In the ever-evolving landscape of cryptocurrency, projects that unlock new potential for established assets like Bitcoin are gaining significant attention. Yala (YALA) is one such project, designed to bridge Bitcoin with the world of decentralized finance (DeFi) and real-world assets (RWAs). This guide explores what Yala is, its core functionalities, and how you can engage with it. For those looking to expand their crypto knowledge, the Phemex Blog offers a wealth of resources to help you trade smarter.

Summary Box (Quick Facts)

-

Ticker Symbol: YALA

-

Chain: Primarily operates on the Bitcoin blockchain, with cross-chain capabilities.

-

Contract Address: 0xf970706063b7853877f39515c96932d49d5ac9cd (Ethereum)

-

Circulating Supply: Approximately 246.36 million YALA

-

Max Supply: 1,000,000,000 YALA

-

Primary Use Case: Unlocking Bitcoin liquidity for DeFi and RWA yield opportunities

-

Current Market Cap: Approximately $51.39 million

-

Availability on Phemex: At 10:00 UTC on July 24, 2025, Phemex will list the new spot trading pair YALA/USDT

What Is Yala (YALA)?

Yala is a decentralized protocol that enables Bitcoin holders to generate yield on their assets without selling them or relinquishing custody. It functions as a sophisticated credit system where the YALA token serves as the backbone for decision-making, utility, and as a recapitalization resource during times of market stress.

Yala is also a Bitcoin-native liquidity protocol that allows Bitcoin holders to earn yield from DeFi and Real-World Assets (RWAs) without relinquishing custody. The core problem Yala addresses is the underutilization of Bitcoin. It transforms Bitcoin from a passive store of value into a productive, yield-generating asset. This is achieved by allowing users to deposit their Bitcoin to mint $YU, a stablecoin pegged to the US dollar. The YALA token then powers the entire ecosystem, ensuring its security and decentralized operation.

Yala explained simply: it transforms Bitcoin into a yield-generating asset. It achieves this through a dual-token system. Users can deposit their Bitcoin into the Yala protocol to mint $YU. This stablecoin is over-collateralized by Bitcoin, meaning the value of the deposited Bitcoin is higher than the value of the minted $YU, creating a buffer against market volatility.

How Many YALA Coins Are There?

YALA has a fixed maximum supply of 1 billion tokens. As of the latest data, around 246.36 million are in circulation. The project has a structured release schedule to promote long-term sustainability. Team and investor tokens are subject to vesting and lock-ups, while mechanisms like token buybacks and burns help manage inflation and support value retention.

The YALA token is not just for speculation; it is deeply integrated into the protocol’s operations. Its utility is built on three pillars:

-

Stability Pool Rewards: The Stability Pool is a core component of the protocol's risk management. Users can deposit their $YU stablecoins into this pool to help absorb system debt during liquidation events. In return, they earn rewards in YALA tokens, shares of liquidated collateral, and stability fees.

-

Cryptoeconomic Security: YALA is used to secure the protocol's critical infrastructure. Token holders can stake their YALA to validator nodes that operate the Notary Bridge cross-chain system. This staking mechanism also helps protect the $YU stablecoin through integration with LayerZero-based Decentralized Verifier Networks (DVNs).

-

Governance Evolution: As the Yala protocol decentralizes, the YALA token becomes the primary tool for decision-making. Token holders can vote on protocol parameters, submit Yala Improvement Proposals (YIPs), and use a vote-escrowed model ($veYALA) to direct emission rewards and incentives across the ecosystem.

