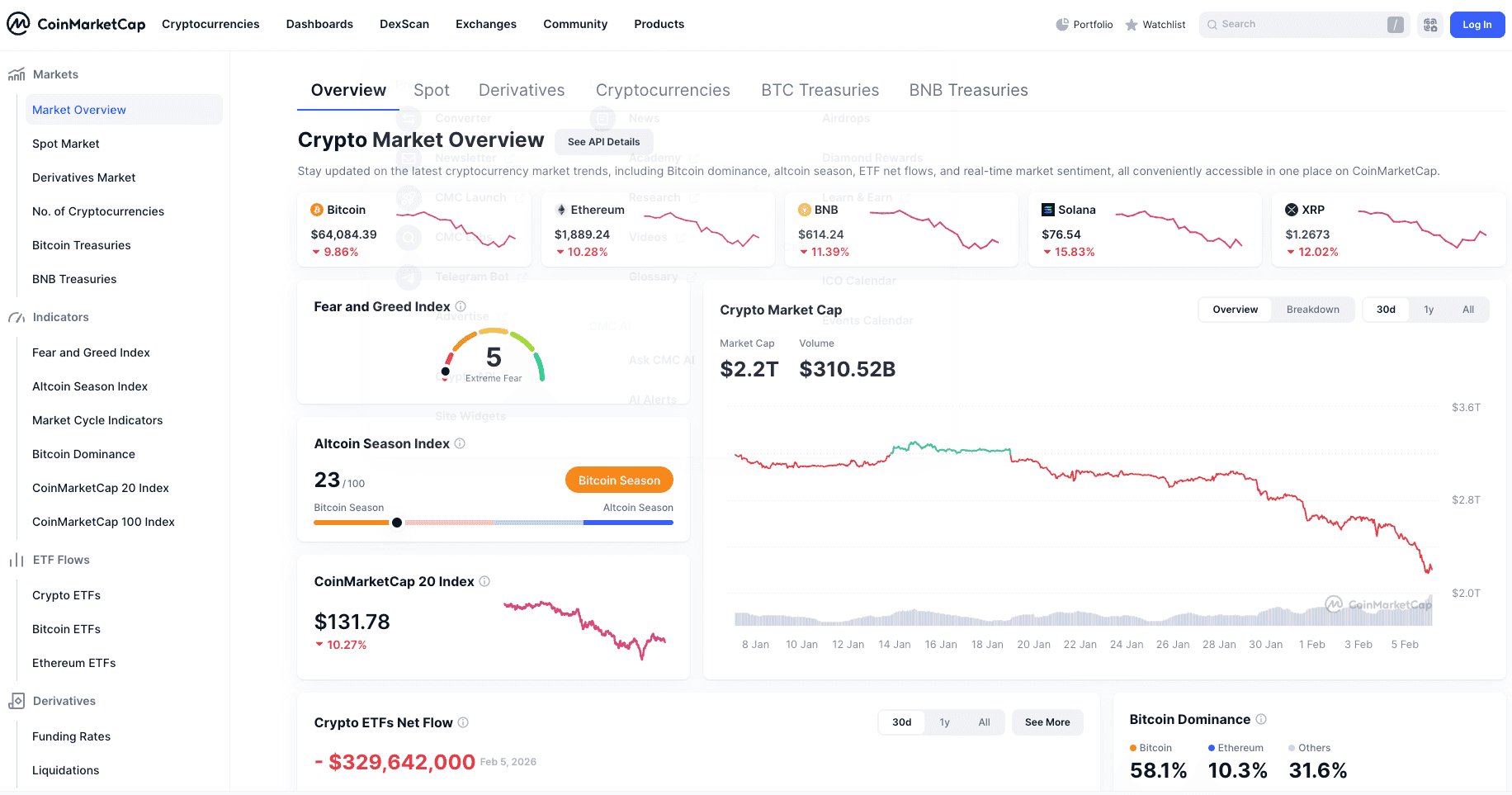

The cryptocurrency market is currently navigating a period of intense volatility that has left many participants questioning the mid-term outlook. As of this morning, February 6, 2026, a "sea of red" has engulfed major digital assets. According to real-time data from CoinMarketCap, Bitcoin (BTC) has retracted to 1,889.24.

