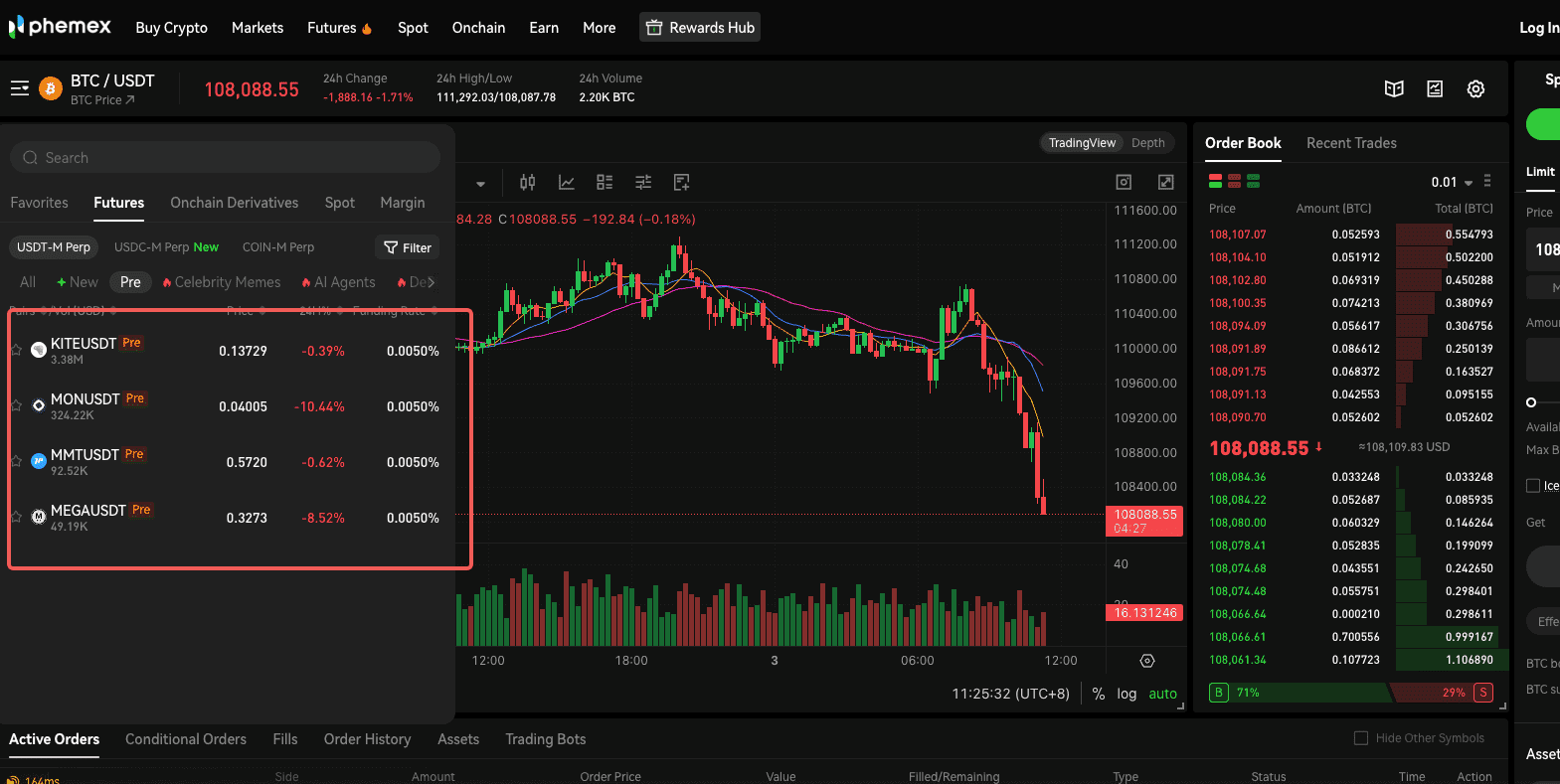

Before KITEUSDT ever hit a spot exchange, before its price was broadcast across the major data aggregators, its value was born on Phemex. For over three days, from 10:00 UTC on October 31, 2025, to 13:10 UTC on November 3, 2025, our Pre-Market Futures market served as the primary, public battlefield where bulls and bears fought to define the initial value of the first AI payment blockchain.

This is the story of that battle, told through data.

