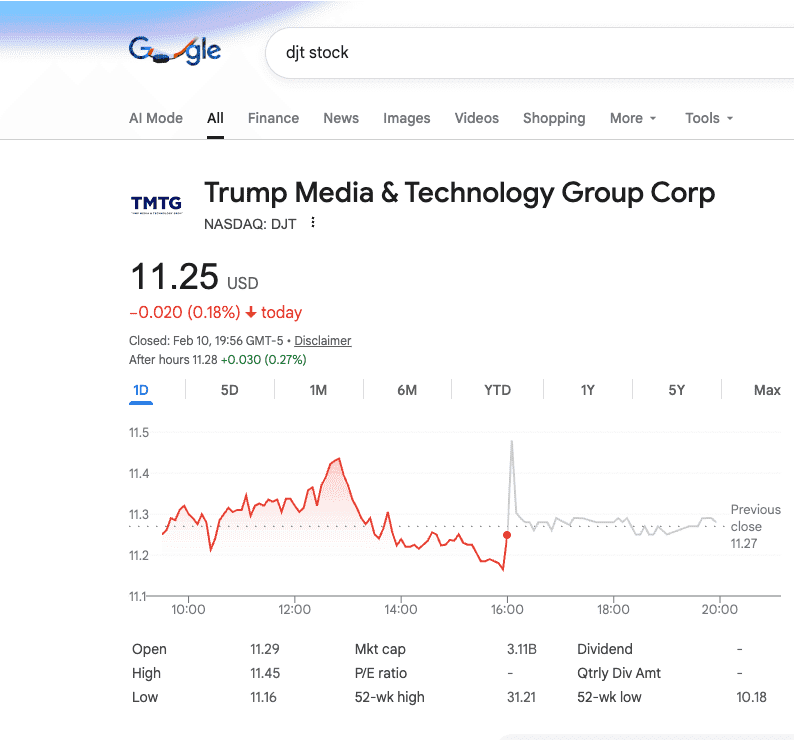

As the US market transitions into Wednesday, February 11, 2026, the spotlight remains on Trump Media & Technology Group (DJT). Following the close of the February 10th session at $11.25 USD, the asset has shown a period of relative consolidation with a minor intraday decline of 0.18%. While the "Trump Trade" often evokes images of extreme volatility, today’s price action suggests a phase of market equilibrium and strategic positioning by both retail and institutional participants.

For traders using the Phemex platform, DJT acts as more than just a stock; it is a sentiment barometer. When DJT moves into a range-bound phase, it often signals a "wait-and-see" approach in the broader political-economic cycle, creating unique opportunities to monitor correlated assets in the crypto and derivatives space.

DJT Stock Performance: Fact-Checking the Numbers

Data Snapshot (as of Feb 10, 19:56 GMT-5):

Closing Price: $11.25 USD

Daily Change: -$0.020 (0.18% ↓)

Intraday Range: $11.16 – $11.45

Market Cap: $3.11 Billion

After-Hours Activity: $11.28 (↑ 0.27%)

The Catalyst: Stability Amidst the Cycle

Unlike the parabolic moves seen in previous quarters, today's DJT action is defined by consolidation. The $11.25 level represents a key psychological floor. The intraday low of $11.16 was met with modest buying pressure, leading to a slight recovery in after-hours trading. This suggests that while the aggressive "buying frenzy" has paused, the asset remains a high-interest 'Sentiment Index' for the 2026 political landscape.

The Correlation: Watching the Ripple Effect

Even during periods of low volatility for DJT, the assets that typically move in sympathy—such as Reddit (RDDT), Tesla (TSLA), and **Gold (XAU)**—may experience independent volatility. For a Phemex trader, the value lies in analyzing these correlations. If DJT stays flat while Gold rises, it may indicate a shift toward a "risk-off" sentiment across the wider market.

View Today’s Zero Fee Futures Pairs

Navigating Correlated Volatility on Phemex

While DJT stock is traded on the Nasdaq, Phemex provides a sophisticated ecosystem for trading USDT-margined perpetual contracts that track the price movements of highly correlated assets. This allows traders to capitalize on the "Trump Trade" narrative with the flexibility of a 24/7 crypto-native platform.

Why Monitor the "Trump Trade" on Phemex?

