Principais Pontos

Finanças Descentralizadas (DeFi) é um termo abrangente para o movimento que recria serviços financeiros tradicionais – como empréstimos, negociações e seguros – em redes blockchain, sem intermediários centralizados como bancos.

Base Tecnológica: O setor é impulsionado por contratos inteligentes, que são códigos autoexecutáveis na blockchain que aplicam automaticamente os termos dos acordos.

Transparência Total: Diferente das finanças tradicionais, todas as transações DeFi e códigos de contratos inteligentes são públicos, permitindo auditoria em tempo real.

Integração de Ativos do Mundo Real (RWA): Uma grande tendência para 2026 é a tokenização de ativos tradicionais, como títulos do governo dos EUA e imóveis, permitindo que instituições acessem liquidez cripto e oferecendo aos usuários retornos potencialmente mais estáveis.

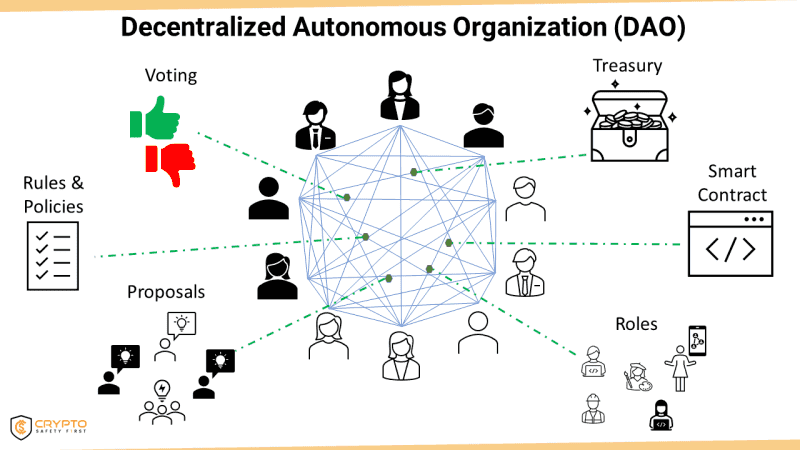

Governança via DAOs: Muitos protocolos são governados por Organizações Autônomas Descentralizadas (DAOs), onde membros da comunidade usam tokens de governança para votar em decisões importantes.

Finanças Descentralizadas, ou DeFi, representa o movimento para recriar e transformar sistemas financeiros tradicionais – como empréstimos, negociações, seguros e outros – na blockchain. Ao invés de confiar em bancos ou intermediários, DeFi utiliza contratos inteligentes e protocolos descentralizados para fornecer serviços financeiros de forma ponto a ponto, aberta e sem permissões. Em resumo, DeFi é finanças por e para as pessoas, movida por código e acessível a qualquer pessoa com conexão à internet.

Neste guia, exploraremos o que é DeFi, como funciona, principais aplicações e plataformas (de exchanges descentralizadas a empréstimos e staking líquido), benefícios, riscos e as tendências que moldam o DeFi até 2026. Ao final, você terá uma visão atualizada do porquê DeFi é considerado o futuro das finanças e como impacta tanto o universo cripto quanto o sistema financeiro tradicional.

DeFi em Resumo: Principais Características e Funcionamento

DeFi refere-se a um conjunto de aplicações financeiras construídas sobre blockchains – predominantemente Ethereum, mas também em outras como Binance Smart Chain, Solana, Polygon e mais. Essas aplicações (conhecidas como dApps – aplicativos descentralizados) executam funções financeiras sem instituições centralizadas. Utilizam contratos inteligentes, que aplicam automaticamente os termos de acordos na blockchain.