This is not just a recap. It is a professional post-mortem analysis of the KITE pre-market launch. In the world of trading, the most valuable lessons are not learned from hypothetical examples, but by studying real-world price action under pressure. In this deep dive, we will dissect the chronological phases of the trade, analyze key data points beyond the price chart, and extract actionable lessons that you can apply to the next big pre-market opportunity. This is your chance to learn from the inside, to see how professional traders navigate the chaotic intersection of hype and valuation to find their edge.

If you're new to this concept, we highly recommend you first read our foundational guide: The Ultimate Guide to Phemex Pre-Market Perpetual Futures to master the basics.

The Setup: What Was the Narrative Driving KITE?

Price action doesn't happen in a vacuum. It is driven by a narrative—a collective story the market tells itself about an asset's future value. To understand the chart, we must first understand the story that traders were pricing in.

The Project: An Ambitious, High-Concept Vision

The official description for Kite is potent and designed to capture the imagination: "Kite is building the first AI payment blockchain, a foundational infrastructure where autonomous AI agents can operate with verifiable identity and programmable governance, with native access to stablecoin payments."

Let's break down why this narrative was so compelling for pre-market participants:

-

AI Payment Blockchain: This places Kite at the intersection of two of crypto's most powerful and enduring trends: Artificial Intelligence and Decentralized Payments.

-

Autonomous AI Agents: This speaks to a futuristic vision where software agents, not just humans, are primary economic actors, creating a vast, untapped addressable market.

-

Verifiable Identity & Governance: This addresses core challenges in the AI space, suggesting a solution for accountability and control, which appeals to more sophisticated, long-term investors.

The narrative was not just about another token; it was about building a fundamental new rail for a future economy run by AI agents. This ambitious vision, available for review at gokite.ai, was the primary fuel for the initial hype and speculative interest.

The Hype Factor & The Information Gap

Leading up to the pre-market launch, the key question for every trader was simple: How do you value such a project? With no spot market history, no established price, and only a visionary whitepaper to go on, the market was operating in a state of high anticipation and almost total price uncertainty. It is precisely this information gap—this "price vacuum"—that Phemex's Pre-Market Futures is designed to fill. It creates a venue for the market's collective intelligence to battle it out and forge a price out of pure information and sentiment.

The Price Action Unpacked: A Chronological Analysis of the KITE Pre-Market

The Phemex KITEUSDT pre-market went live at 10:00 UTC on October 31, 2025. The spot pair was scheduled to list at 13:10 UTC on November 3, 2025. This created a roughly 75-hour window of pure price discovery. Let's break down the key phases of this period.

Phase 1: The Opening Volatility (October 31)

As is common with highly anticipated launches, the opening hours were defined by extreme volatility.

-

The Initial Spike: In the first hours of trading, the price experienced a massive, parabolic spike, reaching a peak near $0.14. This was the "hype premium" being priced in, driven by the most bullish market participants and those with FOMO (Fear Of Missing Out).

-

The Sobering Correction: This initial, frenzied spike was followed by a sharp and deep correction over the next 24 hours, with the price falling back towards the 0.08 range. This is an equally predictable part of the pre-market cycle, driven by early profit-takers and the market's initial search for a rational price level.

Pro-Tip: This initial period often has the widest bid-ask spreads and the most chaotic price action. As we observed in the KITE launch, using Limit Orders instead of Market Orders was absolutely crucial for traders to avoid significant slippage and secure a favorable entry price during this phase.

Phase 2: The Mid-Period Consolidation & News Trading (Nov 1 - Early Nov 3)

After the initial fireworks, the market entered a crucial, multi-day period of consolidation. The price found a floor and began to trade within a relatively defined channel. This phase is less exciting for thrill-seekers, but for professional analysts, it is the most important part of the pre-market.

-

The Battle for a Floor: This is where the real price discovery happens. The initial hype-driven sellers have exhausted themselves, and a new class of value-oriented buyers begins to enter. The order book becomes a battlefield, with buy walls and sell walls forming as the market fights to establish a new equilibrium.

-

Trading the News: During this consolidation, the price becomes highly sensitive to any new information. A positive tweet from a major influencer or a new partnership announcement could cause short-term spikes. This is where active traders can find small, scalpable opportunities.

Phase 3: The Pre-Listing Rally (Late Nov 2 - Nov 3)

In the final 12-24 hours before the transition to a standard perpetual contract, the KITE chart showed a distinct and powerful rally, breaking out of the consolidation range and pushing towards the $0.10 mark, eventually settling at a final price of $0.13. This is another classic pre-market pattern, driven by two professional tactics:

-

Front-Running the Spot Listing: A new wave of sophisticated buyers enters the market. They anticipate that the official spot listing will bring a flood of new, less-informed retail buyers. They buy into the pre-market futures to front-run this expected influx of demand.

