Introduction: The Opportunity Cost of Stagnation

In crypto market cycles, "up only" is a brief anomaly. The majority of price action occurs in consolidation—tight ranges where trend-following strategies often bleed capital through false breakouts and whipsaw volatility. For retail traders, sideways markets are frequently periods of slow capitulation.

Stop fighting the "chop" and start leveraging the pros. While most traders lose their edge in a flat market, Phemex Copy Trading specialists utilize systematic precision to turn volatility into yield. Don't let your capital sit idle—join 10 million+ users and master the market today.

Join Phemex Now: Copy Top Traders & Secure Your 24h Advantage

This case study analyzes a 30-day consolidation period to demonstrate how a diversified Phemex Copy Trading portfolio can act as a hedge, aiming for capital preservation and steady yield (Alpha) even when the broader market (Beta) is flat.

The Experiment Setup: Manual vs. Automated

We modeled two approaches during a 4-week period where Bitcoin oscillated between $60,000 and $65,000.

Case Snapshot

-

Timeframe: 30 Days (Range-Bound)

-

Market Condition: BTC Price Change: -0.5% (Flat)

-

Starting Capital: $10,000 per portfolio

-

The Goal: Outperform the benchmark (BTC Holding) while minimizing volatility.

Portfolio A: The Discretionary Trader (Manual)

-

Strategy: Breakout Trading.

-

Behavior: The trader attempted to long the break of $64,000 (Bull Trap) and short the breakdown of $61,000 (Bear Trap).

-

Result: High emotional fatigue and "stop-hunting" led to a -12.4% loss, despite price ending where it started.

Portfolio B: The Phemex Copy Structure (Automated)

