Introduction: Phemex Expands Its Stablecoin Offerings

Why Stablecoins Like USDR and EURR Matter in Today’s Market

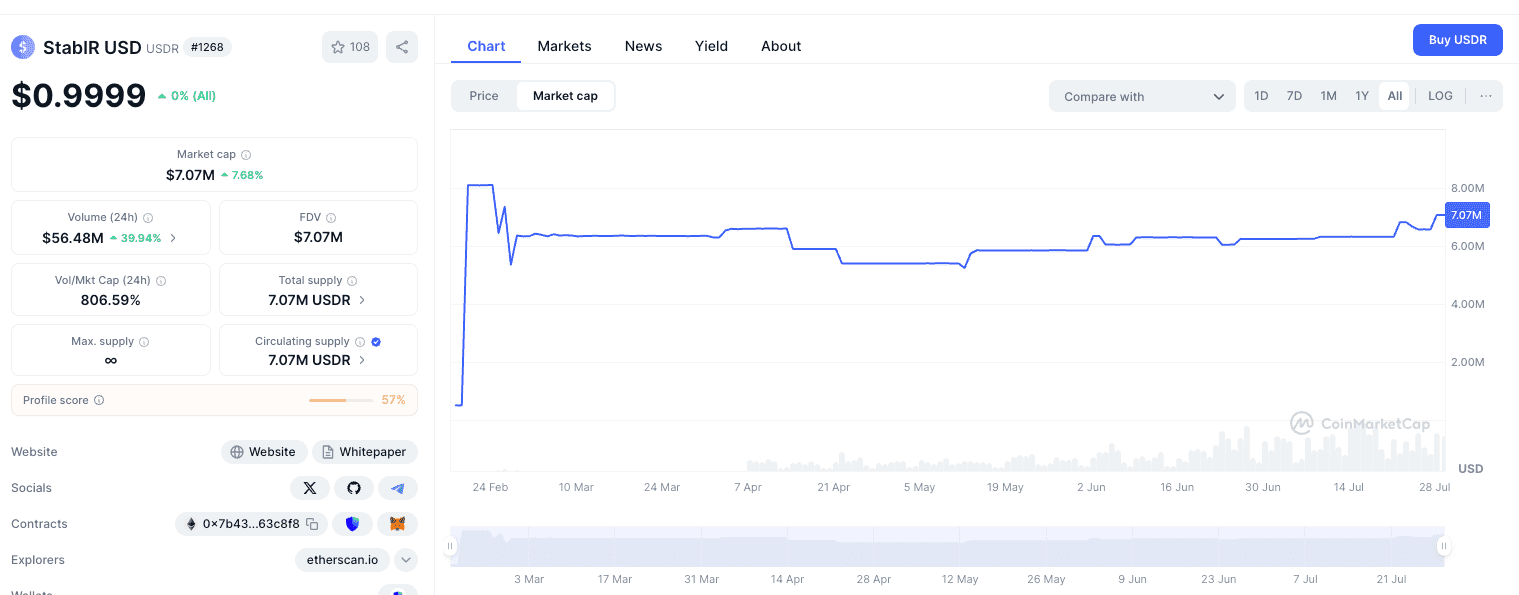

What Is USDR? A Closer Look at StablR USD

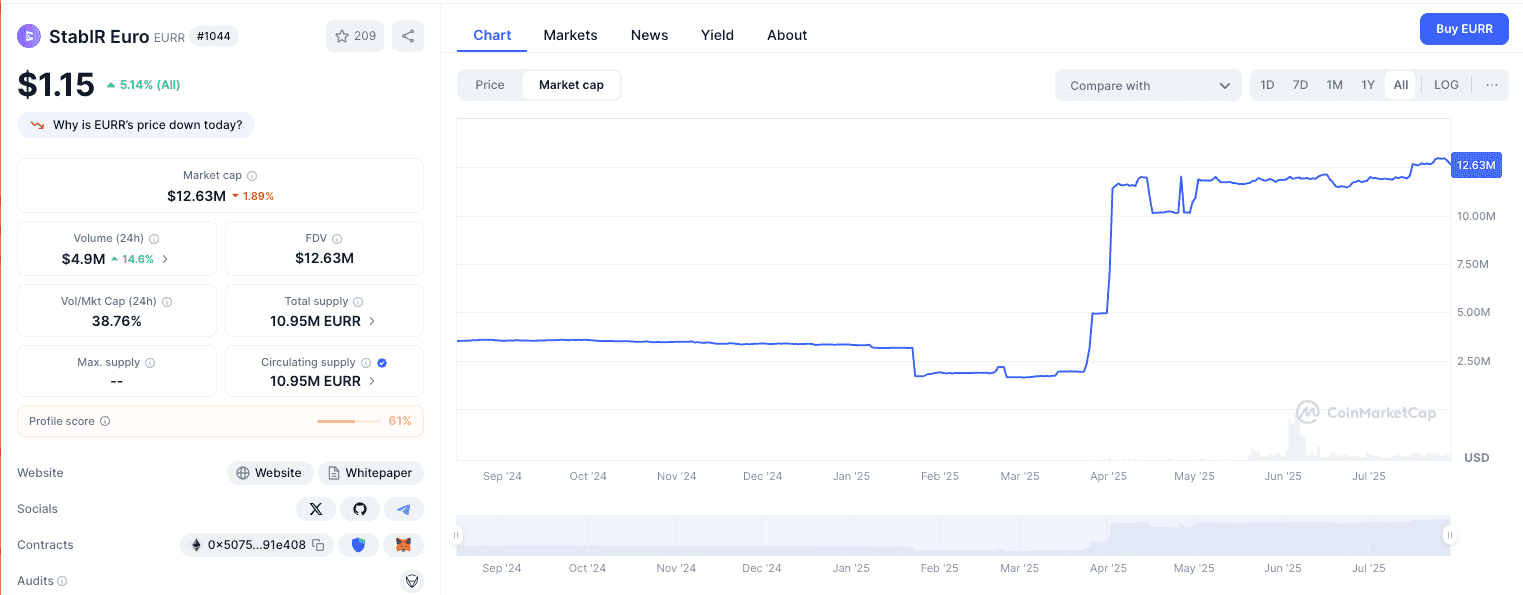

What Is EURR? Introducing a Euro-Pegged Crypto Alternative

The Role of Fiat-Pegged Stablecoins in Modern Crypto

-

Trading: Stablecoins serve as a common base currency on exchanges, simplifying the process of buying and selling other cryptocurrencies.

-

Hedging: During periods of market turbulence, traders can move their funds into stablecoins to preserve capital.

-

Cross-Border Payments: Stablecoins can facilitate faster and cheaper international transactions compared to traditional banking systems.

-

DeFi Applications: They are integral to decentralized finance protocols, enabling lending, borrowing, and yield generation.

Upcoming Trading Pairs on Phemex

-

BTC/USDR

-

EURR/USDT

-

USDR/USDT

Key Differences: USDR vs USDT, EURR vs Traditional Euro Exposure

USDR vs. USDT:

| Feature | USDR (StablR) | USDT (Tether) |

| Issuer | StablR (Europe, backed by Tether) | Tether (Global) |

| Compliance | Holds a Financial Institution licence in Malta | Faces MiCA compliance challenges in the EU |

| Reserve Mechanism | Full fiat backing in separate accounts | Mixed assets, including cash, T-bills, and other investments |