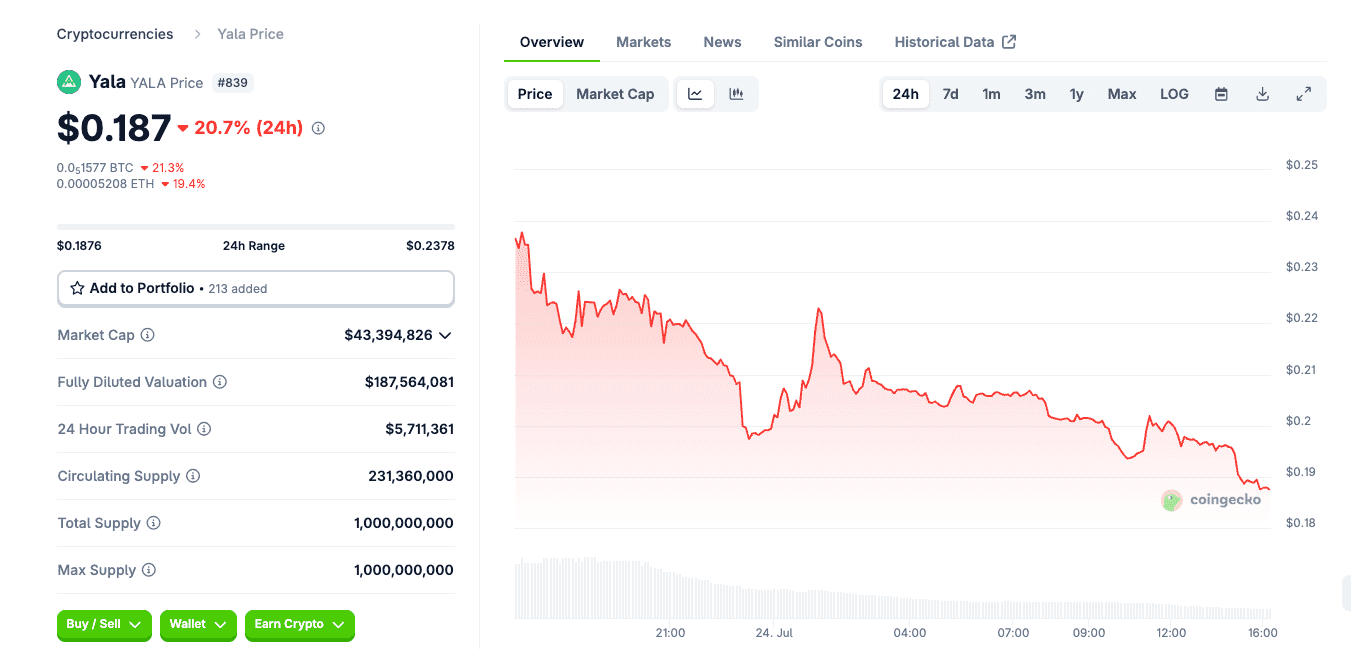

YALA Token Price: Current Value & Market Movement

As of July 24, 2025, the YALA token is trading at approximately $0.187, marking a 24-hour decrease of 20.7%. This notable dip reflects early volatility following its anticipated listing on Phemex, a common occurrence for newly launched tokens as liquidity stabilizes and the market finds equilibrium.

Despite short-term price fluctuations, many investors are watching YALA’s long-term potential due to its unique positioning in the Bitcoin DeFi sector. Key factors that may influence YALA's price moving forward include:

-

Adoption of the $YU stablecoin

-

Total value locked (TVL) across chains

-

Staking and Stability Pool participation

-

Governance activity and protocol updates

To check the live YALA token price, visit Phemex once trading opens, or use platforms like CoinGecko and CoinMarketCap. Note: YALA/USDT trading on Phemex is scheduled to go live at 10:00 UTC on July 24, 2025.

YALA Tokenomics: Distribution and Release Schedule

The total supply of YALA is fixed at 1 billion tokens, a design choice intended to ensure long-term sustainability and align stakeholder interests. The token distribution and vesting schedules are structured to avoid supply shocks and promote healthy market dynamics.

| Category | Allocation | Vesting Schedule Details |

|---|---|---|

| Ecosystem & Community | 20% | 45% unlocked at TGE, then linearly over 24 months |

| Foundation & Treasury | 29.12% | 30% at TGE, 1-year cliff, then 36-month linear vesting |

| Team | 20% | 1-year cliff, then 24-month linear vesting |

| Investors | 15.98% | 1-year cliff, then 18-month quarterly vesting |

| Marketing | 10% | 20% at TGE, 1-year cliff, then 24-month linear vesting |

| Airdrop | 3.4% | Fully unlocked at TGE |

| Market Makers | 1.5% | Subject to specific agreements |

The release schedule prioritizes ecosystem incentives and delays team/investor unlocks to align all participants with the project's long-term vision.

The Yala Governance Framework

Yala employs a sophisticated governance framework to ensure decentralized control. There are three types of proposals:

-

Core Protocol Changes: Require 5% of circulating supply to propose, a 7-day voting period, and 50% quorum.

-

Parameter Adjustments: Require 1% proposal threshold, 3-day vote, and 20% quorum.

-

Emergency Actions: Initiated by multisig wallet, with a 24-hour expedited vote and 67% approval threshold.

Token holders can delegate voting power to trusted experts or community members for more efficient governance.

What Does the YALA Token Do?

