Key Takeaways

-

What is Zebec Network (ZBCN)?: ZBCN is the native token for Zebec Network, a decentralized infrastructure project built on Solana for real-time value transfers, including payroll and micropayments.

-

Core Function: The network facilitates continuous money streams, aiming to replace traditional, delayed payment systems with instant, on-chain financial transactions.

-

DePIN Integration: Zebec is expanding into Decentralized Physical Infrastructure Networks (DePIN) to bridge on-chain finance with real-world applications, including Point-of-Sale (PoS) devices.

-

Token Utility: The ZBCN token is used for governance, network fees, and as collateral. It also provides holders with access to premium features and rewards.

-

How to Trade ZBCN: You can easily trade ZBCN on Phemex through its Spot and Futures markets.

Quick Facts About Zebec Network (ZBCN)

What Is Zebec Network (ZBCN)?

Imagine a world where instead of waiting for a bi-weekly paycheck, an employee's salary flows into their digital wallet every second they work. This is the concept of "streaming finance" that Zebec makes possible. Zebec explained simply, is a protocol that provides the foundational tools for "programmable money." It empowers developers and businesses to build applications for seamless, on-chain financial transactions, from micropayments and subscriptions to complex treasury management for Web3 companies.

The network has evolved beyond its origins on Solana and now operates as a multi-chain ecosystem, with integrations across Base, Ethereum, BNB Chain, and NEAR. By aiming to diminish the role of traditional financial intermediaries, Zebec's vision is to grant individuals and businesses faster, more transparent, and more inclusive access to their funds, fostering a more accessible and efficient global financial environment. Its integrated product suite, including real-time payroll applications, payment cards, and treasury management solutions, is already utilized by hundreds of companies, showcasing its practical application in both Web2 and Web3 economies.

How Many ZBCN Are There?

-

Max vs. Circulating Supply: Zebec Network has a fixed maximum and total supply of 100 billion ZBCN tokens. This hard cap ensures that no new tokens can be created beyond this limit. The current circulating supply is approximately 50.8 billion ZBCN, meaning a significant portion of the tokens is already active in the market.

-

Token Migration: It's important to note that ZBCN is the successor to the protocol's original token, ZBC. The project executed a strategic token migration that included a 1:10 split, where every 1 ZBC token was exchanged for 10 ZBCN. This was implemented to streamline the network's gas fee structure and enhance the token's utility across its expanding multi-chain ecosystem.

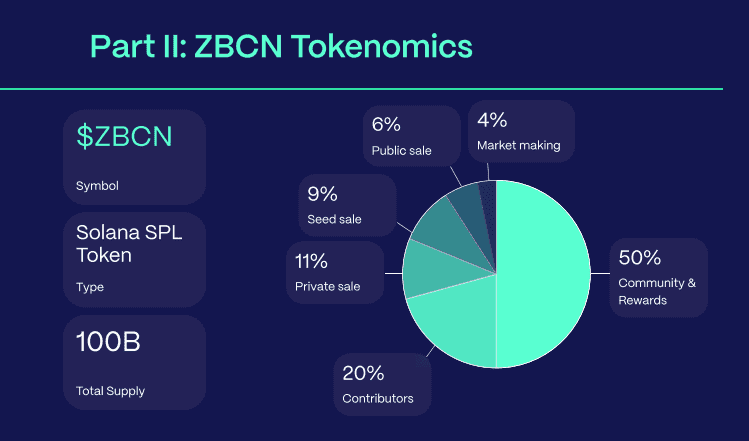

ZBCN Token Distribution:

Following the migration, the 100 billion ZBCN tokens were allocated to support the project's long-term growth, community engagement, and ecosystem development. The distribution is as follows:

-

Community & Rewards: 50%

-

Contributors: 20%

-

Private Sale: 11%

-

Seed Sale: 9%

-

Public Sale: 6%

-

Market Making: 4%

Token Vesting Schedule:

To ensure long-term alignment and prevent market instability, the allocated tokens are subject to a structured vesting schedule. This means tokens are released gradually over time rather than all at once. The key vesting periods are:

-

Seed & Private Rounds: 6-month lockup period followed by a 3-year vesting period.

-

Contributors: 6-month lockup period followed by a 3-year vesting period.

-

Market Making: 3-year vesting period.

-

Community & Rewards: 4-year vesting period.

-

Public Sale: A portion (165 million tokens) was fully unlocked at launch, with the remainder subject to locks of 6 and 12 months.

Inflationary or Deflationary Mechanisms:

With a fixed maximum supply and a structured vesting schedule, the ZBCN token is not inherently inflationary. Moreover, the protocol has integrated a deflationary mechanism. A portion of the ZBCN tokens collected from network fees is automatically and permanently burned, which reduces the total supply over time and is designed to support the token's value as network activity grows.

What Does Zebec Network (ZBCN) Do?