This correction has pushed the Fear and Greed Index into a zone of "Extreme Fear," currently sitting at a level of 5/100. For investors and traders, the central question is no longer just "Why is crypto falling today?" but rather, "How can I protect my capital while maintaining market exposure?"

In response to this high-volatility environment, Phemex has launched the TradFi Futures Zero Fee Carnival, an initiative designed to provide a risk-management sanctuary via Stocks and Metals. This guide provides a deep-dive analysis of the current crash and a tactical roadmap for utilizing these instruments to manage your downside.

The Macro Anatomy of the Crash: Why is Crypto Falling Today?

Understanding the "Why" is the first step in moving from emotional reaction to strategic execution. The data from February 6 reveals a "perfect storm" of three converging factors:

A. Record-Breaking ETF Outflows

One of the most significant data points today is the Crypto ETFs Net Flow, which stands at -$329,642,000. This massive exit of institutional capital indicates a shift in sentiment. Large-scale fund managers are temporarily de-risking their portfolios in response to broader macroeconomic uncertainty, creating significant selling pressure that retail liquidity is currently unable to absorb.

B. The "Extreme Fear" Liquidation Cascade

With the Fear and Greed Index at 5, the market is experiencing what analysts call a "capitulation event." When Bitcoin broke below psychological support levels near $65,000, it triggered a cascade of automated liquidations for leveraged long positions. This "cascade effect" accelerates price drops, as forced selling triggers further stop-losses, leading to the double-digit percentage drops seen in altcoins like Solana (-15.83%) and XRP (-12.02%).

C. Rising Bitcoin dominance (58.1%)

Interestingly, even as Bitcoin's price falls, its market dominance has climbed to 58.1%. This is a classic "Flight to Quality" within the crypto ecosystem. During severe downturns, capital typically exits highly volatile altcoins faster than it exits Bitcoin, leading to the "Altcoin Season Index" dropping to 23/100. For traders, this indicates that the broader altcoin market is currently underperforming, necessitating a shift into more stable instruments.

The Strategic Pivot: Rotating from Crypto to TradFi Assets

In professional risk management, the goal isn't always to exit the market into fiat currency, which may be subject to its own inflationary pressures. Instead, experienced participants perform a "Strategic Rotation" into assets that have historically shown a decoupled or inverse relationship with digital assets during short-term panics.