-

Short Squeezing: Traders who held short positions during the consolidation phase begin to get nervous. They do not want to be short when the massive volatility of a live spot listing occurs. They start to close their positions by "buying to cover," adding fuel to the pre-listing rally.

Beyond the Chart: What the Data Told Us

To truly understand the market, we must look deeper than just the price candles.

Volume Analysis: When Did "Smart Money" Enter?

By analyzing the volume profile, we can infer the market's conviction.

-

Initial Spike Volume: The highest volume occurs during the opening chaos. This is a mix of both FOMO buyers and early sellers.

-

Consolidation Volume: Volume tends to decrease significantly during the consolidation phase. However, a skilled trader looks for subtle clues. A price rise on increasing volume, as seen during the Phase 3 rally, can signal the beginning of a real trend, as it shows that buyers are entering with conviction.

Funding Rate Analysis: A Note on Pre-Market Mechanics

For KITEUSDT, as is standard for all Phemex pre-market futures, the premium index for the funding rate was set to 0 during the entire pre-market period. This is a crucial technical detail. It means that the funding rate was determined solely by the interest rate component, resulting in a very low and stable rate.

-

What this means for traders: During the pre-market, you don't have to worry about high funding rates eating into your profits. However, it also means the funding rate cannot be used as a strong sentiment indicator during this phase. The real insight comes from observing the first funding rate after the contract converts to a standard perpetual.

The Climax: The Transition from Pre-Market to Spot

At 13:10 UTC on November 3, 2025, the moment of truth arrived. The KITE/USDT spot pair was listed on Phemex, and the pre-market contract seamlessly transitioned into a standard perpetual contract.

-

The Final Pre-Market Price: The KITEUSDT pre-market contract settled at a final price of $0.13 USDT. This price, established over 75 hours of intense trading, became the most important data point in the world for KITE.

-

The Spot Listing Price: When the KITE/USDT spot market opened, the initial trades occurred very close to this $0.13 benchmark. Any significant deviation would have been immediately arbitraged away.

-

The Verdict: The Phemex pre-market was not just a side-show; it was an incredibly accurate price discovery mechanism. It provided a fair, transparent, and robust benchmark for the official spot listing, proving its value to the entire crypto ecosystem.

The Playbook: 3 Strategic Takeaways from the KITE Launch

Analyzing the past is only useful if it helps us profit in the future. Here are three actionable strategies derived from the KITE launch.

Winning Strategy #1: The Fundamental Play (For the Alpha Hunter)

A trader who researched KITE's ambitious vision but also understood the risks would have seen the initial parabolic spike as pure hype. They would have patiently waited for the inevitable correction, using their fundamental analysis to establish a fair value estimate and begin accumulating a long position during the consolidation in Phase 2.

Winning Strategy #2: The Volatility Play (For the Scalper)

A pure technical trader would have identified the clear support and resistance levels of the consolidation range in Phase 2 and traded that range—buying at the lows and selling at the highs. With the 20x max leverage available on KITEUSDT, even these small range-bound moves offered significant profit potential.

Winning Strategy #3: The Hedging Play (For the Insider)

An early investor or airdrop recipient could have used the pre-market to execute a perfect hedge. By opening a short position on KITEUSDT during the initial hype-driven spike in Phase 1, they could have locked in a high sale price for their tokens, completely removing the risk of a launch-day dump. The availability of Hedge Mode on Phemex makes this even more flexible.

Are You Ready for the Next One? A Pre-Launch Checklist

The KITE launch provided a clear playbook for success. The next major pre-market launch is your chance to apply it. Here is your checklist:

-

Monitor Phemex Announcements: Follow our social media and announcements page for the next pre-market listing. This is your alpha.

-

Prepare Your Research: Start digging into the project's tokenomics, community, and backers the moment it's announced.

-

Fund Your Futures Account: Be ready to act the moment the market goes live. Don't be left on the sidelines.

-

Define Your Strategy: Are you an Alpha Hunter, a Volatility Trader, or a Hedger? Know your plan before the battle begins.

Conclusion: From Case Study to Your Next Trade

The KITEUSDT pre-market launch was a masterclass in price discovery, volatility trading, and strategic hedging. The data proves that for prepared traders, the Phemex Pre-Market is a powerful engine for generating Alpha. It provides a unique opportunity to act on information while the rest of the market can only speculate.

The next chapter is about to be written. Don't be the one reading about it afterward.