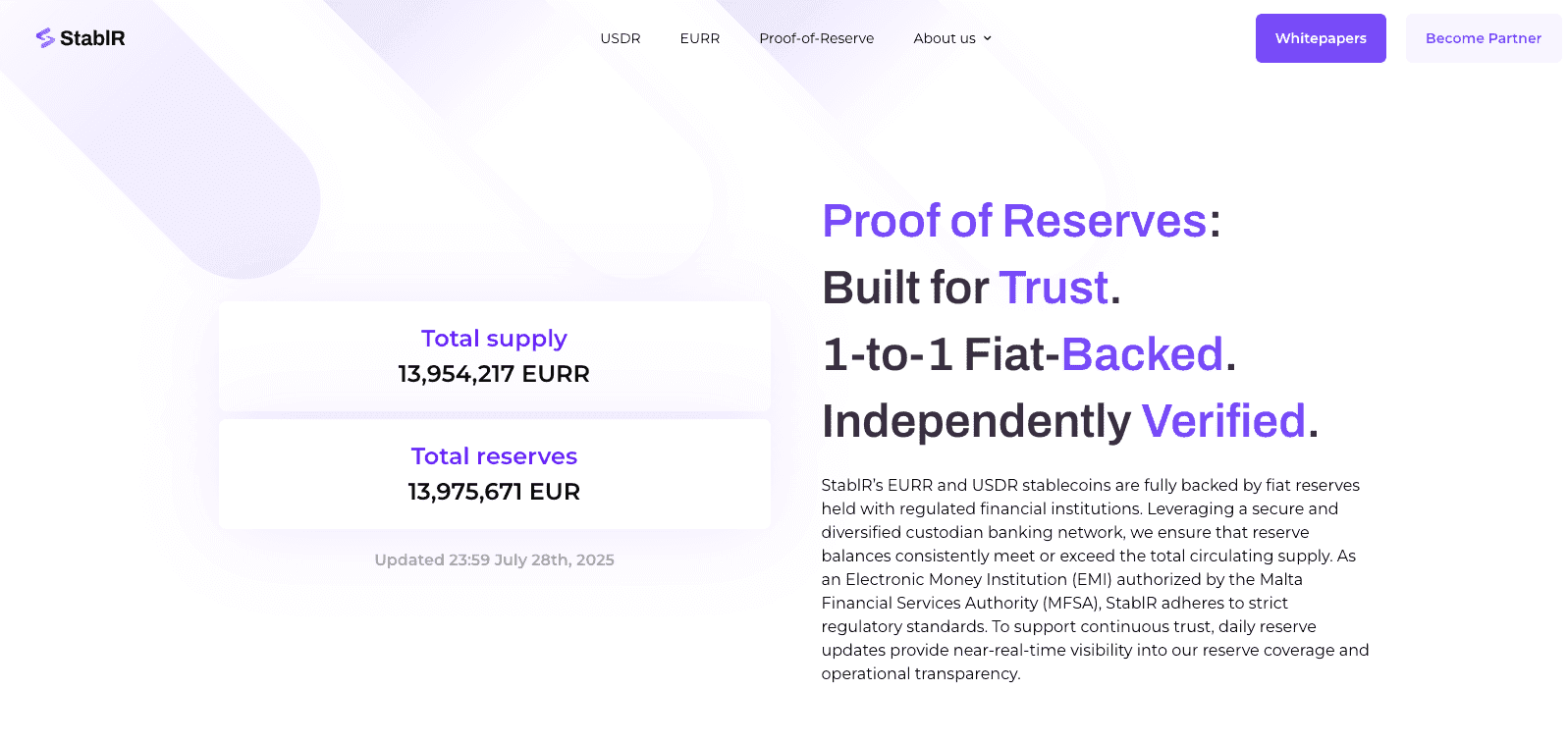

| Audit Reports | Pledges regular third-party audits + real-time proof of reserve | Provides quarterly reports, but frequency and completeness have been questioned |

| Use Cases | Better suited for EU users and institutions with high compliance needs | High global adoption and wide support on exchanges |

EURR vs. Other Euro-Backed Crypto:

Competitive Analysis: StablR vs Other Euro Stablecoins

Here’s how EURR compares to competitors like EURC (by Circle) and agEUR (by Angle Protocol):

| Feature | EURR (StablR) | EURC (Circle) | agEUR (Angle Protocol) |

|---|---|---|---|

| Regulation | MFSA-licensed issuer | Registered in US, no EU license | DeFi-native, no license |

| Reserve Assets | Fiat & cash equivalents | Cash, T-Bills | Crypto-backed, partially algorithmic |

| Audit & Transparency | Real-time proof + independent audits | Monthly attestation | On-chain collateral dashboard |

| Target Market | Institutional & compliant retail | Global, US-focused | DeFi-focused community |

| DeFi Utility | Pending integrations | Limited | High |

Technical Advantages: ERC-20 and Beyond

Both USDR and EURR are ERC-20 tokens, making them instantly compatible with Ethereum wallets, DeFi protocols, and custodians. Looking forward, if StablR expands support to other chains (like Arbitrum, Base, or Solana), their utility will exponentially increase. Multichain compatibility will be key for broader adoption in GameFi, NFTs, and Layer 2 ecosystems.

