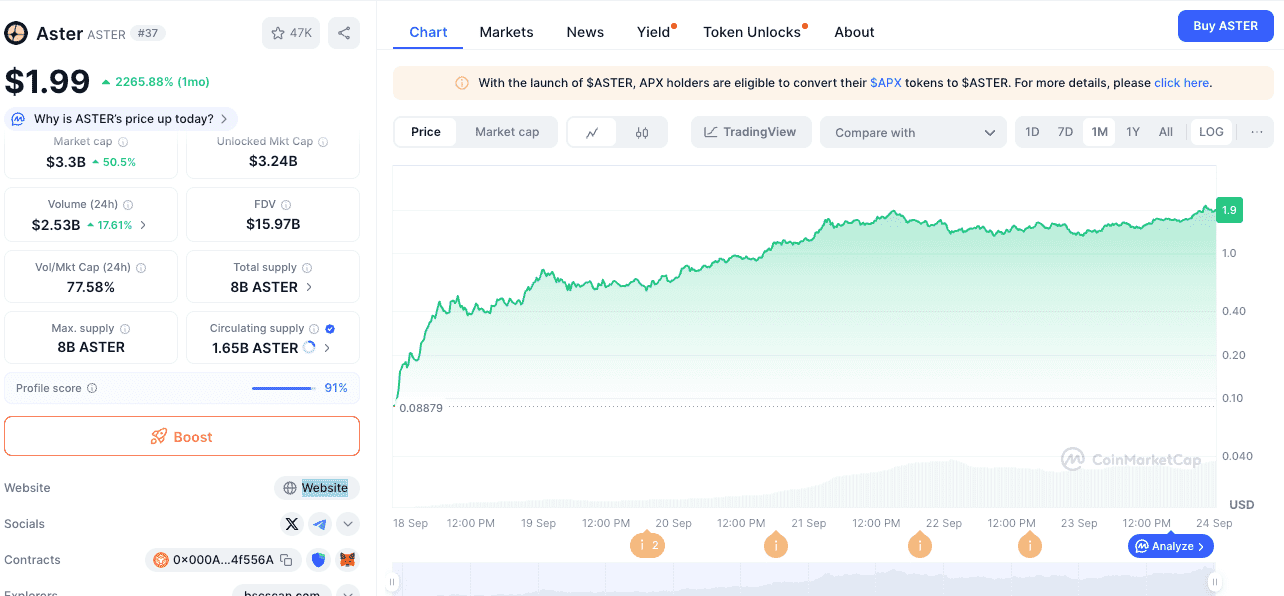

In a market where traders are constantly searching for the next high-performer, Aster (ASTER) has emerged as an undeniable force. In the last month alone, the ASTER token has surged by over 2,200%, rocketing its market capitalization to over $3.3 billion and capturing the attention of the entire DeFi ecosystem.

This isn't a case of speculative hype. The dramatic rise of ASTER is a story of a strategic rebrand, powerful new tokenomics, and explosive on-chain growth that validates its position as a leading decentralized perpetuals exchange. Let's break down the fundamental catalysts driving this monumental pump.

A Strategic Fusion: More Than Just a Rebrand

To label the recent changes as a simple "rebrand" would be a profound understatement. The birth of Aster represents a strategic fusion of two established powerhouses in the DeFi space: APX Finance and Astherus. This was not a rescue or a pivot, but a "strong-strong merger" designed to create a single, dominant force in the decentralized derivatives market.

-

APX Finance brought its proven, high-performance perpetual trading infrastructure to the table. It had already cultivated a substantial user base of active traders who relied on its robust engine for deep liquidity and a CEX-like experience.

-

Astherus contributed its expertise in innovative, yield-generating DeFi products and strategies. It had a community dedicated to its sustainable and capital-efficient financial instruments.

The merger was a calculated move to combine these complementary strengths. By integrating APX's trading engine and user base with Astherus's DeFi innovation and capital, Aster was launched not as a new project starting from scratch, but as a fully-formed ecosystem with pre-existing technology, a loyal community, and significant capital from day one. This powerful synergy created immediate and immense value, which the market quickly recognized.

Powerful Tokenomics: Aligning Community Growth with Real Yield

A core driver of ASTER's value is its meticulously designed tokenomics, which moved beyond simple staking rewards to create a powerful flywheel of community incentives and direct value accrual from protocol revenue. The model is built on two key pillars: a community-first distribution and a direct link between revenue and token value.

