As the digital asset landscape matures, the distinction between fleeting trends and foundational technologies becomes increasingly clear. Chainlink, with its native token LINK, has firmly established itself in the latter category, serving as the indispensable backbone for the burgeoning decentralized economy. By providing a secure and reliable bridge between blockchain-based smart contracts and real-world data, Chainlink has become a lynchpin for sectors ranging from decentralized finance (DeFi) to tokenized real-world assets (RWAs). This pivotal role has not gone unnoticed by savvy investors and large-scale whale accounts, whose recent activities suggest a brewing storm of bullish momentum.

This in-depth analysis will explore the trajectory of Chainlink, dissecting its current market standing, historical performance, and the on-chain metrics that signal its future potential. We will delve into a comprehensive Chainlink price forecast for 2025 through 2030, examining the fundamental drivers and potential risks that could shape its journey. For traders and investors questioning, is Chainlink a good investment?, this article will provide a data-driven framework to navigate the path ahead.

Summary Box (Fast Facts)

-

Ticker Symbol: LINK

-

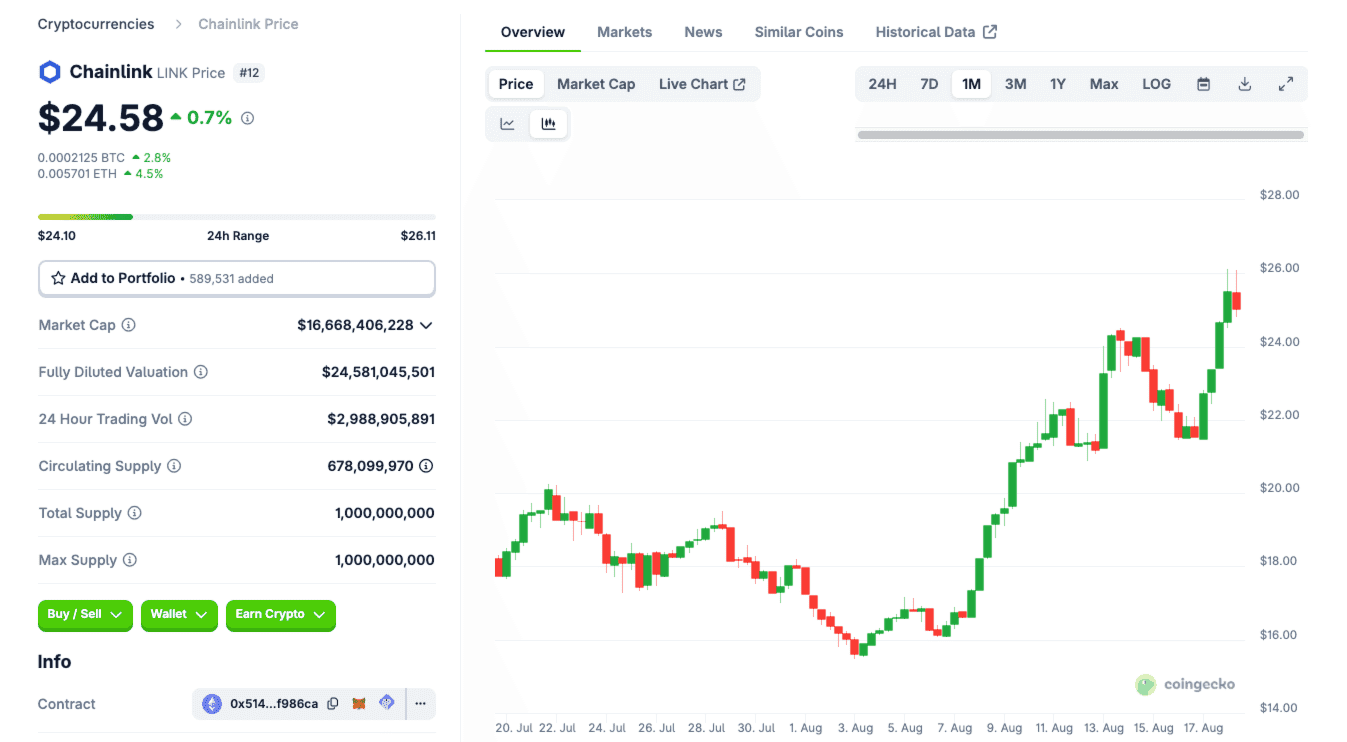

Current Price: $24.58 (as of August 18, 2025)

-

Chain: Ethereum

-

Contract Address: 0x514910771af9ca656af840dff83e8264ecf986ca

-

Market Cap: $16,668,406,228

-

Circulating Supply: 678,099,970 LINK

-

Total Supply: 1,000,000,000 LINK

-

ATH / ATL Price: $52.70 (May 10, 2021) / $0.1482 (Nov 29, 2017)

-

All-Time ROI: Over 16,500%

What Is Chainlink?