1. Unified Multi-Asset Access

Phemex’s Unified USDT account allows you to maintain exposure to various asset classes without the need for multiple brokerage accounts. By holding USDT, you can quickly pivot your strategy from Bitcoin to TSLA/USDT or RDDT/USDT futures, depending on how the DJT news cycle develops. Note: You are trading price-tracking derivatives, not the underlying equity.

2. 24/7 Execution vs. Traditional Gaps

The DJT chart from Feb 10 shows activity tapering off at the market close. However, political sentiment never sleeps. Phemex offers Uninterrupted 24/7 Execution. While traditional equity traders are locked out until the next 9:30 AM EST bell, Phemex users can react to global breaking news in real-time through synthetic stock and commodity contracts.

3. Advanced Risk Management & Leverage

Phemex offers up to 100x leverage on major asset contracts. While this allows for high capital efficiency during small price movements (like today’s 0.18% shift), it also carries an extreme risk of liquidation. To mitigate the dangers of "market gaps"—where prices skip over your stop-loss during off-hours—Phemex employs Off-Market Protection, ensuring liquidations are based on fair market marking.

Strategic Setups for the 2026 Political Cycle

Based on today’s stabilization in DJT stock, here are three ways traders are utilizing Phemex tools to manage their portfolios:

1. The "Safe Haven" Hedge (Gold - XAU/USDT)

When the political narrative becomes unpredictable, many DJT observers turn to Gold. If DJT struggles to maintain its $11.25 support, we often see capital flow into XAU.

The Phemex Edge: Trade Gold perpetuals with deep liquidity and benefit from current Zero Fee Futures Promotions to lower your entry costs.

2. The Social Sentiment Play (Reddit - RDDT/USDT)

RDDT remains the primary alternative for retail liquidity. Today’s consolidation in DJT might precede a breakout in RDDT as retail traders rotate capital within the social media sector.

The Phemex Edge: Use the Phemex mobile app to execute RDDT trades the moment social media volume spikes, regardless of NYSE trading hours.

3. The Disruptor Narrative (Tesla - TSLA/USDT)

TSLA is a high-liquidity proxy for the innovation and disruption themes that DJT also represents. With a $3.11B market cap, DJT is small; TSLA, however, offers the depth needed for larger, high-leverage positions.

The Phemex Edge: Access up to 100x leverage on TSLA/USDT to maximize exposure to the tech leader’s intraday movements.

FAQ: Trading in the 2026 Environment

Q: Why trade correlated assets on Phemex instead of DJT directly?

A: Phemex offers 24/7 availability, higher leverage (up to 100x), and the ability to trade using USDT. Traditional brokers have restricted hours and lower margin limits, which may prevent you from reacting to news that breaks outside of US EST hours.

Q: How does the "Zero Fee" promotion benefit me?

A: During specific campaign periods, Phemex waives maker or taker fees on certain Futures pairs. This is ideal for "scalping" strategies during low-volatility days like today, where every basis point of profit counts.

Q: What is the risk of using 100x leverage on stock-correlated contracts?

A: 100x leverage means a 1% move in the underlying asset's price against your position will result in a 100% loss of your initial margin. We strongly advise using Phemex's Stop-Loss and Take-Profit orders to manage this risk.

Conclusion: Mastering the Sentiment-Driven Market

The DJT stock price of $11.25 on February 11, 2026, serves as a reminder that markets move in cycles of both expansion and consolidation. Mastering this era of trading requires the ability to look past the primary ticker and trade the broader sentiment across a Unified Multi-Asset platform.

Whether you are seeking the stability of Gold or the high-beta potential of Reddit and Tesla, Phemex provides the infrastructure to stay ahead of the curve. Don't wait for the market open—navigate the volatility 24/7.

Regulatory Disclosure & Risk Warning

Phemex is a cryptocurrency and derivatives platform. Trading involves a high risk of loss and may not be suitable for all investors. The assets mentioned (RDDT, TSLA, XAU) are traded as USDT-margined perpetual contracts and do not represent direct ownership of shares or physical metals. The "Zero Fee" promotion is subject to Phemex's terms and conditions as listed in the Rewards Hub. Market data provided for DJT is for illustrative purposes and does not constitute financial advice. Always trade responsibly and perform your own due diligence.