A. Precious Metals: The Store of Value

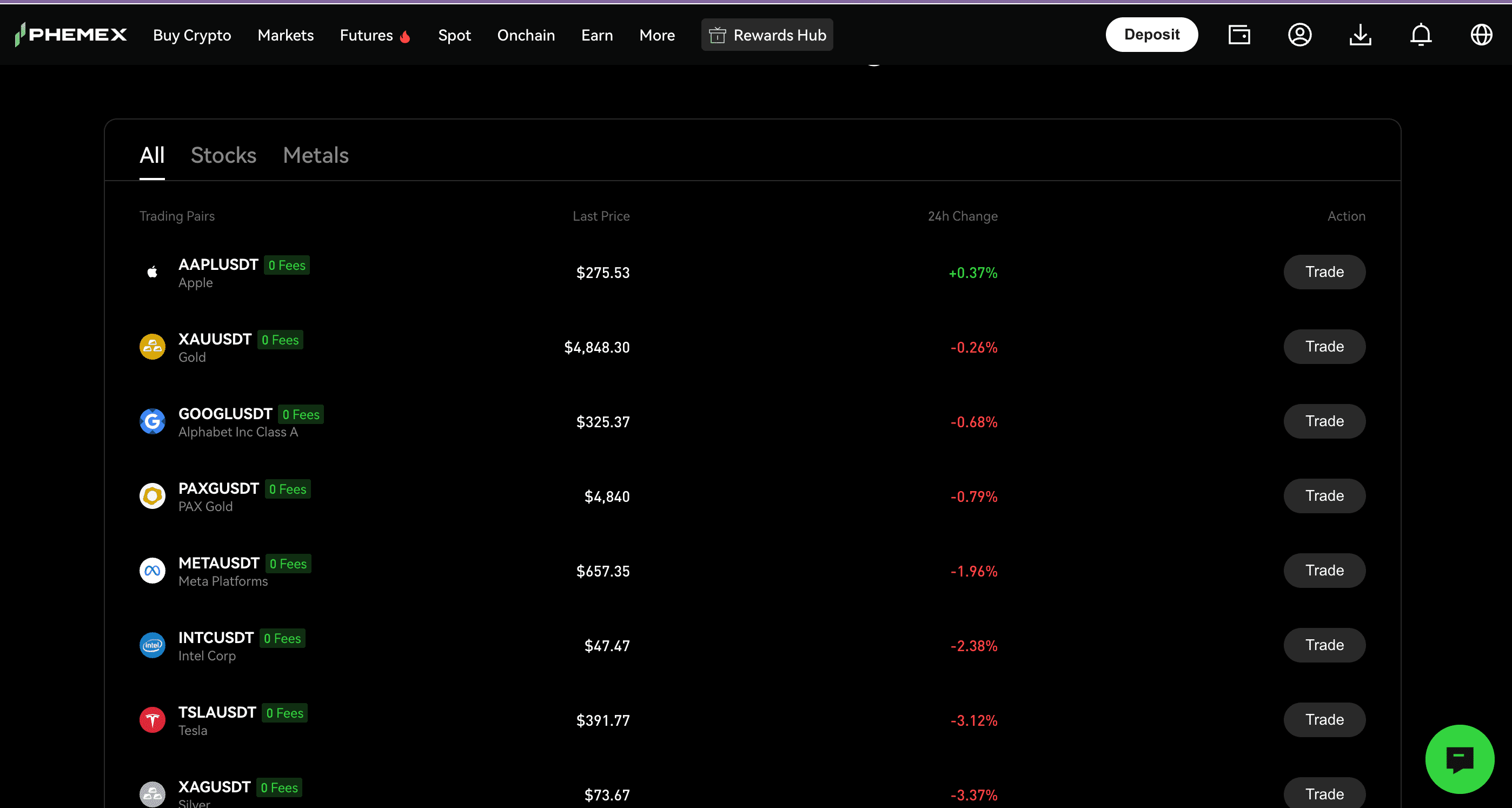

Gold and Silver have remained the world’s most reliable hedges against systemic risk. On Phemex, traders can access XAUT/USD (Tether Gold) and XAG/USD (Silver).

Gold (XAUT): Tracks the price of physical gold with the liquidity of a digital exchange.

The Hedge: While Bitcoin may drop during a liquidity crunch, Gold often acts as a "safe haven" asset, preserving equity when "risk-on" assets are sold off.

- The store of value: Gold and Bitcoin are both discussed as stores of value, but their behavior in market downturns can differ.