-

Incentivizing Participation: Contributors to platform liquidity and stability, such as Stability Pool participants, earn YALA rewards.

-

Protocol Security: YALA can be staked to secure cross-chain infrastructure and decentralized verifiers.

-

Governance: Token holders influence protocol decisions through decentralized governance.

-

Fee Payments: YALA may be used to pay fees within the ecosystem in the future.

Yala vs. Bitcoin

| Feature | Yala (YALA) | Bitcoin (BTC) |

|---|---|---|

| Use Case | Governance & utility token for DeFi protocol | Decentralized digital currency |

| Tech | Modular DeFi protocol, stablecoin, cross-chain | Proof-of-Work, limited scripting |

| Function | Yield generation, RWA access | Value storage and transfer |

| Tokenomics | Dual-token, fixed supply (1B) | Single token, 21M supply, mined |

Yala enhances Bitcoin by transforming it from a passive asset into a yield-generating one within the DeFi ecosystem.

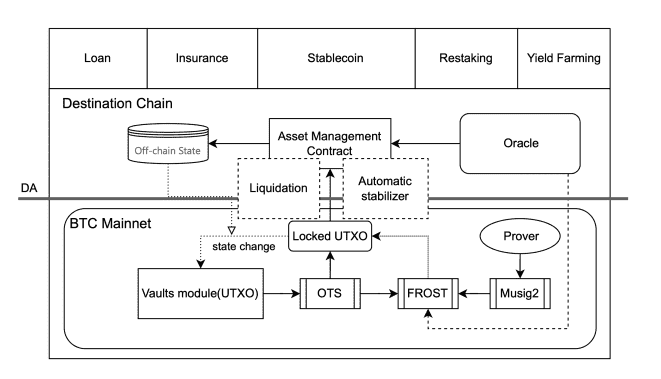

The Technology Behind Yala

-

Consensus & Security: Built as a Bitcoin-native protocol, it inherits Bitcoin's robust security. A trust-minimized design ensures users keep custody of their BTC.

-

Stablecoin & Cross-Chain: $YU is minted by depositing BTC. Yala's MetaMint protocol allows seamless conversion of BTC into stablecoins across Ethereum, Solana, and other chains, without needing to wrap BTC.

-

Partnerships: Collaborations with Alchemy Pay (for crypto spending cards), Euler, and Raydium expand yield access and ecosystem utility.

Team & Origins

Founded in 2023 by experienced professionals:

-

Kaitai Chang (COO): Formerly Binance Labs

-

Bin Liu: Co-founder of Alchemy Pay

-

Vicky Fu (CTO): Former Circle Engineering Director

Team includes alumni from MakerDAO, Microsoft, and Lido. In October 2024, Yala raised $8M in a seed round led by Polychain Capital and Ethereal Ventures, with support from Amber Group and HashKey Capital.

Key News & Events

-

October 2024: Raised $8M, launched testnet

-

May 2025: Mainnet launched, expanded to Solana

-

July 2025: TVL surpassed $208.26M

-

July 2025: Launched "Yala Yeti Card" with Alchemy Pay and YALA token

-

July 24, 2025: YALA/USDT listing on Phemex

Is YALA a Good Investment?

Investment depends on individual risk tolerance. Consider:

-

Price Performance: Volatility typical for new tokens.

-

Adoption: $208.26M TVL indicates growing trust.

-

Tech & Positioning: Strong narrative and utility in BTC DeFi sector.

-

Risks: Includes volatility, regulation, and competition.

Yala presents a compelling use case by bridging Bitcoin with DeFi and RWAs. Its seasoned team, strategic backing, and strong architecture position it as a project worth watching. Always conduct thorough research before investing.

FAQs

What problem does Yala solve?

Yala unlocks the liquidity of idle Bitcoin, enabling holders to earn yield through DeFi and RWA access without selling or losing custody.

What is the difference between the YALA and YU tokens?

$YU is a stablecoin minted by depositing BTC, used to access yield. $YALA is the governance and utility token used for rewards, security, and decision-making.

Is Yala secure?

Yala uses Bitcoin's security and a trust-minimized, over-collateralized architecture. Though it introduces modern DeFi features, users should assess associated risks.

Further Readings

- PENGU Meme Coin Price Analysis: $0.08 Target in 2025?

- Master Altcoin Season 2025: Phemex Trading Guide

- NFT Market Surges 9% as Altcoin Season Looms: CryptoPunks, Moonbirds, and More Lead the Charge

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Crypto trading involves significant risk; only invest what you can afford to lose.