Summary Box (Quick Facts)

-

Ticker Symbol: EDEL

-

Chain: Base (an Ethereum Layer-2)

-

Contract Address: 0xfb3b9b9a4c21147728f381d315f2a893438ccc95

-

Circulating Supply: ~487.03 Million EDEL

-

Total Supply: 1 Billion EDEL

-

Primary Use Case: Decentralized lending protocol for tokenized equities.

-

Current Market Cap: ~$24.12 Million

-

Availability on Phemex: No (As of writing)

What Is Edel?

Edel Finance is a decentralized, non-custodial lending protocol designed to bring the traditional stock lending market on-chain. So, what is Edel? Explained simply, it allows holders of tokenized stocks to "permissionlessly earn rent" on their assets. Instead of going through traditional brokers, users can deposit their tokenized equities into Edel's autonomous system and earn a yield directly in their wallets.

The platform aims to replace what it calls "rent-seeking broker pipes" with efficient, autonomous rails built on smart contracts. This system addresses a key problem: the traditional securities lending market, valued at over $2.5 trillion, is largely inaccessible to individuals, with intermediaries capturing the majority of the $10B+ in annual revenue. Edel's goal is to redirect that value back to the asset owners. By operating 24/7, it also removes the time constraints of traditional markets, allowing portfolios to generate income around the clock.