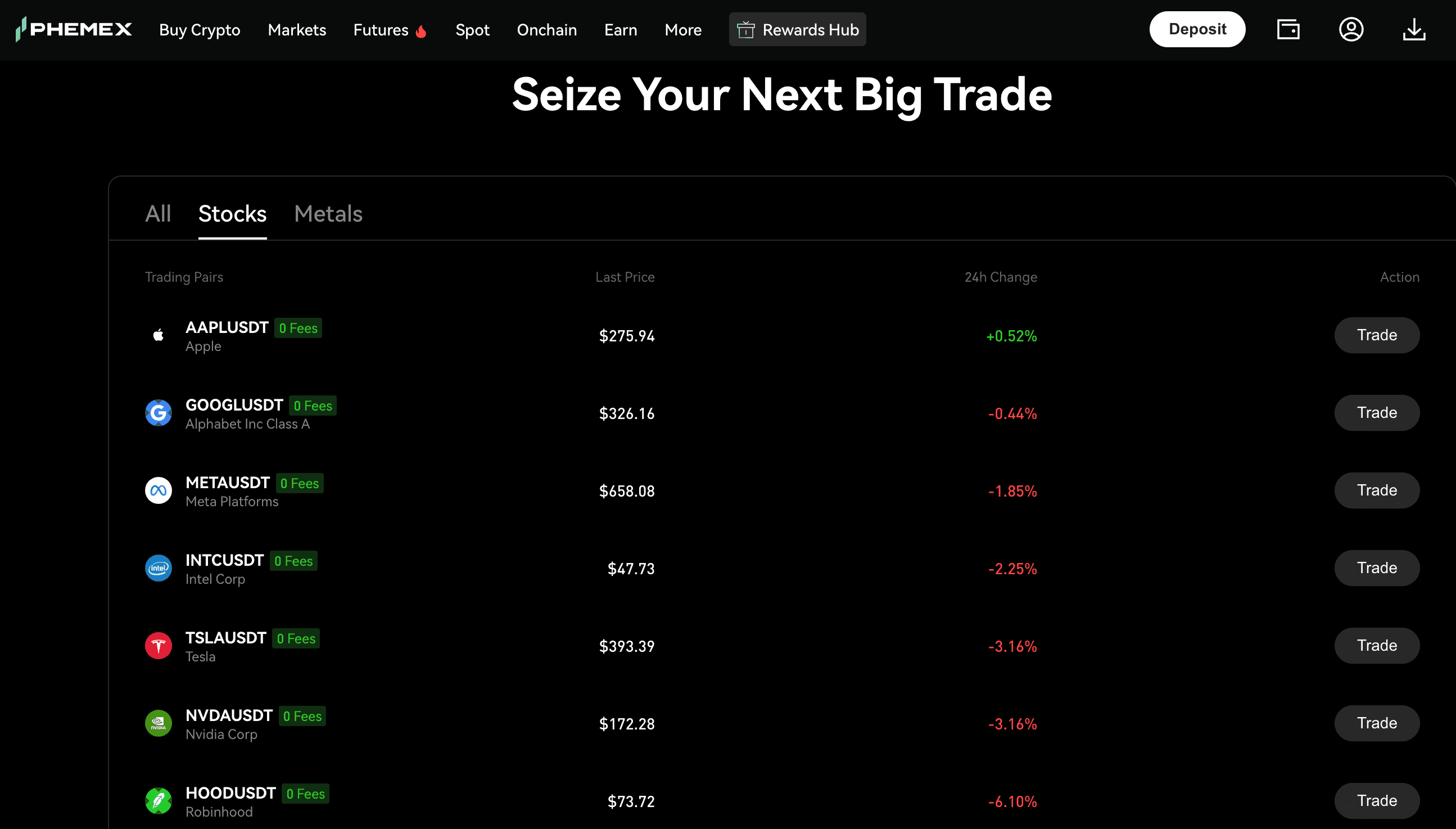

B. Stock Indices: Diversifying with TradFi Equity

For those looking to diversify beyond the crypto market's specific risks, Phemex TradFi Futures now support Stock Indices (such as AAPL or TSLA).

- The Logic: During a localized crypto crash (like the one we are seeing on Feb 6), the broader US Stock market may not be following the same trajectory. By opening positions in Stock Indices, traders can balance their portfolio with traditional equity performance without needing to bridge funds to a legacy brokerage.

Deep Dive: The Phemex TradFi Futures Zero Fee Carnival

One of the greatest obstacles to effective hedging is the "transaction friction." Traditionally, during periods of high volatility, exchanges charge taker fees that can eat into the margins of a defensive trade.

