Bitcoin (BTC), the original cryptocurrency, continues to dominate the digital asset landscape. After a volatile yet ultimately bullish period, investors are keenly watching its trajectory into the second half of the decade. This in-depth analysis explores the Bitcoin price forecast for 2025-2030, examining the technical, fundamental, and on-chain factors that could shape its future. Will BTC continue its upward climb, or are headwinds on the horizon?

Summary Box (Fast Facts)

-

Ticker Symbol: BTC

-

Current Price: ~$108,982.83

-

Market Cap: ~$2.17 Trillion

-

Total Supply: 19.94M BTC

-

ATH / ATL Price: $126,272 (Oct 06, 2025) / $0.05 (Jul 15, 2010)

-

All-Time ROI: Over 200,000,000%

What Is Bitcoin?

Bitcoin is the world's first decentralized digital currency, a form of electronic cash that allows for peer-to-peer transactions without the need for intermediaries like banks or governments. It was created in 2008 by an anonymous entity known as Satoshi Nakamoto and launched in 2009. Functioning on a technology called a blockchain, Bitcoin maintains a public, distributed ledger that records every transaction. This ledger is secured through cryptography, making the network transparent and resistant to fraud.

The core problem Bitcoin solves is the need for a trusted third party in financial transactions. By creating a decentralized and trustless system, it offers an alternative to the traditional financial infrastructure, which can be slow, expensive, and subject to censorship or control. The Bitcoin ecosystem's value lies in its status as a "digital gold"—a scarce, durable, and globally recognized store of value. Its capped supply of 21 million coins makes it inherently deflationary, a key feature that attracts investors concerned about the devaluation of fiat currencies.

