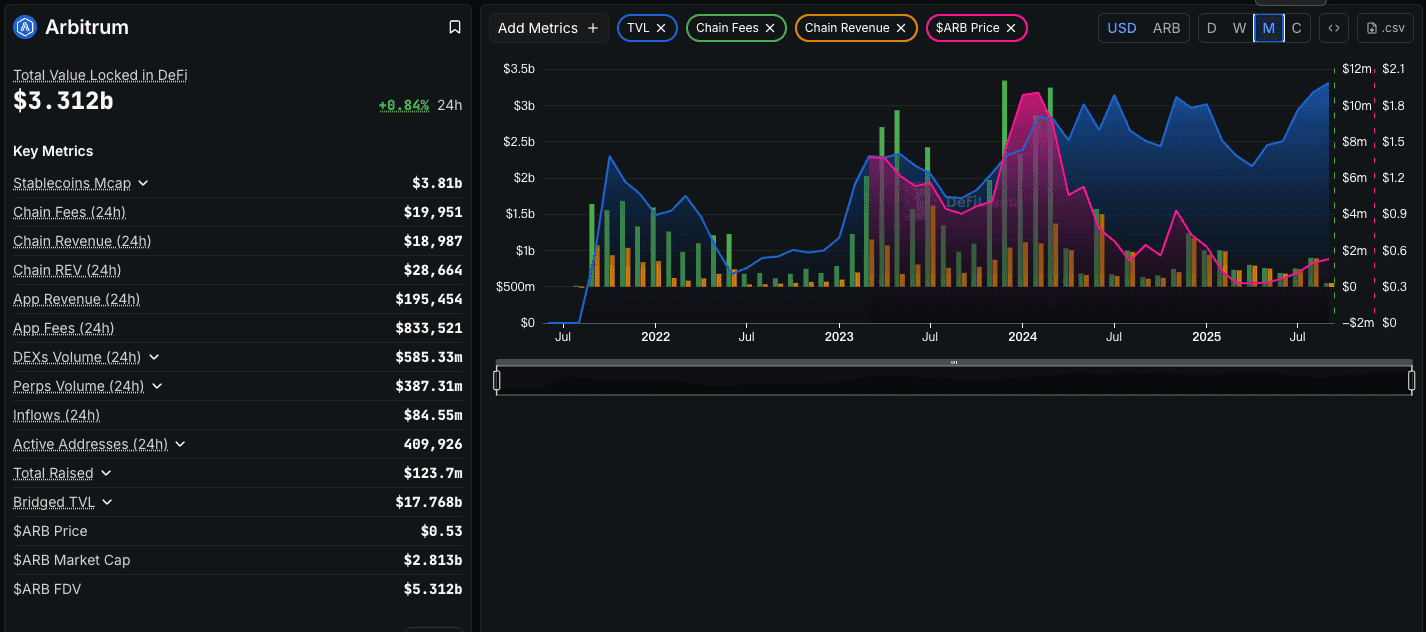

Arbitrum (as an L2): Looking at a successful L2 like Arbitrum, we see a network that is itself generating significant fee revenue. This is where the value capture is happening at the application layer. However, a portion of this revenue is perpetually paid downstream to the Ethereum L1 in exchange for security. This demonstrates the symbiotic relationship perfectly: Arbitrum captures the high-frequency, low-value transaction fees, while Ethereum captures the lower-frequency, high-value settlement and data availability fees.

The New Bull Case for Ethereum - From Digital Oil to Digital Bonds

If L1 gas fees are no longer the primary metric for Ethereum's health, what is? The bull case for Ethereum has evolved. The value accrual thesis has shifted from ETH as "digital oil" (burned to pay for computation) to a more multifaceted view of ETH as the foundational asset of the internet economy.

-

ETH as the Ultimate Settlement Layer (Internet Bonds): The most valuable real estate in the entire digital world is the blockspace on the Ethereum L1. It is the final, immutable court of appeal. The true product Ethereum is selling is not just computation, but security and settlement assurance. L2s batching their state proofs to the L1 are analogous to major financial institutions settling their net balances at a central bank. This is an incredibly high-value service, and the ETH asset is the instrument used to pay for it.

-

ETH as the Premier Reserve Asset: As discussed, the growth of L2s creates structural demand for ETH as the primary collateral in their DeFi ecosystems. This is now being supercharged by a new trend: the "coin-stock" or "Bit-ETH" treasury model. Publicly traded companies like SBET and BMNR are beginning to add ETH to their balance sheets, recognizing it not just as a speculative asset, but as a productive, yield-bearing treasury asset. They see it as a combination of a high-growth tech stock and a bond (due to staking yield). This institutional demand is completely divorced from L1 gas fees.

-

ETH as a Yield-Bearing Asset: Since The Merge, holding ETH and staking it provides a native "risk-free" rate for the crypto economy. This yield makes ETH an attractive asset for treasuries, funds, and individuals to hold, further reducing the circulating supply and increasing its scarcity.

Conclusion: A Victim of Its Own Success, A Master of Its Own Destiny

The great debate over Ethereum's falling revenue is a sign of the network's profound maturation. The critics who point to the revenue charts are not wrong about the data, but they are misinterpreting its meaning. They are judging a next-generation modular network by the monolithic standards of the past.

The revenue decline is the predictable, desired outcome of a brilliant and successful strategic pivot. Ethereum has consciously chosen to sacrifice its high L1 fees to become something far more ambitious and enduring: the foundational security and data availability layer for a sprawling, multi-chain ecosystem of Layer 2s that can scale to billions of users.

The value of the Ethereum network is no longer best measured by the gas burned on its mainnet. It is now measured by the total economic activity secured by its L1, the demand for ETH as the reserve asset across its vast L2 empire, and its emerging role as the premier treasury asset for a new generation of digital-first institutions.

The network is not dying; it is metamorphosing. It is trading the high-margin but low-volume business of being a "boutique" world computer for the lower-margin but infinitely scalable business of being the global settlement layer. The critics are looking at the emptying of the storefront, failing to see that the business has moved into the back office, where it is now building the foundational plumbing for the entire digital economy. Ethereum isn't a tattered flag; it is the bedrock upon which new worlds are being built.

This article is for informational purposes only and does not constitute financial advice. The views expressed are solely those of the author(s) and do not necessarily reflect the official policy or position of Phemex. Cryptocurrency trading involves substantial risk and is not suitable for all investors. Investors should consider their financial situation and consult with a financial advisor before making any investment decisions. Phemex is not responsible for any direct or indirect losses arising from the use of this information.