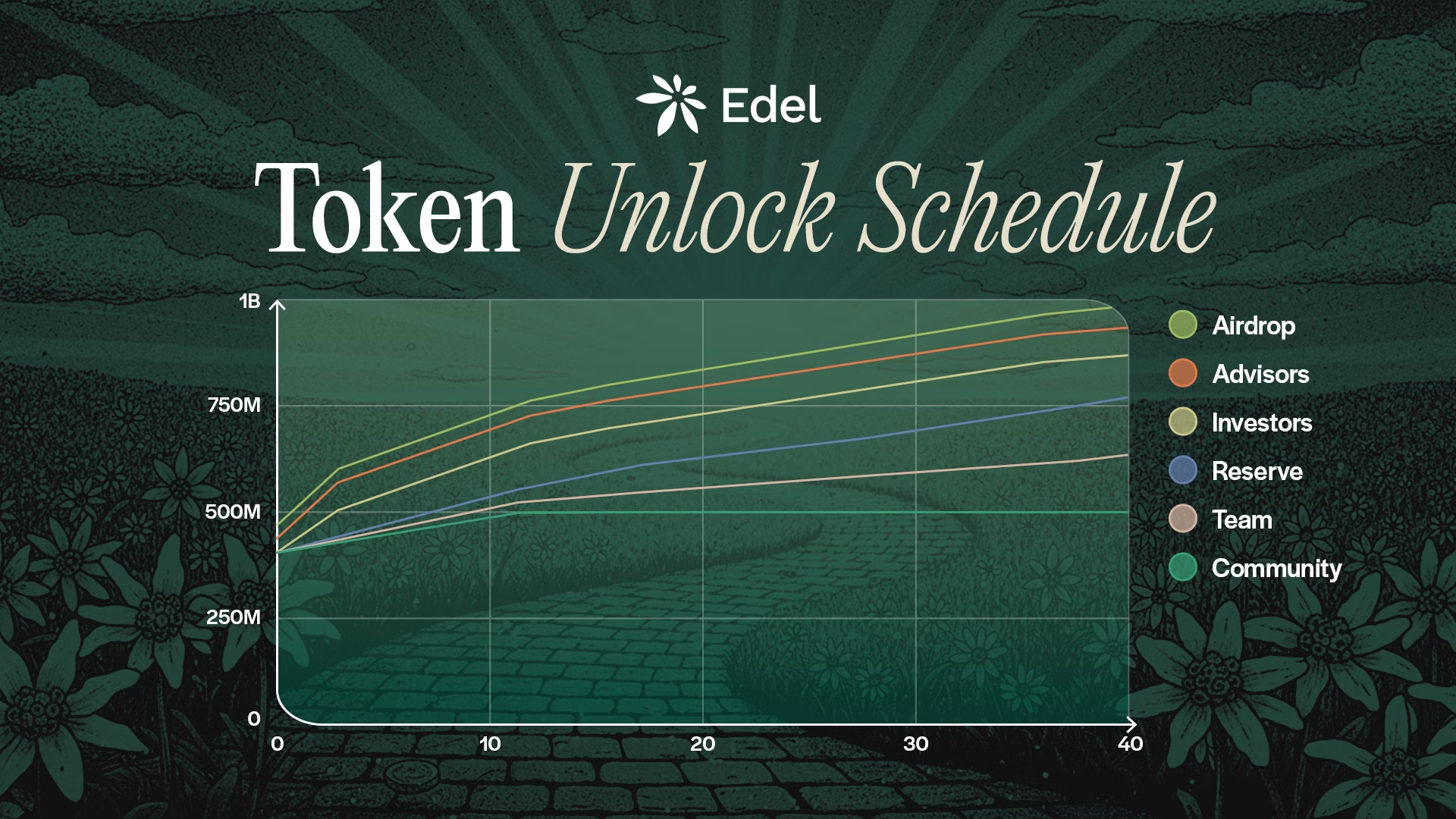

How Many EDEL Are There?

The tokenomics of Edel are designed to support long-term growth and community participation. The EDEL price is influenced by its supply and distribution schedule. The maximum total supply is fixed at 1 billion tokens, allocated as follows:

-

Community: 50%

-

Investors: 15.8%

-

Reserve: 15.0%

-

Team: 12.7%

-

Airdrop: 3.0%

-

Advisors: 2.7%

Key details about the token supply include:

-

Vesting Schedules: To ensure long-term alignment, tokens for the Team and Reserve are subject to vesting schedules. The Team's allocation has a 6-month cliff followed by a 36-month vesting period, while the Reserve has a 3-month cliff and a 36-month vesting period. This structured release is designed to prevent sudden impacts on the token supply.

-

Community Allocation: A significant 80% of the Community allocation was made available at the Token Generation Event (TGE), empowering early participants and fostering decentralized governance from the outset.

-

Supply Model: With a fixed maximum supply of 1 billion tokens, EDEL is designed to be non-inflationary.

What Does EDEL Do?

The primary Edel use case is to function as an autonomous revenue engine for tokenized stocks. The protocol operates on three core pillars:

-

Protocol-Curated Collateral: Edel ensures platform security by only accepting high-grade tokenized equities that meet strict criteria for issuance, custody, and liquidity. This keeps lending pools overcollateralized by design.

-

Autonomous Revenue Engine: All key functions—such as setting interest rates, making margin calls, and managing cash flows—are executed entirely on-chain by smart contracts. This creates a transparent and immutable system without the need for dealer markups.

-

Liquidity Alignment: As users deposit assets, they not only earn yield but also deepen the protocol's overall liquidity, creating a more robust and composable ecosystem for all participants.

The process for users is straightforward:

-

Supply & Unlock: Users deposit their tokenized equities into autonomous vaults. This allows them to earn rent while retaining ownership and unlocking overcollateralized liquidity.

-

Rate & Match: The protocol uses a dynamic interest rate model to transparently set borrowing costs and match supply with demand in real time.

-

Accrue & Stream: In return for their deposits, users receive yield-bearing receipts that continuously accrue revenue as borrowers pay interest.

EDEL vs. Ondo Finance

Instead of viewing Edel and Ondo Finance as competitors, it's more accurate to see them as complementary partners in the Real-World Asset (RWA) ecosystem. Ondo Finance focuses on creating and issuing tokenized securities, while Edel builds a platform where those assets can be used for lending and borrowing.

Here is a breakdown of their key differences:

| Feature | EDEL Finance | Ondo Finance |

| Primary Role | A decentralized lending protocol (a money market) for tokenized assets. | An issuer and asset manager for tokenized Real-World Assets (RWAs). |

| Core Product | A platform for lending and borrowing tokenized equities to earn yield. | Tokenized versions of real-world securities, like U.S. Treasuries (OUSG) and yield-bearing notes (USDY). |

| Asset Focus | Specializes in creating liquidity for tokenized equities (stocks). | Focuses on a broader range of institutional-grade securities, primarily U.S. Treasuries and bonds. |

| Ecosystem Function | Provides utility for existing tokenized assets. | Creates the underlying tokenized assets. |

In short, Ondo brings the assets on-chain, and Edel gives them a place to be productive.

The Technology Behind EDEL

Edel’s infrastructure is built to bridge the gap between traditional finance and DeFi with modern blockchain technology.

-

Consensus Mechanism: As a dApp on Base, Edel relies on Base's infrastructure and, by extension, Ethereum's Proof-of-Stake (PoS) consensus for its security and finality.