Principais Características do DeFi:

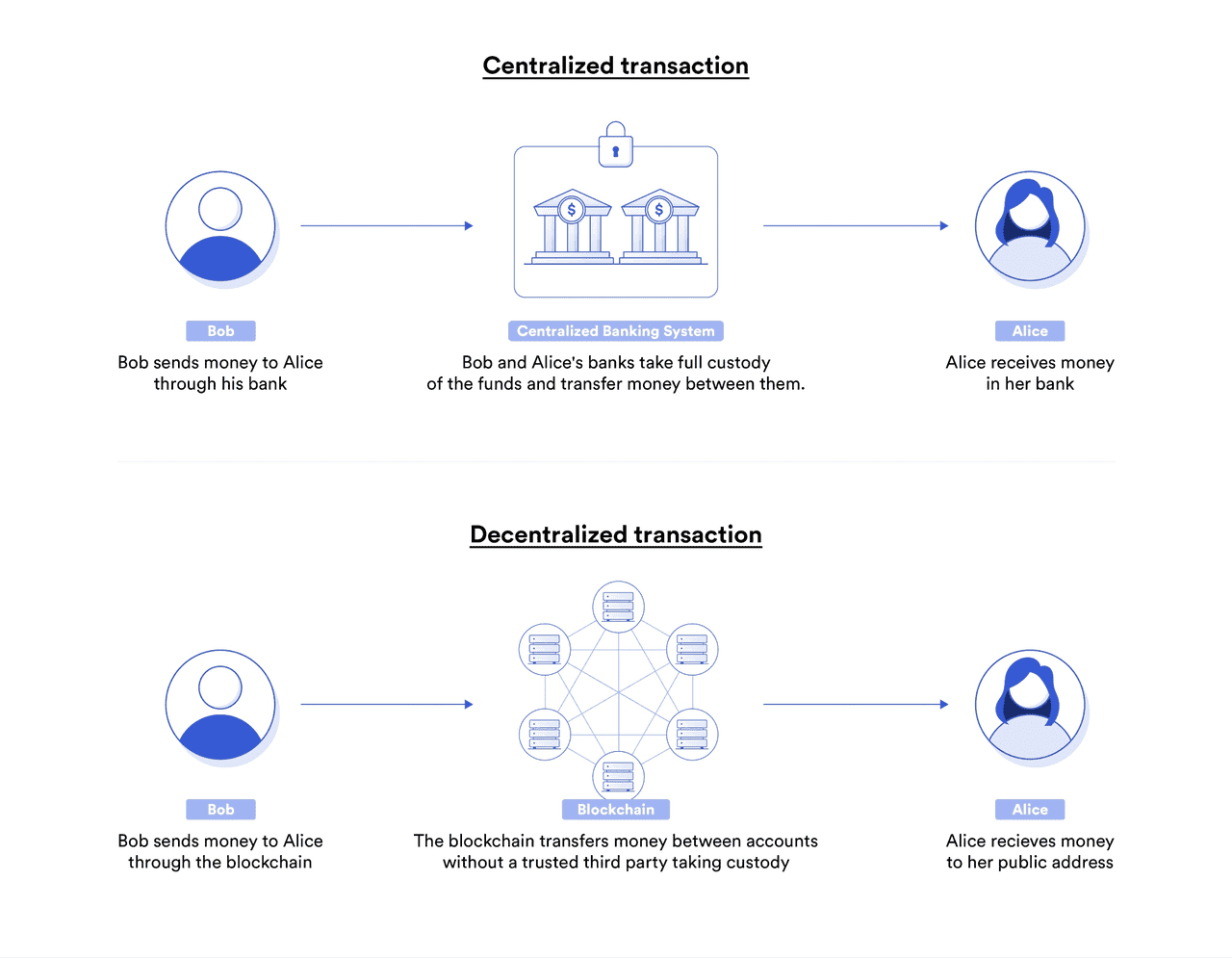

Descentralizado e Sem Confiança: Nenhuma empresa ou autoridade controla um protocolo DeFi; normalmente, é governado por código ou por uma rede distribuída de usuários (muitas vezes, via tokens de governança e DAOs). Usuários confiam no código e no consenso da rede, não em intermediários humanos. Por exemplo, ao emprestar em uma plataforma DeFi, um contrato inteligente gerencia todo o processo, não um funcionário do banco.