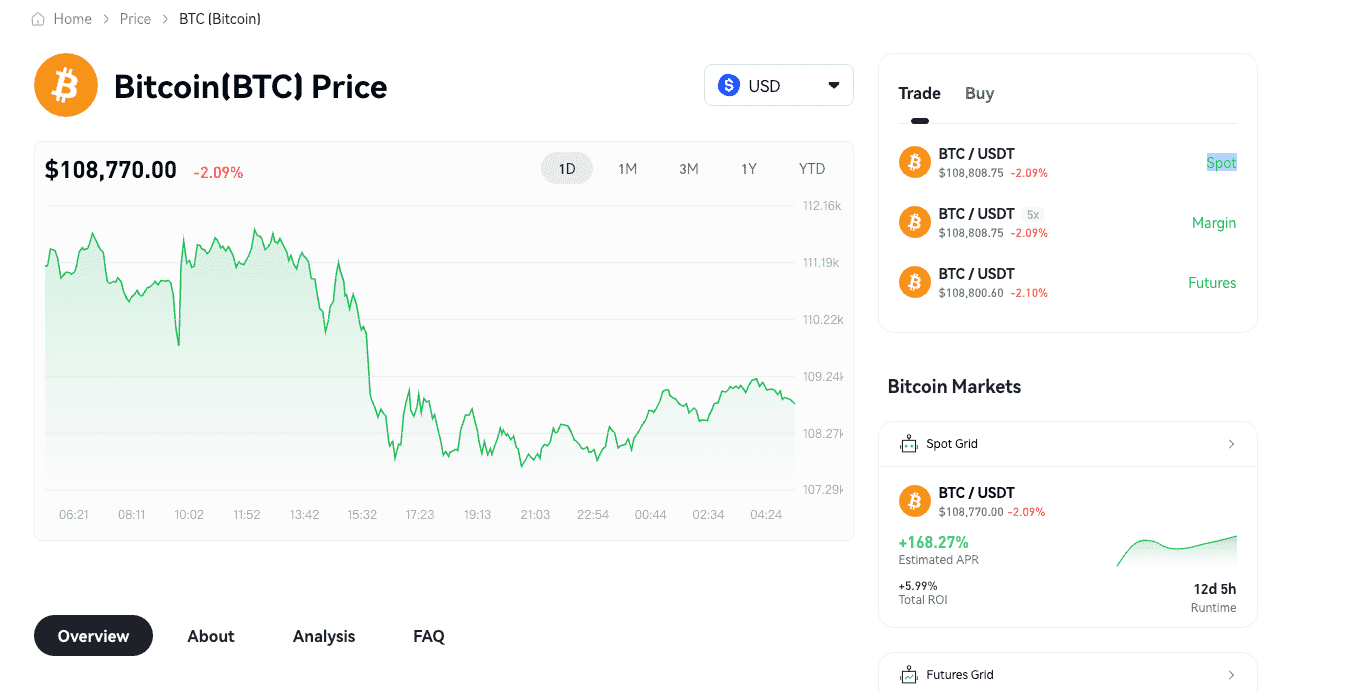

Current Price & Market Data (as of October 17, 2025)

The crypto market faced a significant test last Friday, October 10, 2025, when Bitcoin endured a historic flush. In a matter of hours, the price slipped from the low-120ks into the low-100Ks as leverage unwound aggressively across trading venues. While dramatic, the event is now widely seen as a broad-based deleveraging rather than a structural failure of the market. Since then, BTC has stabilized, hovering in the low-$110K region as traders cautiously rebuild risk.

-

Latest Price Performance: Bitcoin is currently trading around $108,982.

-

% Change over 24h, 7d, 30d: Reflecting the recent flush, BTC has seen a -2.3% change in the last 24 hours and a -11.45% decline over the past 7 days. Over the last 30 days, it is down approximately -3.89%.

-

Market Cap and Rank: With a market capitalization of approximately $2.17 trillion, Bitcoin firmly holds its position as the #1 cryptocurrency.

-

Volume and Liquidity: The 24-hour trading volume stands at a robust $87.48 billion, indicating high liquidity and active market participation.

-

Comparison to ATH and ATL: The current price is roughly 14% below its all-time high of over $126,000, reached on October 6, 2025. It remains astronomically higher than its all-time low of a fraction of a cent in its earliest days.

Price History & Performance Overview

Bitcoin's price history is a story of dramatic bull runs, deep bear markets, and consistent long-term appreciation. Its journey from being virtually worthless to a trillion-dollar asset class has been shaped by a series of key events and market cycles.

-

Early Days and ICO/Airdrop Price: Bitcoin did not have an Initial Coin Offering (ICO). In its infancy, it was distributed for free or mined by a small community of early adopters. The first real-world transaction famously involved 10,000 BTC being used to buy two pizzas in 2010, at which time its value was fractions of a cent.

-

Bull and Bear Cycle Movements: Bitcoin has experienced several major bull and bear cycles, often tied to its "halving" events—a pre-programmed reduction in the reward for mining new blocks that occurs approximately every four years.

-

2013-2014 Cycle: The price surged to over $1,000 before entering a prolonged bear market.

-

2017-2018 Cycle: Fueled by mainstream media attention, BTC skyrocketed to nearly $20,000, followed by a sharp correction in 2018.

-

2020-2021 Cycle: Driven by institutional adoption and macroeconomic tailwinds, Bitcoin shattered its previous all-time high, reaching over $69,000.

-

2024-2025 Cycle: The approval of spot Bitcoin ETFs in the U.S. in early 2024 triggered a new wave of institutional investment, pushing the price to a new record high above $126,000 in October 2025.

-

-

Year-over-Year ROI: Despite its volatility, Bitcoin has delivered staggering returns over the long run. Investors who have held the asset for multiple years have seen significant appreciation in their portfolios. For instance, between the start of 2024 and October 2025, Bitcoin's price saw substantial growth, reflecting strong year-on-year gains.

-

Volatility Profile: High volatility is a hallmark of Bitcoin. Daily price swings of 5% or more are common, and corrections of 30-40% have occurred even within broader bull markets. This volatility is a double-edged sword, offering the potential for high returns but also carrying significant risk.

