Summary:

- The Metaverse Index is an index tracking 16 tokens in the metaverse space, including Sand, Axie Infinity and Decentraland.

- It is represented by the ERC-20 MVI token, and issued by Index Coop, a DAO that specializes in crypto index tokens.

- As with a stock index, the biggest benefit of investing in the Metaverse Index Fund is diversification.

What is the Metaverse Index Fund?

Investors interested in innovations in the digital world will inevitably encounter the term “metaverse index fund”. This term describes exactly what you think it is—an index fund created from assets in the metaverse space.

Just as a stock index is a collection of stocks that are used to track the performance of a particular market or sector, a Metaverse index tracks the performance of the metaverse sector.

However, the Metaverse Index in this case is not just a concept but the name of an actual index itself, the Metaverse Index (MVI). This fund was created by Index Coop, a decentralized autonomous organization (DAO) specializing in creating crypto index tokens.

What Is The Metaverse Index Token (MVI)?

The Metaverse Index is represented by an ERC20 token, MVI, which itself is backed by 16 metaverse tokens. For instance, 1 MVI token can represent 5 SAND, 3 AXS and 10 MANA in addition to others; this allocation is rebalanced as and when necessary.

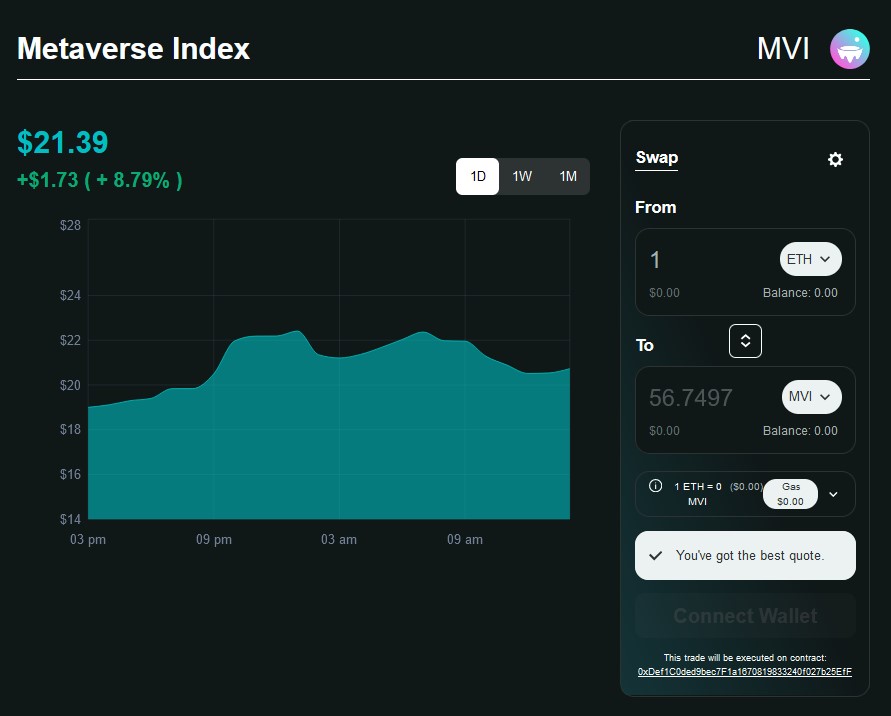

To invest in the Metaverse Index Fund, investors can buy the Metaverse Index token (MVI). The MVI token is trading for $21.57 with a market cap of $3.61 million as of 11 November 2022.

Like most assets crypto or non-crypto, the MVI is going through some “red” times (Source: CoinMarketCap)

Ball Metaverse Index

MVI is not the only choice in this field. The Ball Metaverse Index similarly tracks Metaverse-related companies.

However, the two indices offer entirely different approaches in almost every way—from what assets they include to how they balance their portfolios, that is, investors can invest in both funds if they like what they see in them.

What Is The Benefit of Investing In The Metaverse Index Instead of Individual Metaverse Tokens?

The most obvious benefit of investing in an index instead of individual tokens is that it provides built-in diversification, as it is composed of many different stocks. This diversification can help to mitigate risk and provide stability to a portfolio.

In contrast, if you invest in an individual token and something negative happens to that particular token’s protocol or project, your investment tanks.

On the flip side, it could also mean that the profits you stand to gain may not be as much as if you had invested directly in that token which suddenly goes to the moon because of a strategic partnership or some positive development with that project.

What Tokens Are In The Metaverse Index?

With thousands of coins in the metaverse, MVI relies on a proprietary system to select the tokens that make up its index. For now, there are 16 tokens in the MVI, including Illuvium, Axie Infinity, Sandbox, and Decentraland.

Of course, the chosen tokens are not set in stone as the portfolio is regularly rebalanced.

The assets are screened based on seven factors, which include:

- The asset must be Ethereum-based.

- It must fall into any of the token categories on Coingecko: NFT, Entertainment, Virtual Reality, Augmented Reality and Music.

- The asset’s market cap must be over $50 million.

- The protocol itself must have 3 months’ history of operation and its asset must have at least 3 months of price and liquidity history.

It then uses a formula to estimate each individual token’s weight based on the token’s market cap and DEX liquidity.

The Ball Metaverse Index, on the other hand, tracks non-crypto firms as well, thus giving investors exposure to tech giants such as Nvidia, Meta, Apple, and others.

This means that unlike MVI’s portfolio, which is made of crypto tokens, with the Ball Metaverse Index, you’ll be investing in a stock-based ETF.

While not a guarantee for success, the Ball Metaverse Index presents an investment opportunity to back some of the world’s largest, most profitable, and innovative companies.

Is Metaverse Index a Good Investment?

We are yet to see the developments and triumphs in the metaverse and early investing can potentially bring good profits for the patient investor.

Given the bear market of 2022, however, both the MVI and the Ball Metaverse Index have been down.

From an all-time high of $373 at the end of November 2021, MVI is currently down to $30.74—more than a 90% drop.

The story isn’t rosier for Ball—compared to its peak of nearly $17 in late November 2021, this Metaverse fund closed at $7.76—almost 50% down since its inception.

Of course, another way of looking at things is that this is an opportunity to invest at a low price in an area that will potentially regain its explosive growth.

How to Invest in Metaverse Index?

One of the great positives of the MVI index is that investors only need to buy the Metaverse Index token (MVI) to invest in the index. The MVI token is available on major DEXs and the project’s official website.

To buy the MVI token:

- You need to have ETH on hand.

- Connect your wallet to the MVI platform.

- Swap your ETH for the desired amount of MVI tokens.

Conclusion

There are many benefits of investing in an index, and as the crypto industry matures, more options will definitely be launched. For one, it provides diversification, as it is composed of many different protocols. This diversification can help to mitigate risk and provide stability to one’s portfolio.

Read More

- Crypto Index Funds: Gateway to Low-Risk Cryptocurrency Investing

- What is The Metaverse: A Virtual Future to Embrace or Fear?

- What are Metaverse NFTs: The Launchpad for the Digital World’s Economy?

- What is Virtual Land: The Rising World of Metaverse Real Estate

- What Is Metahero: The Gateway to the Metaverse

- Top 9 Important DeFi Performance Indicators for Successful Investing

- What Are Non-Fungible Tokens (NFTs): Introduction to NFTs

- Crypto Trading vs. Investing: Key Differences Explained