Acesso Sem Permissão: Plataformas DeFi são geralmente abertas para qualquer pessoa no mundo. Normalmente, basta uma carteira cripto – não há análise de crédito, KYC obrigatório (embora alguns estejam evoluindo), ou restrição de perfil. Assim, DeFi é acessível a desbancarizados ou a quem não pode acessar finanças tradicionais. Se você tem internet e colateral cripto, pode participar.

Transparência: Todas as transações e códigos de contrato inteligente em blockchains públicas são transparentes e visíveis por qualquer pessoa. Isso permite verificar como protocolos usam fundos e acompanhar grandes transações. Muitos contratos são open-source e registram tudo em blockchain, facilitando auditoria. Em contraste, finanças tradicionais operam de forma muito menos transparente.

Composabilidade: Conhecida como “lego do dinheiro”. Protocolos DeFi são projetados para se integrarem como peças de lego. Por exemplo, você pode usar um token recebido de uma plataforma (como um token de provedor de liquidez da Uniswap) como garantia em outra (como Aave) para tomar empréstimos. Isso permite inovação rápida e produtos financeiros complexos combinando funções simples – algo difícil no sistema tradicional.

Não Custodial: No DeFi, você geralmente mantém controle dos seus ativos. Interage via sua carteira (MetaMask, Ledger, etc.) e pode sacar a qualquer momento, desde que não tenha bloqueado os ativos em contrato. Você não deposita em um banco – coloca tokens em um contrato que pode monitorar. Atenção: ao depositar ativos em contratos inteligentes, confia-se que o código esteja livre de bugs ou malícia (portanto, a confiança é no código e na comunidade que o valida).

Transações Centralizadas vs. Descentralizadas (fonte)

Setores Chave do DeFi e Principais Plataformas

O DeFi pode ser categorizado pelo tipo de serviço. Veja os principais segmentos, suas funções e plataformas destacadas (em 2025):

- Exchanges Descentralizadas (DEXs) e Pools de Liquidez

Como funcionam: DEXs usam modelos AMM (Automated Market Maker). Usuários fornecem pares de tokens aos pools, tornando-se provedores de liquidez (LPs) que recebem taxas das negociações (exemplo: taxa de 0,3% da Uniswap).

Benefícios: Qualquer um pode criar pools e listar tokens; é não custodial, pois fundos permanecem com o usuário. DEXs operam 24/7 e globalmente, sem KYC.

Riscos/Desvantagens: LPs estão sujeitos à perda impermanente com variação de preços. Traders de arbitragem podem lucrar às custas dos LPs, e grandes transações podem causar slippage devido à liquidez limitada.

Principais Plataformas: Uniswap (Ethereum), Curve Finance (stablecoins), SushiSwap, PancakeSwap (BSC) e Balancer (pools de múltiplos ativos). Em 2025, DEXs também operam em Layer 2 (ex: Optimism), outros Layer 1 (como Serum, no Solana) e agregadores como 1inch para melhores preços.

Exemplo prático: Ao trocar ETH por um novo token na Uniswap, os saldos do pool se ajustam automaticamente, afetando o preço.