-

Events That Influenced Price: Key events that have impacted BTC's price include exchange listings, regulatory news (both positive and negative), technological upgrades, and macroeconomic shifts like changes in interest rates and inflation. The introduction of spot Bitcoin ETFs has been a particularly powerful catalyst, providing a regulated and accessible entry point for institutional capital.

Whale Activity & Smart Money Flows

Analyzing the behavior of "whales"—large holders of Bitcoin—provides crucial insights into market sentiment and potential future price movements. The recent market crash triggered notable shifts in whale behavior.

Following the price flush on October 10, on-chain data showed a surge in activity from long-dormant wallets, with some older whales moving coins to exchanges—a typically bearish short-term signal suggesting profit-taking or risk-off positioning. However, the narrative is not entirely bearish. While some older entities were distributing, other on-chain metrics show renewed accumulation. For instance, several large withdrawals from exchanges to new wallets have been observed, totaling over $160 million in one day, which signals a long-term bullish outlook and reduced intent to sell.

Furthermore, addresses holding between 1 and 1,000 BTC have been actively accumulating during the dip. This trend, coupled with slowing sales from the largest whales, suggests a redistribution is underway, where coins are moving from short-term traders and older whales to new institutional buyers and long-term accumulators. This "smart money" activity is a sign of a maturing market and underlines a conviction that the recent price drop was a deleveraging event, not a fundamental shift in the long-term outlook.

On-Chain & Technical Analysis

A comprehensive technical analysis of Bitcoin's price chart reveals key levels of support and resistance that are likely to influence its trajectory in the coming months. After the recent leverage flush, the market structure has been reset, and traders are closely watching for the next directional cue.

-

Support/Resistance Levels:

-

Critical Support: The area between $108,000 and $110,000 has emerged as a crucial support zone, which bulls are actively defending. A decisive daily close below this level on heavy volume could expose the next liquidity pocket around $105,000, with a worst-case scenario bringing the psychological barrier of 100,000-102,000 into play.

-

- Major Resistance: On the upside, the first key resistance is the 115,000-116,000 area. A reclaim of this level would be the first sign of strength. Above that, the most significant hurdle is the 120,000-123,000 band, which represents the pre-flush supply zone.

-

Fibonacci Zones: Fibonacci retracement levels drawn from the recent high to the post-flush low highlight these same key support and resistance clusters, reinforcing their importance for technical traders.

-

RSI, MACD, and Moving Averages:

-

RSI (Relative Strength Index): The daily RSI has reset from overbought levels and is now in neutral territory, providing room for a significant move in either direction. A bullish divergence is forming, indicating weakening selling pressure.

-

MACD (Moving Average Convergence Divergence): The MACD is showing a bearish trend in the short term, but traders are watching for a potential bullish crossover to confirm a bottom is in place.

-

Moving Averages: Bitcoin is currently testing its 128-day moving average, a level that has repeatedly served as a launchpad for rallies in this bull cycle. Holding this line is critical for the bullish structure. The 200-day moving average provides deeper structural support.

-

-

Volume and Whale Wallet Activity: Trading volume spiked during the sell-off and has since normalized. The key now is to watch for an expansion of volume at the edges of the current range, as this often telegraphs the direction of the next breakout.

Short-Term Price Prediction (2025–2026)

Following the market-wide deleveraging, Bitcoin's short-term path depends on its ability to defend key support and reclaim lost ground. Here are three possible scenarios based on the current technical structure.

-

Bull Case (Reclaim & Run): In this scenario, strong spot demand allows BTC to grind higher and achieve a decisive daily close above $115,000. This would build momentum for a retest of the 120,000-123,000 pre-flush supply zone. A clean break above this band would signal that the correction is over, opening the door for a move toward the 128,000-130,000 range and potentially new all-time highs. Some analysts maintain bullish targets between $133,000 and $175,000 for 2025.

