Key Takeaways:

-

Unified Liquidity: Cycle Network acts as a foundational settlement layer, abstracting the complexities of multi-chain transactions to create a seamless user experience.

-

Bridgeless Technology: The protocol eliminates the need for traditional token bridges by using Verifiable State Aggregation (VSA) to ensure asset consistency across different blockchains.

-

Developer-Friendly SDK: Cycle provides developers with a software development kit (SDK) that simplifies the creation of dApps on its unified liquidity network.

-

Robust Tokenomics: With a fixed total supply of 1 billion tokens, the CYC token is designed for long-term ecosystem growth and security.

Introduction

In the expanding universe of blockchain technology, Cycle Network (CYC) emerges as a pioneering infrastructure protocol designed to solve one of the most significant challenges in decentralized finance (DeFi): fragmented liquidity. By creating a universal, all-chain settlement layer, Cycle Network aims to harmonize asset flows and application logic across more than 20 different blockchains, including major players like Ethereum and BNB Chain. This innovation simplifies the often-complex world of cross-chain transactions, making it easier for both developers and users to navigate the Web3 landscape. With its focus on creating a seamless and secure environment, Cycle Network is poised to become a foundational element for the next generation of decentralized applications. To explore the future of DeFi and other cutting-edge crypto projects, visit the Phemex Academy.

Summary Box (Quick Facts)

-

Ticker Symbol: CYC

-

Chain: Operates across 20+ blockchains, including Ethereum and BNB Chain

-

Contract Address: 0x5845684b49aEf79A5c0F887f50401C247dca7AC6

-

Circulating Supply: Not yet available, to be updated post-launch

-

Max Supply: 1 billion CYC

-

Primary Use Case: Universal settlement layer for Web3

-

Current Market Cap: Not yet available

-

Availability on Phemex: Not available as of writing

What Is Cycle Network?

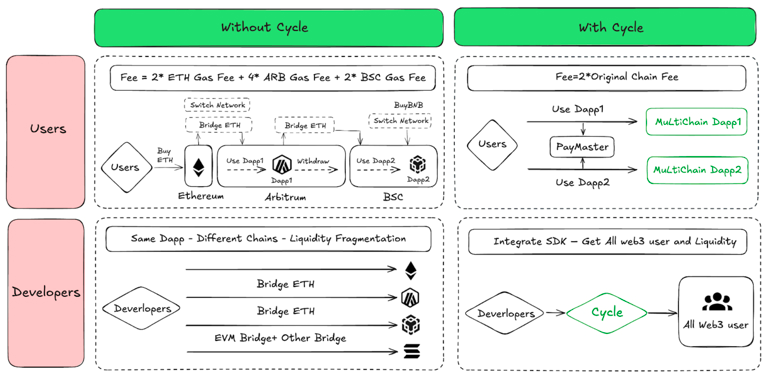

Cycle Network is a trustless, omni-chain ledger protocol that functions as a foundational settlement layer for digital assets and decentralized applications (dApps). In simple terms, it creates a unified system where assets can move and resolve securely across different blockchain environments without the need for traditional, often vulnerable, token bridges.

The primary problem Cycle Network solves is the fragmentation of liquidity and user experience in the multi-chain world. Currently, interacting with dApps on different blockchains requires users to juggle multiple tokens, manage gas fees on each chain, and navigate complex bridging procedures. Cycle Network explained simply, abstracts these complexities away. For instance, a user can transact with a stablecoin like USDC, and Cycle’s infrastructure handles the intricate back-end logic of execution and settlement across various chains. This approach not only streamlines the user experience but also provides developers with a unified liquidity pool and composable infrastructure, empowering them to build more sophisticated and accessible Web3 applications. Explore more crypto concepts at the Phemex Academy.

How Many CYC Are There?

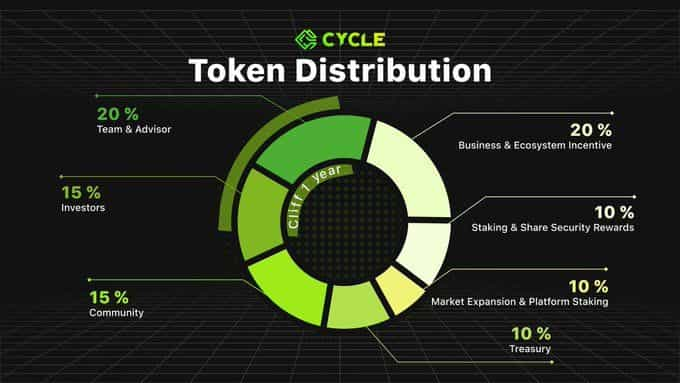

The tokenomics of Cycle Network are designed to support long-term, sustainable growth. The total supply of CYC is capped at 1 billion tokens, with a commitment that no additional tokens will ever be minted, making it a deflationary asset.

The distribution of these tokens is allocated as follows:

-

Team and Advisors: 20%

-

Investors: 15%

-

Treasury: 10%

-

Market Expansion & Platform Staking: 10%

-

Business & Ecosystem Incentive: 20%

-

Community: 15%

-

Staking & Share Security Rewards: 10%

To ensure commitment to the project's future, tokens allocated to the team and investors are subject to a 12-month cliff followed by a linear vesting schedule. This structure is intended to align the long-term interests of the project's backers with the health of the ecosystem. You can monitor the CYC price on the Phemex Markets page upon its listing.

What Does CYC Do?

The CYC token is the native utility and governance asset of the Cycle Network, playing a central role in its operations and security. Its primary functions are designed to fuel the ecosystem and incentivize participation.