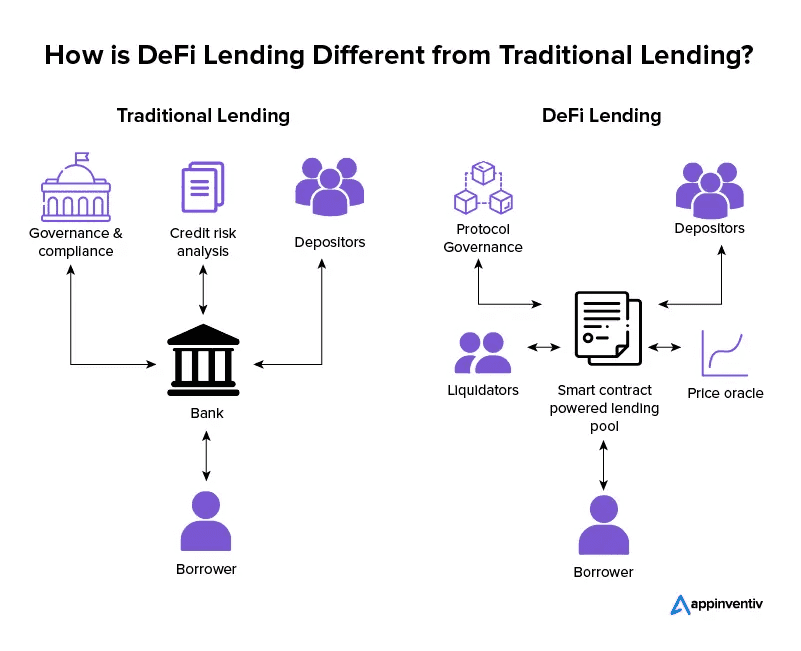

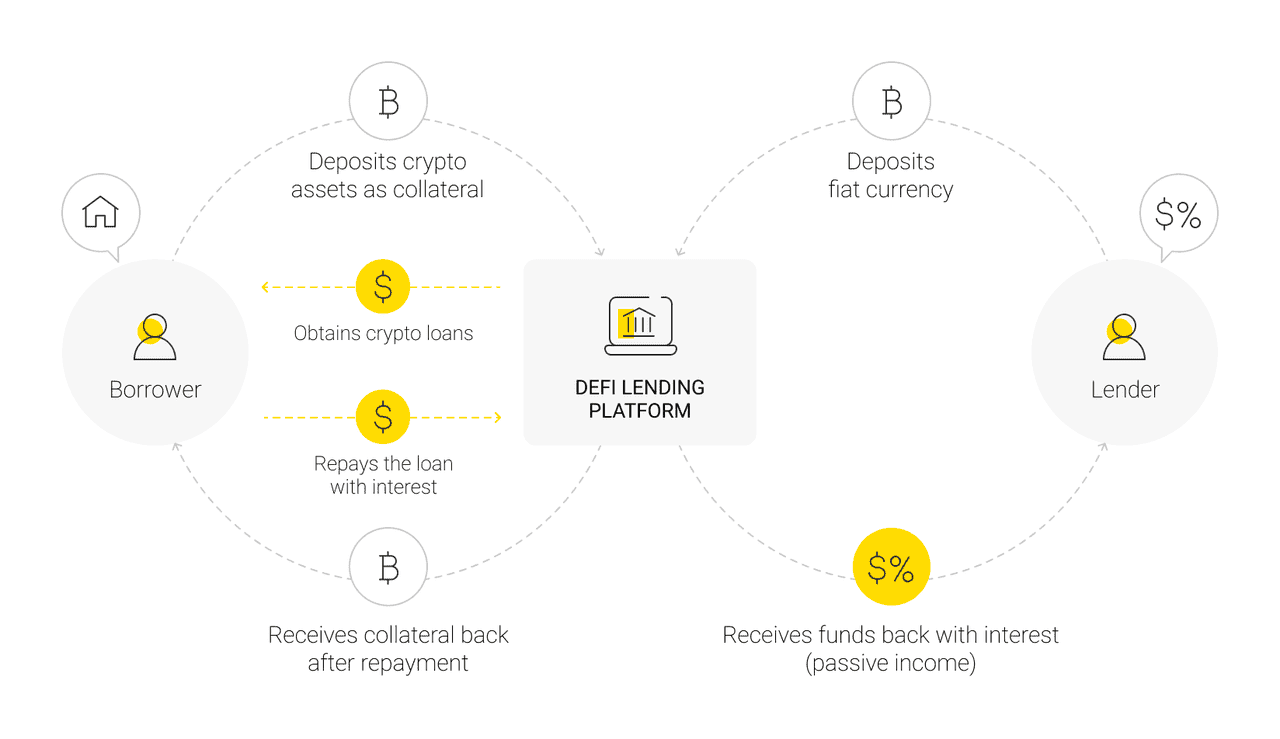

Empréstimos e Empréstimos Tomados

Funcionamento: Usuários depositam ativos em pools de empréstimo. Quem toma empréstimos fornece colateral superior ao valor emprestado. Taxas de juros variam conforme a utilização dos ativos.