-

Neutral Case (Chop & Rebuild): If buying pressure is not strong enough to force a breakout, the market may enter a phase of consolidation. In this path, Bitcoin would trade within a range of roughly $108,000 to $116,000 as volatility compresses and open interest remains subdued. This would be a healthy period of basing, allowing the market to digest the shock and quietly absorb supply before its next major move.

-

Bear Case (Second-Leg Flush): The bearish scenario would unfold if negative headlines or thinning liquidity lead to a failure to hold the $110,000 support. A daily close below this level on heavy sell volume would expose the next support at $105,000. In a disorderly market, prices could sweep toward the 100,000-102,000 region before significant bargain hunters are likely to step in. Some bearish worst-case scenarios from analysts even suggest a potential pullback to the 70,000-96,000 range if multiple support levels fail.

Long-Term Price Forecast (2027–2030)

Looking further ahead to the end of the decade, the Bitcoin price forecast becomes even more speculative, but it is heavily dependent on the trajectory of its adoption as a global store of value.

The primary long-term driver remains Bitcoin's growing adoption by individuals, corporations, and even nation-states. As more entities recognize its properties as a scarce, decentralized asset, demand is likely to increase. The next Bitcoin halving, expected in 2028, will further constrict the new supply, reinforcing its core scarcity narrative. While thousands of "altcoins" exist, none have managed to challenge Bitcoin's position as the dominant digital store of value due to its unparalleled network effect, security, and brand recognition.

Based on these factors, here is a speculative outlook for Bitcoin's potential price range leading up to 2030.

| Year | Conservative Price Prediction | Optimistic Price Prediction |

| 2027 | $220,000 - $280,000 | $350,000+ |

| 2028 | $280,000 - $350,000 (Post-Halving) | $500,000+ |

| 2029 | $350,000 - $450,000 | $750,000+ |

| 2030 | $467,000 - $734,000 | $1,000,000+ |

Risk Disclaimer: It is crucial to remember that these are speculative forecasts. Investing in Bitcoin carries significant risk, and past performance is not indicative of future results. The crypto market is highly volatile, and prices can change dramatically. Investors should conduct their own research and never invest more than they can afford to lose.

Fundamental Drivers of Growth

Beyond the price charts, several fundamental factors are driving the long-term growth of the Bitcoin network.

-

Tech Differentiation: Bitcoin's core technology, the blockchain, was revolutionary. Its proof-of-work consensus mechanism, while energy-intensive, provides unparalleled security and immutability for a decentralized network. The simplicity and robustness of its design are key differentiators.

-

Network Adoption: The growth in the number of Bitcoin users, wallets, and transactions is a primary indicator of its health. Institutional adoption via products like ETFs has been a major catalyst, legitimizing Bitcoin as an asset class for traditional investors. Furthermore, the increasing number of public companies adding BTC to their balance sheets underscores a growing corporate conviction in its long-term value.

-

Integrations (DeFi, NFTs, real-world assets): While Bitcoin's primary use case is as a store of value, developments like the Lightning Network for faster, cheaper payments and Ordinals for NFT-like inscriptions are expanding its utility. These second-layer solutions and protocol innovations are helping to build a broader ecosystem on top of the Bitcoin blockchain.

-

Partnerships: The "partnerships" in Bitcoin's case are less about formal corporate agreements and more about the integration of Bitcoin into the global financial system. The acceptance of Bitcoin by major payment processors, financial institutions, and investment firms is a powerful driver of its adoption.

-

Role in Staking or Governance: Bitcoin does not have a staking mechanism in the proof-of-stake sense. Its governance is decentralized, relying on a consensus among miners, developers, and node operators. This decentralized nature is a core strength, preventing any single entity from controlling the network.

Key Risks to Consider

A balanced analysis requires a clear-eyed view of the potential risks facing Bitcoin investors.

-

Competitive Threats: While Bitcoin is the dominant cryptocurrency, it faces competition from thousands of "altcoins," some of which offer different technological features. However, none have yet come close to matching Bitcoin's network security and decentralization. A more significant long-term threat could come from central bank digital currencies (CBDCs), although many argue these would serve a different purpose and lack the core decentralization that makes Bitcoin valuable.