-

Real-World and Network Use Cases: The primary ZBCN use case is facilitating real-time financial applications. This is most prominently seen in Zebec Payroll, which allows businesses to stream salaries to employees continuously. The ecosystem is rapidly expanding into the domain of Decentralized Physical Infrastructure Networks (DePIN), with the planned launch of its own Point-of-Service (PoS) devices. These terminals will enable merchants in retail and hospitality to accept crypto payments directly, bridging the gap between digital assets and everyday commerce.

-

Utility for Fees, Staking, and Governance: ZBCN serves as the principal utility token for network operations. It is used to pay for gas and bridging fees, with a standardized fee of 1 ZBCN per transaction simplifying the user experience. The token can also be used as native collateral for decentralized applications built within the Zebec ecosystem, a feature intended to bootstrap liquidity and incentivize broader developer adoption. As a governance token, ZBCN empowers its holders with voting rights on key decisions affecting the protocol's future. Through a hybrid governance model that combines off-chain community discussions with formal on-chain voting, holders can influence Zebec Improvement Proposals (ZIPs), shaping everything from fee structures to new feature integrations.

-

Integration in Apps or Platforms: The token is deeply integrated into Zebec's suite of products. Holding ZBCN unlocks a variety of benefits and incentives for users. This includes access to premium, no-fee versions of Zebec products, reduced fees on features like treasury management, and exclusive access to the Zebec Instant Card program. For example, ZBCN holders can gain higher spending limits and automatic enrollment into rewards programs offering up to 5% ZBCN back on spending. Furthermore, holders often qualify for exclusive airdrops and incentives from partner projects, adding another layer of utility.

Zebec Network (ZBCN) vs. Onyxcoin (XCN)

| Feature | Zebec Network (ZBCN) | Onyxcoin (XCN) |

| Primary Use Case | A protocol for real-time, continuous financial streams like payroll and micropayments. Focuses on transforming how value is transferred over time. | A utility, governance, and gas token for the Onyx blockchain, a Layer 3 network designed for financial-grade applications and cross-border payments. |

| Core Technology | Initially built on Solana and now a multi-chain network, leveraging high-speed blockchains to facilitate "programmable money" through a specialized payment-streaming protocol. | A modular Layer 3 blockchain built using Arbitrum technology, which is in turn secured by Ethereum. It uses a federated consensus protocol for its digital ledger. |

| Speed and Fees | Inherits the high throughput and low-cost transaction environments of its underlying blockchains (like Solana), which are essential for its streaming payment model. | Offers near-instant confirmations and consistently low fees (often below $0.01) by operating as a Layer 3 solution, abstracting away gas fee complexities. |

| Ecosystem Focus | Primarily focused on Decentralized Physical Infrastructure Networks (DePIN), real-world payment applications like the Zebec Card, and enterprise solutions for payroll and treasury management. | Focused on providing a secure and scalable platform for banking, securities, and payment dApps, with tools for decentralized identity and on-chain task automation. |

| Decentralization & Security | Relies on the security and decentralization of its underlying Layer 1 networks (e.g., Solana's Proof-of-Stake/Proof-of-History). | Inherits the economic security of the Ethereum network, with its own governance managed by XCN token holders through a DAO on Ethereum. |

The Technology Behind Zebec Network (ZBCN)

-

Consensus Mechanism: As a protocol initially built on Solana, ZBCN leverages the network's unique Proof-of-History (PoH) timing mechanism combined with a Proof-of-Stake (PoS) consensus algorithm. This foundation enables Zebec to process transactions with high throughput and near-instant finality, which is a critical requirement for its core function of real-time payment streaming. As a multi-chain protocol, it also relies on the consensus mechanisms of other supported blockchains like Ethereum and BNB Chain.

-

Unique Technologies (e.g., zk-Rollups, Layer-2s): Zebec’s core innovation is its continuous settlement protocol, a system of smart contracts that automates and secures the per-second streaming of funds. This is not a standard feature of most blockchains and represents Zebec's unique value proposition. To further enhance scalability and interoperability, Zebec has developed its own Layer 3 chain, the Nautilus Chain. This modular, high-performance blockchain is specifically optimized to support global payment flows and DePIN infrastructure, serving as the backbone for its next generation of financial products.

-

Infrastructure and Notable Partnerships: Zebec’s infrastructure is built for broad adoption. It provides developers with Software Development Kits (SDKs) to easily integrate its streaming payment technology into their own decentralized applications across various blockchains. This chain-agnostic approach is crucial for its long-term growth. The project has also forged strategic partnerships that are critical to its mission of bridging Web3 and traditional finance. A landmark collaboration is its partnership with Mastercard, which powers the Zebec Card program, allowing users to spend their crypto seamlessly anywhere Mastercard is accepted. These partnerships, combined with a regulatory-first approach that includes acquiring compliance firms, position Zebec for potential institutional and enterprise adoption.