Sobrecolateralização: Normalmente, exige-se colateral de cerca de 150% do valor emprestado. Se o valor do colateral cair próximo ao empréstimo, pode ser liquidado.

Usos: Permite acessar liquidez sem vender ativos (ex: usar ETH como garantia e tomar empréstimo em stablecoins para operar).

Principais Plataformas: MakerDAO (empréstimos DAI), Compound, Aave (mercados financeiros generalizados) e Liquity (empréstimos sem juros). Outras redes têm plataformas como Benqi (Avalanche) e Solend (Solana).

Riscos: Vulnerabilidades nos contratos inteligentes e volatilidade do colateral. Quedas bruscas de preços podem gerar liquidações rápidas, como visto na MakerDAO em março de 2020.

Taxas de Juros em 2025: Empréstimos com stablecoins no DeFi variam de baixos a dois dígitos, podendo ser mais altos que poupanças tradicionais. Quem toma empréstimos vê taxas de 5-15%. Algumas plataformas oferecem taxas variáveis ou estáveis.

Staking Líquido como Garantia: Em 2024-2025, ativos em staking líquido (como stETH) podem ser usados como garantia, permitindo obter recompensas de staking e tomar empréstimos simultaneamente.

Empréstimos DeFi vs. Tradicionais (fonte)

Stablecoins são fundamentais para o DeFi, sendo o DAI (MakerDAO) a principal opção descentralizada, colateralizada por criptoativos (agora incluindo USDC, embora isso adicione certo risco de centralização). Em 2025, o suprimento de DAI superou US$ 5 bilhões. USDC e USDT, stablecoins centralizadas da Circle e Tether, são amplamente usadas no DeFi para negociação e empréstimos. UST (Terra) colapsou em 2022, destacando riscos dos modelos algorítmicos. Modelos mais recentes como FRAX combinam colateral e algoritmos. Empresas tradicionais, como PayPal (PYUSD) e subsidiárias de grandes gestoras, lançaram stablecoins e fundos tokenizados a partir de 2023-2024.

Stablecoins permitem proteção contra volatilidade e facilitam empréstimos e transferências globais, especialmente em regiões com inflação. Em 2024, mais de US$ 27 trilhões foram liquidados via stablecoins, superando Visa e Mastercard juntos.

Derivativos DeFi e Ativos Sintéticos

Exchanges de futuros perpétuos descentralizados como dYdX e GMX permitem operações alavancadas de forma descentralizada e ganharam tração até 2025. Protocolos como Opyn e Hegic permitem negociação de opções, embora com volumes menores. Synthetix possibilita a criação de tokens sintéticos que replicam preços de ativos tradicionais.

Uma tendência relevante em 2024-2025 é a tokenização de ativos do mundo real (RWA), com projetos como Ondo Finance oferecendo rendimentos de títulos americanos tokenizados e a Maker facilitando empréstimos lastreados em RWAs. No terceiro trimestre de 2025, o volume de RWAs tokenizados passou de US$ 30 bilhões, atraindo interesse institucional.

Mercados preditivos como Augur e Polymarket permitem apostas descentralizadas, mas enfrentam desafios regulatórios e de adoção.

Farming de Rendimento e Liquidity Mining

O farming de rendimento cresceu durante o “DeFi Summer” de 2020, quando novos projetos recompensavam usuários com tokens de governança por prover liquidez ou utilizar a plataforma. Por exemplo, o liquidity mining da Compound permitiu aos usuários receber tokens COMP além dos juros, atraindo liquidez. Usuários buscam as melhores recompensas em tokens.

Tokens de Governança: Esses tokens oferecem direito a voto nas decisões do protocolo, promovendo a governança comunitária, embora muitas vezes a distribuição inicial favoreça fundadores e investidores. Em 2025, grandes plataformas como Uniswap (UNI) e Aave (AAVE) possuem tokens, mas a participação em votações é limitada e grandes detentores influenciam decisões. Ainda assim, a governança tende à descentralização, alinhando interesses dos usuários com o sucesso da plataforma.