-

Token Dilution: This is not a significant risk for Bitcoin. Its supply is algorithmically fixed at 21 million coins, with a predictable and transparent issuance schedule. This programmatic scarcity is one of its most compelling features.

-

Regulatory Impact: The regulatory landscape remains a major uncertainty. While some jurisdictions have embraced Bitcoin, others may impose restrictions or outright bans. Increased regulation is a double-edged sword: it can bring legitimacy and investor protection but may also stifle innovation or impose burdensome compliance costs.

-

Weakening Dev or Social Activity: The Bitcoin network's health depends on the continued engagement of its global community of developers, miners, and users. A significant decline in developer activity or a loss of faith within the community could pose a long-term risk. However, at present, the developer community remains highly active, and social sentiment is strong.

Analyst Sentiment & Community Insights

The sentiment surrounding Bitcoin in late 2025 is a mix of short-term caution and long-term bullishness.

-

Quotes from Analysts or Firms:

-

Many analysts, including those from firms like JPMorgan and Standard Chartered, maintain ambitious price targets for 2025 and beyond, with some projecting moves toward 150,000-200,000.

-

-

-

Despite the recent crash, many analysts view it as a healthy "leverage flush" rather than the start of a bear market, suggesting it created a prime buying opportunity.

-

-

Reddit and Twitter Sentiment: Social media platforms show a vibrant and engaged Bitcoin community. The recent price drop led to a spike in fear, with the Crypto Fear & Greed Index hitting a yearly low. However, many long-term holders view such moments of "extreme fear" as contrarian indicators and opportunities for accumulation.

-

Google Trends: Google search interest for "Bitcoin" often correlates with price action. Spikes in search volume can indicate increased retail interest, which often precedes periods of high volatility. Monitoring these trends can provide a pulse on mainstream market sentiment.

-

CoinGecko/CoinMarketCap Community Ratings: Community ratings on major crypto data aggregator sites remain overwhelmingly positive for Bitcoin, reflecting the strong conviction of its long-term holders.

Is Bitcoin a Good Investment?

Whether Bitcoin is a "good" investment depends on an individual's risk tolerance, investment horizon, and financial goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investments, including cryptocurrencies, carry risks.

-

Long-Term Use Case: Bitcoin's primary use case as a decentralized, non-sovereign store of value is incredibly compelling in an era of rising government debt and currency debasement. Its potential to act as "digital gold" gives it a unique position in the global financial system.

-

Token Strength: Bitcoin's tokenomics are its greatest strength. A fixed, predictable, and finite supply makes it a scarce asset by design. This fundamental characteristic underpins its long-term value proposition.

-

Macro Risks: Bitcoin is not immune to broader market forces. A global recession, geopolitical conflicts, or a significant shift in the regulatory environment could negatively impact its price. Its high volatility means investors must be prepared for significant price swings.

In conclusion, the Bitcoin investment potential remains strong heading into 2025–2030. While short-term volatility is a given, its fundamental drivers—scarcity, decentralization, and growing institutional adoption—provide a solid foundation for long-term growth.

Trade and Earn BTC on Phemex

Phemex is a top-tier cryptocurrency exchange offering a secure, high-performance platform for trading Bitcoin. Whether you are a beginner or a pro, you can easily buy, sell, and trade BTC using spot markets or high-leverage futures contracts. To enhance your strategy, Phemex also provides automated trading bots and passive income products through Phemex Earn.

Exclusive for VIPs: Earn More with BTC Vault

Phemex has launched BTC Vault, a new feature designed exclusively for VIP users. Simply hold your Bitcoin on the platform to automatically earn additional BTC rewards every week. Best of all, there are no lock-ups—your funds remain fully liquid and accessible at all times. It's the perfect way to generate passive income while maintaining complete control over your assets.