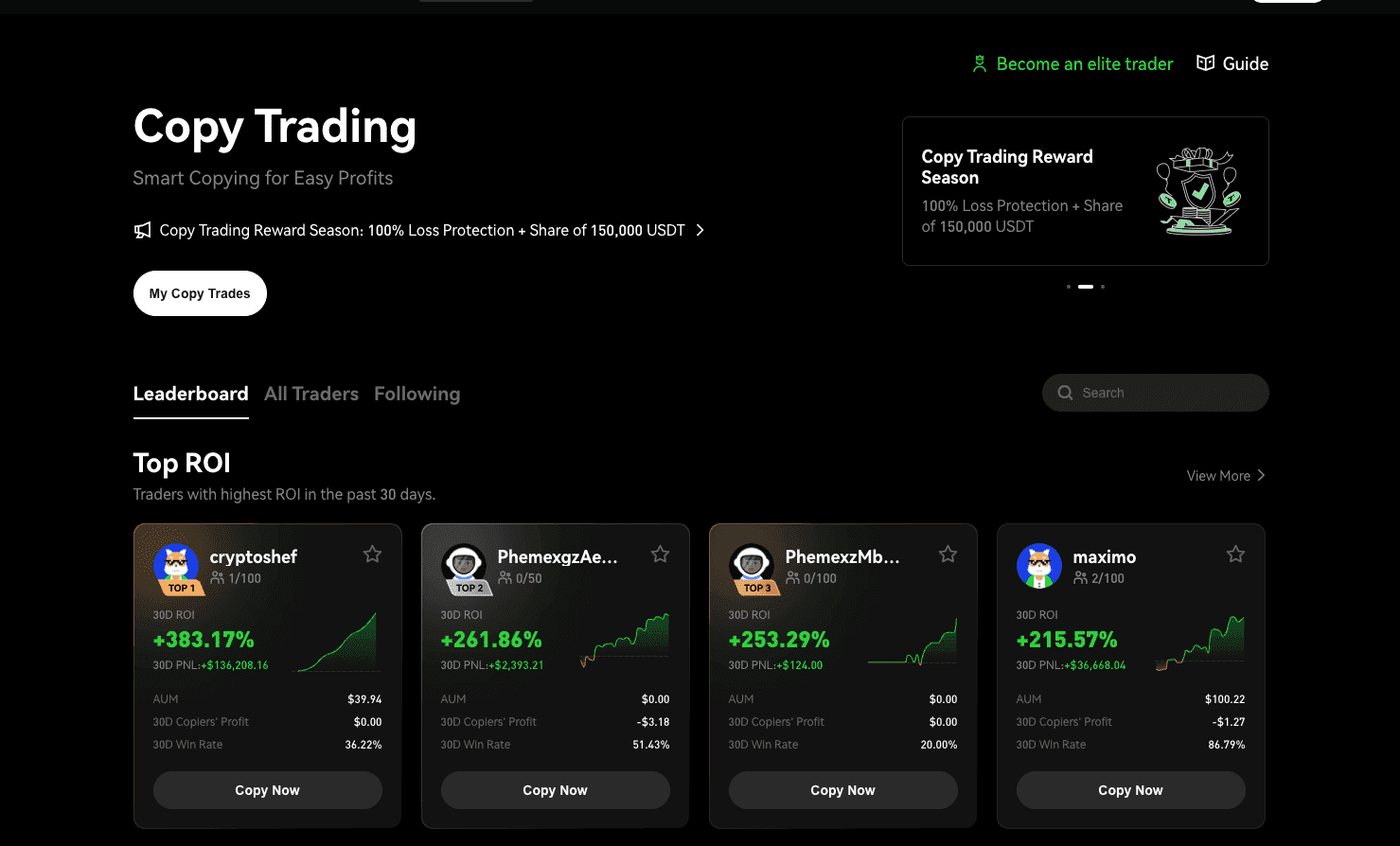

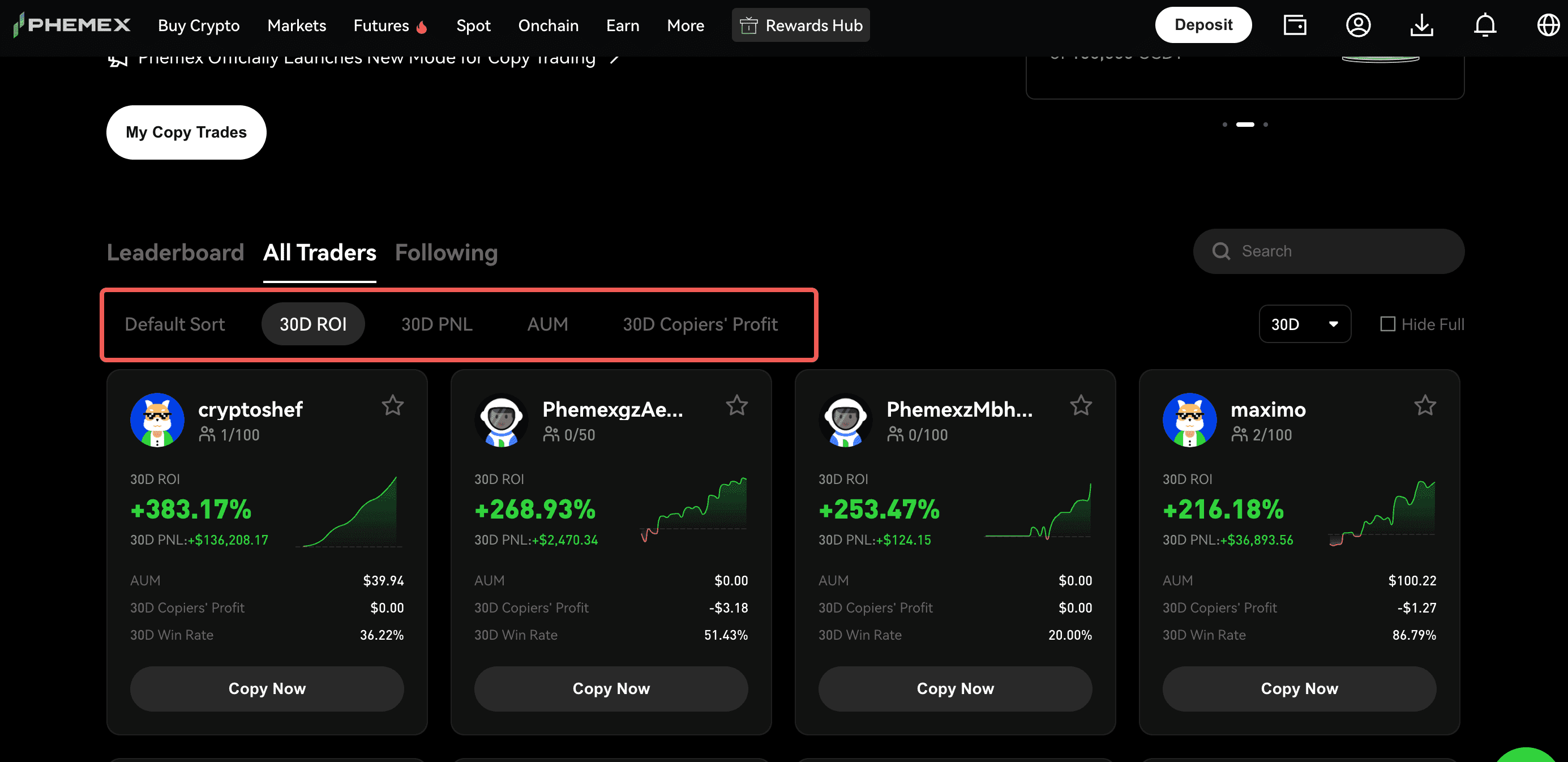

Instead of directional guessing, this portfolio allocated $10,000 across specific Lead Trader profiles filtered via the Phemex Leaderboard.

1. The Allocation Strategy

We utilized the "30D Copiers' Profit" and "30D ROI" filters to identify traders with consistent performance rather than one-time spikes.

-

40% Allocation ($4,000) → Profile: "The Systematic Scalper"

-

Filtered by: High 30D PnL and steady equity growth.

-

Role: Exploiting micro-volatility inside the 65k range.

-

-

30% Allocation ($3,000) → Profile: "The Trend Follower"

-

Filtered by: High 30D Copiers' Profit, indicating reliable execution for followers.

-

Role: Capturing mid-term swings within the range.

-

-

30% Allocation ($3,000) → Cash Buffer (USDT)

- Role: Dry powder reserved for market shifts.

2. Risk Calibration: Fixed Leverage Mode

Crucially, Portfolio B utilized Phemex’s Customized Settings. Instead of following the Lead Trader's potentially high leverage, the user applied:

- Fixed Leverage Mode: Restricted all copied trades to a 5x Fixed Leverage. This ensured that even if a Lead Trader opened a high-leverage position (e.g., 20x), the copier’s risk remained strictly managed at 5x.

The Outcome: Volatility as Fuel

At the end of the 30-day period, while Portfolio A (Manual) was down -12.4% and BTC was flat (-0.5%), Portfolio B (Phemex Copy) yielded a net return of +4.2%.