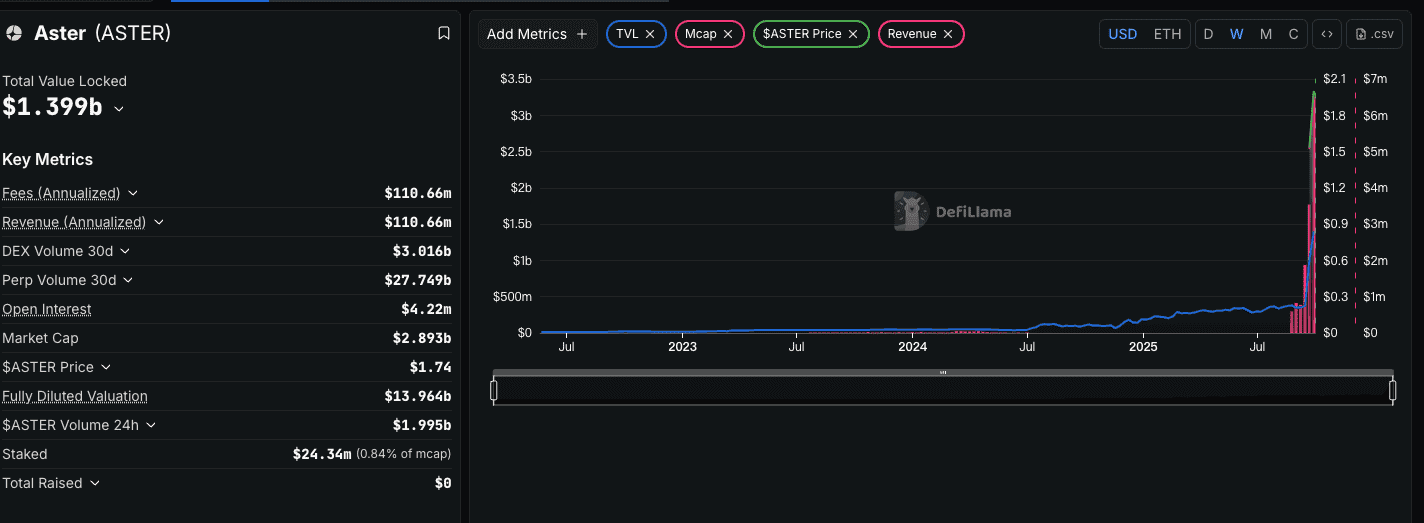

As the DeFiLlama data shows, Aster is a revenue-generating machine with $118.66 million in annualized revenue. The new tokenomics ensure this revenue directly benefits token holders and the long-term health of the protocol.

A Community-First Distribution and Incentive Structure:

The token allocation strategy makes it clear that Aster is built for its users:

-

Massive Community Rewards: An unprecedented 53.5% of the total ASTER supply is reserved for community rewards through airdrops and other initiatives. This is a clear commitment to decentralization and rewarding active participants.

-

Rewarding Early Believers: At the Token Generation Event (TGE), 704,00 airdropped (8.8% of total supply) were immediately unlocked for early participants in programs like Aster Spectra. This builds immense loyalty and validates the contributions of its foundational community.

-

Incentivizing Migration: To ensure a swift transition, a conversion mechanism was created for legacy $APX holders to upgrade to $ASTER. Critically, the conversion rate decreases over time, creating urgency and accelerating the consolidation of the new ecosystem. Unclaimed tokens are then recycled back into the airdrop pool, ensuring value is retained within the community.

The Protocol Revenue Buyback Initiative:

To directly translate its impressive revenue into buying pressure and rewards, the Aster Foundation has committed a portion of protocol revenue to an ongoing $ASTER buyback program. This initiative serves two vital functions:

-

Long-Term Price Stabilization: A portion of the buybacks is allocated to the Aster Foundation's treasury. This creates a strategic reserve that can be used to support the token's price during volatile periods, building investor confidence.

-

Governance Rewards: The other portion is used to distribute rewards to users who actively participate in Aster's decentralized governance. This creates a powerful "real yield" narrative where holding and using your tokens to shape the future of the protocol generates a direct financial return, funded by the protocol's own success.

Explosive On-Chain Fundamentals

The price pump is backed by verifiable and explosive on-chain metrics that prove the platform's utility and adoption.

- Massive Trading Volume: The protocol has processed an incredible 27.74 billion in perptuals volume and 3.81 billion in DEX volume over the last 30 days. This places Aster among the top-tier derivatives platforms in all of crypto, confirming significant product-market fit.

-

Surging Total Value Locked (TVL): Aster's TVL now stands at $1.399 billion. This massive inflow of capital signals deep user trust and provides the necessary liquidity to support its high-volume trading environment.

-

High Capital Efficiency: With a Volume (24h) to Market Cap ratio of 77.58%, the protocol demonstrates extremely high capital efficiency. The trading activity on the platform is immense relative to its market valuation, suggesting heavy, consistent usage.