USDR and EURR in Institutional Use Cases

Treasury Management

For crypto-native organizations and DAOs operating across borders, USDR and EURR introduce a compliant method to manage treasury balances in multiple currencies. These stablecoins allow firms to denominate assets in fiat terms while benefiting from blockchain-based settlement and programmability.

Onboarding Traditional Finance (TradFi)

TradFi institutions, including hedge funds, fintech banks, and FX providers, face rising demand for on-chain assets that mirror traditional currencies. The licensing and reserve structure behind StablR's tokens provides a pathway for these entities to enter Web3 ecosystems without sacrificing regulatory clarity or auditability.

Euro Liquidity Gap in Crypto

Until recently, the Euro has been underrepresented in crypto markets. EURR helps fill this void by offering 24/7 programmable Euro liquidity—something traditional SEPA banking cannot provide. This opens opportunities in algorithmic trading, real-time arbitrage, and regional DeFi growth within the Eurozone.

Understanding the Broader Stablecoin Landscape

Stablecoins have become the backbone of liquidity and capital preservation in the crypto economy. As of 2025, the market capitalization of stablecoins exceeds $150 billion, with USDT and USDC dominating trading volumes. However, as regulators worldwide push for greater transparency and accountability, the next phase of stablecoin adoption hinges on compliant infrastructure.

MiCA (Markets in Crypto-Assets), introduced by the European Union, mandates higher disclosure standards and reserve requirements for stablecoin issuers. In this climate, the introduction of USDR and EURR via a licensed entity like StablR positions them as timely entrants for users and institutions seeking compliant digital asset options.

DeFi Integrations and Potential Ecosystem Growth

Beyond spot trading, USDR and EURR are expected to become critical infrastructure for the decentralized finance ecosystem.

Potential DeFi use cases:

-

Lending Protocols: Platforms like Aave or Compound could integrate USDR and EURR as stable, regulated collateral options.

-

Liquidity Pools: Stable pairs like USDR/USDT or EURR/EUROC can deepen DEX liquidity while offering users arbitrage and yield farming opportunities.

-

Synthetic Assets and Forex on Chain: With Euro-backed liquidity, These stablecoins can power decentralized FX markets (e.g., EUR/USD, USD/JPY), enabling on-chain hedging, remittance, and leveraged strategies.

-

Cross-Chain Bridges: As bridges increasingly demand regulated stablecoins to mitigate illicit flows, USDR and EURR could become the preferred assets for cross-chain value transfers.

Risk Considerations & Market Adoption Challenges

-

De-pegging Risk: Although backed 1:1, a theoretical risk of a stablecoin losing its peg always exists due to market pressure or issues with the underlying reserves. StablR mitigates this through its commitment to full collateralization and transparency.

-

Regulatory Uncertainty: Although StablR has made significant progress by acquiring its licence, the global regulatory landscape for stablecoins is still evolving. Future regulatory changes could impact its operations.

-

Centralization Risk: The reserves for USDR and EURR are held in centralized institutions, which introduces counterparty risk.

-

Market Adoption: As new entrants, USDR and EURR face the challenge of gaining widespread adoption and liquidity in a market dominated by established players like USDT and USDC. Their success will depend on their ability to build trust and prove the value of their compliance-focused approach.

How to Prepare for the Launch

To make the most of the launch, here’s what users should do:

-

Create and Verify Your Phemex Account: Ensure your KYC is completed to avoid trading interruptions.

-

Deposit Stable Assets: Fund your account with USDT, BTC, or ETH to be ready for pair trades.

-

Watch the Listings Calendar: Follow Phemex’s announcements for real-time listing times.

-

Set Up Trading Alerts: Use Phemex’s price alert tools to monitor USDR and EURR pair movements.

-

Enable API or Bot Access: Quant and algo traders can integrate Phemex’s API to build strategies around the new pairs.

Get Ready for the USDR & EURR Launch

Conclusion: USDR and EURR Represent the Future of Regulated Stablecoins

Long-Term Outlook

The introduction of USDR and EURR is not just a listing—it’s a signal of the broader transformation in stablecoin infrastructure. As regulators begin enforcing stricter standards globally, exchanges that prioritize compliance and transparency will outperform.

USDR and EURR offer a credible alternative to legacy players like USDT, especially for European users and institutions. As DeFi matures and merges with TradFi, compliant, fiat-backed stablecoins will become the foundation of global digital finance.