The Cycle Network use case includes:

-

SDK Usage Fees: Developers building on the network must pay fees in CYC to access and utilize the Rollin/Rollout SDK, which enables bridgeless asset transfers.

-

Mainnet Gas Fees: Deploying dApps on the Cycle mainnet requires paying gas fees in CYC, similar to how ETH is used on the Ethereum network.

-

Staking for Security: Users can stake their CYC tokens to enhance the network's security. This is facilitated through platforms like Symbiotic, which allows for restaking to secure the network.

-

Governance: Once the governance system is established, CYC token holders will have the ability to vote on key decisions regarding the network's development and the distribution of ecosystem incentives.

-

Incentivizing Participation: A significant portion of CYC tokens is allocated to reward community users, developers, and liquidity providers who contribute to the network's growth and revenue.

Cycle Network vs. Ethereum

While both Cycle Network and Ethereum are foundational to the Web3 ecosystem, they serve distinct purposes and operate on different technological principles.

| Feature | Cycle Network (CYC) | Ethereum (ETH) |

| Technology | A universal settlement layer that abstracts multiple blockchains, using Verifiable State Aggregation (VSA) and ZK-Rollups. | A Layer-1 blockchain with its own smart contract functionality and a Proof-of-Stake consensus mechanism. |

| Speed and Fees | Designed for efficient and low-cost interactions across different blockchain architectures. | Can experience high gas fees and slower transaction times during periods of network congestion. |

| Use Case | Facilitates seamless liquidity and state consistency across over 20 blockchains. | A general-purpose blockchain for building and deploying decentralized applications (dApps). |

| Interoperability | Its core function is to enable native cross-chain interoperability without traditional bridges. | Interoperability with other chains typically relies on third-party bridges or Layer-2 solutions. |

The key distinction lies in their roles: Ethereum is a primary Layer-1 blockchain, while Cycle Network is a Layer-0 protocol that unifies various blockchains, including Ethereum, to create a more cohesive and user-friendly DeFi landscape. For more in-depth comparisons, check out the guides at the Phemex Academy.

The Technology Behind Cycle Network

Cycle Network's innovative approach to interoperability is built on a sophisticated technological stack designed to abstract away the complexities of the multi-chain environment.

Key technologies include:

-

Verifiable State Aggregation (VSA): This cryptographic mechanism allows the network to verify the validity of actions and balances across different blockchains without relying on traditional token bridges, which are often points of failure.

-

Rollin/Rollout Primitives: These core functions enable applications to seamlessly onboard user assets and settle them across any supported chain through a single interface. This eliminates the need for users to switch networks or manage multiple gas tokens.

-

Omni Distributed Ledger Technology (ODLT): This technology underpins the entire network, creating a trustless omni-chain ledger protocol that harmonizes different blockchain architectures.

-

ZK-Rollups and FHE: To enhance privacy and efficiency, Cycle Network utilizes Zero-Knowledge (ZK) Rollups to reduce latency and Fully Homomorphic Encryption (FHE) to allow computations on encrypted data, ensuring user information remains secure.

The project is backed by notable institutional investors, including Vertex Ventures, a sub-fund of Temasek Holdings, and was incubated by YZi Labs, which was founded by former members of Binance Labs.

Team & Origins

Cycle Network was incubated by YZi Labs and is backed by prominent institutional investors, including Vertex Ventures, which is the Web3 investment arm of Temasek Holdings. This strong backing from established entities in the venture capital and Web3 space lends significant credibility to the project's vision and its ability to execute its ambitious roadmap. While specific founder names are not always at the forefront of their messaging, the project's development and strategic direction are clearly guided by experienced hands from the crypto industry.

Key News & Events

The most significant recent news for Cycle Network is its series of listings on several major cryptocurrency exchanges scheduled for August 4, 2025. This marks a major milestone for the project, as it will introduce the CYC token to a much broader audience of traders and investors. These listings are expected to significantly increase liquidity and market awareness for the project. For the latest news about Cycle Network, stay tuned to Phemex's announcements and the Phemex Blog.

Is CYC a Good Investment?

Evaluating the investment potential of Cycle Network (CYC) requires a balanced look at its innovative technology, market position, and inherent risks. The project's core value proposition—creating a universal settlement layer to unify blockchain liquidity—is a compelling solution to a significant pain point in the DeFi space. Its backing by reputable firms like Vertex Ventures and its incubation by Yzi Labs (founded by ex-Binance Labs members) add a layer of credibility.

However, as with any emerging cryptocurrency, there are risks to consider. The success of Cycle Network will depend on its ability to achieve widespread adoption among developers and dApps. The crypto market is also notoriously volatile, and the CYC price will likely experience fluctuations.

Disclaimer: This is not financial advice. Crypto trading involves risks; only invest what you can afford to lose.

Before making any investment decisions, it is crucial to conduct thorough research and consider your risk tolerance. Exploring resources like the Phemex Help Center can provide additional guidance on safe trading practices.

FAQs

What problem does Cycle Network solve?

Cycle Network addresses the issue of fragmented liquidity and complex user experiences in the multi-chain DeFi ecosystem by creating a unified settlement layer that simplifies cross-chain transactions.

How does Cycle Network ensure security without bridges?

It uses a cryptographic mechanism called Verifiable State Aggregation (VSA) to verify the validity of actions and balances across different blockchains, removing the need for vulnerable token bridges.

What is the main use case for the CYC token?

The CYC token is used for paying network fees (both for SDK access and gas), staking to enhance network security, and participating in the governance of the protocol.