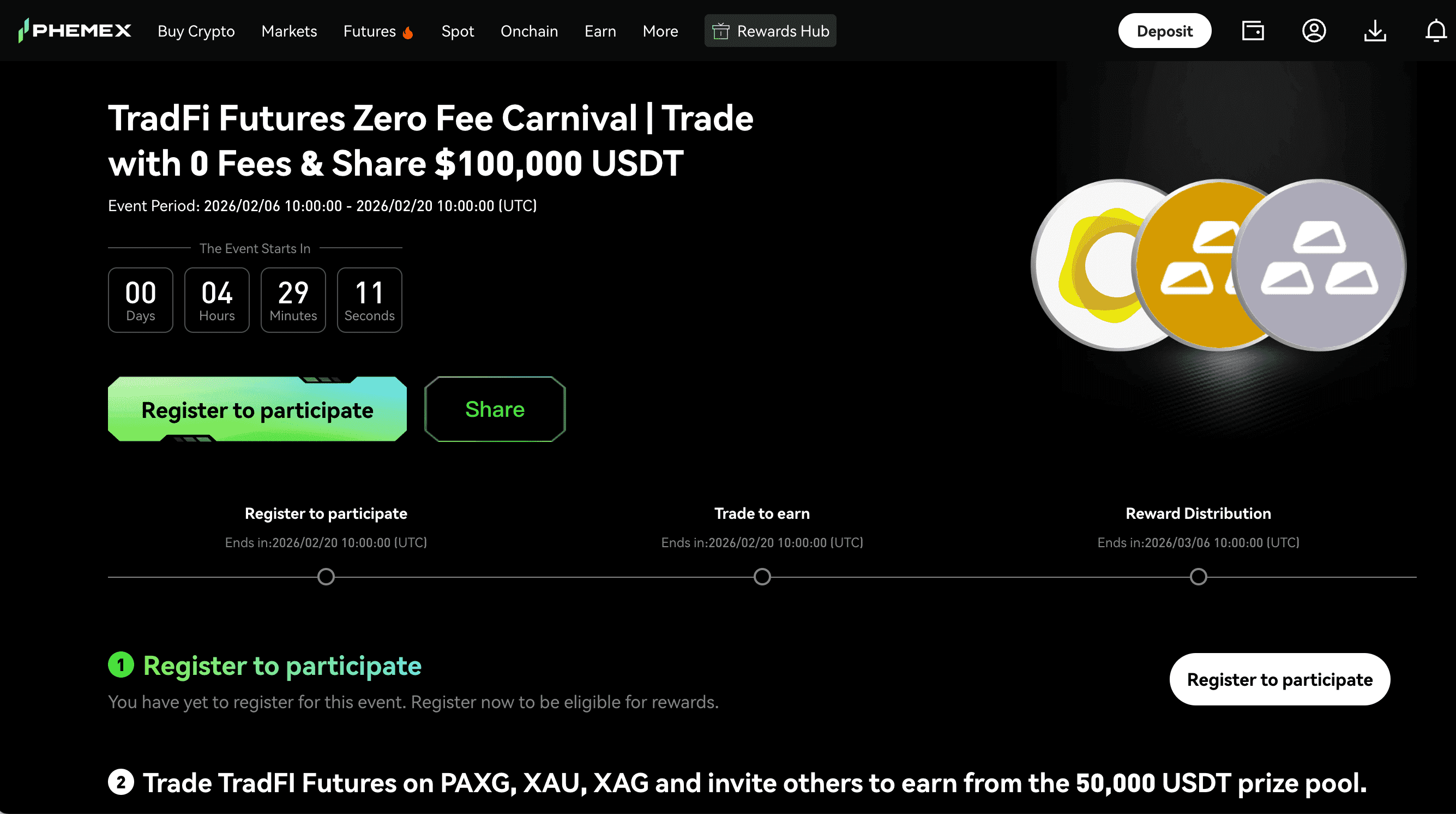

To address this, the Phemex TradFi Futures Zero Fee Carnival (Feb 6 – Feb 20, 2026) has removed the financial barrier to risk management.

Event Mechanics and Zero-Fee Scope

During this event, Phemex is offering 0% Trading Fees on designated TradFi Futures pairs. This includes:

Metals: XAUT/USD (Gold), XAG/USD (Silver).

Stocks: Major Stock Index futures.

Note: While Forex expansion is planned for the future, the current carnival focuses exclusively on providing zero-fee access to the high-demand Metals and Stocks markets.

Analysis of the $100,000 Prize Pool & Apex Challenges

Phemex isn't just waiving fees; they have structured a $100,000 USDT Prize Pool to incentivize disciplined, volume-based risk management. The event is centered around the "Apex Challenge," where trading activity translates into tangible rewards.