At its core, Chainlink is a decentralized oracle network. But what does that mean for the average user? Imagine a smart contract on a blockchain, designed to execute automatically when certain conditions are met—for instance, a crop insurance policy that pays out if rainfall drops below a specific level. That smart contract needs a reliable, tamper-proof way to know what the actual rainfall was. It cannot access this off-chain data on its own.

This is the problem Chainlink solves. It acts as a secure middleware, fetching, validating, and delivering external data from the real world to blockchains. This capability is not just a minor feature; it's a fundamental requirement for smart contracts to have any meaningful real-world application. Chainlink's ecosystem provides the essential infrastructure for DeFi protocols that need accurate price feeds, insurance platforms that rely on event data, and gaming applications that require verifiable randomness. By enabling this seamless and secure flow of information, Chainlink unlocks the true potential of blockchain technology, bridging the gap between digital agreements and the physical world. Understanding what Chainlink crypto is all about is key to seeing its value.

Current Price & Market Data (as of August 18, 2025)

As of mid-August 2025, Chainlink is exhibiting robust market strength, reflecting a growing confidence among investors. The latest chainlink news has been a significant factor in this positive performance. The token is currently trading at approximately $24.58, showcasing significant positive momentum across various timeframes.

-

24-Hour Change: +0.9%

-

7-Day Change: +10.1%

-

30-Day Change: +35.2%

With a formidable market capitalization of $16.67 billion, LINK is firmly positioned as the 12th largest cryptocurrency, a testament to its critical role in the digital asset ecosystem. The 24-hour trading volume stands at a healthy $2.98 billion, indicating high liquidity and active market participation.

While the current price represents a significant recovery and a surge in investor interest, it still trades approximately 53% below its all-time high of $52.70, reached during the bull market peak in May 2021. Conversely, its journey from an all-time low of just under $0.15 in late 2017 highlights the staggering long-term growth and resilience of the network. This gap between the current price and its peak suggests substantial room for growth, especially as fundamental adoption accelerates.

Price History & Performance Overview

Chainlink's journey from an obscure Initial Coin Offering (ICO) to a top-tier digital asset is a compelling narrative of technological innovation and market resilience. Launched in September 2017, the LINK ICO was priced at approximately $0.11 per token. Those early investors who recognized its potential have been rewarded handsomely, witnessing an astronomical return on their initial investment.

The token's early years were characterized by steady development and gradual price appreciation, navigating the brutal bear market of 2018 with relative stability compared to its peers. The real turning point came during the DeFi Summer of 2020. As the decentralized finance ecosystem exploded in popularity, the demand for Chainlink's oracle services skyrocketed. Protocols for lending, borrowing, and derivatives all required Chainlink's reliable price feeds to function, creating a direct link between DeFi's growth and LINK's value. This period saw LINK's price surge dramatically, establishing it as a blue-chip crypto asset. The year 2020 was its best-performing year, with a staggering price increase of 536.06%.

The bull market of 2021 propelled LINK to its all-time high of over $52. This peak was followed by a prolonged correction during the 2022 bear market, where the price saw a significant downturn of -71.50%, a common fate for many altcoins during that period. However, unlike many projects that faded into obscurity, Chainlink's development and adoption never faltered.

Throughout 2023 and 2024, LINK demonstrated a strong recovery, with a notable gain of 169.45% in 2023. This resilience is a direct reflection of the network's expanding utility and integrations. Major events that have influenced its price include listings on major exchanges, strategic partnerships with giants like Google Cloud and Swift, and the continuous expansion of its oracle services across numerous blockchains. The average yearly growth of Chainlink over the last nine years stands at an impressive 177.66%, underscoring its powerful long-term performance profile.

Whale Activity & Smart Money Flows

In the often-opaque world of cryptocurrency markets, tracking the movements of whales—large holders of a specific token—can provide invaluable insights into market sentiment and future price action. Recent on-chain data for Chainlink reveals a significant uptick in whale activity in Chainlink, suggesting a period of strategic accumulation by smart money. This type of chainlink crypto news often precedes significant price movements.

On August 17, 2025, on-chain monitors flagged a substantial withdrawal of over 400,000 LINK tokens, valued at nearly $9.82 million, from centralized exchanges by four major whale addresses within a 24-hour window. This type of large-scale outflow from exchanges to private wallets is often interpreted as a bullish signal. It suggests that these large holders are not planning to sell in the short term and are instead moving their assets into secure, long-term storage, anticipating future price appreciation. This action reduces the immediately available supply on the market, which can create upward pressure on the price.