Dominating a New Paradigm: Why Perpetual DEXs are Winning (and How Aster Leads the Pack)

To fully grasp the magnitude of Aster's rise, one must understand the fundamental market shift it is capitalizing on. The collapse of centralized exchanges like FTX created a massive trust vacuum and triggered a paradigm shift in the crypto trading landscape. This event exposed the inherent risks of custodial platforms, forcing a generation of traders to seek a new solution that offered the best of both worlds: the performance of a CEX with the security and self-custody of a DEX. This is the "holy grail" that Perpetual DEXs (Perpdexes) were built to find.

The Market Need and The User Persona:

The modern crypto trader is sophisticated. They demand high leverage, deep liquidity, low-latency execution, and advanced order types—features historically monopolized by centralized giants. However, they are no longer willing to blindly trust these platforms with their assets.

This creates a clear user profile: the "CEX refugee" or the "DeFi Power User." This user is not a casual swapper; they are an active, professional trader who needs institutional-grade tools but demands the on-chain transparency and self-sovereignty that only DeFi can provide. This is precisely the market that Aster is built to serve.

Aster's Innovation: Bridging the CEX-DEX Divide

Aster's core innovation lies in its refusal to compromise. Instead of forcing users to choose between performance and self-custody, it delivers both through a laser-focused product suite:

-

The "Pro Mode" - A True CEX Alternative: This is not a simplified AMM. It is a full-fledged central limit order book (CLOB) interface that mirrors the experience of a professional trading platform. It provides the low latency, tight spreads, and deep order book that professional traders require to execute complex strategies effectively.

-

The "1001x Mode" - Simplified Power: Recognizing that not all traders need a complex interface, this mode offers a streamlined, one-click trading experience for on-chain perpetuals. Crucially, it is designed to be MEV-resistant, protecting users from the front-running and value extraction that plague many on-chain trading protocols.

-

A Revenue-Driven Ecosystem: As detailed previously, Aster’s most powerful innovation is arguably economic. By directly sharing its massive protocol revenue with token holders, it creates a powerful incentive for users to become owners, aligning the success of the platform with the success of its community.

The Competitive Landscape: How Aster Stands Out

The Perpetual DEX space is fiercely competitive, with each player bringing a unique strength to the market. Aster's strategy is not just to compete on a single feature, but to deliver a superior, holistic experience that combines performance, accessibility, and a powerful economic engine.

Here is a more detailed breakdown of how Aster compares to its main competitors:

| Competitor | Core Focus | Key Strengths | Aster's Differentiating Edge |

| Hyperliquid | A purpose-built L1 blockchain for a hyper-optimized, high-speed order book. |

Unmatched Speed: Sub-second latency provides the fastest possible on-chain trading experience. Pre-Token Engagement: A highly effective points system has driven massive volume and community growth ahead of its token launch. |

Established "Real Yield" vs. Future Promise. Aster's revenue-sharing and buyback model is live and generating tangible returns for token holders now. Hyperliquid's current value is tied to a future airdrop, making its tokenomics speculative. Aster offers proven, present-day value accrual. |

| Lighter | Professional-grade, institutional-focused order book built on Arbitrum. |

Institutional Focus: Backed by the reputable Vesta Finance team, it targets programmatic traders with robust APIs and deep liquidity. Clean & Professional UI: A polished interface designed for serious, high-volume trading. |

Broader User Appeal & More Aggressive Tokenomics. While Lighter targets a professional niche, Aster's dual-mode (Pro/1001x) interface captures a much wider spectrum of traders. Moreover, Aster's explicit revenue-to-buyback mechanism provides a more direct and compelling value proposition for token holders. |

| Jupiter | All-in-one DeFi portal and swap aggregator on Solana. |

Massive User Base: The go-to platform in the Solana ecosystem for a wide range of DeFi activities. Ecosystem Integration: Deeply embedded within Solana, benefiting from its network effects. |

Laser-Focused Specialization. Jupiter is a generalist; Aster is a specialist. By obsessively focusing only on being the best perpetuals exchange, Aster delivers a more refined, dedicated, and powerful experience for serious traders who prefer a specialized tool over a multi-tool. |

| EdgeX | A perpetual DEX leveraging next-generation ZK-rollup technology (zkSync). |

Future-Proofing: A bet on the superior scalability and security of cutting-edge ZK infrastructure. Low Transaction Costs: Inherits the potential for extremely low fees from the underlying ZK-rollup. |

Proven Traction & Present-Day Dominance. While EdgeX represents future potential, Aster delivers proven success today. Its massive trading volume and $118M+ in annualized revenue are verifiable facts, not future promises, offering immediate and tangible value to its users and token holders. |

A Balanced View: Market Sentiment and Potential Risks

While Aster's recent performance is undeniable, a sophisticated market analysis requires looking beyond the hype. The sentiment surrounding the project is nuanced, comprising a strong bull case rooted in performance and a cautious bear case focused on long-term sustainability and external pressures. A neutral observer sees both.