Why Portfolio B Won:

-

Monetizing the Chop: The Systematic Scalper executed high-frequency trades. The volatility that stopped out the manual trader was the fuel that generated profit for the copier.

-

Leverage Discipline: By using Fixed Leverage (5x), Portfolio B survived "flash wicks" that would have liquidated higher-leverage participants.

-

Managerial Mindset: The user shifted from "Analyzing Charts" to "Analyzing Performance Metrics." By focusing on Copiers' Profit and PnL, the user selected for execution quality over luck.

Analysis: Copy Trading as a Professional Workflow

Copy trading is often misunderstood as "passive income." In reality, it is a management workflow.

-

Old Workflow: Analyze Charts → Enter Trade → Emotional Stress.

-

New Workflow: Filter Metrics → Allocate Capital → Set Fixed Risk Parameters.

Disclaimer:

This case study is hypothetical and for illustrative purposes only. Past performance of Lead Traders is not indicative of future results. Cryptocurrency trading involves significant risk. Please utilize risk management features and trade responsibly.

Conclusion

Sideways markets reward range execution and punish directional guessing. By leveraging Phemex’s infrastructure—filtering by 30D ROI and utilizing Fixed Leverage settings—traders can turn a "boring" market into a period of strategic accumulation.

The tools are ready. The professionals are trading. Are you?