This trend is not an isolated event. Data from earlier in the month showed that whale transactions involving LINK had reached a seven-month high, coupled with the highest number of active LINK addresses in eight months. One particularly noteworthy transaction involved a whale with a successful track record—having profited from major market events like the USDC depeg and the Shiba Inu peak—swapping $21.25 million worth of Ethereum (ETH) to accumulate nearly a million LINK tokens. Such a calculated move by an experienced market participant signals strong conviction in LINK's upside potential.

While data from 2021 indicated a high concentration of LINK, with the top 1% of wallets controlling over 80% of the supply, more recent analysis from 2025 suggests a healthier, though still concentrated, distribution, with the top 10 wallets holding around 32% of the supply. This continued accumulation by large players, coupled with a decreasing supply on exchanges, paints a compelling picture of smart money positioning for a significant market move.

On-Chain & Technical Analysis

A deep dive into the technical analysis for Chainlink reveals a constructive and increasingly bullish picture, corroborating the positive on-chain signals from whale activity. After a multi-year consolidation period, LINK has decisively broken out of key resistance levels, setting the stage for a potential new uptrend.

Support and Resistance:

Currently, LINK has established a critical support base around the $22.00 mark. This level has acted as a pivot point in recent months, and holding above it is crucial for maintaining bullish momentum. A successful defense of this zone could pave the way for a test of higher resistance levels. The next significant resistance lies near $26.00 and then the psychological barrier of $30.00. A convincing break above $30 could open the floodgates for a rally toward the 40-60 range in the near term.

Moving Averages and Indicators:

The price of LINK is currently trading comfortably above its 200-day simple moving average, a classic indicator of a long-term bullish trend. Shorter-term moving averages, like the 50-day, are also trending upwards, confirming the strength of the recent price action.

The Relative Strength Index (RSI), a momentum oscillator, is hovering in a healthy range, suggesting that while the asset has seen strong gains, it is not yet in overbought territory, leaving room for further upside. The MACD (Moving Average Convergence Divergence) is also showing bullish crossovers on higher timeframes, indicating that momentum is shifting firmly into the hands of buyers.

Chart Patterns:

Technical analysts have identified a bullish breakout from a multi-year consolidation pattern. Some chartists have also noted the formation of bullish continuation patterns, such as bull flags, on various timeframes. The successful breakout from such a pattern could project a price target significantly higher, with some analysts pointing toward a potential retest of the all-time high around $52 and even a move towards the $100 mark in a strong bull market scenario. The combination of strong on-chain accumulation and a bullish technical structure suggests that the path of least resistance for LINK is currently to the upside.

Short-Term Price Prediction (2025–2026)

Forecasting the trajectory of any cryptocurrency is fraught with uncertainty, yet by analyzing technical patterns, fundamental catalysts, and broader market conditions, we can outline a LINK price prediction 2025 across several scenarios.

Bull Case:

In a bullish scenario, fueled by continued institutional adoption, the explosive growth of the Real-World Asset (RWA) tokenization sector, and positive overall market sentiment, Chainlink could see substantial appreciation. If LINK successfully breaks and holds above the $30 resistance level, momentum could carry it towards the $38 to $50 range by the end of 2025. This would be driven by the flywheel effect of its tokenomics, where increased network usage leads to greater demand for LINK for staking and fees. Heading into 2026, a sustained bull market could see LINK challenge and potentially surpass its previous all-time high, with price targets ranging from $51 to $75.

Neutral Case:

A neutral scenario assumes the broader crypto market experiences steady but not explosive growth, or trades sideways for an extended period. In this environment, LINK’s price would be more closely tied to its fundamental growth and adoption metrics. We could see the price consolidate in a range between $22 and $32 for the remainder of 2025. In 2026, gradual ecosystem expansion and continued integration could push the price steadily upwards into the $30 to $45 range. This case is predicated on Chainlink continuing to execute on its roadmap without major market-wide disruptions.

Bear Case:

The bear case for LINK would likely be triggered by external factors, such as a significant downturn in the global macroeconomic environment, harsh regulatory crackdowns on DeFi and cryptocurrencies, or a major security vulnerability within the Chainlink network itself. In such a scenario, LINK could fail to hold its key support at $22, leading to a correction back towards the $14 to $19 support zone. Throughout 2026, a prolonged bear market could see the price languish in the low $20s, as investment capital flows out of the crypto space and risk appetite diminishes.

