In the relentless, 24/7 arena of decentralized finance (DeFi), traders live and die by their execution. The foundational technology of the Automated Market Maker (AMM) revolutionized access to liquidity, but it came with a steep, often hidden, cost: value leakage. Every swap on a traditional DEX is a battle against price impact and slippage, a microscopic tax that extracts value from every transaction. For large trades, this tax becomes monumental. Furthermore, the public nature of these transactions creates a hunting ground for sophisticated bots, which use strategies like front-running to pickpocket unsuspecting users.

This is the multi-billion dollar problem that Gradient (GRAY) was engineered to solve. It approaches the challenge not with a better bandage, but with a new anatomy for trading. Gradient introduces itself as a decentralized trading layer built around a core, radical idea: the best trade is one that never has to touch a public AMM pool at all. By creating a hybrid system that combines the speed and privacy of off-chain matching with the security and finality of on-chain settlement, Gradient aims to eliminate price impact and give control back to the trader.

This is the definitive guide to the Gradient protocol and its native GRAY token. We will dissect its proprietary engine, scrutinize its unique tokenomics, and evaluate its place in the future of digital asset exchange. This is an exploration of a project that asks a fundamental question: What if your best trade price wasn't found, but was matched?

GRAY: The Dossier (Quick Facts)

-

Ticker Symbol: GRAY

-

Chain: Ethereum

-

Contract Address: 0xa776A95223C500E81Cb0937B291140fF550ac3E4

-

Circulating Supply: 10,000,000

-

Max Supply: 10,000,000

-

Primary Use Case: Ecosystem Incentive Alignment, Governance, and Revenue Sharing

-

Current Market Cap: ~$22.14 Million

-

Availability on Phemex: Not yet available (as of writing)

What Is GRAY? A Foundational Explanation

To understand Gradient, you must first move beyond the concept of a simple DEX aggregator. While it performs that function, it is merely a last resort. What is GRAY at its core? It's a protocol built around a sophisticated off-chain matching engine designed to find the most capital-efficient path for a trade before it's exposed to the volatility of the open market.

Gradient explained simply, is a hybrid trading system. Instead of throwing your order into a public liquidity pool immediately, Gradient’s engine, the Coordinated Order Routing Engine (CORE), first attempts to fill it in a private, off-market environment. This process is hierarchical and prioritizes efficiency:

-

Peer-to-Peer (P2P) Matching: CORE’s first priority is to find a "coincidence of wants." It scans its internal order book for another Gradient user with an opposing order. If you want to sell ETH for USDC, it looks for a user wanting to buy ETH with USDC. If a match is found, the trade is executed directly between the two parties. This is the ideal scenario, resulting in a trade with zero price impact and zero slippage.

-

Market Maker (MM) Matching: If a direct peer isn't available, CORE routes the order to a network of professional, integrated Market Makers. These entities can provide firm, competitive quotes to fill the order, again, in a private, off-market setting. This is far more efficient than interacting with a passive AMM pool.

-

AMM Aggregation (The Fallback): Only if a superior P2P or MM match cannot be found does Gradient engage its powerful AMM aggregator. At this stage, it functions as a top-tier aggregator, intelligently routing the trade across the broader DeFi landscape to find the best possible price on public exchanges.

This "off-market first" approach means that for many trades, users can completely bypass the traditional inefficiencies of AMMs. It shifts the logic from passively taking a price from a pool to actively matching with a counterparty at a preferred rate.

How Many GRAY Tokens Are There? A Look at Supply and Tokenomics

Gradient's tokenomics are a critical component of its design, featuring a fixed supply and a transaction fee mechanism aimed at funding sustainable growth.

The maximum and total supply of GRAY is fixed at 10,000,000 tokens. No more can ever be created, establishing a foundation of scarcity from the outset.

Supply Distribution

The initial allocation of the GRAY token was structured to balance community liquidity with long-term ecosystem development:

-

60% (6,000,000 GRAY): This majority portion was added to the GRAY/WETH liquidity pool on Uniswap V2 at launch. This action provided a deep, publicly accessible liquidity base from day one, promoting a fair and decentralized market for the token.

-

40% (4,000,000 GRAY): The remaining supply was held aside in a treasury and partially vested. This fund is designated for strategic initiatives that support the platform's growth and sustainability. This can include funding marketing campaigns, providing liquidity for new token pairs on Gradient, community incentives, and securing listings on centralized exchanges. The allocation of these funds is flexible to meet the evolving needs of the protocol.