The Treasure Chest Reward System

Participants who reach specific trading volume milestones in TradFi pairs unlock "Treasure Chests." Unlike standard promotional lotteries, these rewards are designed to provide utility to active traders:

Direct USDT Bonuses: Distributed to offset any realized market friction.

Contract Bonuses: Providing additional margin for future trades.

High-Tier Assets: Rare chests contain rewards up to 1 ETH or 10g Physical Gold Bars, providing an asymmetrical upside to a defensive trading strategy.

By participating, you aren't just "surviving" the February 6 crash; you are actively competing for a share of a six-figure pool while using zero-fee tools to protect your main portfolio.

Tactical Playbook: How to Execute a Hedge on Phemex Today

If you are looking at your dashboard and seeing the CoinMarketCap 20 Index down 10.27%, here is the step-by-step framework to transition from "Panic" to "Protocol."

Step 1: Mandatory Event Registration

Trading volume only counts toward the $100,000 prize pool after you register.

Log in to Phemex and navigate to the TradFi Futures Zero Fee Carnival landing page.

Click "Register Now."

Step 2: Identify Your Exposure

Calculate your "Beta" exposure. If you hold $10,000 in altcoins that are currently dropping 15%, your portfolio is at significant risk.

Step 3: Open a Zero-Fee Hedge

Navigate to the TradFi Futures section.

Metal Hedge: Open a Long position on XAUT/USD (Gold). As a hard asset, Gold often stabilizes when the Fear Index hits 5.

Stock Hedge: Utilize Stock Index Futures to capitalize on non-crypto market movements.

The Benefit: Because the fees are 0.00%, you can precisely size your hedge without losing capital to taker fees instantly.

Step 4: Monitor the Apex Challenge Progress

As you maintain your hedge, track your progress on the event dashboard. Reaching the next volume tier could unlock a Treasure Chest, providing you with a contract bonus that acts as "free margin" for your next market move.

Disclaimer: Trading involves significant risk. TradFi futures and crypto assets are highly volatile instruments. The use of leverage can result in the loss of your initial deposit. Ensure you understand the mechanics of hedging and risk management before entering any positions. The Zero Fee promotion applies only to specific pairs as outlined on the official Phemex event page. This content is for informational purposes and does not constitute financial advice.

Risk management vs. Market Exit: Why "Cash" Isn't Always King

When a market hits Extreme Fear (5/100), the instinctive reaction is to "Sell to Cash" and wait. However, this strategy has major flaws that Phemex’s TradFi rotation addresses:

V-Shape Recovery Risk: Markets often recover rapidly. If you are in cash, you may miss the initial bounce. By hedging with Gold or Stocks, you remain active, making it easier to rotate back into BTC once support is confirmed.

Product Diversification: Moving into Metals provides exposure to a different asset class entirely, reducing the "correlation risk" inherent in holding only digital assets.

The Incentive Gap: Holding cash provides zero returns. Participating in the Phemex Zero Fee Carnival provides a 0% fee environment plus the potential to earn from the $100,000 pool.

Final Verdict: Defining Your Strategy in the February 6 Downturn

The question of "Why is crypto tanking today?" has been answered by the data: massive ETF outflows, a liquidation cascade, and a shift toward Bitcoin dominance. However, the more important question is how you will respond to the $2.2T Market Cap support test.

The Phemex TradFi Futures Zero Fee Carnival is more than a promotion—it is a professional-grade toolset for the retail trader. By removing fees and providing a $100,000 incentive pool, Phemex has leveled the playing field, allowing you to manage risk with the same efficiency as institutional desks.

The clock is ticking. The market volatility is here, and the zero-fee window is open until February 20. Don't let the "Extreme Fear" of the market dictate your financial outcome.

Take Action Now:

Join the Zero Fee Carnival & Share $100k– Click here to register and start your zero-fee hedging journey.

Trade XAUT/USD Now – Move into the safety of Gold-backed futures.

Explore Stock Index Futures – Leverage the strength of major fiat currencies against market volatility.