Long-Term Price Forecast (2027–2030)

Looking further ahead, the long-term Chainlink price forecast becomes more speculative but is anchored by the project's foundational role in the digital economy. The primary determinant of LINK's value between 2027 and 2030 will be the scale of adoption for blockchain technology and tokenized assets.

Ecosystem Adoption Potential:

The market for tokenized real-world assets is projected to grow into a multi-trillion dollar industry. As the leading oracle provider, Chainlink is uniquely positioned to capture a significant portion of this value. Every tokenized asset, from real estate to private equity, will require reliable data feeds for valuation and transfer—a service Chainlink provides. By 2027-2030, if this vision materializes, Chainlink could be processing trillions of dollars in value, making the network's native token incredibly valuable.

Competitor Comparisons:

While Chainlink enjoys a dominant market share, it is not without competitors. Projects like Band Protocol and API3 are also working on oracle solutions. However, Chainlink's first-mover advantage, extensive network of partnerships, and proven security have created a significant moat. Its integration with traditional finance giants like Swift gives it a level of legitimacy and institutional buy-in that competitors currently lack.

Speculative Price Range (2027-2030):

Given these factors, long-term price predictions are optimistic.

-

By 2027, should the RWA and DeFi markets continue their exponential growth, a price range of $66 to $80 is plausible.

-

Looking towards 2030, some of the more bullish forecasts place LINK in the $189 to $250 range. These predictions are contingent on Chainlink maintaining its market leadership and the continued, large-scale integration of blockchain technology into the global financial system.

Disclaimer: This is not financial advice. The cryptocurrency market is highly volatile, and investors should conduct their own research and consult with a financial professional before making any investment decisions.

Fundamental Drivers of Growth

The long-term value of Chainlink is not rooted in speculation but in its undeniable utility and the fundamental strengths of its network. Several key drivers are poised to fuel its growth in the coming years.

-

Technological Differentiation and Security: Chainlink's decentralized architecture is its greatest strength. By sourcing data from a wide network of independent, reputation-vetted oracle nodes, it eliminates single points of failure and ensures the data delivered to smart contracts is highly reliable and tamper-proof. This security model is mission-critical for protocols securing billions of dollars in value.

-

Unmatched Network Adoption and Integration: With over 3,000 projects integrated into its ecosystem, Chainlink is the undisputed market leader. Its services are used by the vast majority of leading DeFi protocols, including Aave, Synthetix, and many more. This widespread adoption creates powerful network effects; as more projects build on Chainlink, it becomes the default choice for new developers, further solidifying its dominance.

-

Pioneering the Real-World Asset (RWA) Revolution: The tokenization of real-world assets is heralded as the next major growth vector for crypto. Chainlink is at the forefront of this movement, providing the essential infrastructure to connect these tokenized assets with the data they need to function. The RWA market has already grown from $1 billion to over $25 billion in just two years, creating immense demand for Chainlink's services.

-

Strategic Institutional Partnerships: Chainlink's collaborations read like a who's who of global finance and technology. Its landmark partnership with Swift, the global financial messaging network connecting over 11,500 banks, positions Chainlink as the potential bridge for traditional finance to enter the blockchain space. Further collaborations with entities like the Depository Trust & Clearing Corporation (DTCC), Euroclear, and major banks underscore its role as the go-to institutional-grade oracle solution.

-

Innovative Tokenomics and Staking: The introduction of Chainlink Economics 2.0 has created a sophisticated and sustainable economic model. Revenue generated from network fees is used to programmatically buy back LINK tokens, creating consistent buying pressure. Furthermore, the staking mechanism allows LINK holders to secure the network and earn a yield (currently around 4.3%), which incentivizes holding and reduces the circulating supply. This creates a powerful flywheel effect where network growth directly translates to value accrual for the LINK token.

Key Risks to Consider

Despite the overwhelmingly positive outlook, a balanced analysis requires acknowledging the potential headwinds and risks of investing in Chainlink.

-

Competitive Threats: While Chainlink is the current leader, the oracle space is competitive. New and existing projects could develop innovative solutions that chip away at Chainlink's market share. Blockchains may also develop their own native oracle solutions, potentially reducing reliance on third-party services like Chainlink.

-

Token Dilution and Supply: The total supply of LINK is capped at 1 billion tokens, but a significant portion is still held by the team and allocated for node operator incentives. While these are earmarked for ecosystem growth, the schedule of their release into the circulating supply could create selling pressure and temporarily dilute value if not managed carefully.

-

Regulatory Uncertainty: The global regulatory landscape for digital assets is still evolving. Unfavorable regulations targeting DeFi or the specific function of oracles could create hurdles for adoption and impact market sentiment.