The 5% Transaction Fee

A notable feature of the GRAY token is a 5% transaction fee applied to both buys and sells on decentralized exchanges. According to the project's documentation, this fee is designed to be a mechanism for self-funding. The revenue accrued from this tax is allocated to the treasury to support the same growth initiatives as the 40% ecosystem fund. This model allows the protocol to finance its own development, marketing, and expansion without relying solely on venture capital or selling off large portions of the treasury. The team has stated that this fee percentage may be lowered in the future but will never be raised.

What Does the GRAY Token Actually Do? Unpacking the Utility

The GRAY token is engineered to be the central economic component of the Gradient ecosystem. Its purpose extends beyond simple speculation; it's designed to align incentives among all participants and reward those who contribute to the platform's health and efficiency. The core GRAY use case is to drive a self-sustaining economic "flywheel."

Here's how it functions:

-

Incentive Alignment and Real Yield: Unlike many protocols that rely on inflationary token emissions to reward users, Gradient's design is focused on sustainability. The protocol generates fees from the trades facilitated by its CORE engine. Instead of being retained entirely by a central entity, a portion of these fees is routed back to active participants in the ecosystem, such as those who stake or provide liquidity. The GRAY token is the key to accessing these rewards.

-

The Flywheel Effect: The system is designed to be self-reinforcing.

-

Traders are drawn to Gradient for its superior execution, which reduces their costs.

-

This increases the platform's trading volume, which in turn generates more protocol fee revenue.

-

This revenue is then distributed as a "real yield" (e.g., in ETH or stablecoins) to engaged GRAY token holders.

-

The attractive yield incentivizes more users to buy GRAY and participate in the ecosystem (e.g., through staking or governance), increasing demand and reducing the liquid supply.

-

Engaged token holders are then motivated to govern the protocol wisely to further improve the trading experience, attracting even more traders and restarting the cycle with greater momentum.

-

-

Governance: As with many DeFi protocols, GRAY token holders who lock their tokens (often in a vote-escrow or "ve" model) gain governance rights. This allows the community to have a direct say in the future of the platform, from adjusting protocol parameters to approving treasury expenditures. This decentralized control ensures that the protocol evolves in a way that benefits its most committed users.

GRAY vs. Uniswap: A Tale of Two Trading Philosophies

To truly grasp Gradient's place in the DeFi universe, one must compare it not to the blockchain it lives on, but to the undisputed king of on-chain exchange: Uniswap. While both platforms facilitate decentralized trading, their underlying philosophies and mechanisms are worlds apart. This is not a battle of good versus evil, but a contrast between passive, open liquidity and active, optimized execution.

| Feature | Gradient (GRAY) | Uniswap (UNI) |

| Trading Model | A hybrid system. It prioritizes off-chain P2P and Market Maker matching via its CORE engine. On-chain AMM aggregation is used only as a fallback. | A pure on-chain Automated Market Maker (AMM). All trades execute directly against liquidity pools governed by a mathematical formula (V2 or V3). |

| Execution Environment | Private and off-chain for primary execution. This design aims to eliminate slippage and shield users from front-running (MEV). | Public and on-chain. All pending transactions are visible in the public mempool, making them inherently susceptible to slippage, price impact, and MEV. |

| Primary Value Prop | Capital efficiency for the trader. It seeks the absolute best execution price by avoiding AMM inefficiencies wherever possible. | Permissionless liquidity for everyone. It provides deep, accessible, on-chain liquidity for a vast array of tokens, available 24/7 to any user. |

| Token Utility | GRAY: Economic alignment and "real yield." Designed to capture protocol revenue and distribute it to stakeholders. Includes a transaction tax for growth. | UNI: Primarily governance rights over the protocol. The "fee switch" for revenue sharing exists but has historically been inactive. |

| Analogy | A private, high-tech brokerage firm that finds an efficient, off-market deal for you before resorting to the public exchanges. | A public, 24/7 currency exchange bureau. You walk up to the counter and accept the rate on the board, which changes with every transaction. |

In essence, Uniswap created the foundational layer for decentralized, on-chain liquidity. It is the vast, public ocean where anyone can swim. Gradient, on the other hand, is building a high-speed hydrofoil designed to skim across that ocean's surface with maximum efficiency, only dipping into the water when absolutely necessary. For a trader, the choice between them comes down to a fundamental question: Do you want to trade with the market, or do you want to trade smarter than the market?

The Technology Behind Gradient: A Hybrid Masterpiece

Gradient's most significant innovation is its Coordinated Order Routing Engine (CORE). This is not just a smarter router; it's a paradigm shift from public market execution to private, efficient matching. The system is best understood as a two-part hybrid model.