Team & Origins

The launch timeline was rapid, and the project quickly gained significant traction within the venture capital community. Zebec has successfully raised $35 million in investments from a roster of top-tier firms, including Circle, Coinbase Ventures, Solana Ventures, Breyer Capital, Republic Capital, and Lightspeed Venture Partners. This strong financial backing from some of the most respected names in the fintech and crypto industries provided the runway for Zebec to build out its team and product suite.

The leadership team is composed of professionals from both the Web2 and Web3 worlds, creating a powerful synergy of traditional financial expertise and cutting-edge blockchain innovation. The project has also attracted notable advisors, including former executives from major payroll companies like ADP. This blend of experience underscores Zebec's strategic focus on disrupting legacy industries by offering practical, blockchain-based solutions that are both technologically advanced and commercially viable.

Key News & Events

-

Token Migration (May 2025): In a pivotal move for its ecosystem, Zebec successfully completed the token migration from ZBC to ZBCN. This event included a 1:10 token split designed to enhance the token's utility, simplify gas fee calculations for its payment applications, and improve overall network efficiency.

-

Launch of Zebec Card Program: A major milestone was the rollout of the Zebec Card, a crypto debit card powered by Mastercard. This product line, featuring the Zebec Silver and Zebec Black cards, directly connects the Zebec ecosystem with the global financial system, allowing users to spend their digital assets at millions of merchants worldwide.

-

Regulatory Clarity and Compliance Focus (October 2025): The SEC's decision to provide clearer regulatory guidelines for DePIN tokens was a significant positive development for the entire sector, including Zebec Network. This event bolstered market sentiment and validated Zebec's proactive, compliance-focused strategy, which includes achieving SOC 2 compliance for data security.

-

Expansion into DePIN: Zebec officially announced its strategic expansion into Decentralized Physical Infrastructure Networks. This includes the development of its own Point-of-Sale (PoS) devices, signaling a major step towards building a comprehensive, decentralized infrastructure for retail and commercial payments.

-

Major Exchange Listings: Throughout its development, the ZBCN token has been listed on several major crypto platforms. These listings have been crucial for increasing the token's liquidity, accessibility, and visibility to a global audience of traders and investors.

Is ZBCN a Good Investment?

-

Past Performance: The ZBCN token, and its predecessor ZBC, have experienced significant price volatility, which is characteristic of the broader cryptocurrency market. Its performance has often been influenced by major project milestones, partnership announcements, and overall market sentiment. Investors should analyze its historical price charts while remembering that past performance is not indicative of future results.

-

Community Growth: Zebec has demonstrated tangible growth in user adoption. The network services hundreds of enterprise clients and boasts over 50,000 monthly active users for its suite of products. A strong and growing user base is a positive indicator of product-market fit. The project also has strong backing from reputable venture capital firms, which signals a degree of confidence from sophisticated investors in its long-term potential.

-

Technology and Market Positioning: Zebec’s focus on real-world use cases, such as payroll and its strategic expansion into the burgeoning DePIN sector, positions it at the forefront of some of the most promising areas in blockchain. Its technology aims to solve a clear problem: the inefficiency of traditional payment systems. News about ZBCN frequently highlights its innovative payment solutions and growing infrastructure. This focus on tangible utility could drive long-term adoption and value.

-

Risks (Regulatory, Volatility): The investment potential of ZBCN is not without risks. The cryptocurrency market is notoriously volatile, and the ZBCN price can experience sharp fluctuations. Regulatory uncertainty remains a significant risk for the entire industry; while Zebec has a compliance-first approach, future regulations could impact its operations. Furthermore, the project faces competition from both traditional fintech companies and other blockchain-based payment protocols.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Crypto trading involves significant risks; only invest what you can afford to lose.

How to Buy ZBCN on Phemex

FAQs

Zebec Network solves the critical problem of delayed and inefficient payment systems that are common in traditional finance. It achieves this by creating a decentralized infrastructure for real-time, continuous money streaming, making financial transactions like payroll, micropayments, and treasury management faster, more transparent, and globally accessible.

2. Is ZBCN a governance token?

Yes, ZBCN serves a dual role as both a utility and a governance token. This empowers holders to actively participate in the protocol's future by voting on Zebec Improvement Proposals (ZIPs). These proposals can relate to network upgrades, fee structures, and other key policy decisions, ensuring a community-driven approach to development.

3. Why did Zebec migrate from ZBC to ZBCN?

The migration from ZBC to ZBCN, which included a 1:10 token split, was a strategic decision to optimize the network's tokenomics. The primary goals were to simplify the gas fee structure for its growing suite of payment applications and to enhance the token's overall utility and user experience within its expanding multi-chain ecosystem.

Ready to deepen your understanding of the crypto landscape? Explore the future of finance by visiting the Phemex Academy to learn more about innovative crypto projects and sharpen your trading skills.