-

Market Volatility and Macroeconomic Factors: Like all cryptocurrencies, LINK is subject to the high volatility of the broader market. A downturn in the global economy or a bear market in crypto would inevitably affect its price, regardless of its strong fundamentals.

-

Dependence on Ecosystem Growth: Chainlink's success is intrinsically tied to the success of the smart contract platforms it serves. If the growth of DeFi, NFTs, and RWAs were to stall or reverse, the demand for oracle services would diminish accordingly.

Analyst Sentiment & Community Insights

The sentiment surrounding Chainlink among professional analysts and the broader crypto community is overwhelmingly bullish heading into the latter half of the decade. The latest chainlink news regarding institutional adoption has fueled this positive sentiment, backed by strong on-chain metrics and a clear understanding of the project's fundamental value proposition.

Prominent crypto analyst Miles Deutscher has described LINK as perhaps one of the most obvious large-cap investment opportunities of this cycle, highlighting it as the primary beneficiary of the institutionalization of crypto and the growth in tokenization. This view is echoed across the industry, with many seeing Chainlink not just as another cryptocurrency, but as a core piece of Web3 infrastructure.

Community platforms like Reddit and X (formerly Twitter) are buzzing with positive discussions, focusing on the implications of recent partnerships and the strong whale accumulation trends. The community sentiment on data aggregator sites like CoinGecko is also marked as Bullish. Google Trends data shows a steady and growing interest in Chainlink and related search terms, indicating rising awareness among both retail and institutional investors. The Fear & Greed Index, a broad market sentiment indicator, currently shows Greed, reflecting the positive momentum in the crypto space, which provides a tailwind for fundamentally strong projects like Chainlink.

Is Chainlink a Good Investment?

After a thorough examination of its technology, market position, on-chain data, and future growth drivers, the question remains: is Chainlink a good investment?

Disclaimer: The content of this article is for informational purposes only and should not be construed as financial advice. All investment decisions should be made with caution and after conducting thorough personal research.

Chainlink's long-term use case is arguably one of the strongest in the entire cryptocurrency industry. It solves a fundamental problem for blockchains, enabling them to interact with the real world in a secure and decentralized manner. This is not a niche application; it is a foundational requirement for the vast majority of advanced blockchain use cases.

The strength of the LINK token is intrinsically tied to the utility and security of the network. Through its innovative tokenomics, including staking and programmatic buybacks from network revenue, the token is designed to capture the value it helps create. As network usage grows, the demand for LINK is hardwired to increase.

However, investors must weigh this immense potential against the macro risks inherent in the cryptocurrency market. Volatility, regulatory uncertainty, and competition are real factors that cannot be ignored.

In conclusion, for those with a long-term investment horizon who believe in the continued growth of decentralized finance and the tokenization of real-world assets, Chainlink presents a compelling proposition. The Chainlink investment potential remains strong heading into 2025–2030. It represents a bet not on a single application, but on the foundational infrastructure that will power the next generation of the internet.

Why Trade Chainlink on Phemex?

For traders and investors looking to gain exposure to Chainlink (LINK), choosing the right platform is paramount. Phemex stands out as a top-tier centralized exchange, renowned for its institutional-grade security, high-performance trading engine, and a suite of tools designed for both novice and professional traders.

Phemex offers a comprehensive ecosystem to engage with the market, featuring:

-

Spot Trading: Instantly buy and sell LINK and over 100 other digital assets with deep liquidity and competitive fees, ensuring efficient order execution.

-

Futures Contracts: For more experienced traders, Phemex provides access to high-leverage perpetual contracts on top coins, including LINK, allowing for up to 100x leverage to capitalize on market volatility.

-

Trading Bots: Automate your trading strategies with ease. Phemex offers powerful, AI-driven trading bots, such as grid trading bots, which can be deployed on the LINK/USDT pair to systematically profit from price fluctuations without constant monitoring.

-

Phemex Earn: Put your assets to work and earn passive income. Phemex Earn offers a variety of flexible and fixed savings products, providing competitive yields on your crypto holdings.

-

Phemex Launchpool: Participate in new token launches by staking assets to earn new crypto for free, offering a low-risk way to discover promising projects.

Chainlink (LINK) is fully integrated into the Phemex platform and is available for both Spot and Futures trading. This allows users to not only invest in the long-term potential of LINK but also to actively trade its price movements. The compatibility of LINK with Phemex's advanced trading bots further empowers users to implement sophisticated, automated strategies, making Phemex an ideal and comprehensive venue for interacting with one of the most crucial assets in the crypto economy.