Part 1: The Off-Chain Matching Engine

This is where the magic happens. When a user submits an order, it enters Gradient's private, off-chain environment. This is a controlled space where CORE acts as a neutral, high-speed coordinator. Users submit their orders with predefined parameters, such as:

-

Token Pair: The assets they wish to trade.

-

Price Limits: The minimum price for a sell or maximum price for a buy.

-

Order Size: The amount to be traded.

-

Time-to-Live (TTL): The duration for which the order remains active.

CORE continuously scans this private order book in real-time to find valid matches between buyers, sellers, and integrated Market Makers. The benefits of this off-chain approach are profound:

-

Immunity to Front-Running: Because the orders are never broadcast to the public mempool (the waiting area for pending Ethereum transactions), predatory MEV bots cannot see them and cannot execute front-running or sandwich attacks.

-

Elimination of Slippage and Price Impact: Since trades are matched at a predetermined price between two counterparties, there is no "slippage" or price impact. The price agreed upon is the price executed.

-

Real-Time Efficiency: Off-chain matching is computationally inexpensive and incredibly fast, allowing the engine to process complex matching logic without being constrained by blockchain block times or gas fees.

Part 2: The On-Chain Settlement

Once CORE confirms a valid match off-chain—whether P2P or with a Market Maker—it triggers the second part of the process: a secure, on-chain settlement.

-

Atomic Settlement: CORE bundles the trade into a single, automatic settlement transaction that is then broadcast to the Ethereum blockchain.

-

Trustless and Non-Custodial: Throughout the entire process, users retain full custody of their funds in their own wallets. The smart contract only facilitates the transfer after a successful match is confirmed and executed. This minimizes risk and maintains the core principles of self-custody.

-

On-Chain Transparency: While the matching is private, the final settlement details are recorded immutably on the blockchain, providing a transparent and verifiable record of the trade.

This hybrid approach aims to deliver the best of both worlds: the CEX-like speed, privacy, and execution quality of an off-chain engine, combined with the DEX-like security, transparency, and self-custody of on-chain settlement.

Team, Origins, and Launch Strategy

Following a common practice in the DeFi space, the team behind Gradient operates under pseudonyms. The project's credibility is not built on the reputations of its founders but on the verifiable quality of its code and the tangible performance of its platform.

The launch strategy provides insight into its ethos. By allocating 60% of the total token supply directly to a Uniswap liquidity pool, the project opted for a "fair launch" model. This approach promotes decentralization by making the majority of the tokens immediately available to the public, rather than reserving them for private investors or insiders.

The remaining 40% constitutes an ecosystem fund, a war chest designed to fuel the protocol's long-term growth. This structure—combining a large public float with a substantial, vested treasury for strategic development—reflects a pragmatic approach to building a sustainable protocol in the competitive DeFi landscape.

Key News & Events: The Gradient Timeline

Tracking the progress of a technically-driven project like Gradient involves monitoring both its development milestones and its market performance. Key news about GRAY and its ecosystem includes:

-

Protocol Launch: The official deployment of the Gradient trading layer and its Coordinated Order Routing Engine (CORE).

-

Token Generation Event (TGE): The launch of the GRAY token with its 5% transaction fee and the establishment of the initial 60/40 supply distribution, including deep liquidity on Uniswap V2.

-

Ecosystem Fund Initiatives: Ongoing announcements regarding how the 40% treasury fund is being used, such as for marketing campaigns, new liquidity incentives, or potential CEX listing efforts.

-

DAO and Governance Milestones: The formal establishment of the DAO and the first governance proposals from the community, marking the transition to decentralized control.