Tendências: Inicialmente, o liquidity mining incentivava estratégias de curto prazo, mas os projetos evoluíram. O modelo vote-escrow da Curve (veCRV) incentiva a manutenção de longo prazo. A tendência de “real yield” foca em recompensar usuários com receitas reais do protocolo, não apenas tokens inflacionários.

Staking Líquido e Restaking: Tokens de staking líquido como stETH da Lido permitem recompensas de staking mantendo liquidez. Em 2024, o TVL da Lido chegou a quase US$ 40 bilhões. O restaking, introduzido pela EigenLayer, permite usar ETH em staking para garantir outras redes e obter rendimento adicional, embora introduza riscos extras.

Organizações Autônomas Descentralizadas (DAOs)

Muitos projetos DeFi são governados por DAOs, onde a comunidade vota propostas usando tokens de governança. Por exemplo, a MakerDAO define os tipos de colateral do DAI. Alguns desafios incluem baixa participação nas votações, mas DAOs como a própria Maker desenvolveram processos eficientes. A governança por tokens diferencia o DeFi do sistema financeiro tradicional e está alinhada com a descentralização.

Como funcionam as DAOs (fonte)

Benefícios do DeFi

Acessibilidade & Inclusão: DeFi oferece acesso global via smartphones e internet, dispensando contas bancárias ou documentos. É especialmente útil em regiões instáveis, permitindo, por exemplo, converter moeda local em stablecoins e obter rendimento, funcionando como alternativa de poupança em dólar.

Transparência: Atividades on-chain proporcionam transparência radical, revelando valores totais de empréstimos, colaterais e endereços de carteiras, ajudando a reduzir riscos ocultos e facilitar a auditoria.

Resistência à Censura: Protocolos DeFi descentralizados são resistentes a censura ou bloqueio, oferecendo alternativas para quem vive sob controles de capital. Mesmo que sites sejam bloqueados, é possível acessar contratos inteligentes diretamente.

Eficiência e Inovação: DeFi opera 24/7 com liquidação quase instantânea e automação, reduzindo custos. É um polo de inovação financeira, criando produtos e modelos únicos, como flash loans, em velocidade superior ao sistema tradicional.

Propriedade e Autonomia: Usuários mantêm controle de seus ativos, sem depender de instituições que possam congelar fundos. Tokens de governança alinham interesses e recompensam usuários iniciais, semelhante à distribuição de participação em empresas.

Interoperabilidade: Serviços DeFi podem ser combinados facilmente, permitindo, por exemplo, tomar empréstimos e trocar ativos com poucos cliques, ao contrário dos processos tradicionais demorados.

Inovação e Experimentação Financeira: O DeFi é um campo de testes para novos modelos econômicos, como stablecoins algorítmicas e tokens de governança, que podem transformar finanças, embora existam riscos de alguns experimentos não serem bem-sucedidos.

Riscos e Desafios do DeFi

Apesar do potencial, DeFi apresenta riscos:

Bugs e Ataques em Contratos Inteligentes: O código rege o DeFi e falhas podem ser exploradas, causando perdas significativas. Incidentes notórios incluem o hack da DAO (2016), Poly Network e Ronin bridge. Auditorias ajudam, mas não eliminam riscos.

Perda Impermanente e Riscos de Mercado para LPs: Fornecedores de liquidez podem sofrer perdas se os preços dos tokens divergem. Taxas de negociação podem compensar, mas há risco de perdas permanentes.

Liquidação e Volatilidade para Tomadores de Empréstimos: Tomadores devem monitorar seu colateral; quedas rápidas podem levar à liquidação. Crashes de mercado aumentam as dificuldades.

Golpes e Rug Pulls: Nem todos os projetos DeFi são legítimos. Alguns desenvolvedores criam contratos fraudulentos para roubar fundos. A ausência de regulamentação requer cautela e pesquisa dos usuários.

Problemas de Usabilidade: DeFi pode ser complexo para novos usuários devido ao gerenciamento de chaves privadas e taxas altas (especialmente no Ethereum). Soluções Layer 2 aumentam a usabilidade, mas existem desafios.