The Bull Case: Why the Market is Excited

The positive sentiment is driven by tangible, verifiable successes that are difficult to ignore:

-

A Profitable Business Model: Proponents argue that Aster has transcended the typical DeFi protocol model to become a genuine, cash-flow-positive business. Its ability to generate over $118 million in annualized revenue from fees provides a concrete valuation metric. This "real yield," distributed back to token holders, is seen as a sustainable foundation for value, contrasting sharply with the inflationary token rewards of older protocols.

-

Undeniable Product-Market Fit: The on-chain data—billions in monthly volume and over $1.3 billion in TVL—is interpreted as irrefutable proof that Aster has built a product traders want and trust. This high level of activity suggests the platform has solved the critical challenges of liquidity and user experience that have hindered many other DEXs.

-

Effective Community Building: The strategic tokenomics, especially the large airdrop allocation and the urgent APX-to-ASTER migration, are viewed by market analysts as a highly successful user acquisition and community-building campaign. It effectively created a large, invested user base from its inception.

The Bear Case: What Skeptics and Cautious Investors are Watching

Conversely, experienced market participants are raising several critical questions and pointing to potential long-term risks:

-

Sustainability of Revenue and Yields: The most significant concern is whether the massive trading volume is sustainable. Perpetual DEX revenue is highly reflexive; it thrives on market volatility and bullish sentiment which encourages leverage. Skeptics question if these revenue figures can be maintained during a prolonged bear market or a period of low volatility. A significant drop in volume would directly impact the "real yield," potentially weakening the core bullish narrative.

-

Token Supply Overhang and Sell Pressure: While the 53.5% community allocation is excellent for growth, it also represents a massive potential supply overhang. A key risk is "airdrop farming," where users participate only to immediately sell their rewards, creating consistent sell pressure. The long-term emission schedule, even if gradual, will introduce new tokens into the market that must be absorbed. The long-term price action will depend heavily on whether buyback pressure can consistently outweigh this potential inflation.

-

A Brutally Competitive "War for Liquidity": The Perpdex sector is one of the most competitive in all of crypto. While Aster is currently a leader, competitors like Hyperliquid are also innovating at a breakneck pace and have their own token launches on the horizon, which could siphon away both users and liquidity. This is an ongoing "war for liquidity," and leadership positions can be transient.

-

Regulatory Headwinds and Security Risks: Like all decentralized derivatives platforms, Aster operates in a complex regulatory grey area. Increased scrutiny from global regulators on leveraged trading platforms is a persistent macro risk for the entire sector. Furthermore, with over $1 billion in TVL, the protocol is a prime target for hackers, and any potential smart contract vulnerability would have catastrophic consequences.

Conclusion: A New Benchmark for Decentralized Exchanges

The explosive rise of Aster (ASTER) is not a random market event driven by speculation. It is the result of a perfectly executed strategic convergence where a foundational merger, a powerful economic engine, and verifiable on-chain success have aligned to meet a critical market need.

Aster's story provides a compelling blueprint for the future of DeFi. It began by creating a product that professional traders genuinely need—offering the performance of a CEX with the security of a DEX—and then wrapped it in a masterfully designed tokenomics model. By transforming protocol revenue directly into holder value through buybacks and rewards, Aster's "real yield" narrative has moved from a theoretical concept to a proven, multi-million dollar reality.

While the path ahead is not without its challenges—from the relentless pressure of competition to the ever-present risks of market volatility and regulation—Aster's current position is one of undeniable strength. It has set a new benchmark for what a Perpetual DEX can achieve, not just in terms of trading volume, but in creating a sustainable, self-reinforcing ecosystem.

For traders and investors, the key takeaway is that Aster's pump is fundamentally rooted in its ability to operate like a highly profitable, high-growth tech business that happens to be built on-chain. This combination of a superior product, massive revenue generation, and community-centric incentives is the definitive answer to the question of "Why Aster is Pumping."

Ready to Act on the Aster Opportunity?

Now that you understand the powerful fundamentals driving ASTER's growth, Phemex is your premier destination to get in on the action. We offer a full suite of trading options to match your strategy:

-

Spot Trading: Buy and hold ASTER directly on our liquid and secure spot market.

-

Futures Trading: Leverage your insights and trade ASTER perpetual contracts with high performance.

-

ASTER CandyDrop: Don't miss out! Participate in our exclusive CandyDrop event for a chance to earn free ASTER rewards.

Whether you're a long-term investor or a professional derivatives trader, Phemex has the tools you need.