-

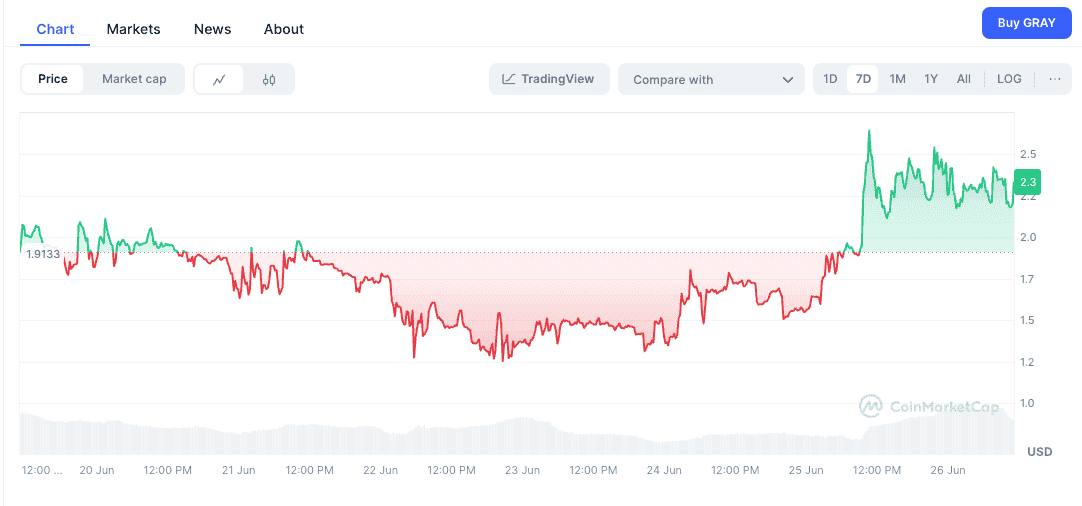

Trading Volume and Fee Generation: A crucial ongoing metric is the volume processed by CORE. Growth in this area is a direct indicator of platform adoption and directly impacts the potential yield for GRAY stakeholders, influencing the GRAY price. Anyone looking to trade GRAY should monitor these figures closely.

Is GRAY a Good Investment? The Risk and Reward Equation

Evaluating the GRAY investment potential requires a clear-eyed assessment of its innovative technology against the significant risks of the crypto market. It is a high-risk, high-reward proposition for investors with a strong thesis about the future of DeFi trading.

Disclaimer: This section is for informational purposes only and does not constitute financial advice. The cryptocurrency market is extremely volatile, and you should always do your own research and consult with a financial professional before making any investment decisions.

The Bull Case for Gradient (The Upside):

-

A Technologically Superior Model: The hybrid off-chain/on-chain system is a genuine innovation. By tackling front-running, slippage, and price impact head-on, it offers a demonstrably better trading experience than traditional AMMs.

-

Sustainable "Real Yield" Model: The reliance on protocol fees for rewards, rather than inflationary emissions, is a highly attractive feature for long-term investors. It creates a direct, sustainable link between platform usage and investor returns.

-

Strong Incentive Alignment: The "flywheel" effect, if successfully initiated, creates powerful network effects. The 5% tax and 40% treasury also provide a dedicated and self-sustaining war chest for growth, a luxury many projects do not have.

-

Solves a Massive, Persistent Problem: Value leakage in DeFi is a multi-billion dollar issue. A protocol that can capture even a small fraction of this market has an enormous ceiling for growth. For those researching How to buy GRAY, this represents the core of the speculative potential.

The Bear Case for Gradient (The Risks):

-

The 5% Transaction Tax: While designed to fund growth, a transaction tax can be a significant deterrent for traders, especially those dealing in high frequency or large volumes. It introduces friction that may push some users to tax-free alternatives, even if the execution is slightly worse.

-

Intense Competition: The DEX and aggregator space is fiercely competitive. Gradient competes with established giants who have immense brand recognition and deep liquidity. It must overcome the "cold start" problem of attracting enough users and market makers for its CORE engine to be maximally effective.

-

Centralization and Treasury Risk: The 40% ecosystem fund, while strategic, represents a significant concentration of supply. The community must trust the team to deploy these funds wisely and transparently. Mismanagement of the treasury could negatively impact market sentiment.

-

Market-Wide Volatility: Like all altcoins, the GRAY price is subject to the dramatic swings of the broader crypto market. A bear market would reduce overall trading volume, which in turn would diminish the protocol fees that form the basis of the token's yield.

Conclusion:

Gradient (GRAY) is one of the most technologically ambitious projects in the decentralized trading space. It is not an iteration; it is a re-imagination. Its hybrid CORE engine presents an elegant solution to some of DeFi's most costly and persistent problems.

An investment in GRAY is a high-conviction bet on this technological vision. It's for the investor who believes that superior capital efficiency will ultimately win the day. The protocol's design is clever, its tokenomics are built for sustainability, and its target market is enormous. The risks, however, are equally real, centered on fierce competition and the market's perception of its transaction tax. For the discerning DeFi native, Gradient offers a sharp, sophisticated, and potentially transformative approach to trading—a true test of whether better engineering can build a better market.

Disclaimer: The information presented in this article is for educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not treat any of the article's content as such. Phemex does not recommend that any specific cryptocurrency should be bought, sold, or held by you. The cryptocurrency market is subject to high market risk and volatility. Past performance is not indicative of future results. All investment strategies and investments involve risk of loss. You should conduct your own due diligence and consult a qualified financial advisor before making any investment decisions. Phemex is not responsible for any investment decisions you make based on the information provided in this article.