Desafios de Integração com Finanças Tradicionais: Tokenizar ativos do mundo real traz oportunidades, mas também riscos de contraparte e necessidade de supervisão regulatória. Projetos como MakerDAO buscam diversificar colaterais para gerar rendimento.

Riscos Sistêmicos: A composabilidade do DeFi pode causar efeitos em cadeia. Por exemplo, se uma stablecoin grande colapsar, pode afetar vários protocolos. O colapso da UST/Terra em 2022 causou perdas relevantes. Ataques econômicos, como manipulação de oráculos, também são riscos.

Gestão de Chaves & Irreversibilidade: Perder acesso à carteira ou transferir fundos incorretamente significa perda irreversível. Má segurança e contratos maliciosos podem levar a perdas. É importante educar-se e buscar alternativas como carteiras com recuperação social.

Escalabilidade e Performance: Blockchains públicas enfrentam congestionamento, afetando o DeFi. Soluções incluem rollups Layer 2 no Ethereum, blockchains alternativas como Solana e upgrades de rede para melhorar custos e capacidade.

Fluxo de Trabalho DeFi (fonte)

Tendências e Desenvolvimentos do DeFi em 2026

Principais tendências até 2026:

Ativos do Mundo Real (RWA) e DeFi Institucional: A tokenização de ativos reais permite que instituições acessem liquidez cripto e oferece retornos potencialmente mais estáveis a usuários. Em 2024, a MakerDAO lucrou com títulos do Tesouro dos EUA, Ondo Finance criou produtos para stablecoins com exposição indireta a títulos, e o mercado de RWAs ultrapassou US$ 30 bilhões em 2025.

Dominância do Staking Líquido: Após a transição do Ethereum para Proof of Stake, o staking líquido ganhou espaço, com a Lido liderando. Em 2025, yields de staking podem girar em torno de 4-5% e serem integrados a produtos DeFi. Isso aumenta a eficiência, mas acrescenta riscos se grandes provedores tiverem problemas.

Adoção de Layer 2 e Melhor UX: Atividades DeFi migraram para L2s como Arbitrum e Optimism, com pontes mais fáceis. Melhorias em carteiras e abstração de contas simplificaram a experiência do usuário.

Segurança e Seguro: Devido ao aumento de ataques, projetos intensificaram auditorias e medidas de mitigação de riscos, criando uma cultura de testes rigorosos e conscientização dos usuários.

Ferramentas de Conformidade Regulatória: Para atender a regulações, plataformas DeFi implementam recursos como bloqueio de endereços. Isso pode dividir o ecossistema entre plataformas totalmente descentralizadas e as permissionadas, visando facilitar a participação institucional.

Integração Web3 e Social Descentralizada: Plataformas sociais Web3 e NFTs estão se integrando ao DeFi – usando NFTs como colateral de empréstimos e criando "super apps" que unem negociação, chat e galerias NFT até 2025.

Conclusão

O DeFi evoluiu de um experimento de nicho em 2018-2019 para um setor de bilhões em 2025, ganhando reconhecimento global. O setor superou ciclos de mercado e desafios como altas taxas, graças a soluções Layer 2, mas ainda enfrenta desafios de segurança e regulação. Continua sendo uma fonte de inovação, oferecendo novas formas de operar finanças de modo aberto e eficiente.

Assim como o e-commerce, que no início era caótico mas hoje é amplamente confiável e regulado, o DeFi pode trilhar caminho semelhante à normalização. Embora não substitua totalmente os bancos, há previsões de que instituições financeiras integrarão tecnologias DeFi em suas operações por meio de neobancos e corretoras.

Por ora, DeFi é uma fronteira empolgante em cripto e fintech, mostrando o potencial de um sistema financeiro mais inclusivo. Contudo, interessados devem pesquisar com cuidado, começar com valores pequenos e estar conscientes dos riscos. Para quem busca a experiência de usuário de uma exchange centralizada, a Phemex oferece uma plataforma de negociação profissional.