-

Smart Contracts: The protocol is anchored by battle-tested, audited smart contracts that automate the entire lending process. Its advanced risk engines are designed to collapse the gap between TradFi desks and DeFi liquidity.

-

Infrastructure and Notable Partnerships: Its ecosystem is strengthened by key integrations. It sources tokenized assets from Ondo Finance and xStocks, uses Chainlink for reliable price feeds, and leverages LayerZero for potential cross-chain interoperability.

Team & Origins

Information regarding the specific founders or developers of Edel Finance is not prominently featured on its official website. The project's public materials focus on its mission, technology, and the market opportunity it addresses. This approach is common in the DeFi space, where the strength of the code and the protocol's utility are often emphasized over the identities of the creators. The project is backed by its ecosystem partners and is focused on building a permissionless, autonomous protocol.

Key News & Events

As a relatively new project, the most significant events for Edel are centered around its launch and foundational partnerships. Stay updated on news about EDEL for the latest information.

-

Platform Launch: The Edel platform is currently in a "launching soon" phase, with a waitlist available for early access on its official website.

-

Key Integrations: Establishing partnerships with major players in the tokenized asset space, like Ondo Finance and Chainlink, represents a major milestone, ensuring a supply of reliable assets and price data from day one.

-

Market Trend Alignment: The project has launched at a time when tokenization is a major topic of discussion among financial leaders at institutions like BlackRock and Nasdaq, adding significant tailwinds to its mission.

Is EDEL a Good Investment?

Determining the EDEL investment potential requires a balanced look at its opportunities and risks. This article is not financial advice. All crypto trading involves risks; only invest what you can afford to lose.

-

Past Performance: As a new token, EDEL does not have a long history of performance. Its current market cap is relatively small, suggesting room for growth if the project succeeds.

-

Community Growth: The project is in its early stages, with over 15,000 users signed up for the waitlist, indicating initial interest.

-

Tech and Market Positioning: Edel is positioning itself as a first-mover in the on-chain securities lending market, a multi-trillion dollar industry. Its focus on tokenized real-world assets (RWAs) is one of the fastest-growing narratives in crypto.

-

Risks: Key risks include regulatory uncertainty surrounding tokenized securities, competition from both traditional finance and other DeFi protocols, and the inherent volatility of the cryptocurrency market. Its success also depends on the continued growth and adoption of the Base ecosystem.

In conclusion, Edel presents a high-risk, high-reward opportunity. Its success hinges on its ability to execute its vision and navigate a complex regulatory landscape.

Community Perspectives

Discussions across community platforms like X (formerly Twitter) and Reddit reveal a generally positive but cautious outlook on Edel Finance.

-

Bullish on the RWA Narrative: Many community members are optimistic about Edel's focus on Real-World Assets, viewing it as a major growth sector in crypto. The partnership with Ondo Finance is frequently cited as a significant vote of confidence that adds legitimacy to the project.

-

Anticipation for Launch: There is clear excitement for the protocol's official launch, with many users on the waitlist eager to see how the platform performs in a live environment. The concept of earning yield on tokenized stocks is a strong hook for potential users.

-

Points of Concern: Some community members raise valid questions. The anonymity of the team is a point of discussion, though this is not uncommon in DeFi. Others express caution regarding the long-term regulatory challenges that all RWA protocols will inevitably face. The project is seen as promising but still in a speculative, early stage.

FAQs

1. What is Edel Finance's main goal?

Edel Finance's primary goal is to create a decentralized, transparent, and efficient lending market for tokenized stocks, allowing users to earn yield on their assets without traditional intermediaries.

2. What blockchain does EDEL run on?

EDEL operates on the Base blockchain, a Layer-2 scaling solution for Ethereum known for its low fees and fast transaction speeds.

3. Can I use real stocks like TSLA or AAPL on Edel?

You can't use stocks directly from a traditional brokerage. Instead, you use tokenized versions of these stocks provided by Edel's partners, such as Ondo Finance and xStocks, which are digital tokens backed by the real-world asset.

Summary: Why It Matters

Edel matters because it stands at the intersection of traditional finance and DeFi. By aiming to decentralize the $2.5 trillion stock lending market, it seeks to redirect billions in annual revenue from centralized brokers to individual asset holders. If successful, Edel could become a foundational pillar for the tokenized economy, demonstrating a powerful use case for blockchain technology in transforming one of the world's largest financial markets.

For those looking to deepen their understanding of innovative DeFi protocols, this project is one to watch. To learn more about trading digital assets and exploring market trends, check out the resources available at the Phemex Academy.